Here is a brief overview of the Webinar I did for the @lbmaexecutive webinar "Gold's role in a portfolio post Covid-19" http://lbma.org.uk/webinars

Gold is seen to have stable characteristics for investors

a)Inflation Hedge

b)Diversifier

c)Safe Haven

d)Positively Skewed Returns 1/n

Gold is seen to have stable characteristics for investors

a)Inflation Hedge

b)Diversifier

c)Safe Haven

d)Positively Skewed Returns 1/n

Question is: Will gold continue to act in the same way going forward - Are these Stable characteristics gold investors can rely on or are they a feature of the post-1968 gold market?

Need to look at how gold acted before 68, so I gathered missing daily gold price data 1919-68

Need to look at how gold acted before 68, so I gathered missing daily gold price data 1919-68

This is available ( https://bullion.rothschildarchive.org/home or by request)

I started to look at whether the characterises above hold for the 1930's when the gold market was free and I have found daily equity and fixed income data (thanks to Rothschilds for funding the data transcription!)

I started to look at whether the characterises above hold for the 1930's when the gold market was free and I have found daily equity and fixed income data (thanks to Rothschilds for funding the data transcription!)

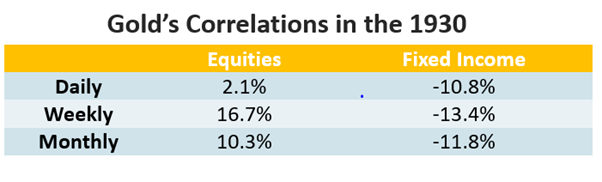

So was gold a diversifier for investors (called "Hoarders" at the time) in the 1930s? Its correlations to other assets classes were very low at daily, weekly and monthly frequencies - meaning it would have reduced the riskiness of a portfolio if included(see below) But how much..

to own is a difficult question to answer. Modern research points to a 5-10% allocation ( https://www.tandfonline.com/doi/abs/10.1080/09603107.2013.839858) The 1930's investor should have held between 6-30% of their money in gold - so this characteristic is stable - even if the optimal proportion changes.

Has gold always been a Safe Haven? Modern research ( https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3244371) finds that gold holds its value when markets crash and its seems to have done this in the 1930's as well. Another persistent characteristic for investors to rely on going forward.

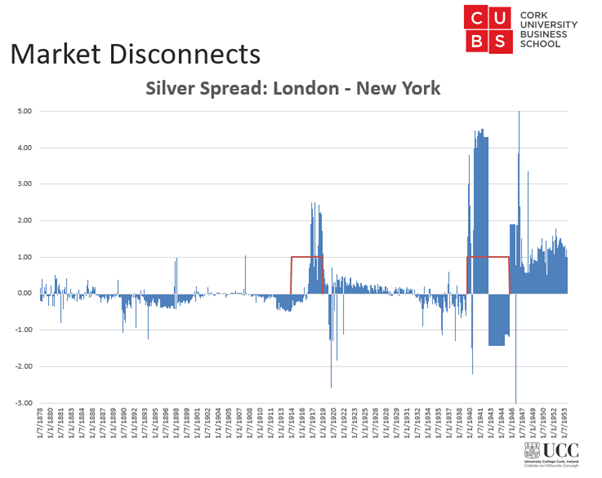

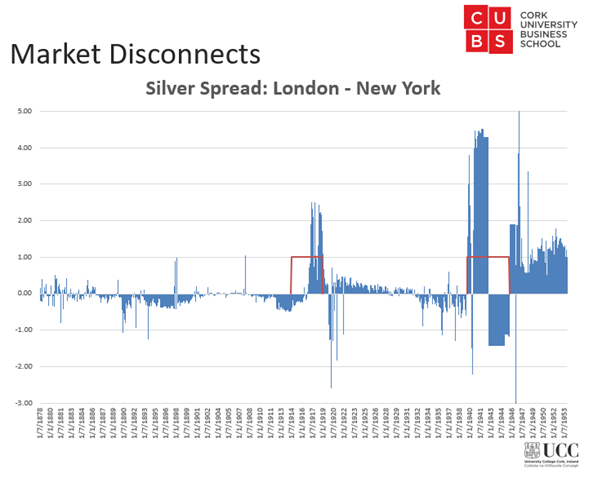

How did the Spanish Flu effect gold markets? Montagu's (the bullion bank) Annual Letters to their investors don't mention the Flu. Gold prices were fixed in 1918 and only floated in September 1919. However other research I have( https://www.sciencedirect.com/science/article/pii/S1544612320303780) on Silver...

shows the same type of price disconnect between London and New York silver price during both World Wars that we have recently seen in Gold. This was down to the same reason - the difficulty of transporting enough silver from one to the other.

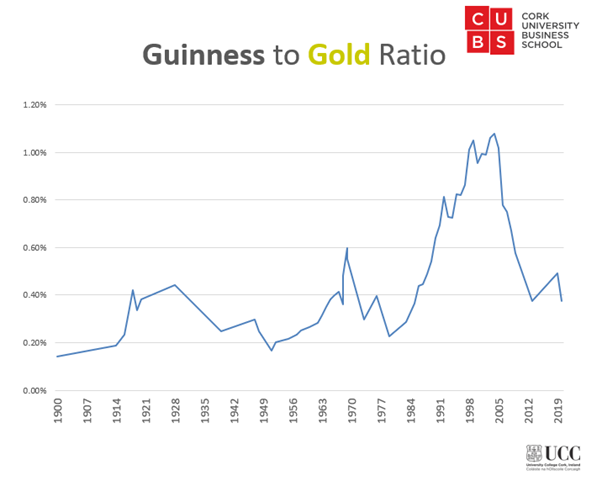

Lastly is gold an inflation hedge? Lots of research says yes, even over a 200-year time frame( https://www.sciencedirect.com/science/article/abs/pii/S105752191500037X). But be careful-this is the LONG RUN. In the short run gold and inflation can remain disconnected for extended periods - See Guinness as an example

So I think that based on this new/old data & analysis there is evidence that Gold's role in an investors portfolio is stable (Inflation, Diversify, Safe Haven&skew) and should remain fixed even as the drivers of gold move from the official sector pre-68, to investment now. #GOLD

Read on Twitter

Read on Twitter