The challenge now is to assure investors that the medium-term stabilization in debt is possible. Near-term outlook is difficult:

FY 2020/21 deficit 15.7% (Feb announcement 6.8%)

Debt at 81.8%

Note 90% of debt of #SouthAfrica is domestic. https://twitter.com/elinaribakova/status/1275784354103517185

FY 2020/21 deficit 15.7% (Feb announcement 6.8%)

Debt at 81.8%

Note 90% of debt of #SouthAfrica is domestic. https://twitter.com/elinaribakova/status/1275784354103517185

Pandemic is of no fault of South Africa and healthacare spending is needed, issue is that SA entered COVID19 shock with poor fiscus. New leadership ran out of time to fix legacy issues (SOE mismanagement, poor wage settlement agreements, electricity supply) before the shock hit.

Minister @tito_mboweni: " @IMFNews Board Meeting on SA likely in early July after protracted, difficult negotiations... This is borrowing, not revenue, of about $4.2bn."

The additional money is little and as the Minister says it is debt, not revenue or a grant.

The additional money is little and as the Minister says it is debt, not revenue or a grant.

Markets are reacting well, I suppose everyone was prepared by the statements leading up to the announcement. Issuance plan is not a big surprise.

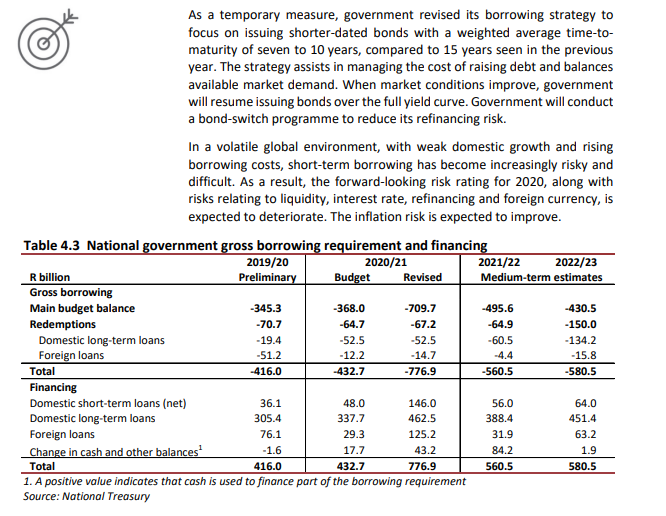

Not surprising the @TreasuryRSA is switching towards borrowing at shorter maturities: "As a temporary measure, government revised its borrowing strategy to

focus on issuing shorter-dated bonds with a weighted average time-tomaturity of 7-10y, compared to 15y"

focus on issuing shorter-dated bonds with a weighted average time-tomaturity of 7-10y, compared to 15y"

Read on Twitter

Read on Twitter