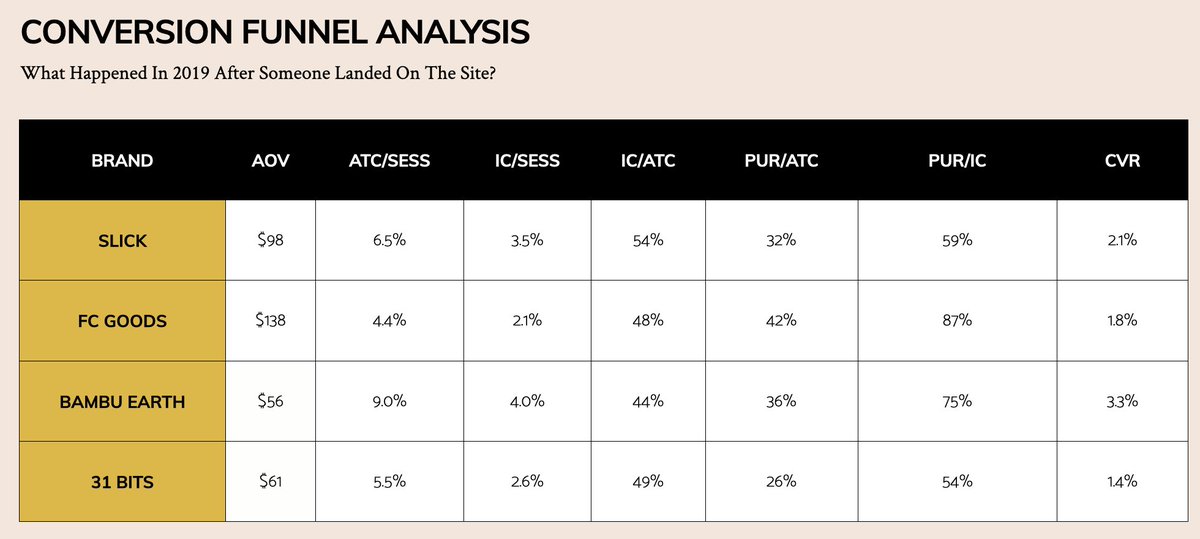

What do our brands' customers do after landing on our sites?

As I've been working on @31bits' growth strategy, I've dug into our on-site conversion funnels by comparing Bits to our other brands.

How many add to cart, initiate checkout, and purchase? Where is the funnel leaky?

As I've been working on @31bits' growth strategy, I've dug into our on-site conversion funnels by comparing Bits to our other brands.

How many add to cart, initiate checkout, and purchase? Where is the funnel leaky?

A few things jump out for me:

1. AOV is, as always, a factor. Remember this when you're analyzing any conversion rate (CVR).

As a general rule, AOV =

AOV =  CVR. That context is as crucial here as anywhere, and explains some of the variations here. https://twitter.com/andrewjfaris/status/1271509807506132992

CVR. That context is as crucial here as anywhere, and explains some of the variations here. https://twitter.com/andrewjfaris/status/1271509807506132992

1. AOV is, as always, a factor. Remember this when you're analyzing any conversion rate (CVR).

As a general rule,

AOV =

AOV =  CVR. That context is as crucial here as anywhere, and explains some of the variations here. https://twitter.com/andrewjfaris/status/1271509807506132992

CVR. That context is as crucial here as anywhere, and explains some of the variations here. https://twitter.com/andrewjfaris/status/1271509807506132992

2. Bits has major conversion rate (CVR) problems.

I knew this, but this highlights it, starting with the fact that before any other funnel problems happen, customers simply don't add products to cart.

NB: these are unique ATCs, and there is almost no paid traffic.

I knew this, but this highlights it, starting with the fact that before any other funnel problems happen, customers simply don't add products to cart.

NB: these are unique ATCs, and there is almost no paid traffic.

Here's my #1 takeaway from that: Bits has a product problem.

Major conversion rate problems are offer (where "offer" = product + price) problems.

The issue is more fundamental than any content, messaging, or usability.

Major conversion rate problems are offer (where "offer" = product + price) problems.

The issue is more fundamental than any content, messaging, or usability.

At the end of the day, Bits sells jewelry. Which means unless we are wildly overpriced(we aren't), we have to make products that customers want to wear. If they don't think our stuff is beautiful, it doesn't matter how good the story is: they won't buy it.

3. Once customers do add to cart, they don't finish their purchase.

Part of this is probably downstream from #2. But part of it is probably also because Bits charged for shipping last year.

Here's an actionable takeaway: low Pur/ATC ratios are often due to shipping costs.

Part of this is probably downstream from #2. But part of it is probably also because Bits charged for shipping last year.

Here's an actionable takeaway: low Pur/ATC ratios are often due to shipping costs.

This also explains why @FCGOODS cart-adders finish their purchases at the highest rate (free shipping on all orders there) and @slickproductusa is the other lowest (free shipping threshold was variously $75 and $100 last year).

When I first saw this, I immediately made all shipping free just to see if I could effect this quickly and easily. It's too early to tell right now, but I expect this will help.

4. Unrelated to Bits, the dropoff from ATC to IC was pretty significant for @bambuearth over this time period. I wonder if that is a funnel problem or just reflects a shopping behavior more inherent to the Bambu customer/SKU set.

Put it all together, and the order of highest-leverage to lowest-leverage actions are:

1. Fix the product mix. This takes time but is crucial. Lots more to say about this in the future.

2. Monitor the shipping price change.

3. Hone in on usability and on-site content.

1. Fix the product mix. This takes time but is crucial. Lots more to say about this in the future.

2. Monitor the shipping price change.

3. Hone in on usability and on-site content.

It's not that usability and on-site content don't matter. It's just that those things are not going to fix problems this big on their own, so it's not what we're betting on.

And realistically, we're attacking all three of these at once. But that's the order of importance.

And realistically, we're attacking all three of these at once. But that's the order of importance.

By the way: if you want to go on this journey with me and my team to see how this stuff pans out as we make changes, I'm detailing it essentially as its own season of my podcast.

In the meantime, please DTC Twitter: tell me anything else you see here! https://twitter.com/andrewjfaris/status/1273737567813263360

In the meantime, please DTC Twitter: tell me anything else you see here! https://twitter.com/andrewjfaris/status/1273737567813263360

Read on Twitter

Read on Twitter