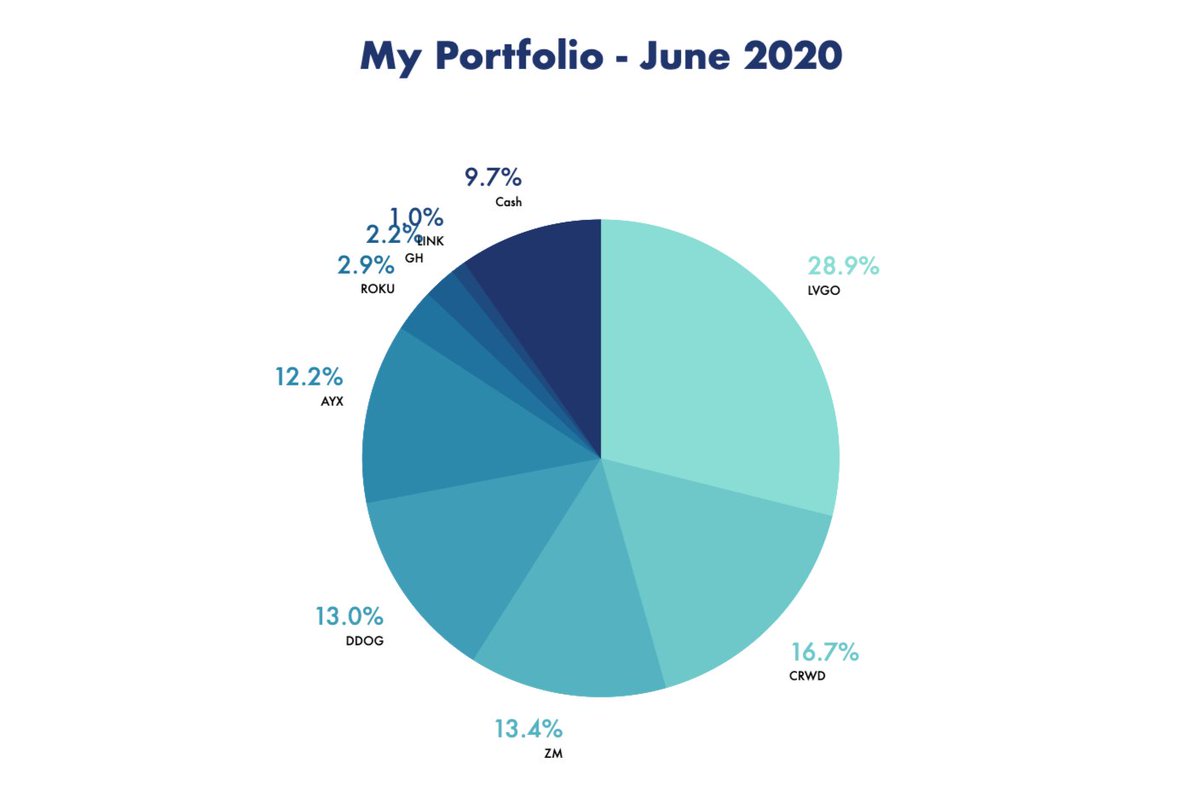

My portfolio as of Jun 30, 2020:

$LVGO – 28.9%

$CRWD – 16.7%

$ZM – 13.4%

$DDOG – 13.0%

$AYX – 12.2%

$ROKU – 2.9%

$GH – 2.2%

LINK – 1.0%

Cash – 9.7%

Performance:

+116.6% YTD vs -4.04% S&P 500

$LVGO – 28.9%

$CRWD – 16.7%

$ZM – 13.4%

$DDOG – 13.0%

$AYX – 12.2%

$ROKU – 2.9%

$GH – 2.2%

LINK – 1.0%

Cash – 9.7%

Performance:

+116.6% YTD vs -4.04% S&P 500

Initiated: GH

Added: LVGO, CRWD, DDOG, AYX, ZM, ROKU

Sold out: FSLY, CRNC, ESTC

Note that I have been tracking my returns manually and didn’t account for booked gains and contributions until now. My return this month was 22% so my YTD would have been 104.4% without doing so.

Added: LVGO, CRWD, DDOG, AYX, ZM, ROKU

Sold out: FSLY, CRNC, ESTC

Note that I have been tracking my returns manually and didn’t account for booked gains and contributions until now. My return this month was 22% so my YTD would have been 104.4% without doing so.

2) I added to CRWD and ZM after earnings as both destroyed my expectations in every metric. The new WFH economy has significantly benefitted both and I have never been more confident in their future.

I also continued to add to LVGO, DDOG, ROKU, and AYX after some nice dips

I also continued to add to LVGO, DDOG, ROKU, and AYX after some nice dips

3) I initiated a position in GH, owned it last summer and want to diversify a little out of SaaS. Hyper-growth story with massive potential, a reasonable valuation that has come down significantly since IPO, and catalysts like FDA approval for Guardant360 right around the corner

4) I personally also think COVID-19 will accelerate the adoption of liquid biopsies as there exists a growing backlog of tissue biopsies. As mentioned on the call, GH's mobile phlebotomy services are the obvious choice over risking your staff and the patient by bringing them in.

5) I sold out of ESTC after disappointing guidance, I still think they have a great platform with tons of potential but after a year of waiting, my thesis is just not playing out the way I expected.

See thread: https://twitter.com/richard_chu97/status/1268741212313391106?s=20

See thread: https://twitter.com/richard_chu97/status/1268741212313391106?s=20

6) I sold out of CRNC because I wanted to allocate the funds to higher growth names like GH. It remains a compelling undervalued, under-the-radar play on the fast-growing connected car market.

I may re-enter if they are able to sustain strong growth rates into the next quarter

I may re-enter if they are able to sustain strong growth rates into the next quarter

7) I sold out of FSLY at ~$80.50 as I felt it has reached unsustainable levels. It was always a lower-confidence position for me as low customer growth has always been a pain point for me and echo Beth’s view that usage pull forward can only go so far. https://seekingalpha.com/article/4355130-cloud-and-zoom-shift-is-still-in-early-days-video

8) Software Stack Investing had a good article on its potential in edge. Notably, FSLY's solution can start-up in 35 microseconds, which is 100x faster than competitive solutions and their background as a CDN should help them lock in existing customers. https://softwarestackinvesting.com/fastly-fsly-q1-2020-earnings-results-review/

9) I acknowledge that Fastly is well-positioned to dominate high-growth edge computing market and that this will likely offset the drop-off in DBNER but with Compute@Edge set for general release in 2021, there is just not enough data for me to feel comfortable at this valuation.

10) Lastly, I just wanted to say that this year has been life-changing. I started investing because I wanted financial freedom, to live life on my terms.

I made a lot of very costly mistakes initially, but I didn’t give up and learned from the smartest investors I could find

I made a lot of very costly mistakes initially, but I didn’t give up and learned from the smartest investors I could find

11) I developed a philosophy that made sense to me and stuck by it

Fast forward to today and I’ve now earned more YTD with my investments than I would have in a full yr with my job!

But this is just the start of my journey and I have so much that I have yet to learn

Fast forward to today and I’ve now earned more YTD with my investments than I would have in a full yr with my job!

But this is just the start of my journey and I have so much that I have yet to learn

Read on Twitter

Read on Twitter