Interesting tweet thread on market behavior - determining when to follow the trend and when to disengage and go contrarian.

https://twitter.com/MacroOps/status/1276205912013840384?s=19

@MacroOps

Quoting below from the thread on references to Soros's investing style.

https://twitter.com/MacroOps/status/1276205912013840384?s=19

@MacroOps

Quoting below from the thread on references to Soros's investing style.

You want to be a trend follower when there's a lot of people saying "this move makes NO SENSE" and a contrarian when people are saying "this makes so much sense". This is why a bull climbs a wall of worry & a bear falls down the stairs of hope. Trends are driven by (dis)belief

Let's look at what the current mkts are signalling in terms of buying into the "disbelief trend"

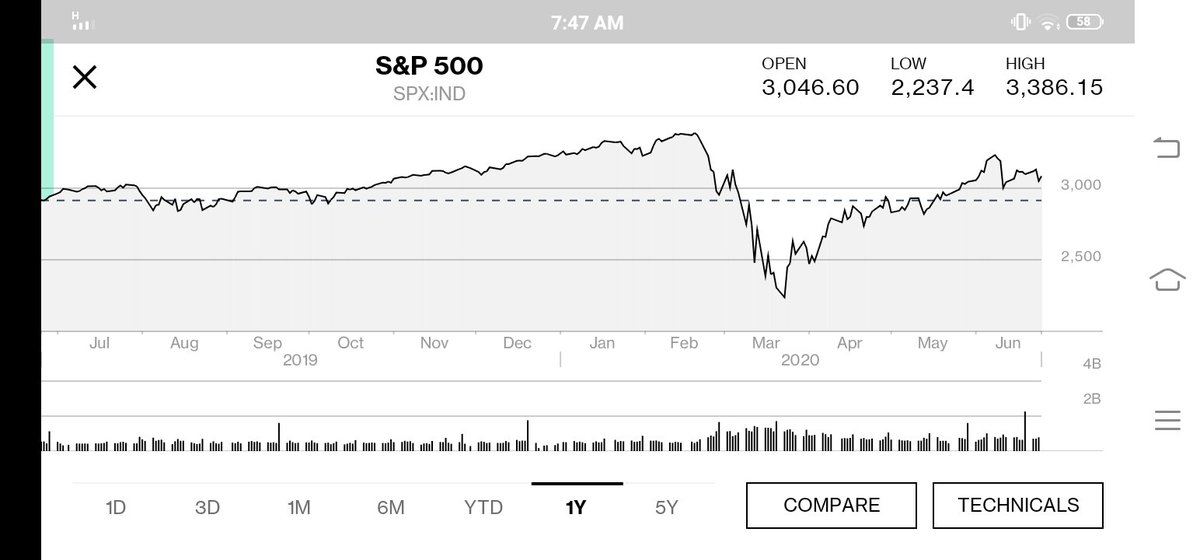

The risk-on trades are very much on - Equities (S&P500 as a reference)

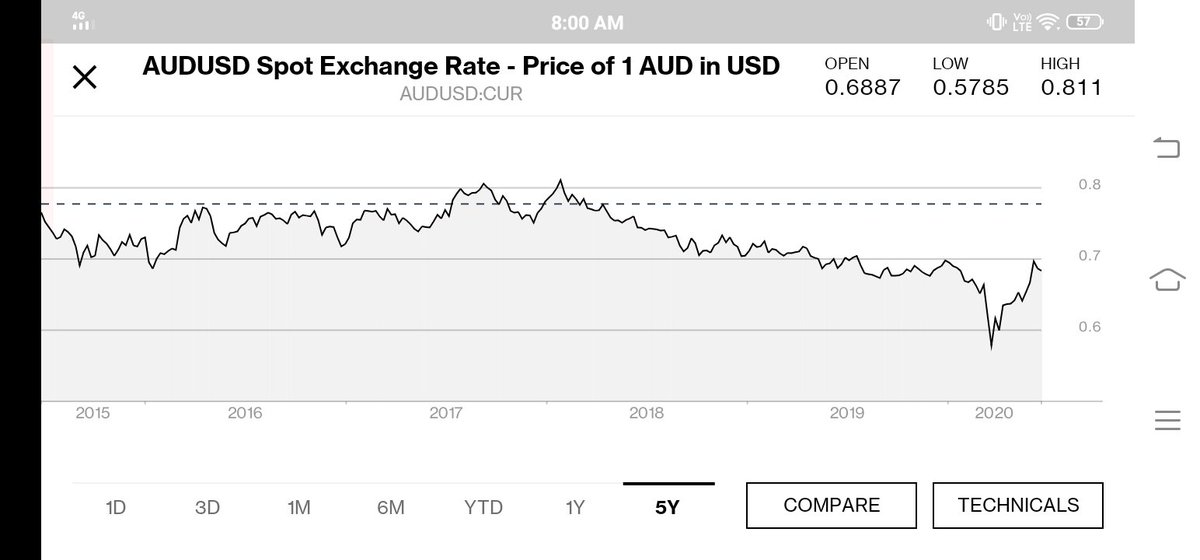

- EM FX carry (Aussie $ as a ref)

i.e. completely buying into the "disbelief trend"

The risk-on trades are very much on - Equities (S&P500 as a reference)

- EM FX carry (Aussie $ as a ref)

i.e. completely buying into the "disbelief trend"

Gold is slowly buying to the possible inflation argument courtesy QE the easing liquidity conditions globally (softer USD and rising EM FX).

i.e. starting to buy into the "disbelief trend".

The next leg in Gold likely is accompanied by a further weakening of the USD.

i.e. starting to buy into the "disbelief trend".

The next leg in Gold likely is accompanied by a further weakening of the USD.

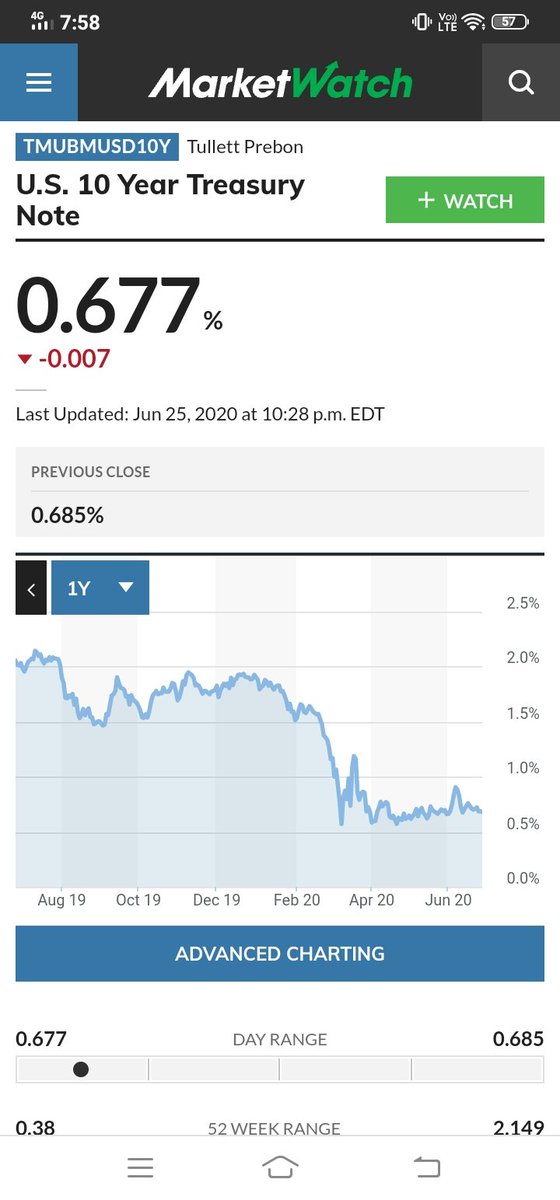

Bonds seem to have currently ignored the rally altogether. Deflation trade since mid-2018 largely intact as reflected by Long term treasuries and the US bond aggregates (safest bonds)

Ofcourse could well be due to mkt participants hedging the risk-on rally via risk-off assets

Ofcourse could well be due to mkt participants hedging the risk-on rally via risk-off assets

So possibly the final leg of the "disbelief trend" may involve the bond mkts giving some way and at least partially buying into it.

Likely via some rise in bond yields & fall in USD. Equities may melt up as rotation from bonds and tailwinds from a weaker USD support it.

Likely via some rise in bond yields & fall in USD. Equities may melt up as rotation from bonds and tailwinds from a weaker USD support it.

And that's when you likely have to start disengaging from the trend as the final hold-out to the "disllbelief trend" also buys into it.

@KalpenParekh

@KalpenParekh

Read on Twitter

Read on Twitter