The word “invest” has 2 distinct meanings in relation to capital:

Invest (1): Spend money to build a capability. Example: a bridge, a factory, a mansion.

Invest (2): Spend money to acquire a formal stake in an existing capability. Example: stock, bond, lien.

2 now dominates 1

Invest (1): Spend money to build a capability. Example: a bridge, a factory, a mansion.

Invest (2): Spend money to acquire a formal stake in an existing capability. Example: stock, bond, lien.

2 now dominates 1

The two are coupled. For example, you invest (2) in my company so I can invest (1) in a new factory. Instead of shareholder value or a dividend, you might claim a share of the output at a good price for example (offtakes, kinda like futures) https://www.investopedia.com/terms/o/offtake-agreement.asp

To me it seems like the natural arrangement. The recent thing with negative oil prices should not seem weird at all. When you buy oil futures, the natural assumption should be that you’ll actually take delivery. Invest (2) should imply a direct stake in invest (1).

It’s a moral hazard to purely invest (2) in money-in-money-out (MIMO) ways. You have no interest in how black box works. All knowledge risk lies with investee. If your MIMO deal is not honored you can’t tell fraud apart from real problems. You can’t judge whether to grant relief.

This is the definition o dumb money. Of course most real investment (2) does informally include some appreciation of the underlying investment (1), but not in any way that is operationally specific. Few investors who play for even controlling stakes actually desire control.

Control in finance has come to mean “control of the board and ability to hire/fire top executives” which is increasingly just too shallow to address the complexity of modern principal-agent relations. Money *wants* to be stupid because the wealthy don’t want to do invest (2) work

Financialization, “shareholder value” as a disease etc all have their roots in a single psychological problem: the rich are really lazy. They don’t want to put in the work to make their money smart. They want to either swarm opportunities via imitation, or rely on “analysts”

Sorry, typo... 2 tweets up should be “don’t want to do invest (1) work” https://twitter.com/maxwells_d3mon/status/1277268243405815809?s=21 https://twitter.com/maxwells_d3mon/status/1277268243405815809

There is a lot of bullshit conservative sermonizing about how the poor deserve their fates because they don’t work hard and that’s why the economy suffers etc. This is not only not the problem, it is not even true. Most economic problems arise from the rich not work hard enough.

If you have 10s of millions of dollars, it *matters* how hard you, PERSONALLY think about where to put it. Even a single degree of delegation creates huge principal-agent distortions. To the extent some wealth creation opportunities need concentrated capital, the rich must think.

Some rich do think and work hard but they think wide and shallow for the “highest ROIC” (where the I is investment (2), not (1)) opportunities. They rarely think deep about how a particular invest (2) will drive the invest (1). They don’t care about the meaning of the money.

There is something deeply nihilistic, stupid, fearful, and acting-dead about this. If the only difference between 2 investments for you is return rates, and you are not curious about the futures implied by investing in either, you’re kinda dumb and boring.

“Capital seeking returns” is a stupid 1-quarter-out mindset. It aspires to be as smart as evolution, which is also “blind”, but doesn’t have a similar (2) —> (1) indirection injecting stupidity. Genes don’t magically jump to the most fecund species driving booms/busts.

If biological evolution, to which market is often compared, were as stupid as market, entire gene pool would have jumped into the horniest pair of rabbits a million years ago and life would have vanished in one giant subprime rabbit boom and bust. Evolution invests (1), not (2).

Ie capital is too mobile. It has ADHD. It rarely hangs around long enough to learn about survival in a given evolutionary niche and create civilizational wealth there. The exception is when people like Musk force money to pay attention, making invest (1)= invest (2)

Notably capital markets have a notion of seeking alpha (novel information to guide investment) but no notion of how long that information needs to be acted on to realize value. New alpha simply moves the money, regardless of whether or not it actually invalidates previous alpha.

It’s obvious why. Because capital is so imitative, the primary payoff of alpha is convincing others there *is* alpha. Most invest (2) is a bigger-fool scheme that has zero structural interest in the actual meaning of a piece of alpha.

Better mousetrap? Most value lies in convincing others it is better.

Teleportation technology? Most value lies in convincing others it is exciting.

Capital isn’t interested in either unless someone detains it by force for long enough.

Teleportation technology? Most value lies in convincing others it is exciting.

Capital isn’t interested in either unless someone detains it by force for long enough.

There have been ideas like long term stock market etc, but I think they’re too crude and give up too much information sensitivity.

Kind of thing I have in mind would be stocks that act like bonds. What if stocks were priced based on how long you were willing to hold?

Kind of thing I have in mind would be stocks that act like bonds. What if stocks were priced based on how long you were willing to hold?

Not RSUs or options per se. The same stock would cost $10 instead of $15 if you committed not to sell until next year etc. Ie invest (2) would effectively rent, not own equity. But not in the sense of options. A hotel room night costs more than a year lease on apartment for eg.

One of the reasons I’m in indie consulting is I only have time to invest, not money. But the other reason is that it allows you to bridge invest (2) (abstract management theories, macro trends) and invest (1) (applying it to a specific company, going as deep as possible)

Not all consultants do this. There are lazy equivalents to investors (2) who you can call consultants (2). Jump from client to client, never bothering to understand any business, shilling the same “process” workshop regardless of context. Lean, “design thinking”, holacracy

Detest those types. They give the rest of us a bad name. There is no such thing as a context-independent business process or function. If you don’t care to learn about a business and adapt your offering, you’re lazily peddling fads the same way investors (2) lazily pump up stocks

But back to economy after that bit of product placement. This whole point is why I’m not a socialist. I don’t think it matters much who “owns” the capital. Whether it is a workers coop or a fat-cat single rich person, the question is how hard they think.

A single wealthy person might decide where to put a million dollars by spending 10 hours thinking about it.

A collective of 100 people each with a 10k stake in a million might spend an hour each thinking about it, so 100 hours.

100 diverse hours or 10 single-mind hours?

A collective of 100 people each with a 10k stake in a million might spend an hour each thinking about it, so 100 hours.

100 diverse hours or 10 single-mind hours?

On paper that’s 10x the hours but most of it will go to solving the coordination problem. The collective will be smarter in some cases, he single mind will be smarter in others.

The solution is a mix of concentrated and distributed capital pools driven by both kinds of smarts.

The solution is a mix of concentrated and distributed capital pools driven by both kinds of smarts.

I’m learning this the hard way with the @yak_collective

Some projects I’d take to that consulting collective hive-mind, others I’d do by myself. Very different challenges.

Same with money. Distributed investing is very hard. This is why passive investment in everything works.

Some projects I’d take to that consulting collective hive-mind, others I’d do by myself. Very different challenges.

Same with money. Distributed investing is very hard. This is why passive investment in everything works.

This tldrs the whole thread so far  https://twitter.com/jimyoull/status/1277286206997327872?s=21 https://twitter.com/jimyoull/status/1277286206997327872

https://twitter.com/jimyoull/status/1277286206997327872?s=21 https://twitter.com/jimyoull/status/1277286206997327872

https://twitter.com/jimyoull/status/1277286206997327872?s=21 https://twitter.com/jimyoull/status/1277286206997327872

https://twitter.com/jimyoull/status/1277286206997327872?s=21 https://twitter.com/jimyoull/status/1277286206997327872

You can’t fix the problems of markets and capitalism by changing who gets to be stupid and uninterested in the details of where it goes. Smart money is simply money that is paying attention to what it is doing.

No matter what the mechanism and who is investing, attention is key.

No matter what the mechanism and who is investing, attention is key.

Radical thought: centrally planned Soviet communism and Chinese capitalism aren’t actually that different from Western markets. All suffer from the exact same divorce between invest (1) and invest (2) leading to dumb ADD money.

They all just have different externalities.

They all just have different externalities.

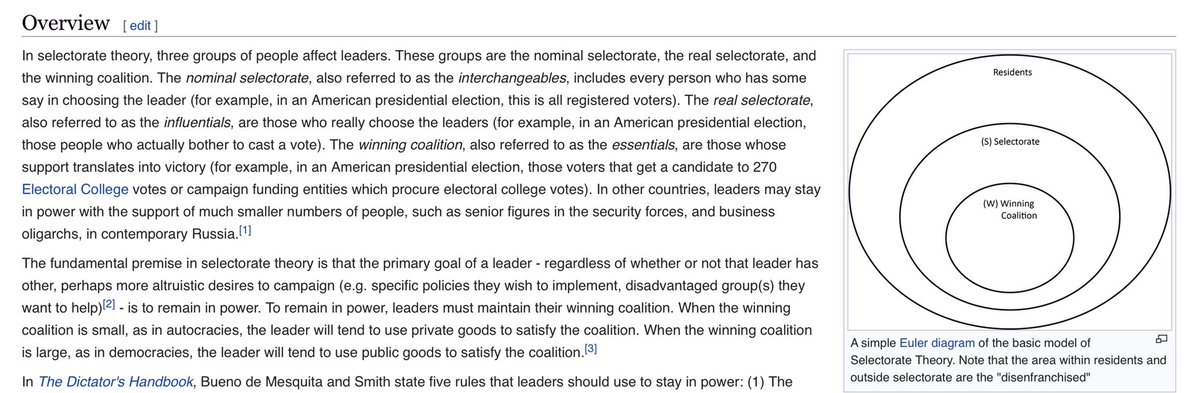

You could actually construct a Dictator’s Handbook style grand unified model comparing all three consistently. Selectorate theory can compare the substance of governance systems while ignoring their formal doctrinal differences. https://en.wikipedia.org/wiki/Selectorate_theory

In that theory you compare democracies and dictatorships in terms of 3 groups: nominal selectorate, real selectorate, winning coalition. Aka interchangeables, influentials, essentials.

In my economic theory: passive investors, investor-2s, investor-1s.

In my economic theory: passive investors, investor-2s, investor-1s.

USSR, modern China, and modern West represent differences in degree, not kind. All 3 are just different points in the 3D vector space of investor-selectorate theory.

For USSR, Spufford’s Red Plenty comes highly recommended. I’ve read summaries. https://www.amazon.com/Red-Plenty-Francis-Spufford/dp/1555976042

For USSR, Spufford’s Red Plenty comes highly recommended. I’ve read summaries. https://www.amazon.com/Red-Plenty-Francis-Spufford/dp/1555976042

Okay, after a run and a shower, I have more to say.

I probably have among the biggest income source spans on the planet. I’ve been paid directly by billionaires and centimillionaires for consulting, and by starving artists who can barely make rent via newsletter subs/ebook buys

I probably have among the biggest income source spans on the planet. I’ve been paid directly by billionaires and centimillionaires for consulting, and by starving artists who can barely make rent via newsletter subs/ebook buys

This makes me part of the direct service class, not that different from butlers or restaurant waiters. Bridging two very different worlds. Each side unconsciously tries really hard to avoid direct, humanizing contact with the other.

There is a motivated interest in doing this. Humanizing contact falsifies glib generalizations like “the poor are just lazy” or “the rich are just venal” and class-based theories of how things fail. This allows them to blame absolutely everything systemically wrong on other side.

On both sides I listen more than I talk (which may seem impossible to some who complain that I talk too much), while making it clear that the counterparty should not assume my sympathies. One way or another I’m being paid to think on their behalf, not commiserate. Like a lawyer.

To both sides I’m slightly suspect. The poor are suspicious of my work with the rich, and I’m often accused outright of being a petit bourgeoisie capitalist shill. Which is 100% true.

Equally the rich often suggest I’m a commie in bourgeois disguise. Also 100% true.

Equally the rich often suggest I’m a commie in bourgeois disguise. Also 100% true.

The opposite of every great truth is also a great truth.

The poor are exploited. True.

The poor are ressentiment driven identitarians who may or may not work hard. Also true.

The rich are lazy venal rentiers. True.

The rich are burdened with large responsibilities. Also true.

The poor are exploited. True.

The poor are ressentiment driven identitarians who may or may not work hard. Also true.

The rich are lazy venal rentiers. True.

The rich are burdened with large responsibilities. Also true.

This is class-based bothsidesism of course, which is why the worst of both sides are the ones who hate people like me the most (“vertical centrists” perhaps?).

But for every systemic failure theres plenty of blame to distribute from top to bottom of pyramid.

But for every systemic failure theres plenty of blame to distribute from top to bottom of pyramid.

Every class is complicit in how the world works. Every class has its full complement of sociopaths, clueless and losers. Every class has lazy and hard working types. Every class has people with fixed and fluid class identities. It’s a fractal thing.

Despite the fact that rewards of the system working are very unevenly distributed, ironically, every class winning or losing in terms of rewards seems super attached to the identities that keep the system the same. They want more rewards, but don’t want to change their identities

To bring it back around to investing, there is investing in *yourself* to consider.

Self-Investors (1) invest in their own growth, destroying last identities to forge new ones.

Self-Investors (2) double down harder and harder on who they think they are.

Self-Investors (1) invest in their own growth, destroying last identities to forge new ones.

Self-Investors (2) double down harder and harder on who they think they are.

There’s also Self-Investors 1.5. People who “grow” in a limited way reducible to class mobility.

Start rich, fall into poverty and go commie. Start poor, get rich, and go capitalist.

They say you’re the mean of your 5 best friends. These class-movers just change their 5.

Start rich, fall into poverty and go commie. Start poor, get rich, and go capitalist.

They say you’re the mean of your 5 best friends. These class-movers just change their 5.

In Great Tuth terms, these 1.5ers never achieve any sort of integration between opposed great truths. They just go from one great truth to its negation, by cherrypicking a different subset of confirmatory evidence from their experiences.

There’s a behavior I call default-stereotype switching.

Going socialist to capitalist? Switch poor-default from the suffering, exploited people you know to the resentful lazy ones. Going the other way? Switch rich-default from generous entrepreneur to Wall Street scammer.

Going socialist to capitalist? Switch poor-default from the suffering, exploited people you know to the resentful lazy ones. Going the other way? Switch rich-default from generous entrepreneur to Wall Street scammer.

So long as you don’t pop out of the class-mobility identity ladder entirely, and drop class-based defaults of admiration and contempt for individuals, you’re part of the problem. Which is fine. It’s not a shaming. It means you’ll be manipulated as interchangeable passives.

Not a coincidence: every single time anyone has strongly criticized me for my values, politics, or aesthetics (usually lack thereof), when I look, there’s a strong, hardened class identity behind it (this is not true of competence/skill/ignorance criticisms, which I appreciate)

I’m pretty bourgeois. Petit, not haute. It’s traditionallly been the least admired class, inviting the most contempt. The identitarian poor see it as a snobbish climber class. The identitarian rich see it as a gauche not-even-new-money class.

It is the most fluid-identity class.

It is the most fluid-identity class.

The upside of being in maximal contempt zone is that it is the zone where it is most difficult to harden an identity. There are no bourgeois manifestos or middle-class ideological tracts *for the bourgeois*, despite this being the class that writes these things for other classes

Writing *about* the petit bourgeois is almost universally unsympathetic. Much of it by members of the class themselves, via ritual self-flagellation. This is the world of Babbitts and Karens. They are portrayed as standing for nothing except their own comfort and convenience.

But middle-class societies tend also to be the ones in which human nature evolves fastest, through identity creative-destruction, as tidal forces of contempt from above and below tear apart and reconstitute the class, every generation. They also staff the investor (1) world.

Rich and poor usually don’t change and don’t want to change. They have stable identities they aspire to, conform to, and then cling to with hardened determination. The petit bourgeois middle class doesn’t have this psychological luxury. It evolves as a series of tropes and memes.

I don’t mind this. I’m fine with my life story being a series of bad memes that don’t cohere. Wojack today, Karen tomorrow. Neither world-denting Straussian-Girardian hero n or working class hero. Maybe I’ll title my autobiography “Glub and brrr: the story of a series of memes”

Positive archetypes are for people who live on maps. Investor (2) types, whether they invest with money or hardened self-congratulatory class identities that make growth an imperative for everybody but themselves. The price of living on the territory is being reduced to a meme.

I’ll stop here though I could go on. If you’re interested in this line of thought, I’m mainly developing it in my Great Weirding essay series on @breaking_smart

This thread is kinda my starter assumptions for that, though I’ve never laid it out like this https://breakingsmart.com/en/the-great-weirding/

This thread is kinda my starter assumptions for that, though I’ve never laid it out like this https://breakingsmart.com/en/the-great-weirding/

Read on Twitter

Read on Twitter