A snippet from @abc730 @AlanKohler's #economiccrisis

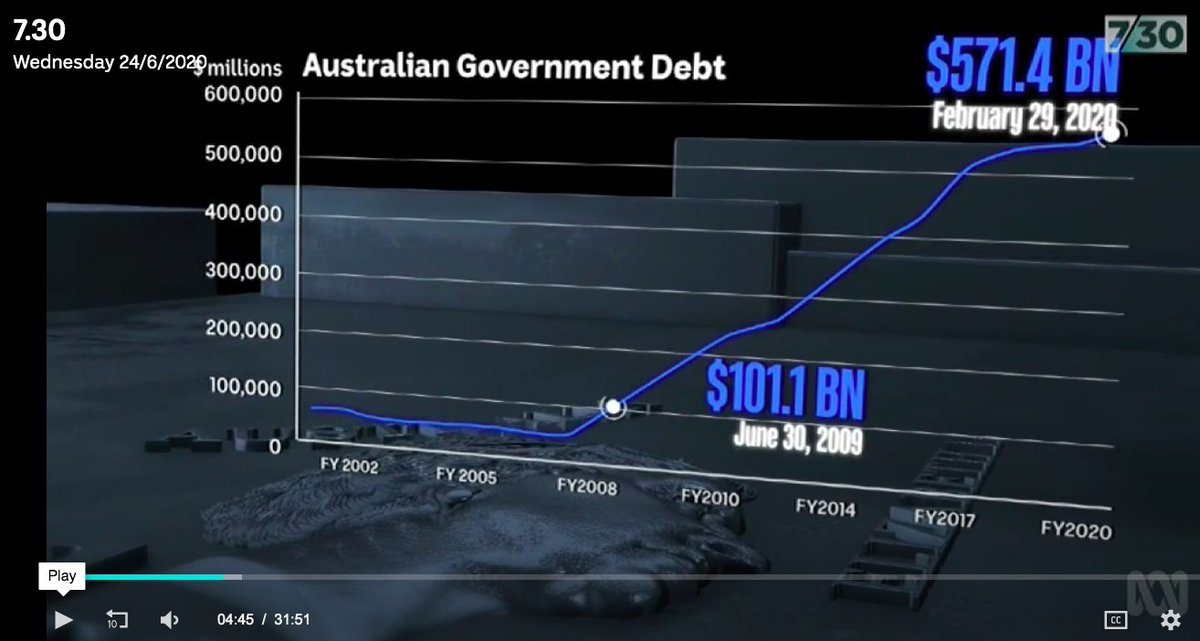

AK: But of course there's no bigger debt ATM than govt debt. The federal govt started the crisis with more than $570billion of debt

AK: But of course there's no bigger debt ATM than govt debt. The federal govt started the crisis with more than $570billion of debt

AK: More than 5X what it got to after the #GFC.

AK: Close to $260billion new spending has been announced but the deficits will be more than that since unemployment & lower business income means less tax revenue. Also deficits lasted for more than 10 years after the last recession

AK: Close to $260billion new spending has been announced but the deficits will be more than that since unemployment & lower business income means less tax revenue. Also deficits lasted for more than 10 years after the last recession

AK: So there's not much doubt that govt debt will hit 13 figures, i.e. a trillion $$.

PC: I don't think you'd pay back a trillion $$, well, yu can't pay back any of it until yu turn a budget surplus, right? ... & then how many budget surpluses would you need to pay that back? 20?

PC: I don't think you'd pay back a trillion $$, well, yu can't pay back any of it until yu turn a budget surplus, right? ... & then how many budget surpluses would you need to pay that back? 20?

PC: 20 in a row? Um, you know, can you imagine that?

AK: {smiles, shakes head}

PC: The last time we paid back govt debt it took 10 budget surpluses, & it wasn't as big as this.

AK: It could go away, if the RB bought it all, & then cancelled it, right?

AK: {smiles, shakes head}

PC: The last time we paid back govt debt it took 10 budget surpluses, & it wasn't as big as this.

AK: It could go away, if the RB bought it all, & then cancelled it, right?

PC: I mean, what will happen, Alan, is you know, uh, govts will, might, degrade their currencies. {nod, nod, nod} right?

AK: yeah

PC: which is what you're saying, right?

AK: yep!

AK: yeah

PC: which is what you're saying, right?

AK: yep!

AK: What I'm saying is if the RB bought all the debt & cancelled it, that would involve them printing a whole lot of money, and of course the more $$'s you print the less each $ is worth

PC: You've got to think though,as to what that means to other savers, I mean, all of a sudden

PC: You've got to think though,as to what that means to other savers, I mean, all of a sudden

PC: other savers are holding a currency that's been degraded by their own govt. That brings all sort of problems in its own wake. https://iview.abc.net.au/show/7-30

. @Ross_Garnaut does not agree.

RG: Even with 1/2 a trillion accumulated debt over the next 4years, our debt levels as a proportion of GDP would be less than half of Trump's US as they went into the #pandemic; it'll be much more when they end the pandemic; it'll be a great deal less in AU under the Menzies govt

RG: And it'll be less than Britain nearly all the time since the Napoleonic wars of the early C19th.

An interesting moment. #PeterCostello in @AlanKohler's take on the #currentcrisis expresses more clearly than we've seen from treasurers like #JohnHoward #PaulKeating @SwannyQLD @Bowenchris etc.(I won't even consider #inexplicables like @JoeHockey @ScottMorrisonMP @JoshFrydenberg

of the simplistic connection made betw #taxation #payments #defict/ #surplus, #governmentdebt & the #valueofthecurrency & how we'll all pay a bigprice if our #currency's degraded by the #RB buying back the debt. No reasoning, it's like it's absolute #commonsense, #ipsofacto #getit

It seems to be the exact arguments being made by both #Conservative & #Labour governments in the 20s (100 years ago today) taken on by #JohnMaynardKeynes #JMK who was saying that this simplistic connection doesn't stack up, & this nonsense was leading to #Depression 1929

Rather than look to #Keynesianism that helped #capitalism survive #Depression in the 30s our key treasurers have allowed themselves to be kept in the simplistic dark by the #MiltonFriedman-ism of the 70s, taking us back to the beginnings of economics simple #JohnStewartMill-ism

The current batch of #MMT economists such as @StephanieKelton are telling us that's it's not as simple as that. They're saying that what @Ross_Garnaut is saying here is more important. There's no direct link between surpluses & paying off the debt. https://www.publicaffairsbooks.com/titles/stephanie-kelton/the-deficit-myth/9781541736184/

That's how households work but economies are not households. They don't work like that. The #RB *could* do what @AlanKohler is implying. It would only have the effect that #PeterCostello is implying if it set off an inflationary surge, causing savings & incomes able to buy less.

The #MMT economists measure the value of income & savings not in terms of how much debt the government has with the #RB but on what they can buy & this is only degraded in times of inflation. And there's things the government can do at those times to keep its impact to a minimum.

Read on Twitter

Read on Twitter