With the election less than 5 months away, we're getting more questions. A common one is on corporate taxes.

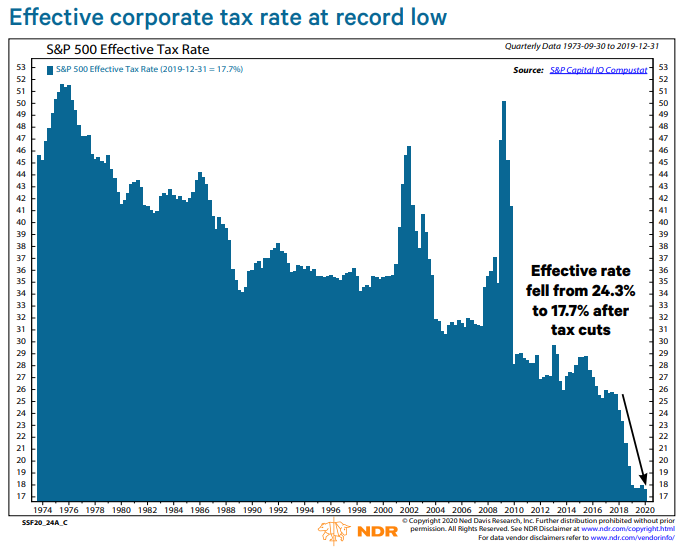

The $SPX's effective tax rate was already at a record low in 2017. It fell another 6.6% points to 17.7% as of 12/31/2019. @NDR_Research 1/5

The $SPX's effective tax rate was already at a record low in 2017. It fell another 6.6% points to 17.7% as of 12/31/2019. @NDR_Research 1/5

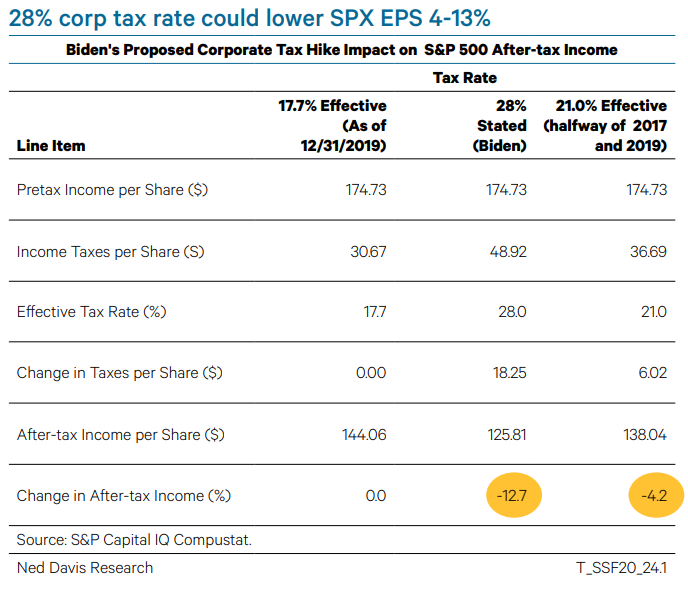

Biden has proposed raising the corp rate from 21% to 28%, reversing 50% of the 2018 cut. A 28% rate would have reduced 2019 after-tax EPS 12.7%, ceteris paribus.

The effective rate fell 6.6% points. Raising it 3.3% points (removing 50% of the 2018 cut) would reduce EPS 4.2%. 2/5

The effective rate fell 6.6% points. Raising it 3.3% points (removing 50% of the 2018 cut) would reduce EPS 4.2%. 2/5

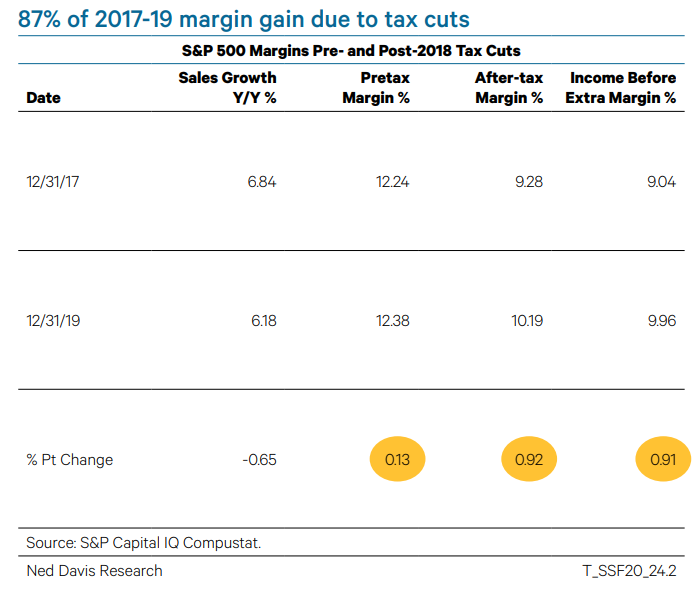

The above tweet is a static analysis, ignoring things like economic growth. 2 years isn't enough to measure tax changes, but from 2017-19, SPX sales growth slowed. Almost all of the margin expansion came at the tax line. 3/4

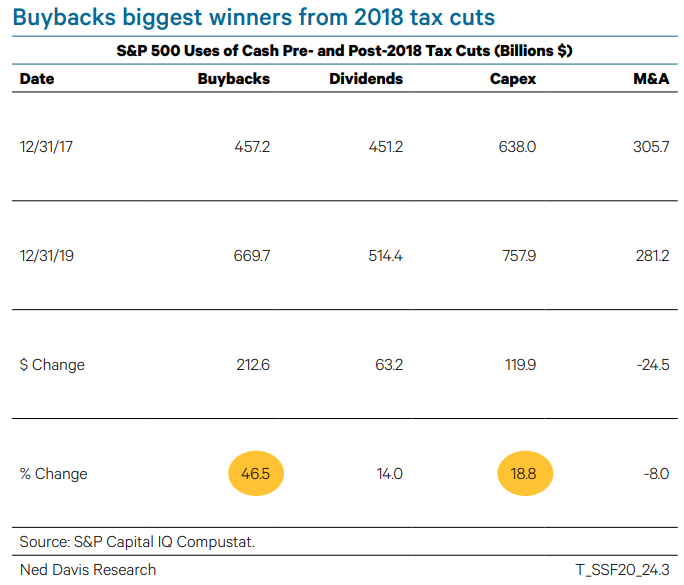

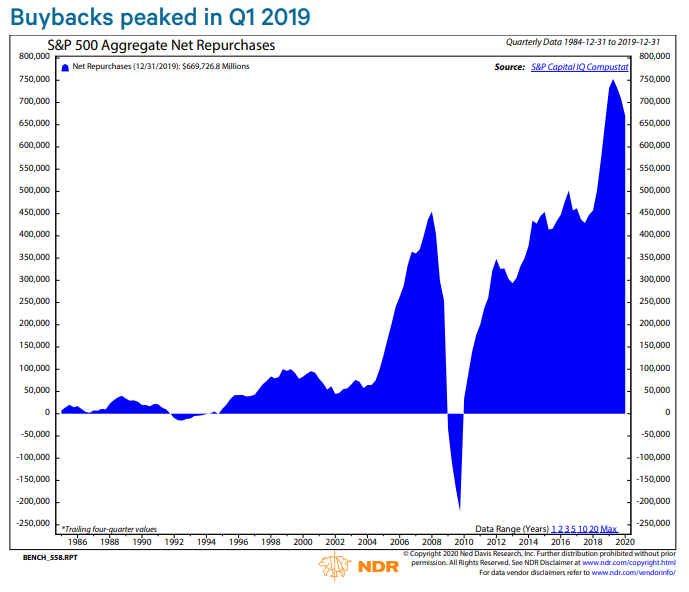

#buybacks were the biggest winners from the 2018 tax cuts. $SPX buybacks surged 47% from 2017-19. Much maligned capex rose 19%. Buybacks could be the biggest loser from a tax hike, at least at first glance... 4/5

Buybacks had already peaked, as the repatriation windfall subsided.

But versus other uses of cash, it's not a foregone conclusion firms take the marginal $ from buybacks. If investment opportunities are poor and rates low, why not buy back stock (IF you have spare cash)? 5/5

But versus other uses of cash, it's not a foregone conclusion firms take the marginal $ from buybacks. If investment opportunities are poor and rates low, why not buy back stock (IF you have spare cash)? 5/5

Read on Twitter

Read on Twitter