DeFi is mooning.

Why isn’t ETH?

The short story is that there’s no direct reason why ETH needs to rise with DeFi.

The long story is that it may do so anyways.

1/

Why isn’t ETH?

The short story is that there’s no direct reason why ETH needs to rise with DeFi.

The long story is that it may do so anyways.

1/

First the short story.

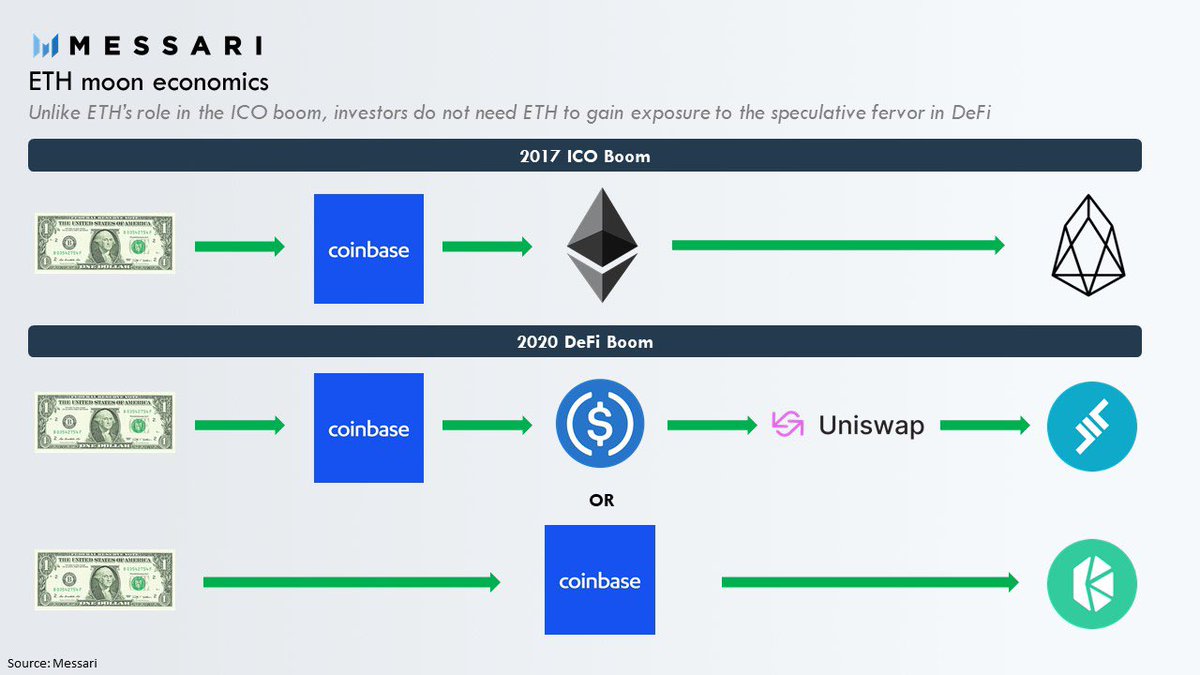

Last year, @QWQiao was one of the first people to argue why this is the case when he argued that stablecoins (crypto dollars), allow investors to bypass native cryptoassets like ETH for their speculative fervor. https://twitter.com/qwqiao/status/1210284534085902337

Last year, @QWQiao was one of the first people to argue why this is the case when he argued that stablecoins (crypto dollars), allow investors to bypass native cryptoassets like ETH for their speculative fervor. https://twitter.com/qwqiao/status/1210284534085902337

There’s no need to actually touch ETH when you can buy a DeFi token because you can just use widely available crypto dollars.

For an increasing amount of DeFi tokens, you can even just use a bank account.

For an increasing amount of DeFi tokens, you can even just use a bank account.

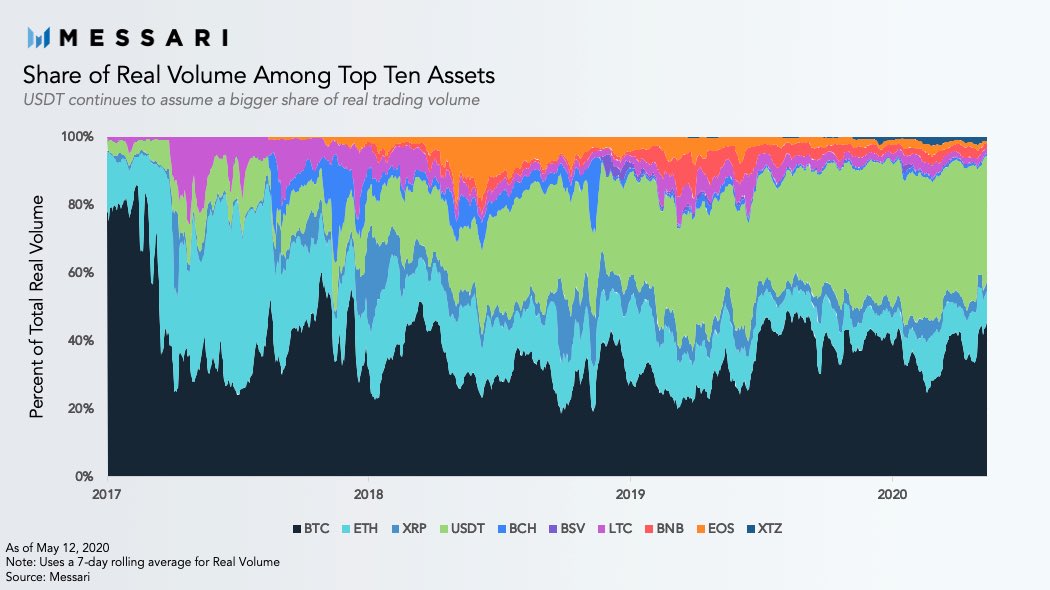

We can see this phenomena in how trading volumes have evolved since 2017.

Crypto dollars eliminate the need to onboard into crypto through Ether, reducing the derivative demand it received from the ICO boom.

Crypto dollars eliminate the need to onboard into crypto through Ether, reducing the derivative demand it received from the ICO boom.

Now for the longer story.

There are other ways in which DeFi’s growth can create direct demand for ETH.

After all, many DeFi protocols require capital to work.

Anytime you want to borrow money on Ethereum for example you must post collateral.

There are other ways in which DeFi’s growth can create direct demand for ETH.

After all, many DeFi protocols require capital to work.

Anytime you want to borrow money on Ethereum for example you must post collateral.

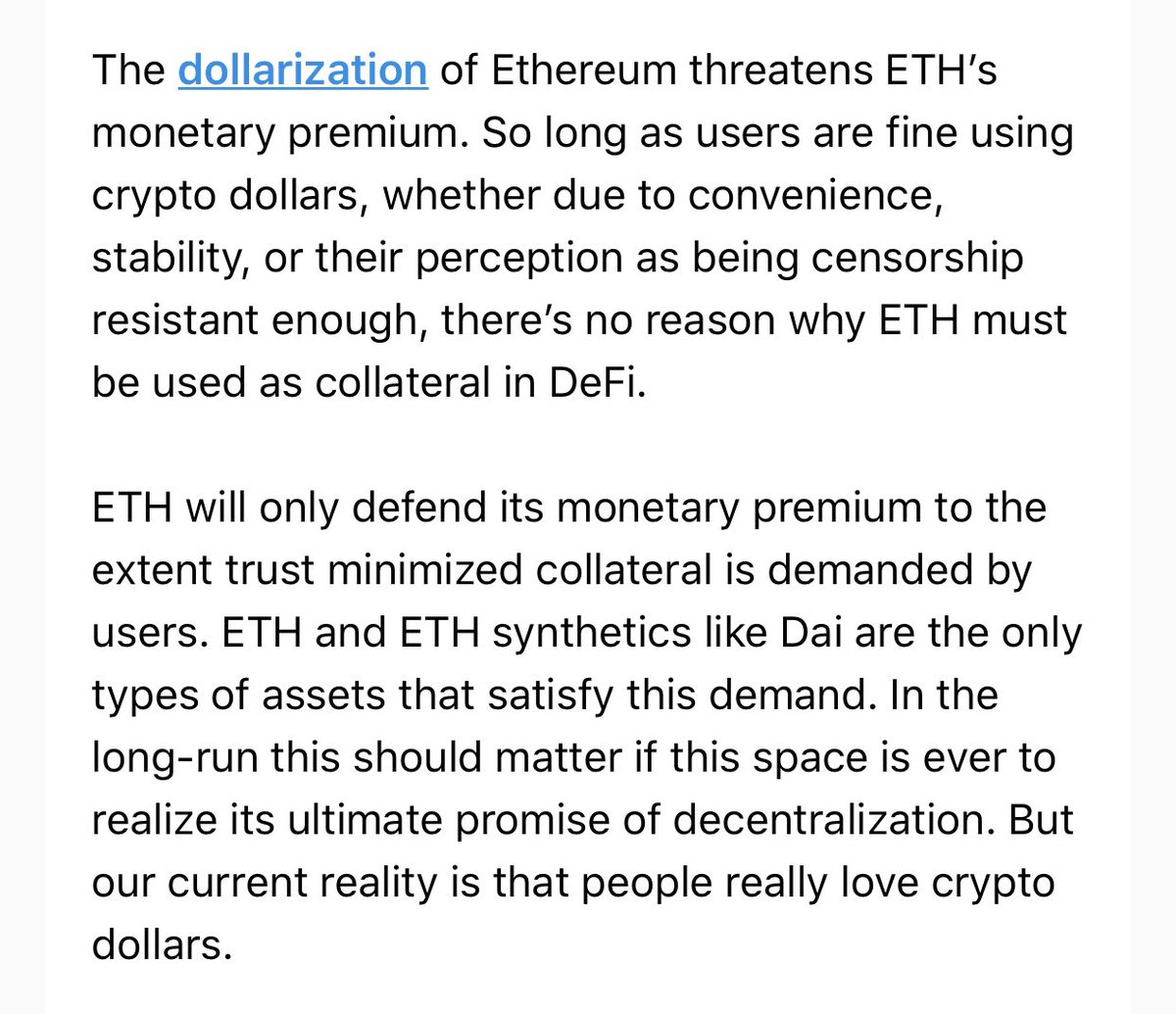

Crypto dollars complicate this economic relationship as well.

I’ve covered this topic multiple times since I first discovered crypto dollars were the dominant currency on Ethereum in January of this year. https://twitter.com/ryanwatkins_/status/1222533131011534851

I’ve covered this topic multiple times since I first discovered crypto dollars were the dominant currency on Ethereum in January of this year. https://twitter.com/ryanwatkins_/status/1222533131011534851

My thinking has evolved and become more nuanced over time, but my core thesis has remained the same.

Crypto dollars are threat.

But that threat can be mitigated.

Crypto dollars are threat.

But that threat can be mitigated.

However, it’s not all doom and gloom for ETH.

While DeFi may not directly impact the price of ETH, DeFi could indirectly impact the price of ETH and produce an equally satisfying result.

While DeFi may not directly impact the price of ETH, DeFi could indirectly impact the price of ETH and produce an equally satisfying result.

DeFi’s progress is not only a sign of DeFi’s product-market fit, but Ethereum’s product-market fit.

In the past two years, Ethereum has developed from a piggy bank for ICO projects to a burgeoning digital economy. https://twitter.com/ryanwatkins_/status/1266019725626179584

In the past two years, Ethereum has developed from a piggy bank for ICO projects to a burgeoning digital economy. https://twitter.com/ryanwatkins_/status/1266019725626179584

This is important because utility is a key component of what makes money valuable (just look at the USD).

Perhaps just as much as a money’s store of value properties.

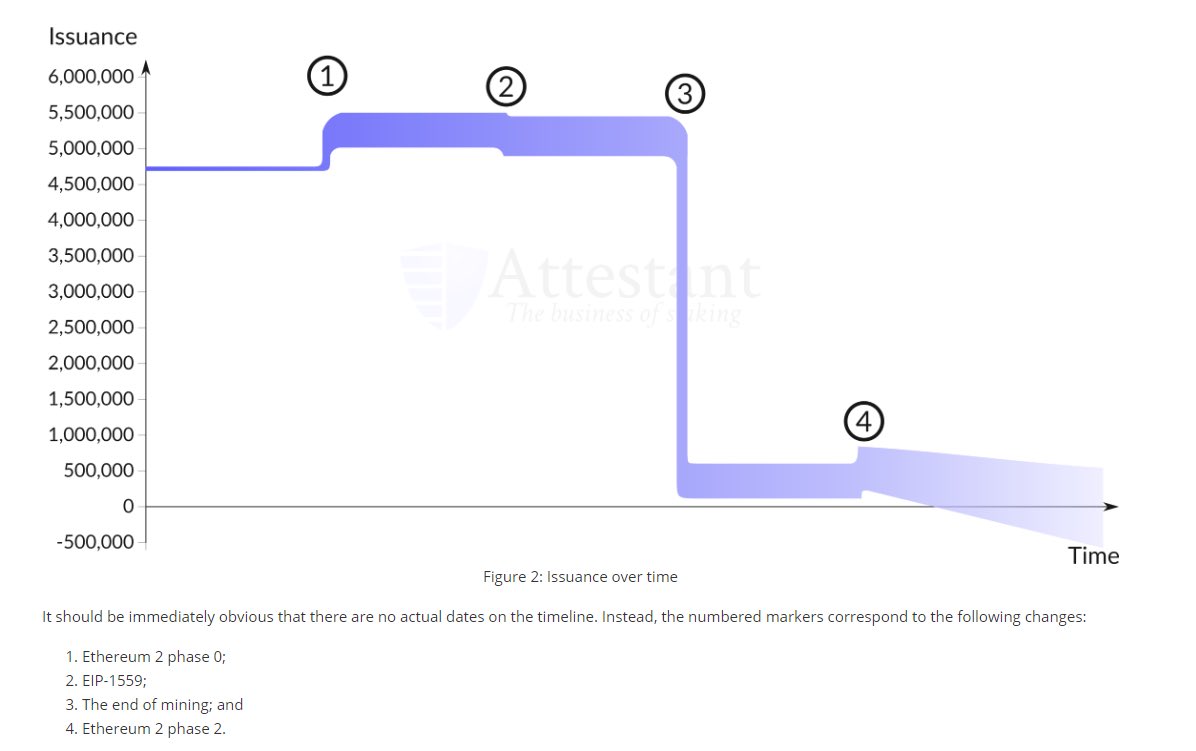

ETH is progressing on both fronts given its continually developing economy and technical roadmap.

Perhaps just as much as a money’s store of value properties.

ETH is progressing on both fronts given its continually developing economy and technical roadmap.

It is possible that within a couple years, ETH may not only be the most useful asset in crypto given its on-chain economy, but also crypto’s most credibly scarce asset given ETH 2.0 and EIP 1559.

Only time will tell.

Only time will tell.

In my latest piece I take an in depth look at:

- ETH’s relationship with DeFi

- ETH’s utility + store of value properties

- How DeFi’s animal spirits could find their way into ETH https://messari.io/article/defi-is-mooning-why-isn-t-eth

- ETH’s relationship with DeFi

- ETH’s utility + store of value properties

- How DeFi’s animal spirits could find their way into ETH https://messari.io/article/defi-is-mooning-why-isn-t-eth

Read on Twitter

Read on Twitter