Today marks the end of an era. Right as yield farming is taking off we just finalised a poll on SCCP-29 https://sips.synthetix.io/sccp/sccp-29 . This was the original yield farming pool for sETH:ETH on Uniswap V1. So as it winds down, let's take a little trip down memory lane.

At the start of 2019 we were trying to work out how to create a liquid on-ramp to http://synthetix.exchange . A few proposals were put forward by the community, including paying an incentive to add liquidity in Uniswap for sUSD:ETH.

The intent being to replicate the success of the staking incetives we had announced for SNX a few months earlier.

The issue was impermanent loss, and with ETH hovering around $100 everyone was too bullish to commit to putting ETH against sUSD. Yes, everyone in our Discord was insane. So the idea was dropped. I was one of the most vocal critics of this proposal, because I am an idiot.

In early March 2019 we added a bunch of liquidity to sUSD and SNX pools on Uniswap. This was back in the good old days when we had to submit a PR to get them listed in the UI and beg @haydenzadams to merge it. https://twitter.com/degenspartan/status/1103838264383815680

Thank you to @worthalter who provided the ETH for the liquidity pools in Uniswap at the start and took the impermanent loss risk on for us.

A while later @DegenSpartan was discussing the weird volume on the WETH uniswap which @nocturnalsheet had discovered was coming from NUO being dipshits and using Uniswap to wrap ETH instead of just making a contract call.

Then in May @kiculovic dropped this: https://discordapp.com/channels/413890591840272394/549492529288970251/577987249803624449 why not sETH:ETH?

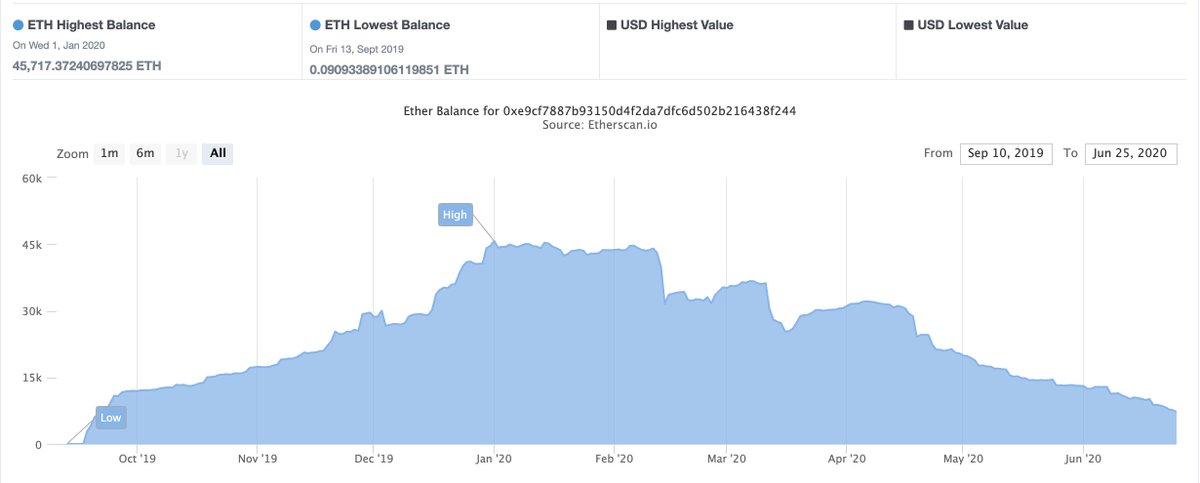

The thread was dropped but @DegenSpartan picked it up again, and then @kiculovic decided to yolo and create the pool himself. https://etherscan.io/tx/0x84e9aa194a5aa4d6098bb10f893a80806bda061e037f4560c7f3f9585c2edabf June 11th 2019, 380 days ago.

Myself and @Arthur_0x were still pretty anti-seth pool at this point though, and didn't get much traction. Then @DegenSpartan raised the idea of connecting the previously discarded incentive idea with the sETH pool.

Then the sKRW incident happened and it was dropped for a few weeks…

But the idea stuck with me and the more I thought about it the more convinced I was, so we decided to go for it and on the 12th of July we published this: https://blog.synthetix.io/uniswap-seth-pool-incentives/

But as with so many things there were unintended consequences, the debt pool was skewed heavily towards sETH, and even though the peg was much better, as ETH rallied through 2019 debt increased significantly and so earlier this year we decided to focus incentives elsewhere.

Thus was born the sUSD curve pool. It is now on it's second iteration and holds over $20m in stablecoins. The other day the SNX Foundation address did a 2.5m sUSD to USDC swap, one of the largest AMM tx ever with almost no slippage.

So while it is a sad day to see this OG incentive wound down, it served the project incredibly well and was one of the main awareness builders for the project through late 2019.

Thank you to everyone who contributed to this incredible incentive. Press F for the sETH pool.

Read on Twitter

Read on Twitter