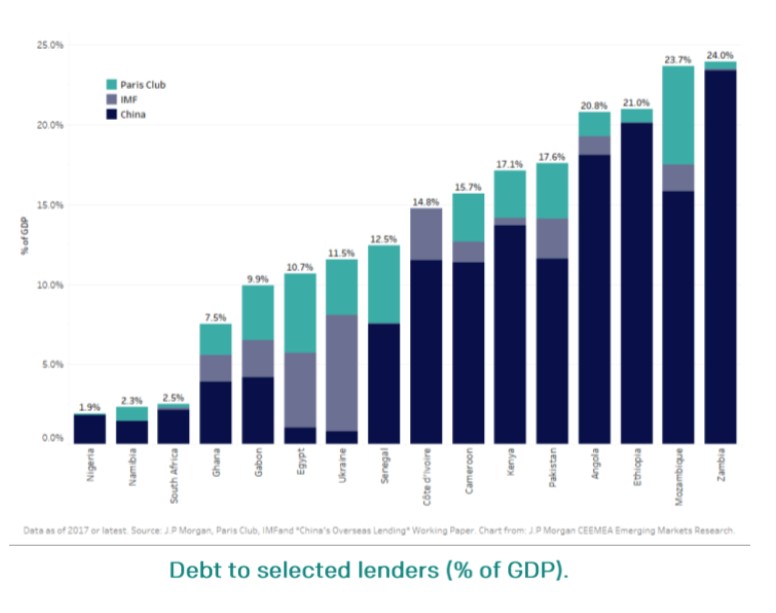

THREAD: CHINA IS A HUGE DEAL FOR DEBT RELIEF: New data from @WorldBank shows China is owed $11.4bn in debt service this year and $10.5 next year. 10x the next largest bilateral creditor.

@mbgoodman @Sara_Harcourt @jriver_a @kerezhi

@mbgoodman @Sara_Harcourt @jriver_a @kerezhi

Check out the data in @onecampaign new dashboard @jriver_a https://public.tableau.com/views/ONEsDSSIdashboard/DebtService?%3Aembed=y&%3Atoolbar=no&%3Adisplay_count=no&%3AshowVizHome=no#2

This week at the #EU #China Summit leaders discussed “the need for solidarity in addressing the consequences in developing countries, notably as regard debt relief.” This follows last week’s extraordinary #COVID19 summit between Xi Jinping’s and African leaders.

Xi Jinping’s speech from the China Africa summit sounds great - and some of it is- but the devil is in the detail. https://news.cgtn.com/news/2020-06-17/Full-text-Xi-s-speech-at-China-Africa-summit-on-COVID-19-fights-Rp7hgf5tu0/share_amp.html#click=https://t.co/HBjRTvPe6P

The good news is that between 2000 and 2019, China cancelled $3.4 billion of debt. It never formally coordinated with the Paris Club, but the timing roughly parallels HIPC. @SaisCari https://static1.squarespace.com/static/5652847de4b033f56d2bdc29/t/5eeaa56e9520d517aa49b213/1592436079485/WP+39+-+Acker%2C+Brautigam%2C+Huang+-+Debt+Relief.pdf

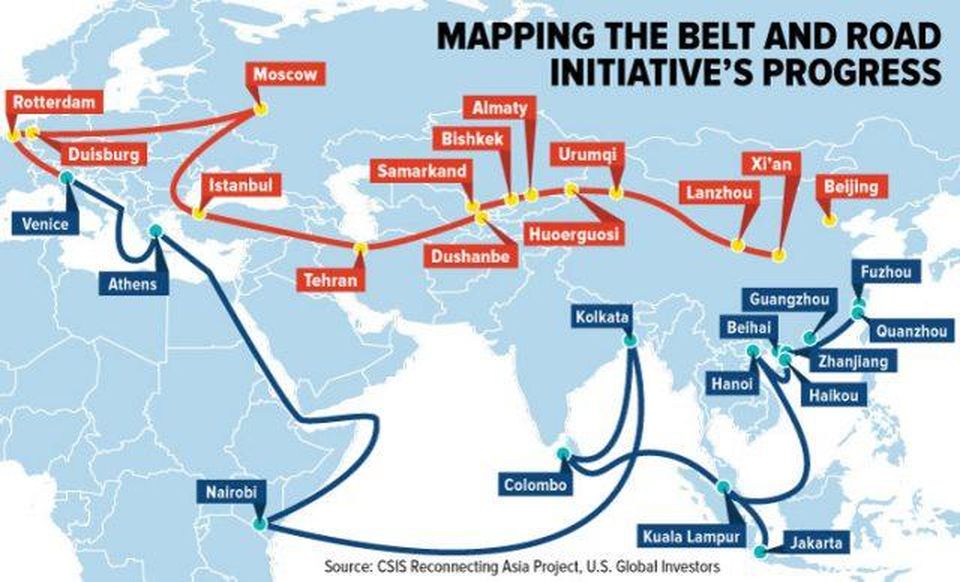

Last week Xi Jinping said “China will cancel the debt of African countries in the form of interest-free government loans that are due to mature by the end of 2020.” Sounds good. But most of the Belt and Road Initiative loans are due well after 2020.

Cancelling ‘interest-free loans’ discounts the majority of loans. Zero-interest loans, offered by China’s Ministry of Commerce, are 5% of China’s overall lending to Africa (2000-2018). Previous cancellation was almost exclusively for zero-interest loans.

Interest-bearing loans have almost never been, and likely will never be, considered for cancellation. They are negotiated separately loan-by-loan rather than for the entire portfolio.

Xi said “For those African countries that are hardest hit by the coronavirus...China will work with the global community to give them greater support...further extending the period of debt suspension, to help them tide over the current difficulty.” This is good news.

. @FitchRatings reported that China is participating in the G20 initiative, and in some cases going further and cancelling some debts rather than suspending. https://www.fitchratings.com/research/sovereigns/chinas-debt-relief-to-support-liquidity-in-stressed-ems-24-06-2020

Xi said “We encourage Chinese financial institutions to respond to the G20's Debt Service Suspension Initiative and to hold friendly consultations with African countries according to market principles to work out arrangements for commercial loans with sovereign guarantees.”

But @ECA_OFFICIAL’s Vera Songwe said last week that the reality is complex. “of the 9 countries that have finalized the Debt Service Suspension Initiative (DSSI) process not one of them has China included which means essentially China is not participating in the DSSI......."

"...we had thought we could say that every agreement that had a government guarantee was then backed by the state ...it doesn’t seem to be that straightforward.”

China has restructured or refinanced c$15 billion of debt in Africa between 2000&2019. Chinese lenders prefer to address restructuring quietly, on a bilateral basis. Many mines, ports etc. have been leveraged already so countries should be vigilant to the terms.

Xi said “China will work with other members of the G20 to implement the DSSI and, on that basis, urge the G20 to extend debt service suspension still further for countries concerned, including those in Africa.” This is good news.

The lack of reliable information is a real challenge for two reasons.

First, we don’t know what’s actually going on.

First, we don’t know what’s actually going on.

Second, more importantly, we don’t know what relief has been provided - which makes it much harder to make the case to other lenders that relief is needed.

Second, more importantly, we don’t know what relief has been provided - which makes it much harder to make the case to other lenders that relief is needed.

First, we don’t know what’s actually going on.

First, we don’t know what’s actually going on.  Second, more importantly, we don’t know what relief has been provided - which makes it much harder to make the case to other lenders that relief is needed.

Second, more importantly, we don’t know what relief has been provided - which makes it much harder to make the case to other lenders that relief is needed.

Ultimately, this is not a problem that is going away because the sustainability of this and private debt is...well unsustainable.

Read on Twitter

Read on Twitter