1/n

Memorable expiry. Did excellent adjustments and also made mistakes. Good expiry to learn from.

Will post all details in the thread for the trading journal.

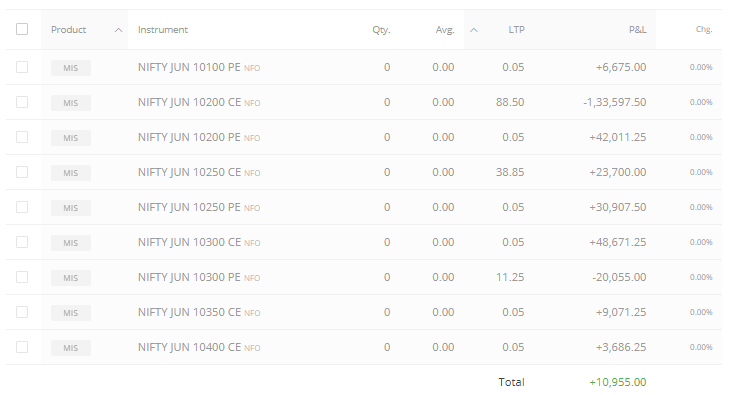

Got 10K. But not happy with my performance today because of

1. Overtrading

2. One wrong emotional trade & hoping.

Memorable expiry. Did excellent adjustments and also made mistakes. Good expiry to learn from.

Will post all details in the thread for the trading journal.

Got 10K. But not happy with my performance today because of

1. Overtrading

2. One wrong emotional trade & hoping.

2/n

1. Took 10200 short straddle at 9.18am for a combined premium of 101.

2. SL hit for 10200 CE at 10.25am and exited at 91.

3. Holden 10200 PE and converted it to strangle by selling 10400 CE at Rs.10

1. Took 10200 short straddle at 9.18am for a combined premium of 101.

2. SL hit for 10200 CE at 10.25am and exited at 91.

3. Holden 10200 PE and converted it to strangle by selling 10400 CE at Rs.10

3/n

4. Also took additional 10300 short straddle for a combined premium of Rs. 92 at 10.50am

5. Booked 4000rs profit in 10400 CE and rolled down to 10350 CE as Nifty broke 10280 levels at 12pm. Bought 10400 CE for Rs.6 and sold 10350 CE at 15.5

4. Also took additional 10300 short straddle for a combined premium of Rs. 92 at 10.50am

5. Booked 4000rs profit in 10400 CE and rolled down to 10350 CE as Nifty broke 10280 levels at 12pm. Bought 10400 CE for Rs.6 and sold 10350 CE at 15.5

4/n

6. SL triggered for 10300 PE at 82, so exited 10300 CE also at the same time.

7. Exited 10200 PE at 16rs as Nifty broke down further and trading at 10230 levels

8. Took 10250 short straddle for a combined premium of Rs..80 at 12.40

6. SL triggered for 10300 PE at 82, so exited 10300 CE also at the same time.

7. Exited 10200 PE at 16rs as Nifty broke down further and trading at 10230 levels

8. Took 10250 short straddle for a combined premium of Rs..80 at 12.40

5/n

9. Market broke 10200 and I booked 10250 PE and converted it to strangle 10100-10250

10. Market again moved higher and broke 10240, so booked above strangle and took 10200 CE - 10250PE ITM strangle for a combined premium of 96.

9. Market broke 10200 and I booked 10250 PE and converted it to strangle 10100-10250

10. Market again moved higher and broke 10240, so booked above strangle and took 10200 CE - 10250PE ITM strangle for a combined premium of 96.

6/n

11. Exited 10200 CE at 77 as market crossed 10280

12. Until now everything was fine and was doing good adjustments. But took one wrong trade on Greed, without any plan and hoping the market will go down again.Entered 10200 CE again at 88 thinking I am getting 11 points extra

11. Exited 10200 CE at 77 as market crossed 10280

12. Until now everything was fine and was doing good adjustments. But took one wrong trade on Greed, without any plan and hoping the market will go down again.Entered 10200 CE again at 88 thinking I am getting 11 points extra

7/n

13. Now market zoomed up and this CE went until 140rs, but because of HOPE that market will go down I was holding it, this was a BIG MISTAKE. Should have booked loss as soon as it went 20 points up like at 108.

13. Now market zoomed up and this CE went until 140rs, but because of HOPE that market will go down I was holding it, this was a BIG MISTAKE. Should have booked loss as soon as it went 20 points up like at 108.

8/n

14. Rolled up 10250 PE to 10300 PE as the market was up.

Now holding only 10200 CE and 10300 PE.

15. Luckily the market came down and booked 10200 CE at 114.

16. Sold 10300 CE thus making 10300 short straddle at 2.50pm

14. Rolled up 10250 PE to 10300 PE as the market was up.

Now holding only 10200 CE and 10300 PE.

15. Luckily the market came down and booked 10200 CE at 114.

16. Sold 10300 CE thus making 10300 short straddle at 2.50pm

9/n

17. Booked 10300 PE and sold 10250 PE.

18. Finally booked 10250PE and 10300 CE at 15 paise.

All positions cleared and got 10k.

This market is not for weak-hearted.

17. Booked 10300 PE and sold 10250 PE.

18. Finally booked 10250PE and 10300 CE at 15 paise.

All positions cleared and got 10k.

This market is not for weak-hearted.

n/n

- Even after doing so many good adjustments, just one wrong trade can take away all your profits.

- Always respect SL and don't HOPE.

- Trade as per the plan and decide when to exit before entry itself.

- Use any parameters like VWAP, EMA to know the market direction.

- Even after doing so many good adjustments, just one wrong trade can take away all your profits.

- Always respect SL and don't HOPE.

- Trade as per the plan and decide when to exit before entry itself.

- Use any parameters like VWAP, EMA to know the market direction.

Read on Twitter

Read on Twitter