1) Portfolio summary - June-end

$ADYEY $AYX $COUP $CRWD $DDOG $DOCU $ETSY $LVGO $MELI $NOW $OKTA $PINS $ROKU $SE $SHOP $SQ $TTD $TWLO $VRM $WORK http://9923.HK

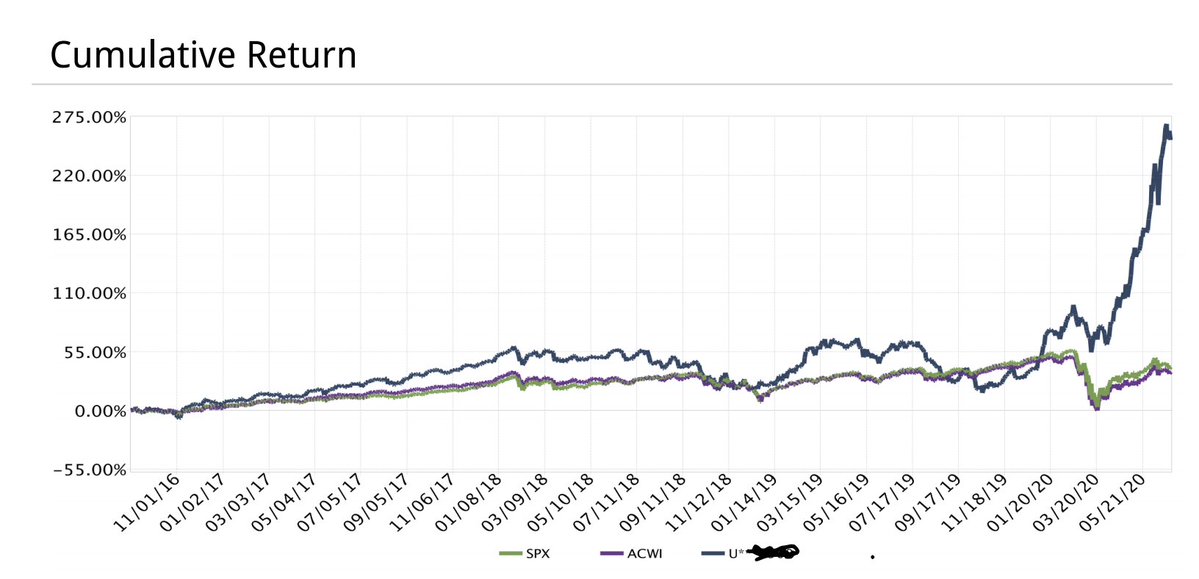

Return since 1 Sept '16 -

Portfolio +255.69%

$ACWI +24.48%

$SPX +42.81% ...

$ADYEY $AYX $COUP $CRWD $DDOG $DOCU $ETSY $LVGO $MELI $NOW $OKTA $PINS $ROKU $SE $SHOP $SQ $TTD $TWLO $VRM $WORK http://9923.HK

Return since 1 Sept '16 -

Portfolio +255.69%

$ACWI +24.48%

$SPX +42.81% ...

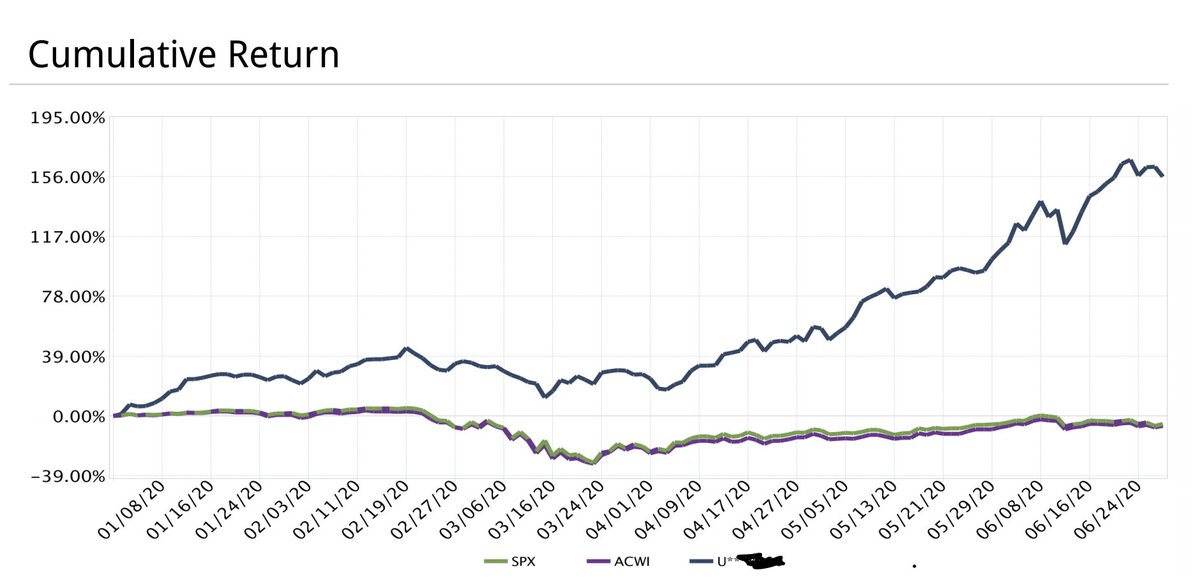

2) CAGR since inception (1 Sept 2016) -

Portfolio +39.28%

$ACWI +5.88%

$SPX +9.75%

YTD return -

Portfolio +155.75%

$ACWI (-)8.09

$SPX (-)4.04% ...

Portfolio +39.28%

$ACWI +5.88%

$SPX +9.75%

YTD return -

Portfolio +155.75%

$ACWI (-)8.09

$SPX (-)4.04% ...

3) Commentary -

June was an incredible month for my portfolio and it surpassed all my expectations!

In fact, the entire first half of this year has been surreal - first, the epic March-crash which played out perfectly for my hedging strategy by putting cash in my pocket)...

June was an incredible month for my portfolio and it surpassed all my expectations!

In fact, the entire first half of this year has been surreal - first, the epic March-crash which played out perfectly for my hedging strategy by putting cash in my pocket)...

4)...near the bear-market lows (which I invested at depressed prices) and then, this equally epic rally which just shows no sign of fizzling out!

I don't know about you but there is no way I could have predicted this year's price action, which is why I stopped using my...

I don't know about you but there is no way I could have predicted this year's price action, which is why I stopped using my...

5)...crystal ball a long time ago. And I have no clue what the market will do tomorrow, next week or next month - all I know is that my trend filter is currently flashing UPTREND but that can change anytime.

In terms of my portfolio, June was a busy month...

In terms of my portfolio, June was a busy month...

6) I sold out of $ESTC (too tough for me to understand), $FB (mature + too many issues), $WORK (disappointed by Q1 results and increasing competition) and I invested in $NOW, $OKTA , $ROKU , $VRM and http://9923.HK (try out position)....

7) Finally, on the back of rising COVID-19 cases, I dumped all my rentals (which were from the most heavily impacted, sensitive sectors).

Going forward, I'm pretty comfortable with my current holdings but getting concerned about the sky-high valuations of some of my companies..

Going forward, I'm pretty comfortable with my current holdings but getting concerned about the sky-high valuations of some of my companies..

8) I'll repeat - it is *not* normal for large cap companies to double or triple within 3-4 months and at some point, this will end badly. However, with the Fed's pedal to the metal and speculative juices flowing/resurgence of day traders, the party might continue for a while....

9) If my assessment is correct, the SaaS sector has now become an incipient bubble - it'll probably get bigger but I am fairly certain that the 5-year forward returns won't match the past 5 years' returns.

This may not be the popular opinion but this is how bubbles form...

This may not be the popular opinion but this is how bubbles form...

10) (a) Great disruption based story (b) excellent fundamentals (c) long growth runway - all extrapolated into eternity and discounted in the here and now.

Look, I'm not smart enough to know how far the rubber band will stretch but am experienced enough to know that at some...

Look, I'm not smart enough to know how far the rubber band will stretch but am experienced enough to know that at some...

11) ...point, it'll snap and disappoint the latecomers.

For my part, I've recently trimmed some of my over-extended/over-valued holdings and invested the cash in $NOW , $ROKU and $VRM (which appear more reasonably valued to me).

If this insanity continues, I might be forced..

For my part, I've recently trimmed some of my over-extended/over-valued holdings and invested the cash in $NOW , $ROKU and $VRM (which appear more reasonably valued to me).

If this insanity continues, I might be forced..

12) to trim even more and allocate that cash to more sanely valued holdings - despite what you might hear; trees don't grow to the heavens.

Finally, in terms of the economy, I continue to feel that ecommerce, fintech and software will grow for years so this is where I've...

Finally, in terms of the economy, I continue to feel that ecommerce, fintech and software will grow for years so this is where I've...

13)...focused my investments.

All these sectors have become necessities (utilities on steroids); they save both time and money for both companies and consumers and their customers use these services often - good enough for me.

I hope this update was useful.

The end.

All these sectors have become necessities (utilities on steroids); they save both time and money for both companies and consumers and their customers use these services often - good enough for me.

I hope this update was useful.

The end.

Read on Twitter

Read on Twitter