1/

Here's my thesis on investing in DTC.

Experience comes from co-founding the largest independent DMA in the US and working with DTC brands like @HelixSleep @rothys @billiebody @TommyJohn + ~50 more.

Here's my thesis on investing in DTC.

Experience comes from co-founding the largest independent DMA in the US and working with DTC brands like @HelixSleep @rothys @billiebody @TommyJohn + ~50 more.

2/

Caveat 1: what do I know - I've only been in the investing space for ~18 months or so.

Caveat 2: I don't invest in fashion due to inventory / returns / need to be on trend.

Caveat 3: here talking about DTC where direct online sales through O+O website is a $50MM+ /year opp.

Caveat 1: what do I know - I've only been in the investing space for ~18 months or so.

Caveat 2: I don't invest in fashion due to inventory / returns / need to be on trend.

Caveat 3: here talking about DTC where direct online sales through O+O website is a $50MM+ /year opp.

3/

Principle #1: Subscription where subscription makes sense

Principle #2: First order has high Contribution Margin $

Principle #3: Current buying process sucks, especially if due to inertia of legacy players

Oh and do I love it when a company hits on 2 or even 3 of those!

Principle #1: Subscription where subscription makes sense

Principle #2: First order has high Contribution Margin $

Principle #3: Current buying process sucks, especially if due to inertia of legacy players

Oh and do I love it when a company hits on 2 or even 3 of those!

4/

As always, sizeable TAM is important. ( https://twitter.com/irrvrntVC/status/1275665905826050051?s=20)

And for me, as an investor who wants to be first check in, strong founder-market fit is essential.

Differentiated product is critical too but if you have founder-market fit you almost always get that too!

As always, sizeable TAM is important. ( https://twitter.com/irrvrntVC/status/1275665905826050051?s=20)

And for me, as an investor who wants to be first check in, strong founder-market fit is essential.

Differentiated product is critical too but if you have founder-market fit you almost always get that too!

5/

Starting with Principle #1: Subscription where subscription makes sense.

Examples from my own portfolio:

@GetcheekyC ( @jackgindi1)

@dyelikeaman

Subscription businesses for consumable products or products you need to replace is

Cheeky provides custom night guards...

Starting with Principle #1: Subscription where subscription makes sense.

Examples from my own portfolio:

@GetcheekyC ( @jackgindi1)

@dyelikeaman

Subscription businesses for consumable products or products you need to replace is

Cheeky provides custom night guards...

6/

Although they offer a one-time purchase, most customers opt for subscription as night guards get gross after a certain point. (Some customers even want them more frequently than quarterly).

This creates recurring revenue which investors love.

Although they offer a one-time purchase, most customers opt for subscription as night guards get gross after a certain point. (Some customers even want them more frequently than quarterly).

This creates recurring revenue which investors love.

7/

-> Predictable cash flow + as you acquire new customers, their revenue 'stacks' on top of previous customers' reorders, etc.

TrueSons offers best-in-class men's hair dye in 7 different shades via proprietary foaming experience. They also offer one-time + subscription options.

-> Predictable cash flow + as you acquire new customers, their revenue 'stacks' on top of previous customers' reorders, etc.

TrueSons offers best-in-class men's hair dye in 7 different shades via proprietary foaming experience. They also offer one-time + subscription options.

8/

In both instances -> subscription just makes sense.

If you're a teeth grinder it's unlikely you will ever stop needing night guards. Similarly, once you dye your hair it's unlikely you will stop.

Cheeky + True Sons also fit into Principle 3 - current buying experience sucks.

In both instances -> subscription just makes sense.

If you're a teeth grinder it's unlikely you will ever stop needing night guards. Similarly, once you dye your hair it's unlikely you will stop.

Cheeky + True Sons also fit into Principle 3 - current buying experience sucks.

9/

Subscription revenue can lead to a high LTV. By having a lower AOV to start you aim for a higher CvR and get customers to try your product.

Depending on unit economics, which are a critical component, you can aim to break even on first order, 3, 6, or 12 month payback.

Subscription revenue can lead to a high LTV. By having a lower AOV to start you aim for a higher CvR and get customers to try your product.

Depending on unit economics, which are a critical component, you can aim to break even on first order, 3, 6, or 12 month payback.

10/

Then you get to scale as quickly as possible within that constraint of payback period ~= Marginal CaC target.

As you get more data around retention curve and fully-baked LTV, you can hopefully raise your Marginal CaC target to allow for more long-term-profitable growth.

Then you get to scale as quickly as possible within that constraint of payback period ~= Marginal CaC target.

As you get more data around retention curve and fully-baked LTV, you can hopefully raise your Marginal CaC target to allow for more long-term-profitable growth.

11/

Another way to look at CaC targets instead of payback is LTV / CaC ratios. Baseline in consumer is 3:1, but I like to see 4+:1,

And my definition of LTV is very strict with Margins, WACC, Shipping, Returns, CC Fees, Marginal CS costs, etc. all baked in.

Another way to look at CaC targets instead of payback is LTV / CaC ratios. Baseline in consumer is 3:1, but I like to see 4+:1,

And my definition of LTV is very strict with Margins, WACC, Shipping, Returns, CC Fees, Marginal CS costs, etc. all baked in.

12/

Deep understanding of retention + cohort analysis is critical here. Often, an ounce of retention is worth a pound of acquisition.

Places you can spend to increase LTV:

-product

-CS

-site speed / experience

-unboxing / shipping

-retention mktng https://twitter.com/irrvrntVC/status/1207087115353362432?s=20

Deep understanding of retention + cohort analysis is critical here. Often, an ounce of retention is worth a pound of acquisition.

Places you can spend to increase LTV:

-product

-CS

-site speed / experience

-unboxing / shipping

-retention mktng https://twitter.com/irrvrntVC/status/1207087115353362432?s=20

13/

Also important to test pricing. Not all revenue is equal; extreme example below:

+1k subs @ $100/mo > $100k MRR

+5k subs @ $20/mo > $100k MRR

COGS, shipping, etc will be significantly lower in scenario 1. Even 'fixed costs' like rent + employees can also be lower.

Also important to test pricing. Not all revenue is equal; extreme example below:

+1k subs @ $100/mo > $100k MRR

+5k subs @ $20/mo > $100k MRR

COGS, shipping, etc will be significantly lower in scenario 1. Even 'fixed costs' like rent + employees can also be lower.

14/

Now on to

Principle #2: First order has high Contribution Margin $

Portfolio Examples:

@CarawayHome

@officebybranch ( @greghayes44)

Not 'traditional DTC' but it was always in the playbook: https://techcrunch.com/2020/06/11/covid-19-nearly-killed-this-office-furniture-startup-turning-to-home-offices-may-save-it/

Now on to

Principle #2: First order has high Contribution Margin $

Portfolio Examples:

@CarawayHome

@officebybranch ( @greghayes44)

Not 'traditional DTC' but it was always in the playbook: https://techcrunch.com/2020/06/11/covid-19-nearly-killed-this-office-furniture-startup-turning-to-home-offices-may-save-it/

15/

Caraway sells some of the most beautiful, functional, and healthy cookware. Their hero product is a $395 4-piece cookware set.

Industry reports put this category at ~50% GM so that means CM$ here is ~$200.

Caraway sells some of the most beautiful, functional, and healthy cookware. Their hero product is a $395 4-piece cookware set.

Industry reports put this category at ~50% GM so that means CM$ here is ~$200.

16/

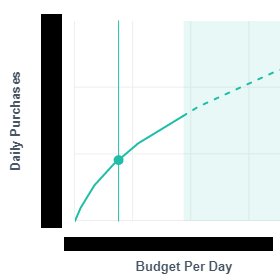

This allows for a high-allowable profitable paid CaC. Remember the order curve for ad spend v. orders looks something like this. (Below is from a FB dummy account).

This allows for a high-allowable profitable paid CaC. Remember the order curve for ad spend v. orders looks something like this. (Below is from a FB dummy account).

17/

Yes Marginal CaC goes up as you go out on the curve but more revenue (as long as still even somewhat profitable is the goal.

There's room for expanding LTV via reorders + product expansion but goal is to be at a min profitable on first order after CaC and all costs baked in.

Yes Marginal CaC goes up as you go out on the curve but more revenue (as long as still even somewhat profitable is the goal.

There's room for expanding LTV via reorders + product expansion but goal is to be at a min profitable on first order after CaC and all costs baked in.

18/

Having a high CM$ is critical to getting revenue flywheel started. As you do that, you can order in higher inventory's and drive up your GM%. This has big impact on the biz as inventory is a major nominal ($) and % cost here.

Having a high CM$ is critical to getting revenue flywheel started. As you do that, you can order in higher inventory's and drive up your GM%. This has big impact on the biz as inventory is a major nominal ($) and % cost here.

19/

As GM goes up, your allowable CaC goes up in concert, creating a nice flywheel:

Higher allowable CaC > more revenue > better GM > higher allowable CaC > more revenue > better GM.

As GM goes up, your allowable CaC goes up in concert, creating a nice flywheel:

Higher allowable CaC > more revenue > better GM > higher allowable CaC > more revenue > better GM.

20/

Also, these biz usually get valued (acq / IP) at revenue multiples, although obviously profitability plays an important factor.

Branch, while not traditional DTC, has a lot of the same characteristics, albeit at a much higher AOV (for b2b).

Also, these biz usually get valued (acq / IP) at revenue multiples, although obviously profitability plays an important factor.

Branch, while not traditional DTC, has a lot of the same characteristics, albeit at a much higher AOV (for b2b).

21/

Principle #3: Current buying process sucks, especially if due to inertia of legacy players.

Portfolio examples:

@drinkhaus

(+Stealth)

If you haven't heard of Haus, what rock are you living under? They make alcohol that somehow tastes even better than it looks.

Principle #3: Current buying process sucks, especially if due to inertia of legacy players.

Portfolio examples:

@drinkhaus

(+Stealth)

If you haven't heard of Haus, what rock are you living under? They make alcohol that somehow tastes even better than it looks.

22/

In the US there is regulation around alcohol - a three-tier system in which producers / importers (1) sell to distributors (2) who sell to retailers (3) who sell to you.

This regulation has existed since the repeal of Prohibition + is starting to be chipped away at.

In the US there is regulation around alcohol - a three-tier system in which producers / importers (1) sell to distributors (2) who sell to retailers (3) who sell to you.

This regulation has existed since the repeal of Prohibition + is starting to be chipped away at.

23/

@helena + @woodyhambrecht 'hacked' the system via their apéritifs which are ~15% alcohol.

Natural ingredients + lower ABV + locally sourced > less hangovers and fits into the brand ethos of 'drinks you can feel good about.' https://www.modernretail.co/startups/how-haus-is-building-a-booze-brand-for-the-dtc-era/

@helena + @woodyhambrecht 'hacked' the system via their apéritifs which are ~15% alcohol.

Natural ingredients + lower ABV + locally sourced > less hangovers and fits into the brand ethos of 'drinks you can feel good about.' https://www.modernretail.co/startups/how-haus-is-building-a-booze-brand-for-the-dtc-era/

24/

Now on to startups that check more than one box.

+ Haus > also recently released membership so users can get early access to flavors + more.

+ True Sons > current buying option is via drugstores. A la Hims + Roman, it's a category that some would prefer to buy online.

Now on to startups that check more than one box.

+ Haus > also recently released membership so users can get early access to flavors + more.

+ True Sons > current buying option is via drugstores. A la Hims + Roman, it's a category that some would prefer to buy online.

25/

Branch > offers a premium buying option. (Business) buyerset white-glove service including free delivery + set up.

Cheeky > is way more convenient (+ way more affordable) than going to a dentist. You can order a kit and complete the entire buying process from your couch.

Branch > offers a premium buying option. (Business) buyerset white-glove service including free delivery + set up.

Cheeky > is way more convenient (+ way more affordable) than going to a dentist. You can order a kit and complete the entire buying process from your couch.

26/

Ah looks like I found a work-around for the 25-limit thread.

As always, these are just my opinions. I welcome any + all (respectful) debate!

Ah looks like I found a work-around for the 25-limit thread.

As always, these are just my opinions. I welcome any + all (respectful) debate!

27/

Also why it's hard for me to get excited about (non-personalized) beauty, even though GM% is high. https://twitter.com/irrvrntVC/status/1276006724319748096?s=20

Also why it's hard for me to get excited about (non-personalized) beauty, even though GM% is high. https://twitter.com/irrvrntVC/status/1276006724319748096?s=20

Read on Twitter

Read on Twitter