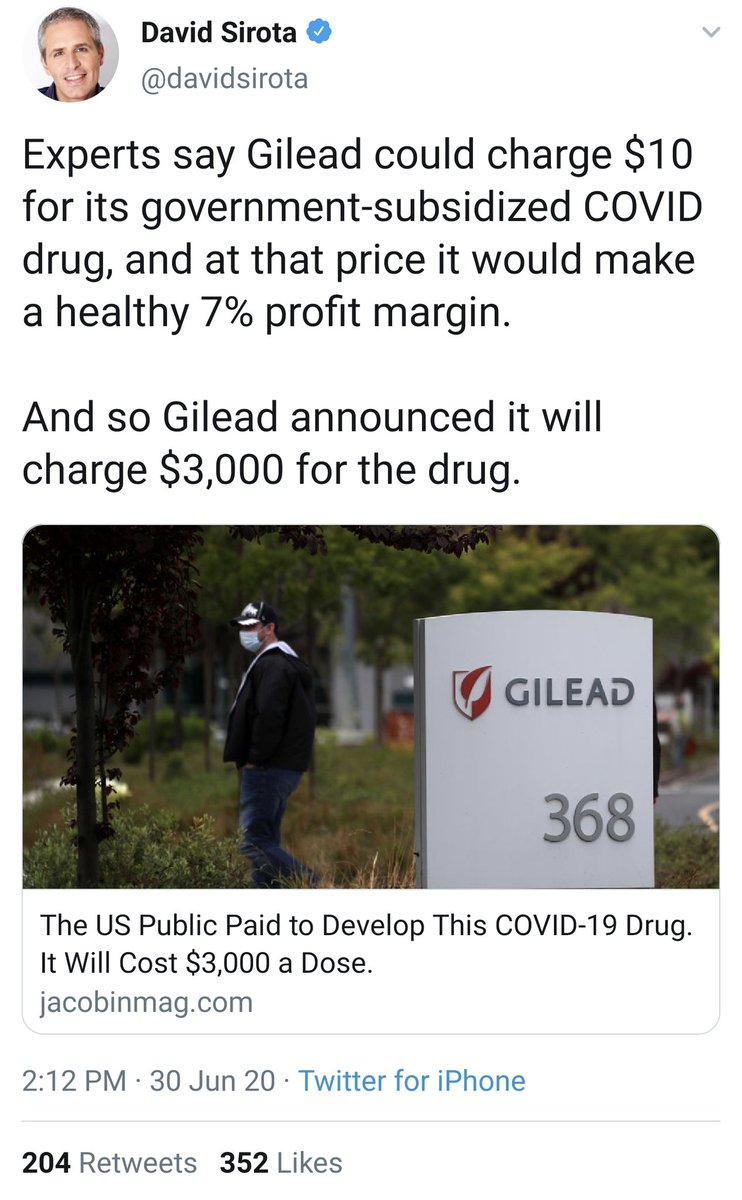

Liberals: "OMG Gilead wants to charge $3,000 for a drug that the US GOVERNMENT developed with taxpayer money!!!"

Gays:

Gays:

what if... I told you that this was entirely 100% predictable back in March, down to the price tag (because $3000/course is not an arbitrary number)

also, the sticker price is largely meaningless, because people with insurance aren't going to be paying $3000, insurance companies aren't going to be paying $3000, and people without insurance will likely end up paying far less than $3000 as well

that doesn't make Gilead's actions any less bad, but it does help to have an understanding of *why* the system is so persistent in behaving this way, rather than breathlessly reporting on the value of arbitrary numbers that nobody is actually paying

as someone who thinks the pharmaceutical industry is chock full of bullshit, I am BEGGGING journalists and activists alike: please have SOME understanding of how the pharmaceutical market works, especially if you want to fix it

if Gilead says remdesivir costs $3000, and journalists report that figure with no qualifications or caveats, and people then get outraged at the high sticker price?

...then Gilead celebrates, because this was their *goal* and everyone is repeating their propaganda for free

...then Gilead celebrates, because this was their *goal* and everyone is repeating their propaganda for free

So why does Gilead saying that remdesivir costs $3000 not actually mean anyone is paying $3000, and why is it still bad that they're saying it costs $3000?

Here's a brief explanation (with some simplifications)

Here's a brief explanation (with some simplifications)

Background: The US is by far and away the largest market for pharmaceuticals. It's the third-largest country in the world. And of the 8 largest countries in the entire world, it's the only one that *isn't* a developing nation (developing nations generate less revenue)

As long as those two facts hold, no matter what the US does, it will always be the country where pharmaceutical companies look first to try and recoup their investment. (They may not succeed, but they will *try*, because the US is so large and so wealthy).

If they have to choose, pharmaceutical companies would much rather sell to one market of 300 million than to twenty different markets of 15 million each, because the overhead means that larger markets are more profitable than smaller markets at the same price point.

They'd rather sell to both, obviously, but if they have to choose, and if all other things are equal, they will always choose the larger market. That's their cash cow, and they will do anything to protect it, including sacrificing other (smaller) markets to preserve their big one

In addition to being a large market, the US has relatively few price controls.

(For reasons that I'll get to later, European-style price controls on pharmaceuticals wouldn't work as well in the US without some changes, but for now, remember/assume that the US has ~none.)

(For reasons that I'll get to later, European-style price controls on pharmaceuticals wouldn't work as well in the US without some changes, but for now, remember/assume that the US has ~none.)

This means that the US market is ride-or-die for pharmaceutical companies. Even for European-based pharmaceutical companies like Roche (#2 by revenue), Novartis (#4), GlaxoSmithKline (#6), Bayer, etc. - the US market is where they extract the bulk of their revenue.

I'll say that again: *all* pharmaceutical companies - including European ones - generate an obscenely disproportionate amount of their global revenue from sales in the US alone.

(In some cases/years, it can even be an outright *majority* of their brand-name drug sale revenue)

(In some cases/years, it can even be an outright *majority* of their brand-name drug sale revenue)

The trick to making money as a pharmaceutical company: always charge every customer the absolute most that they are willing to pay.

It doesn't matter customer A is paying $50. If customer B is willing to pay $400, you charge them $400.

It doesn't matter customer A is paying $50. If customer B is willing to pay $400, you charge them $400.

Here's how negotiations *don't* work:

Pharma: I have a drug. It costs $100.

Insurer: Wow, only $100! I was actually willing to pay $200, though, so let's split the difference and I'll pay you $150.

Pharma: I have a drug. It costs $100.

Insurer: Wow, only $100! I was actually willing to pay $200, though, so let's split the difference and I'll pay you $150.

Here's how internal conversations go at pharma companies when determining prices:

A: We predict Cigna will pay up to $200, Aetna up to $400, BCBS up to $500, and Medicare up to $80.32

B: Great. So we all agree: the drug costs $3000?

A: You bet.

A: We predict Cigna will pay up to $200, Aetna up to $400, BCBS up to $500, and Medicare up to $80.32

B: Great. So we all agree: the drug costs $3000?

A: You bet.

Even if a pharma company knows that insurers will only pay $200-500 for a drug, they'll still say that the drug costs $3000, for two reasons:

1) it's guaranteed to be more than any insurer will pay

2) the insurers want the drug to be expensive (yes, really!)

1) it's guaranteed to be more than any insurer will pay

2) the insurers want the drug to be expensive (yes, really!)

Remember that, for the pharma company, there is a huge risk of underpricing a drug (they're leaving money on the table if they charge $300 when someone would pay $400) but literally no penalty for overpricing it (insurers will never walk away without negotiating).

You might be surprised to read that insurers *want* drugs to be expensive, but that's actually true!

They don't want to *pay* a lot for drugs, but they want the drugs to be very expensive, because that justifies their own existence and value proposition for you.

They don't want to *pay* a lot for drugs, but they want the drugs to be very expensive, because that justifies their own existence and value proposition for you.

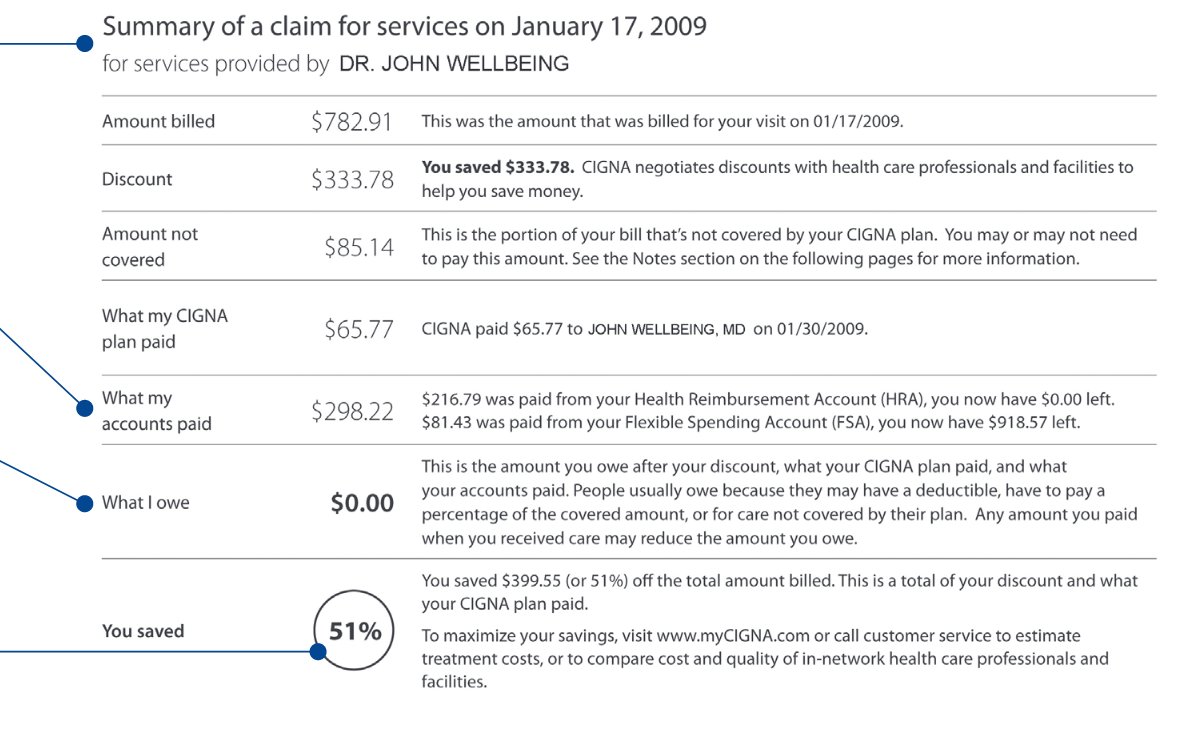

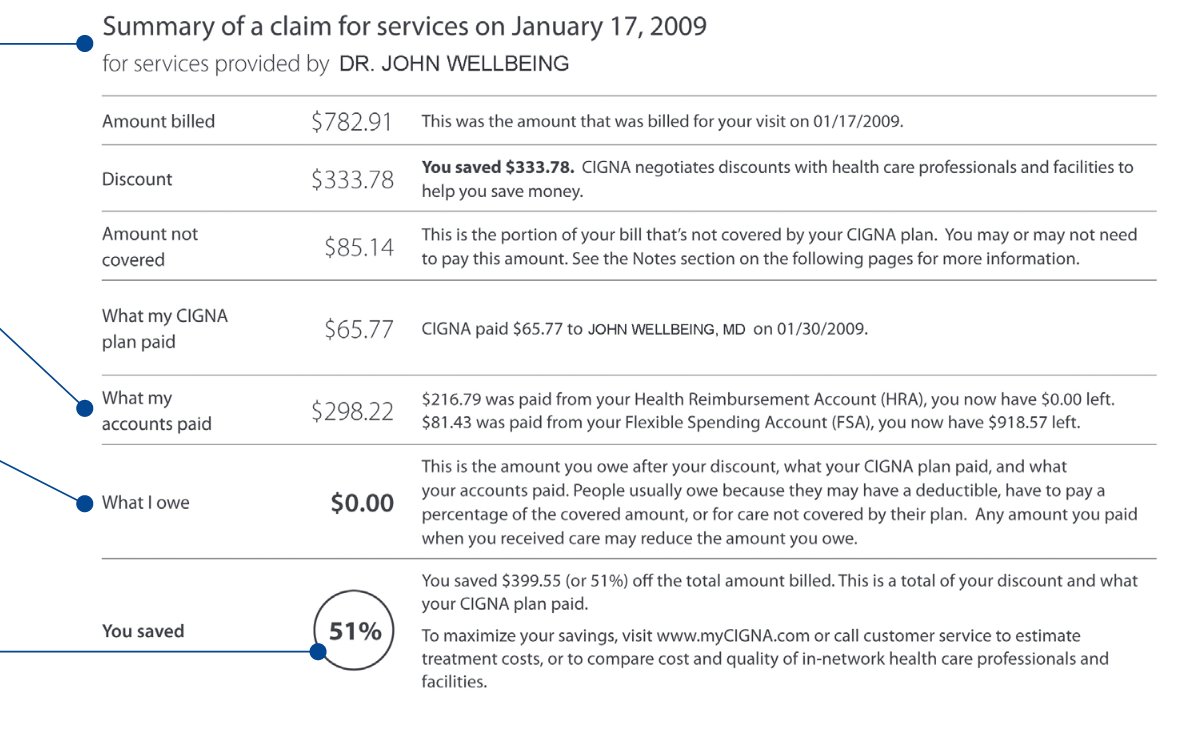

Anytime your insurance pays for a medication, you receive an Explanation of Benefits from them, which looks like this. Let's break this down:

(This example one is for a doctor bill, but it works the same way)

(This example one is for a doctor bill, but it works the same way)

The "amount billed" is the amount that the pharmaceutical company claims that the drug costs (say, $3000).

"What my plan paid" is the amount that the insurer actually paid the pharma company. Note that it could easily be 10% or less of the "amount billed"!

"What my plan paid" is the amount that the insurer actually paid the pharma company. Note that it could easily be 10% or less of the "amount billed"!

The insurer wants the "You saved" field to be as high as possible. It can do that two ways:

1) pay more for the drug

2) pay the same amount, but increase the "amount billed" (and increase the "discount" by the same amount)

guess which one the insurer prefers

1) pay more for the drug

2) pay the same amount, but increase the "amount billed" (and increase the "discount" by the same amount)

guess which one the insurer prefers

For the insurer, the billed amount is arbitrary. They're thrilled if they can say they were billed $100,000, "negotiated" a "discount" of $99,900, and left you to pay "only" $100, a 99.9% cost savings.

Compare that to them being billed $110, "negotiating" a "discount" of $10, and leaving you still $100 to pay, but for only a 9% cost savings.

That doesn't make them look so great, does it? Even though you (the patient) end up paying the same amount in the end.

That doesn't make them look so great, does it? Even though you (the patient) end up paying the same amount in the end.

However, it gets worse than that. The private insurers actually use inflated drug prices to offset the subsidies for public insurers both in the US and outside the US.

I'll outline how that works here, though caveat: in the interest of simplicity and *not* going into intricate detail on stuff that varies heavily by state, the numbers for this next section are simplified - don't take them too literally.

The flow-of-funds is what's important.

The flow-of-funds is what's important.

Drug companies are required, by law, to charge Medicare/Medicaid less than they charge any private insurer. The Medicare/Medicaid prices are *not* statutorily tied to manufacturing cost, which is both a liability and a massive loophole.

Let's say that a particular drug costs $100 to produce wholesale. Ignore R&D, overhead, all of that - we're talking just the additional marginal cost of producing another unit of that drug.

That *sounds* like a lot, but (a) remember what I said about these numbers being simplified, and (b) some drugs - esp. vaccines for rare diseases - actually do have really high production costs, because they rely on expensive and labor-intensive ingredients.

However, Medicare and Medicaid prices/reimbursements are *not* tied to manufacturing costs, so even if the manufacturer is altruistic and offers the drug at-cost ($100), Medicare/Medicaid will pay only $76.90 for it.

That's a problem for this hypothetical altruistic pharma co.!

That's a problem for this hypothetical altruistic pharma co.!

If you're altruistic and just want to make sure you get the drug to as many people who need it as you can, offering it at-cost sounds like the best idea, but it'll actually run you out of business, because you'll *lose* money on every Medicare/Medicaid patient. That's not good :(

You can't force Medicare/Medicaid to pay you a minimum of the production costs, so the only way you can make this work is to mark up the rates that you charge private insurers.

There's a problem with that, though: you can't charge high prices to insurers without charging high prices to patients who are on HDHPs or who have no insurance. Ideally you want to charge exorbitant prices from insurers, but very little for uninsured patients.

Solution: offer "copay assistance programs" (instant rebates) for patients. This lowers the amount that patients pay out-of-pocket, but it doesn't affect the amount that insurers pay you (the rare altruistic pharma company).

Where does the money for these assistance programs come from?

That's easy, just raise the sticker price on the drugs even more!

That's easy, just raise the sticker price on the drugs even more!

Now, you also have the international market to worry about. Switzerland is a country of 8.5 million people, and they have instituted price controls. They will only pay $70/patient for your drug. That's a loss of $30/patient. There's no way you can cover that!

Again, remember, you're not an evil pharma company: you're a purely altruistic pharma company who wants nothing but to serve people as best you can, within your financial means. But losing $30 on every patient isn't sustainable, no matter what. What do you do?

You could try to negotiate with the Swiss government. But that's a lot of work, and it could take months or years (with patients suffering meanwhile). And after all that, all you'd do is expand access to only 8.5 million people. That's less than the population of New York City!

Instead of going through all that, you could just accept the Swiss price (losing $30/patient in Switzerland) and raise the price in the US even more to make up the difference. Problem solved!

As you can see here, even if a pharmaceutical company is run by people who are acting truly altruistically and without any profit motive (beyond the basic financial needs to stay operational), all roads lead to high sticker prices for drugs.

There are countless forces acting on drug prices in the US, and *all* of them act to increase the sticker prices. Even for a purely altruistic company, there are no incentives to lower sticker prices for drugs in the US.

And of course, pharmaceutical companies are not altruistic. They're perfectly willing to let people die if it helps their bottom line. So if even an altruistic pharma co. would be forced to have high drug prices, it's no surprise that a ruthless, profit-seeking company would too.

I only mentioned it briefly, but you'll notice that the example of the Swiss market (a small market with incredibly aggressive price controls) only functioned because the pharma company was able to make up the difference from a larger and more lucrative market.

That's not an accident - most European countries that have enacted aggressive price controls on drugs are only able to do so because of the globalized OECD market - and specifically, because of the US market.

If the US didn't exist, European drug prices would be much higher.

If the US didn't exist, European drug prices would be much higher.

It's tempting to say that Switzerland (in this example) would have leverage because they're gatekeeping a market of 8.5 million people, but for essential medicines, the pharamaceutical company has the leverage of being able to walk away, leaving patients blaming the politicians.

This doesn't mean that the US can't enact price controls on pharmaceutical drugs, but it does mean that it's nonsensical to use European drug prices as a baseline for what the US could expect to pay - those prices are already subsidized by the US!

And remember, about half of the top pharmaceutical companies in the world are based in Europe, so from a profit perspective, Europe is essentially double-dipping: lower drug prices for Europeans, subsidized by US patients, with fat profits for European companies in the process.

We're talking about pharmaceutical pricing here, but this general flow-of-funds is also why you can't use Medicare's budget as a reference point for a hypothetical single-payer system in the US.

Medicare's budget is explicitly subsidized by private insurance, by law.

Medicare's budget is explicitly subsidized by private insurance, by law.

That doesn't mean you can't argue in favor of single-payer healthcare in the US, but it *does* mean that you need to have a more sophisticated analysis and plan, beyond simply pointing to Medicare and assuming that those subsidies will exist even after private insurers are gone.

Okay, back to pharmaceutical pricing: even if the sticker prices are meaningless, because pharma companies make much higher per-capita revenue in the US, that still means that US patients are paying more at the end of the day, which is bad.

How do we fix it?

How do we fix it?

One easy solution is to allow prescription drug imports from other OECD countries. How would this lower prices?

Let's say Gilead manufactures a drug in the US. They sell that drug in the US for a hefty price, but they also export that drug to Canada/Europe/etc. where they sell it at a lower price.

It's the exact same drug, made at the exact same factory. Why two different prices?

It's the exact same drug, made at the exact same factory. Why two different prices?

The only reason that Gilead *can* charge a higher price in the US while charging lower prices elsewhere is because US pharmacies are not allowed to reimport drugs.

If they could, then they could use the cheapest source for the drug.

If they could, then they could use the cheapest source for the drug.

Again, we have no issues of provenance or manufacturing here, because we're talking about brand-name drugs that are already manufactured in the US by the same company at the same plant. They may even have the same packaging!

Only difference is the shipping label on the box.

Only difference is the shipping label on the box.

If this were allowed, and Gilead tried to charge $3000 in the US but $200 in another country, your local US pharmacist could tell Gilead "thanks bro, but I'm going to place an order from our European warehouse instead, and then just mail that back here".

In reality, few shipments of drugs would actually need to make two transatlantic trips like this. But the fact that it's an *option* means that Gilead can't really charge (much) more for a direct shipment than it *would* cost do the reimport.

Sometimes, the mere threat suffices!

Sometimes, the mere threat suffices!

Are there any efforts to pass a law allowing us to reduce pharmaceutical prices by allowing prescription reimports?

Funny you should ask...

Funny you should ask...

In 2017, Senators Sanders and Klobuchar introduced Amendment 178, which would have lowered drug prices by permitting reimports.

It failed by 5 votes, with 13 Democrats opposing it.

It failed by 5 votes, with 13 Democrats opposing it.

Democrats who blocked the 2017 bill to lower prescription drug prices by allowing drug imports include:

* Bennett (Colorado)

* Booker (New Jersey)

* Cantwell (Washington)

* Casey (Pennsylvania)

* Feinstein (California)

* Menendez (New Jersey)

* Murray (Washington)

* Bennett (Colorado)

* Booker (New Jersey)

* Cantwell (Washington)

* Casey (Pennsylvania)

* Feinstein (California)

* Menendez (New Jersey)

* Murray (Washington)

now that you understand why sticker prices for drugs are high in the US (and how the US subsidizes low drug prices abroad) watch this exchange between @AOC and the CEO of Gilead from last year https://twitter.com/Public_Citizen/status/1277982392192360450?s=19

Truvada is a particularly weird case because it's currently generic abroad and not in the US, but even before that there was a massive price difference, and the US government paid for the development of PrEP (which is being used worldwide, and which Gilead is profiting from)

In the case of PrEP, I have no problem with the US government (taxpayers) funding a lifesaving discovery that could end the HIV/AIDS pandemic globally, without international funding.

But that's not what's happening - a private company is profiting off that taxpayer research, despite doing essentially nothing to contribute to that discovery.

The case is even more clear for remdesivir. Gilead had abandoned remdesivir, and it's only because taxpayer funds developed the drug that it exists today!

It's hard to make a coherent argument that Gilead deserves the right to profit off its use for COVID-19 treatment.

It's hard to make a coherent argument that Gilead deserves the right to profit off its use for COVID-19 treatment.

If you find some junk while digging through a dumpster, and then use that junk to make a lifesaving medicine, the person who threw away the junk can't claim they own the medicine you invented.

So why should Gilead pretend they own remdesivir?

So why should Gilead pretend they own remdesivir?

Here @PrEP4AllNow makes a clear case that the federal government is an owner of the key patents on remdesivir, which would mean Gilead has no authority to prevent the federal government from authorizing generic versions of remdesivir at a low cost. https://www.prep4all.org/news/remdesivir

Not only is that *not* a far-fetched claim, but the Patent Trial and Appeals Board just upheld an analogous case *also* involving Gilead, affirming that the federal government does have legitimate claim to these drug patents: https://www.statnews.com/pharmalot/2020/02/05/gilead-hiv-patents-truvada-cdc/

Read on Twitter

Read on Twitter