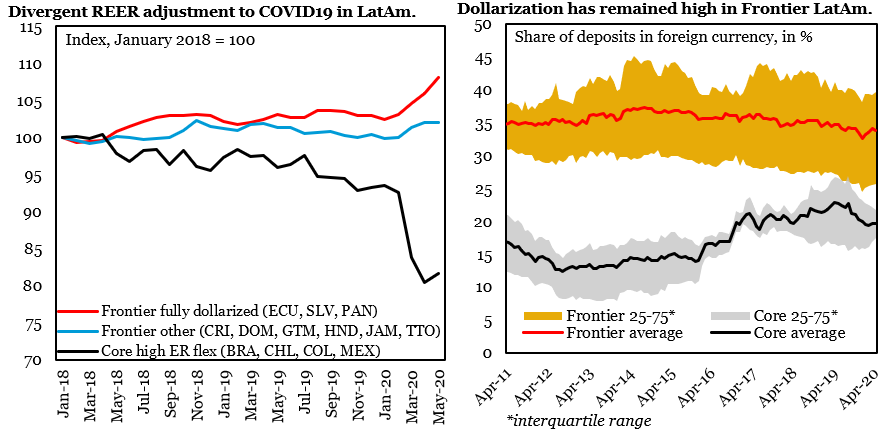

“Fear of floating” has been a longstanding EM challenge that several LatAm economies have attempted to overcome. How have countries fared so far in terms of letting the exchange rate help absorb the COVID19 shock? 1/5

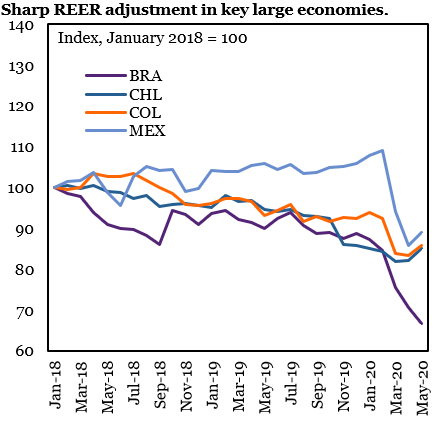

Carefully crafted inflation targeting regimes in Brazil, Mexico, Chile, and Colombia have allowed for substantial exchange rate flexibility, even though some intervention took place. Robust fiscal schemes, deeper local markets, and ample dollar liquidity have also helped. 2/5

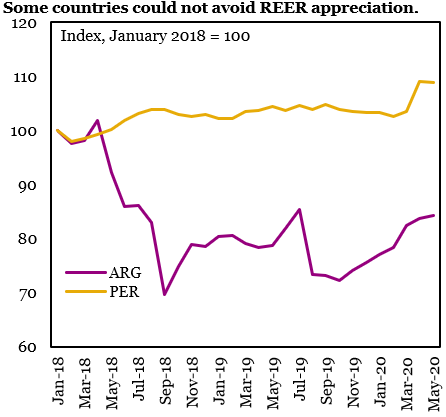

The story is different in other places. Despite buffers, Peru has continued to manage the exchange rate tightly due to still-high financial dollarization. Meanwhile, Argentina has tried to resist depreciation pressure, wiping out previous REER gains in the official FX market. 3/5

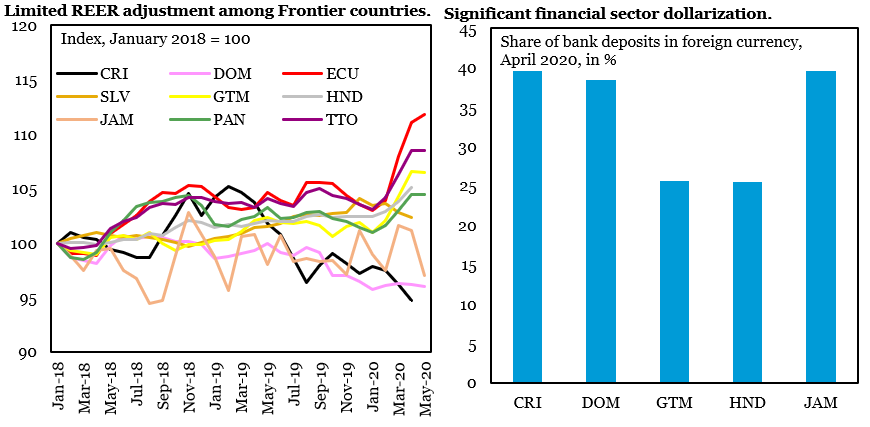

Overall, "fear of floating” has also remained high in Frontier LatAm, including most Central America and the Caribbean economies, amid dollarization, undeveloped financial markets, and weak policy buffers. 4/5

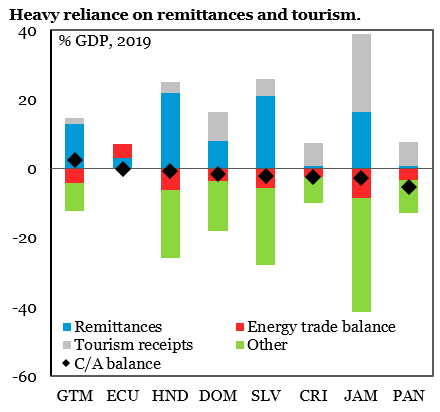

In Frontier LatAm, the lack of exchange rate flexibility could further weaken critical sources of dollar liquidity such as remittances and tourism, complicating the post-COVID19 recovery. 5/5

Read on Twitter

Read on Twitter