Q&A #Thread 22

#CYIENT #Stock #Investment #Analysis

Q->Don't worry Hold #CYIENT it's Gem !! Its a clean company !! It will be a Multibagger !!

1n

#CYIENT #Stock #Investment #Analysis

Q->Don't worry Hold #CYIENT it's Gem !! Its a clean company !! It will be a Multibagger !!

1n

Me->I am not sure about Future Multibagger just presenting some facts & findings

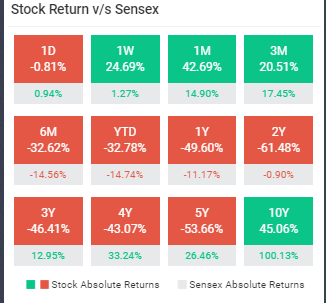

Stock Return under-performed Sensex & Peers in last 1, 3, 5 & 10Yr

Stock Price CAGR

10 Years:3.93%

5 Years:-13.78%

3 Years:-18.57%

1 Year:-49.18%

Poor Stock Return despite good ratios ?

2n

Stock Return under-performed Sensex & Peers in last 1, 3, 5 & 10Yr

Stock Price CAGR

10 Years:3.93%

5 Years:-13.78%

3 Years:-18.57%

1 Year:-49.18%

Poor Stock Return despite good ratios ?

2n

Sales Growth 10yr ~ Profit Growth 10yr

Sales growth 5Yr > Profit growth 5yr

Sales growth 3Yr > Profit growth 3yr

I doubt companies where Sales growth is higher than Profit growth over longer periods.

Let's quickly glance at some other data of #Cyient .

3n

Sales growth 5Yr > Profit growth 5yr

Sales growth 3Yr > Profit growth 3yr

I doubt companies where Sales growth is higher than Profit growth over longer periods.

Let's quickly glance at some other data of #Cyient .

3n

Good ROCE, ROE.

Revenue is lower than last yr.

EPS, OPM%, NPM% has declined substantially from last Yr.

Fin Trend is -ive

High Dividend Yield 5.44%

No Solvency Issue

Stock Dilution 20.37% in last 12 yrs. I am not a fan of this. Retail shareholders are at loosing end.

4n

Revenue is lower than last yr.

EPS, OPM%, NPM% has declined substantially from last Yr.

Fin Trend is -ive

High Dividend Yield 5.44%

No Solvency Issue

Stock Dilution 20.37% in last 12 yrs. I am not a fan of this. Retail shareholders are at loosing end.

4n

Promoter holding is low 22.87% & has marginally increased by 0.69% in last 3 yrs.

Institution Holding is High 64.25%. Basically stock in at their mercy.

For last 3yrs FII has been reducing their stake same time DII has been increasing

5n

Institution Holding is High 64.25%. Basically stock in at their mercy.

For last 3yrs FII has been reducing their stake same time DII has been increasing

5n

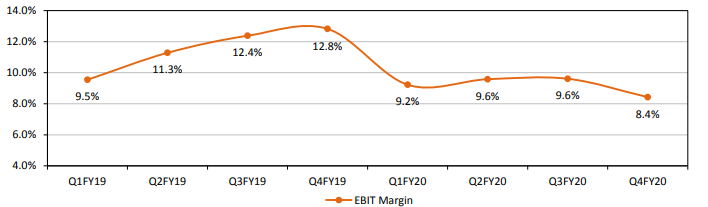

EPS growth is mediocre.

OPM & NPM is under pressure.

EBIT margin is declining 12.8%(Q4FY19) to 8.4%(Q4FY20)

Healthy Cash & Cash Equivalent.

Despite having Cash on books it's increasing it's Borrowings every year 182Cr (FY16) to 325Cr (FY19).

Why ?

6n

OPM & NPM is under pressure.

EBIT margin is declining 12.8%(Q4FY19) to 8.4%(Q4FY20)

Healthy Cash & Cash Equivalent.

Despite having Cash on books it's increasing it's Borrowings every year 182Cr (FY16) to 325Cr (FY19).

Why ?

6n

Last 10yr->

CFO 2085Cr

Net Profit 2789Cr

So 700+ Cr gap (33% of CFO)? It raised my doubt further. Need more investigation.

Looks like it is in Other Income - Investment in MF & FDs

Working capital is deteriorating.

7n

CFO 2085Cr

Net Profit 2789Cr

So 700+ Cr gap (33% of CFO)? It raised my doubt further. Need more investigation.

Looks like it is in Other Income - Investment in MF & FDs

Working capital is deteriorating.

7n

#Cyient spending approx 80 Cr/yr on Machinery repair when it does not have any manufacturing operations?

This is Not common for IT services company as they are asset-light business.

FY2019 machinery repair was 86.8 Cr. On Fixed asset base of 274 Cr this feels Very High.

8n

This is Not common for IT services company as they are asset-light business.

FY2019 machinery repair was 86.8 Cr. On Fixed asset base of 274 Cr this feels Very High.

8n

Acquisitions !

Softential (-3cr asset) negative asset acquired in 150Cr in Apr 2014. Why loss making company at such premium?

Rangson now DLM (37 Cr asset) acquired in 292 Cr in Feb 2015. Why 37cr asset in 292 Cr?

Despite 5 Yr after DLM acquisition, it is still loss making

9n

Softential (-3cr asset) negative asset acquired in 150Cr in Apr 2014. Why loss making company at such premium?

Rangson now DLM (37 Cr asset) acquired in 292 Cr in Feb 2015. Why 37cr asset in 292 Cr?

Despite 5 Yr after DLM acquisition, it is still loss making

9n

Derivative Contracts !

#Cyient has reported large profits as well as losses due to derivative contracts.

It plays with Risky Derivative contracts that's not expertise of IT services company.

Good times profit but when tide turns could lead to huge losses.

10n

#Cyient has reported large profits as well as losses due to derivative contracts.

It plays with Risky Derivative contracts that's not expertise of IT services company.

Good times profit but when tide turns could lead to huge losses.

10n

Forward Contracts are reason for large Variance in Other Income.

In Mar 2019 ICRA opines that Cyient’s board discussions on risk are currently limited, and that a more robust risk evaluation and policy framing at the board level is required.

11n

In Mar 2019 ICRA opines that Cyient’s board discussions on risk are currently limited, and that a more robust risk evaluation and policy framing at the board level is required.

11n

Compliance !

Delay in depositing undisputed dues including PF, Tax, Employees State Insurance, IEPF, Sales Tax, Wealth Tax, Works Contract Tax, Service Tax, Custom Duty etc in FY2012, FY2013, FY2014 ?

Compliance needs improvement, especially when it is undisputed.

12n

Delay in depositing undisputed dues including PF, Tax, Employees State Insurance, IEPF, Sales Tax, Wealth Tax, Works Contract Tax, Service Tax, Custom Duty etc in FY2012, FY2013, FY2014 ?

Compliance needs improvement, especially when it is undisputed.

12n

Corporate Governance !

(Nov 2017)

ICRA- Avoidance of Interlinkage in Boards – One of the executive directors of Cyient is a member of a Board and audit committee of a company where an independent director of Cyient is a promoter. This could result in conflict of interest..

13n

(Nov 2017)

ICRA- Avoidance of Interlinkage in Boards – One of the executive directors of Cyient is a member of a Board and audit committee of a company where an independent director of Cyient is a promoter. This could result in conflict of interest..

13n

...and prevent independent decision making; and thus, avoidance of the same is imperative.

In July 2019 management admitted - Losing revenue from its biggest customers & Lagging behind in new-age technologies (Virtual reality,analytics, Augmented Reality, IoT etc)

14n

In July 2019 management admitted - Losing revenue from its biggest customers & Lagging behind in new-age technologies (Virtual reality,analytics, Augmented Reality, IoT etc)

14n

#Cyient has exposure to Aerospace & Defense (37.8% of revenues),transportation (10.2%) and Energy & Utility (12.0%), facing max impact of Covid 19.

Boeing is it's client & we all know what's going on there.

15n

Boeing is it's client & we all know what's going on there.

15n

Tax incentive of many SEZ units are phasing out from 100% to 50%.

Probably why we are seeing steady Tax% increase from 15% (Mar2019) to 46% (Mar2020).

This will further adversely impact its Margin in future.

16n

Probably why we are seeing steady Tax% increase from 15% (Mar2019) to 46% (Mar2020).

This will further adversely impact its Margin in future.

16n

Succession No Issue. Remuneration pf Board Members reasonable

Short term hope & speculation can make price movement either direction

FII & DII are in strong position to make it move

Long-term chose wisely

I rest my points here. Please add anything if you know or I missed.

17n

Short term hope & speculation can make price movement either direction

FII & DII are in strong position to make it move

Long-term chose wisely

I rest my points here. Please add anything if you know or I missed.

17n

Read on Twitter

Read on Twitter