Tomorrow the market is back open. How things might look for our beloved $KTOV & with Q2 ending Tuesday, will partnerships be announced? Is there really a buyout in play? & why $KTOV might be a stronger stock than many have originally anticipated

(thread below)

(thread below)

(thread below)

(thread below)

First, always remember, this is my opinion based upon my research. I've put lots of time into this stock so make sure you always research before investing. This is deep DD, public information. This is simply a breakdown from my mindset & how I feel towards all this information.

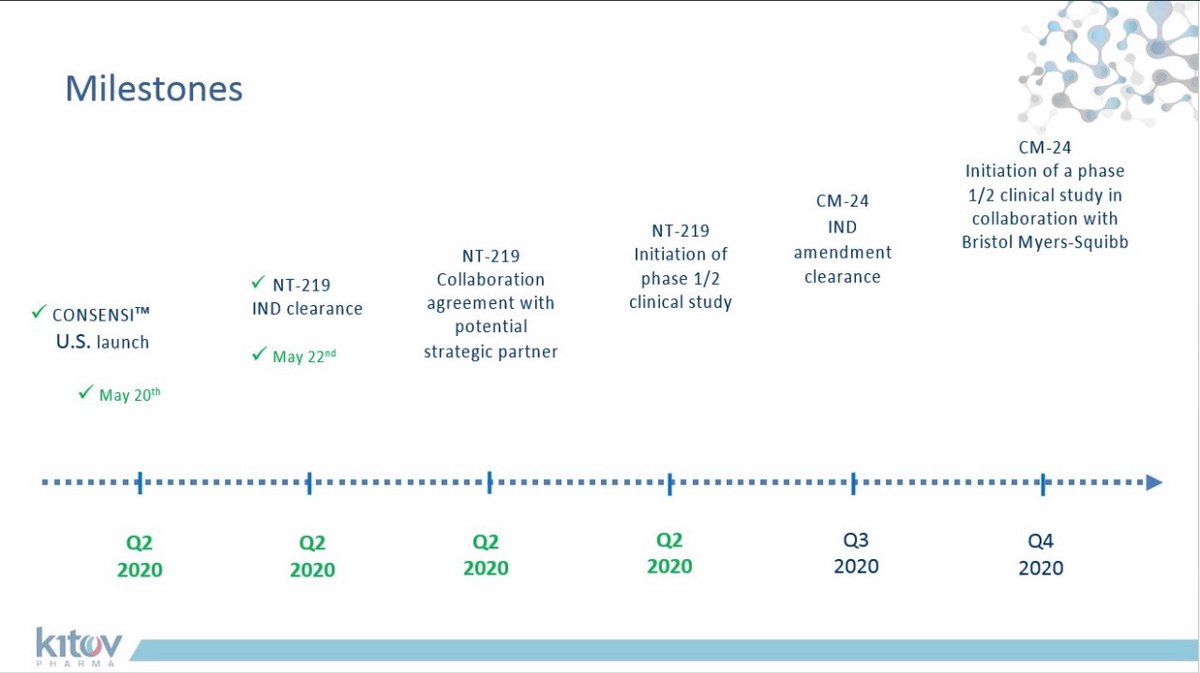

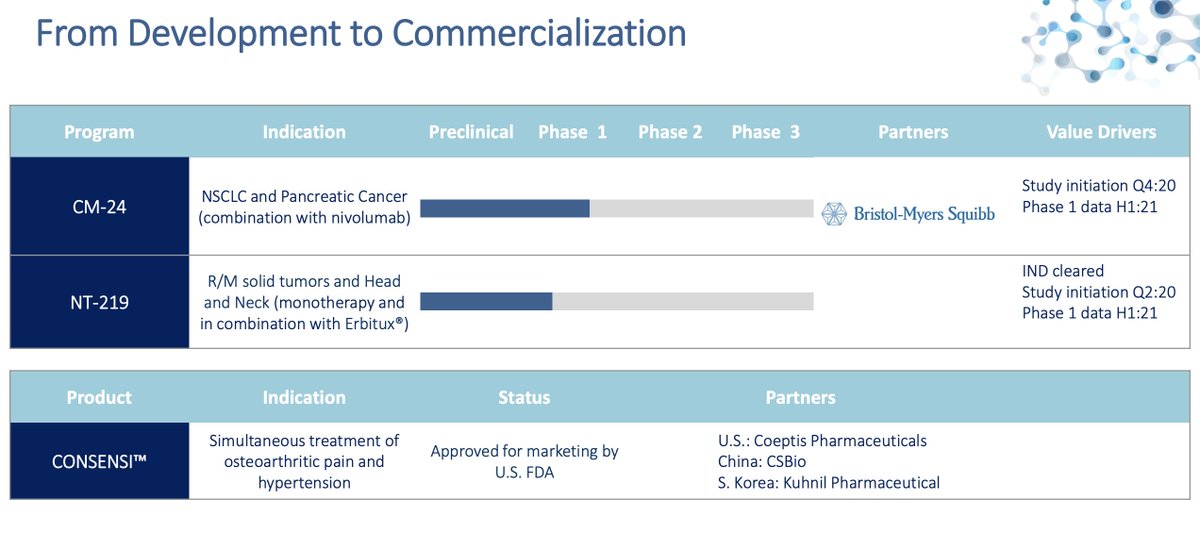

Where do we begin? Yes, the milestones. As we all know, two big milestones are waiting to be announced which has caused excitement, fear & debate on when they will be announced, those two consist of the powerful cancer drug NT-219 (Collab partner & initiation of phase 1 study).

Partnerships are big. It can make an effective impact to a share price if collaborating with a big partner. For example, I mentioned $SURF in a pervious thread when they collaborated with Merck last month. The share price jumped from $2.66 to $7+ day of announcement.

But I'm starting to believe whoever the partner is, it will be big & this is why I think people are not understanding the significance of NT-219. The more I dive into this drug, the more I realize how much it could actually be worth. A drug that could disrupt the oncology sector

First, NT-219 is "First in class". I believed this term has been overlooked. If approved by the FDA, it will be the first & only of its kind, there's nothing else like it. NT-219 enhances the efficacy of other cancer therapy drugs & helps reduce tumors significantly. But..

It's not just what it does, it's what it's doing for so many companies & people. There's two sides to this: The Clinical & Non Clinical - The Clinical is going to be based off the data derived from primary & efficacy endpoints. The Non Clinical is how it'll improve patients lives

We're talking life changing if it passes both phase 1 & phase 2. We've seen what NT-219 does in humanized studies already (check previous threads) & now we're beginning to understand the possible demand for all these big Pharma companies such as Merck, Eli Lilly, etc.

& this is where the speculation of buyout comes into play. If you could imagine a multi-billion dollar company such as Merck having a powerful streamline cancer therapy drug in Keytruda & knowing it can become even more powerful with NT-219, the possibilities are endless..

First, Keytruda is Merck's top selling drug ($11 Billion+ revenue last year) & The 36-month overall survival is 43.7% for Keytruda. In studies with NT-219, tumors reduced 80%. Just imagine the survival rate increase & revenue generated if Merck brought in NT-219...

Second, the competition. NT-219 has enhanced efficacy in studies for big Pharma's & this could lead to urgency for a potential offer or one of their counterparts beating them to the punch. But would $KTOV CEO Isaac Israel want that? With other drugs KTOV has, money talks sometime

Third, dominance. Merck has showcased they want to dominate the Pharma marketplace with 2 acquisitions in the 6 months w/ Themis Bioscience (Covid-19) & ArQule (Oncology). Could this recent Form 8K filed on June 24th mean another? Pure speculation but highly possible...

Form 8K's are usually filed for 1 of 4 things: Acquisition, Buyout, Bankruptcy & Executives Released or Resigning. Hard to imagine 1 of the last 2 being the culprit because the amount was for $4.5 billion dollars, an amount that would signify something big...

Whatever the potential outcome is, I believe the general public is catching on to how powerful NT-219 is & just maybe why $KTOV has showed strength & health in the market this past week. But I believe there's other variables on why maybe it's undervalued even w/o a Collab yet

First, the company $SURF I dived into their pipeline & they have not one drug past Phase 1 yet. I mention this because they were trading around $2.66 before the partnership & it makes me wonder where $KTOV should be given they actual have a drug in commercial & showing milestones

That leads me to Consensi. $KTOV closes the gap on a market where 44% of patients who have high blood pressure have osteoarthritis. Essentially, 1 out of ever 2 patients. KTOV also expects to receive $28M+ in royalties from Consensi between 2020 & 2022. Lastly, it's for sale.

& then there's the two powerful cancer therapies in CM-24 (Collab w/ Bristol Myers) & NT-219. Two drugs, that have shown promising results in the data given to us. Drugs that can change the world but yet it's trading at $1.21/share right now. Is it undervalued? Underestimated?

I'm not sure what's to happen coming up but I'll leave you with this quote from $KTOV CEO: “The beauty of NT-219 is that it’s been found, in pre-clinical trials, to be very effective in a wide range of combinations of therapies,” Mr. Israel says..

He added: “So the market is enormous.” He noted that Merck & Co.’s Keytruda, for example, has already reached "blockbuster" status.

Which leads me to believe $KTOV is exactly who we thought they were.

Which leads me to believe $KTOV is exactly who we thought they were.

So that leaves us here, two days left in Q2, a plethora of speculations & potentially something big whether a Collab, acquisition, buyout, etc. All I know is, this is what's in front of us and we can only make educated decisions moving forward on $KTOV

I hope this helps and I can't wait to see what this week brings with $KTOV. Don't forget our catalyst is still out there & with all the potential upside it has to offer, who knows what's going to happen. I wish everyone nothing but the best. It's our time, Let's F****** GO!!!!!

Read on Twitter

Read on Twitter