Enjoyed this post from @DubraCapital

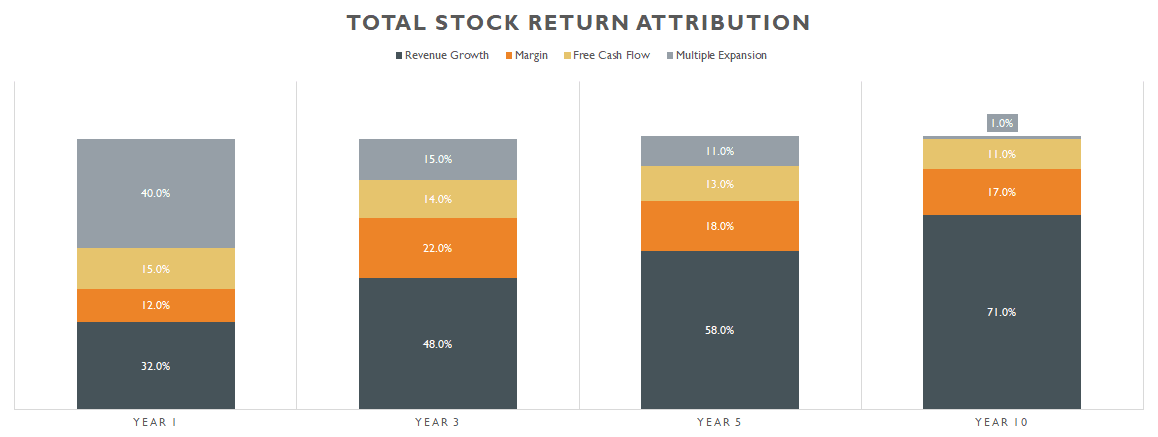

Seeing that BCG study that essentially concluded

sustainable revenue growth = the best returning stocks

triggered my last major investment philosophy change (on the long side) a couple years ago.

https://dubra.substack.com/p/the-anatomy-of-stocks-that-go-up

Seeing that BCG study that essentially concluded

sustainable revenue growth = the best returning stocks

triggered my last major investment philosophy change (on the long side) a couple years ago.

https://dubra.substack.com/p/the-anatomy-of-stocks-that-go-up

Big TAM, better product than existing solution, and innovative management teams seem to be among the common qualities some of the best returning stocks have in common. https://dubra.substack.com/p/stocks-that-go-up-a-recipe

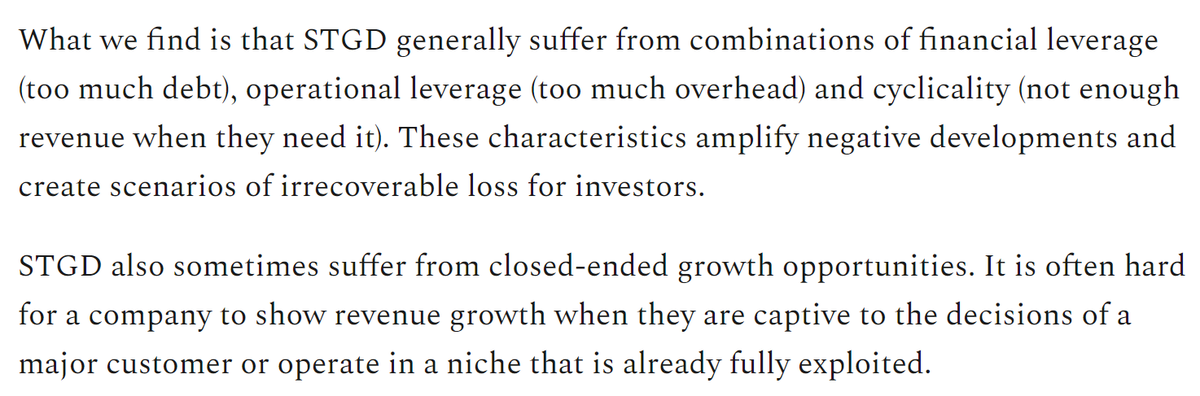

The first post also covers Stocks That Go Down (STGD) which are some charateristics I've used for finding shorts and managing risk / sizing in the long book (avoid or limit the total size of bets that have these characteristics if you must be long them)

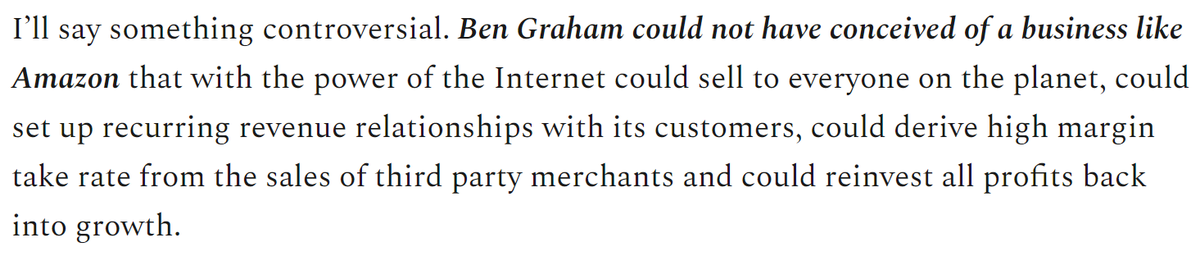

I think historic case studies help and working on my investment framework until it could have identified and allowed me to own the best returning stocks like NFLX & AMZN has been the biggest recent change in my investment style. https://dubra.substack.com/p/amazon-the-goat-stgu

One part of the 3rd post I disagree with is that Ben Graham could have concieved of a business like AMZN because he owned one, GEICO.

GEICO had the ability to sell to many with low capital costs.

GEICO had the ability to sell to many with low capital costs.

Similar to today's growth stocks, GEICO lost money in the first year of a customer (like $200-300 I think) with very high lifetime values ($2,000+)

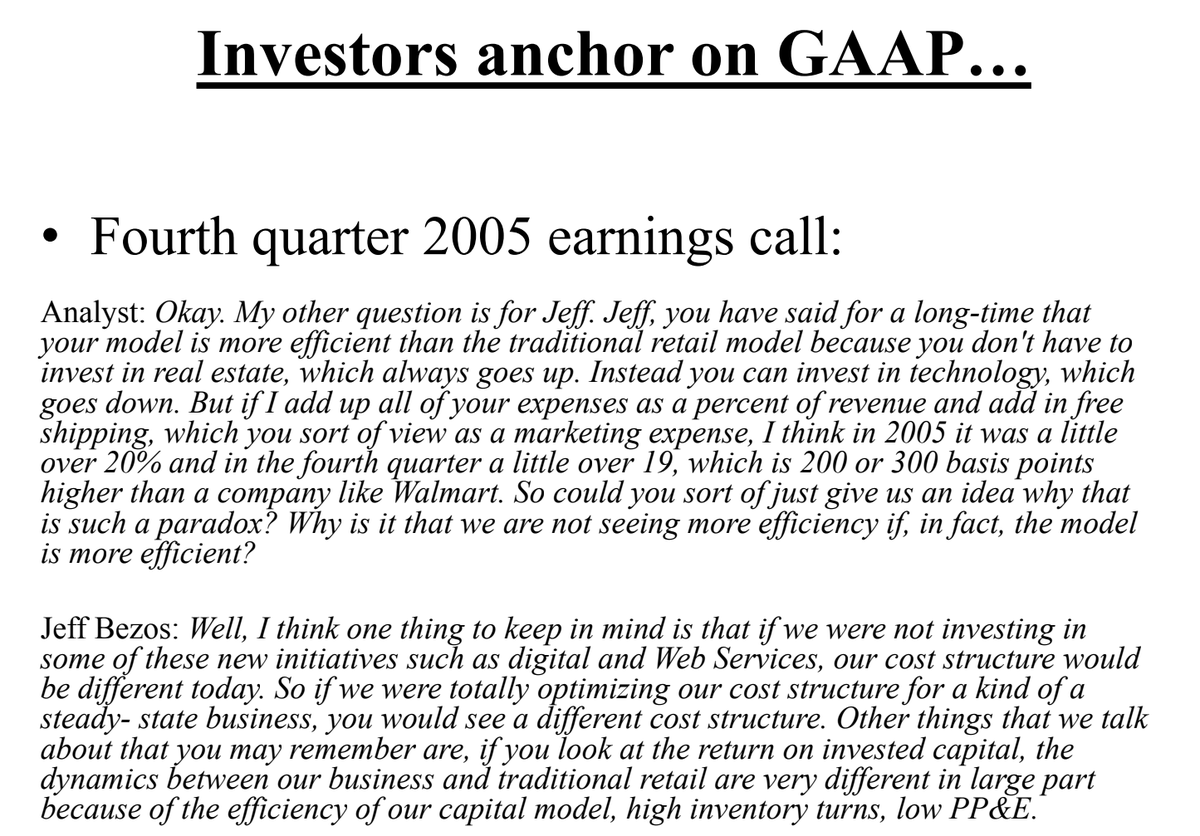

The business didn't take off until it was owned by someone that didn't care about reported GAAP earnings...

The business didn't take off until it was owned by someone that didn't care about reported GAAP earnings...

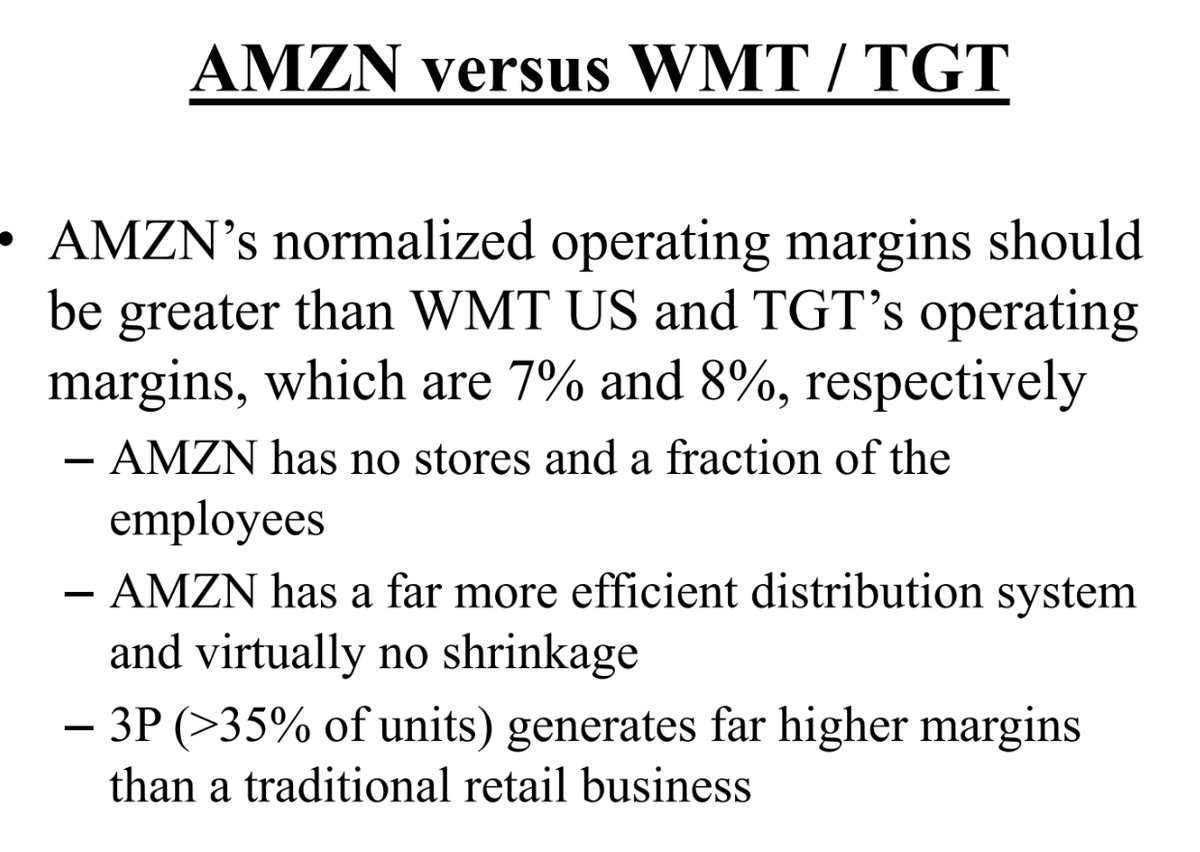

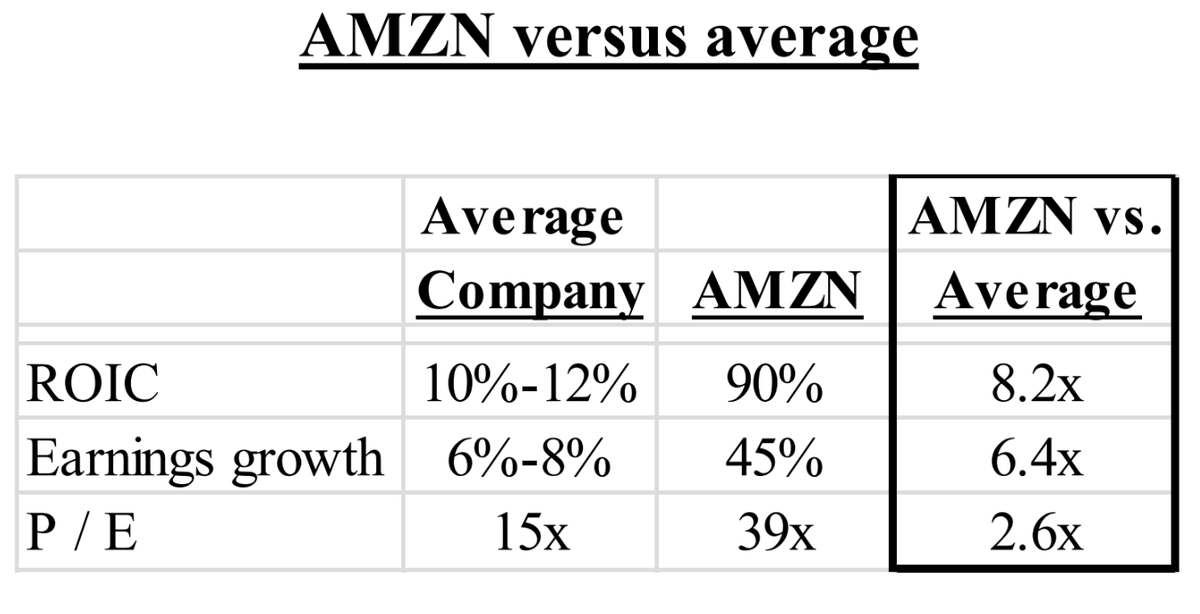

This $AMZN pitch from Josh Tarasoff, PM of Greenlea Lane Capital, is instructive in analyzing and valuing growth companies.

Basically, normalize margins to back out growth investments, and see where it trades relative to market and its own history.

https://docs.google.com/viewerng/viewer?url=https://valuexvail.com/wp-content/uploads/2018/03/98208572-ValueXVail-2012-Josh-Tarasoff.pdf

Basically, normalize margins to back out growth investments, and see where it trades relative to market and its own history.

https://docs.google.com/viewerng/viewer?url=https://valuexvail.com/wp-content/uploads/2018/03/98208572-ValueXVail-2012-Josh-Tarasoff.pdf

The most directly comparable recent example for me was using this framework to analyz $CHWY. Another company that has negative reported income by choice (they invest in marketing to acquire new customers) that otherwise would have extremely high ROIC on a normalized basis.

Another reason why I enjoyed the book 7 Powers so much. Basically identifying circumstances where a company can create sustainable growth / value creation.

I WILL get around to doing my notes on that, right after I crown a hard seltzer champion...

I WILL get around to doing my notes on that, right after I crown a hard seltzer champion...

Read on Twitter

Read on Twitter