THREAD: I have a new working paper out on the impact the EU's tax haven list (the grey and blacklist) and the process that led to its creation - has had on getting jurisdictions to adopt policies to curb profit shifting and tax evasion https://www.brookings.edu/blog/up-front/2020/06/25/did-the-eus-attempt-to-name-and-shame-tax-havens-into-behaving-better-work/

First, a little recap of history of the EU's list: the first version, an amalgamation of lists maintained by Member States, was widely panned for being opaque and arbitrary

Even the OECD threw some shade on it - when other bureaucrats are mocking you, it's time to start over

Even the OECD threw some shade on it - when other bureaucrats are mocking you, it's time to start over

So the EU went back to the drawing board and began concocting a set of criteria to determine which jurisdictions would get reviewed for consideration on the next iteration of the list

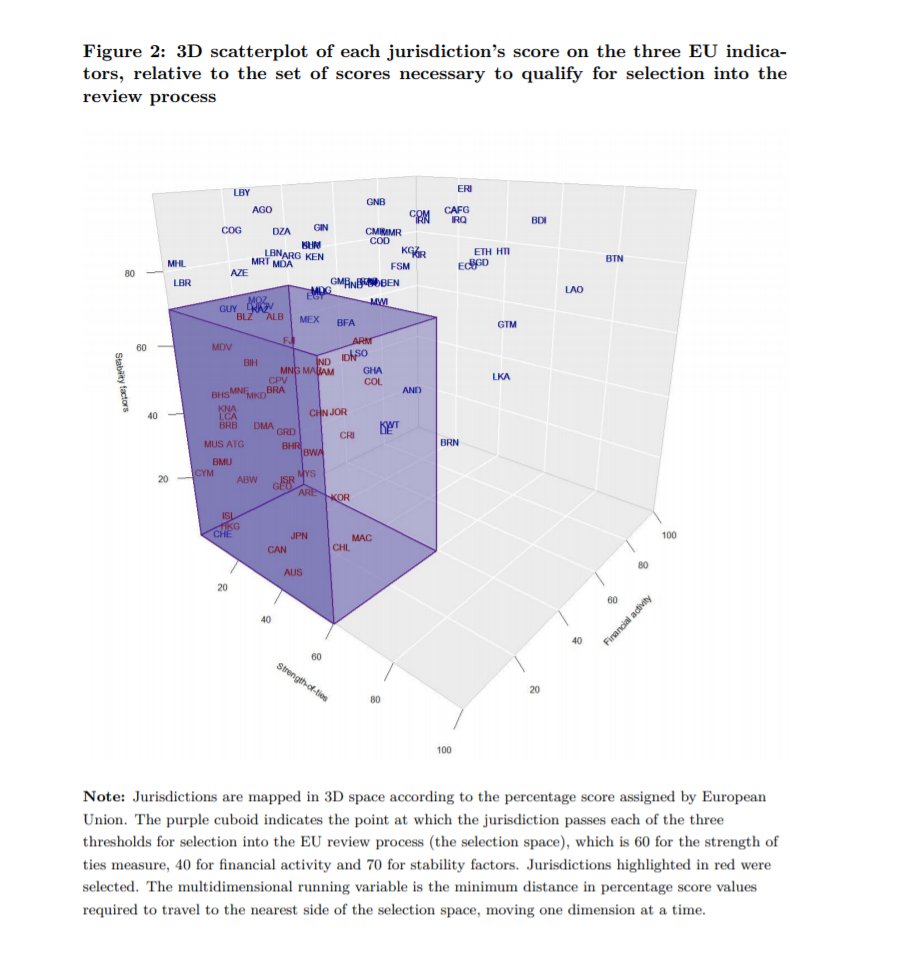

They focused on three things:

They focused on three things:

(1) How strong the EU was economically tied to the jurisdiction (e.g. multinationals with affiliates there, FDI, trade)

(2) How much financial activity there was overall in the jurisdiction

(3) How stable the jurisdiction was (e.g. rule of law, control of corruption)

(2) How much financial activity there was overall in the jurisdiction

(3) How stable the jurisdiction was (e.g. rule of law, control of corruption)

In order to be reviewed for selection into the new list, a jurisdiction had to pass a set threshold on *all three* indicators

Thinking about selection in 3d space can be nightmare fuel, but here is an approximation of that process, with countries "in the cube" being considered

Thinking about selection in 3d space can be nightmare fuel, but here is an approximation of that process, with countries "in the cube" being considered

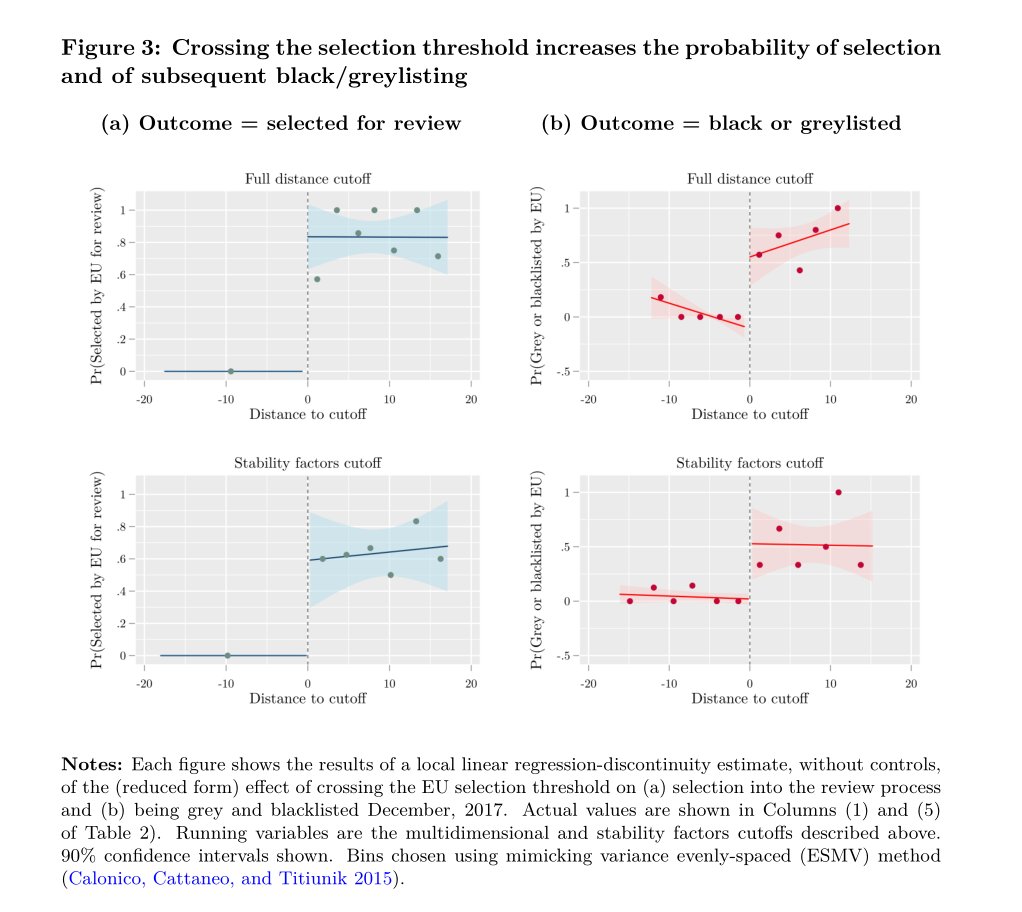

It sounded like a regression discontinuity in the making, so I collapsed the three dimensions into a single score based on how many points away each jurisdiction was from the review cutoff

those that exceeded the threshold were much more likely to be selected and then listed

those that exceeded the threshold were much more likely to be selected and then listed

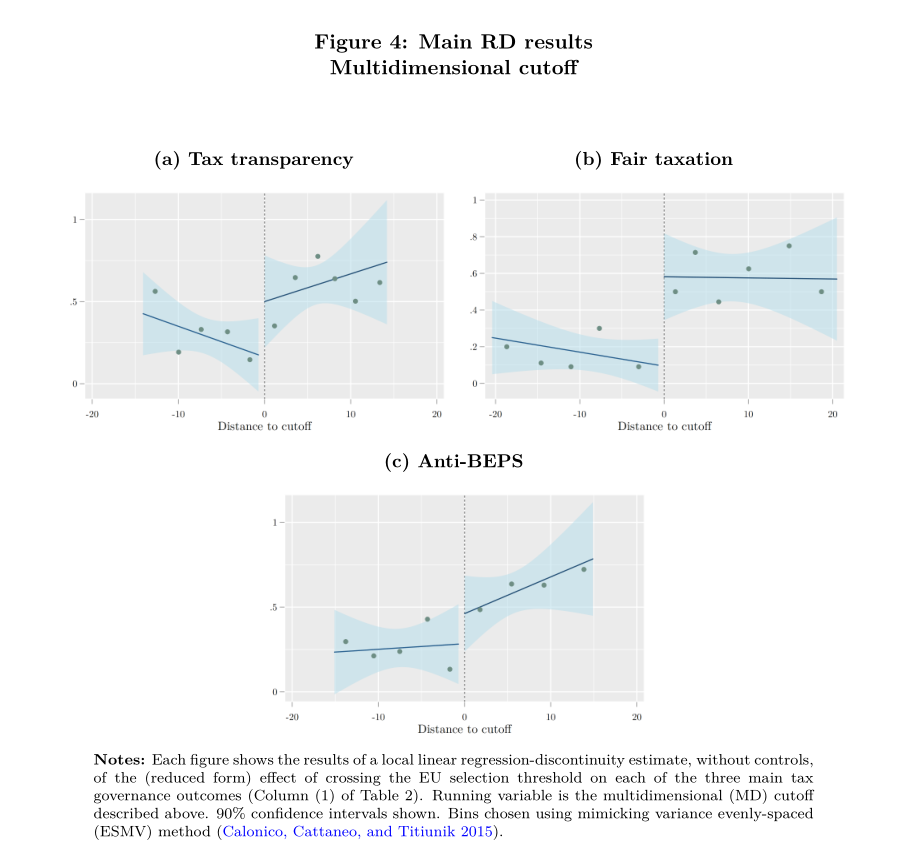

The EU was targeting a large number of outcomes with the listing exercise

For those that I could measure I collapsed them into three broad outcomes: tax transparency (e.g. exchange of information), fair taxation (harmful regimes) and anti-base erosion & profit shifting (BEPS)

For those that I could measure I collapsed them into three broad outcomes: tax transparency (e.g. exchange of information), fair taxation (harmful regimes) and anti-base erosion & profit shifting (BEPS)

The main takeaway is that jurisdictions selected for review by the EU saw no *significant* improvements in the average number of tax transparency reforms, a jump in fair taxation, and really very little in anti-BEPs

But there is a lot behind those average results

But there is a lot behind those average results

For Tax Transparency: if we dig down into specific outcomes, there is some evidence that EU pressure led to an increase in the number of jurisdictions that were rated as "largely compliant" on an older form of information exchange, known as exchange-of-information on request

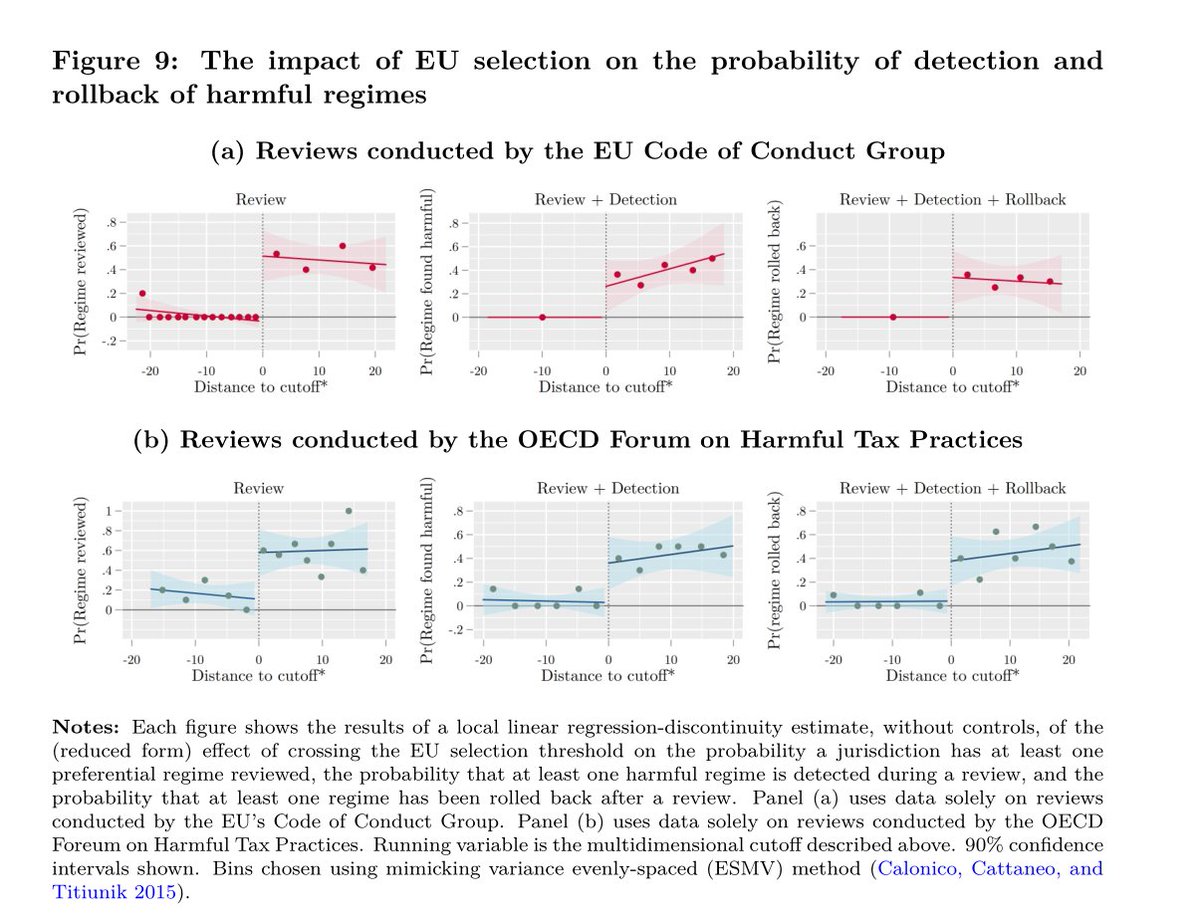

For Fair Taxation: we are faced with a measurement problem. The EU wanted to reduce the number of harmful tax regimes out in the world.

The standard way of detecting a harmful regime is, well, to review a regime and determine if it is structured in a way to be harmful.

The standard way of detecting a harmful regime is, well, to review a regime and determine if it is structured in a way to be harmful.

Several entities do this work, including the EU's Code of Conduct Group for Business Taxation (COCG) and the OECD's Forum for Harmful Tax Practices (FHTP)

But here's the rub: we can't observe (in the data) harmful regimes in jurisdictions that the COCG and FHTP don't review

But here's the rub: we can't observe (in the data) harmful regimes in jurisdictions that the COCG and FHTP don't review

This makes it impossible to fully judge how the EU review process has moved the needle on reducing harmful tax practices, so instead I look to see if, upon selection, a jurisdiction is more likely to get reviewed by *someone* and now no longer has any harmful regimes in place

This gives the EU a lot of credit because it counts being reviewed by the COCG as a win, but jurisdictions selected in the listing process were reviewed by default

BUT selected jurisdictions were also more likely to be reviewed by the OECD - suggesting a crowding in of attention

BUT selected jurisdictions were also more likely to be reviewed by the OECD - suggesting a crowding in of attention

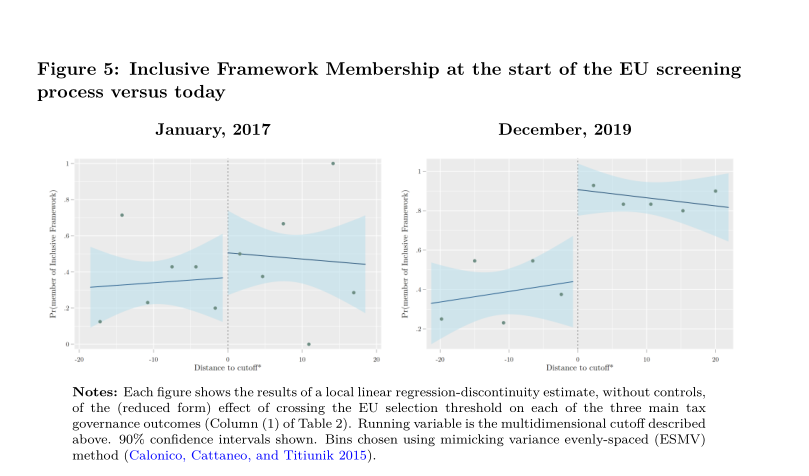

The results on BEPS aren't much to speak of, but the most robust, consistent, result of the entire paper is that the EU review and listing process seems to have led to a significant jump in the number of jurisdictions joining the Inclusive Framework

This was the lowest cost action that jurisdictions being targeted could take: vaguely commit to adopting anti-BEPs measures, and subject oneself to reviews by the FHTP

The jump in participation largely happened *in anticipation* of the publication of the first grey/blacklist

The jump in participation largely happened *in anticipation* of the publication of the first grey/blacklist

One struggle with a regression discontinuity framework is that it is difficult (and assumption + data heavy) to infer what the treatment effect was as you move away from the cutoff. All these effects are for jurisdictions that were *just barely* selected by the EU into review

The RD results suggest large effects (70+ percentage points) To understand the broader effect, I ran a simple difference in difference estimate of the impact of selection on joining and got a 30 pp increase

This suggests the IF is about 15% bigger thanks to the EU's involvement

This suggests the IF is about 15% bigger thanks to the EU's involvement

Have to turn my attention elsewhere but more on this later!

Read on Twitter

Read on Twitter