In the breathless news cycle, some questions of genuine long-term importance can get left behind; spare some time to read our take on the state of money and the payment system... and where we should be headed https://twitter.com/BIS_org/status/1275746244342829057

The pandemic has underlined why access, speed and cost of payment services for the general public are more important than ever; Covid-19 has been a real life stress test for our most important financial infrastructure: the payment system. The record here has been mixed...

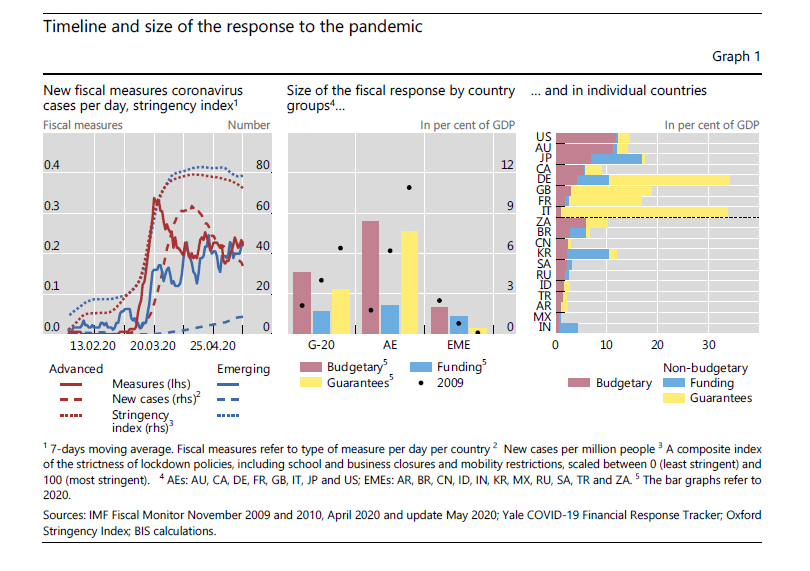

Fiscal authorities put in place (very swiftly) much needed fiscal support measures to households and firms - around 10% of GDP in budgetary measures, and about the same again in terms of funding and guarantees https://www.bis.org/publ/bisbull23.htm

But actually *reaching* those most in need has been another matter. Some jurisdictions did well, making the most of their fast retail payment systems, or using e-wallets for disbursement of support to put money in the hands of those most in urgent need...

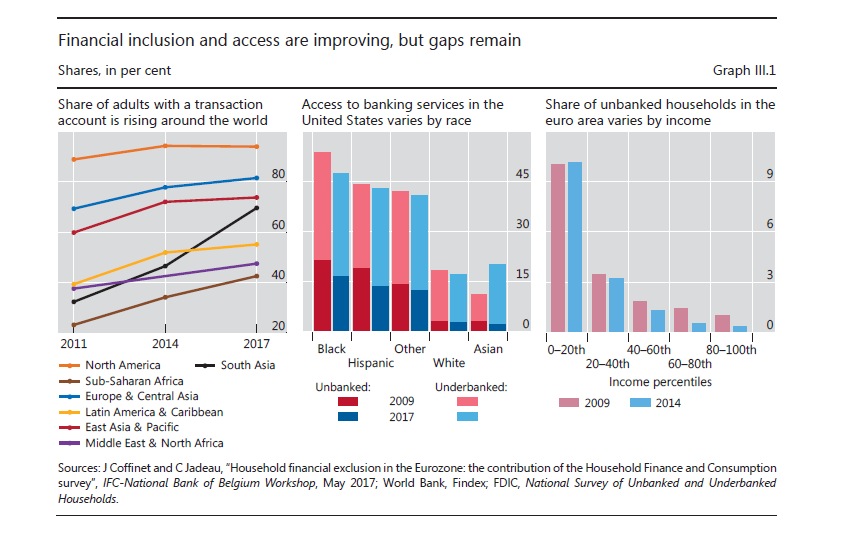

But access has been a problem; not everyone has a bank account, and certainly not all the bank accounts are linked to fast retail payment systems (the kind where your money appears immediately in your account, as soon as the sender clicks the "send" button)

Even for those who *do* have bank accounts, sometimes they have to wait for the paper cheque to arrive by post; in any case it can take days for the money to appear in your account

In short, access is still an unresolved issue; the pandemic has only served to highlight why it's a problem

https://www.bis.org/publ/arpdf/ar2020e.htm

https://www.bis.org/publ/arpdf/ar2020e.htm

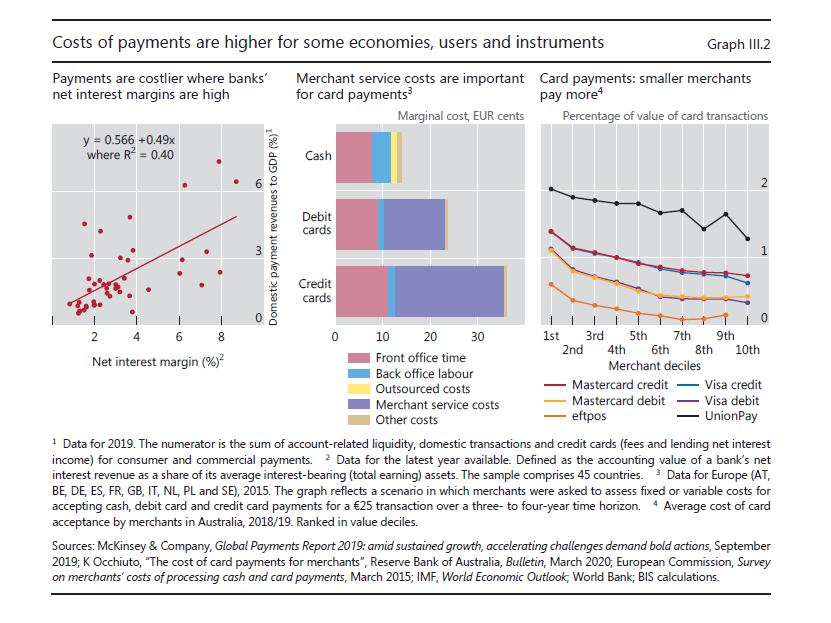

Another issue is the *cost*, and who bears it; unfortunately, it's the most disadvantaged groups that pay most to gain access to payment services

In all this, network effects of payment platforms can be a mixed blessing; on the one hand, you benefit from having everyone on the same app, but a dominant operator can charge retailers and merchants hefty charges to service the users

Consumers don't always see these costs on their balance statements, but the economy as a whole will bear the burden; just like the incidence of taxes, everyone will bear those costs eventually

Hence our key message:

Technology will take you only so far; ultimately, it's also about the underlying economics and the competitive landscape

https://www.bis.org/publ/arpdf/ar2020e.htm

Technology will take you only so far; ultimately, it's also about the underlying economics and the competitive landscape

https://www.bis.org/publ/arpdf/ar2020e.htm

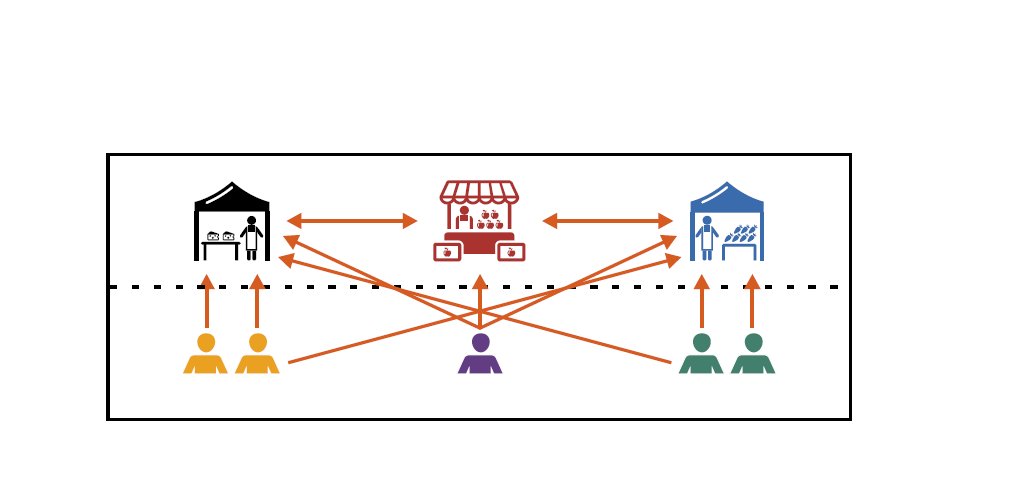

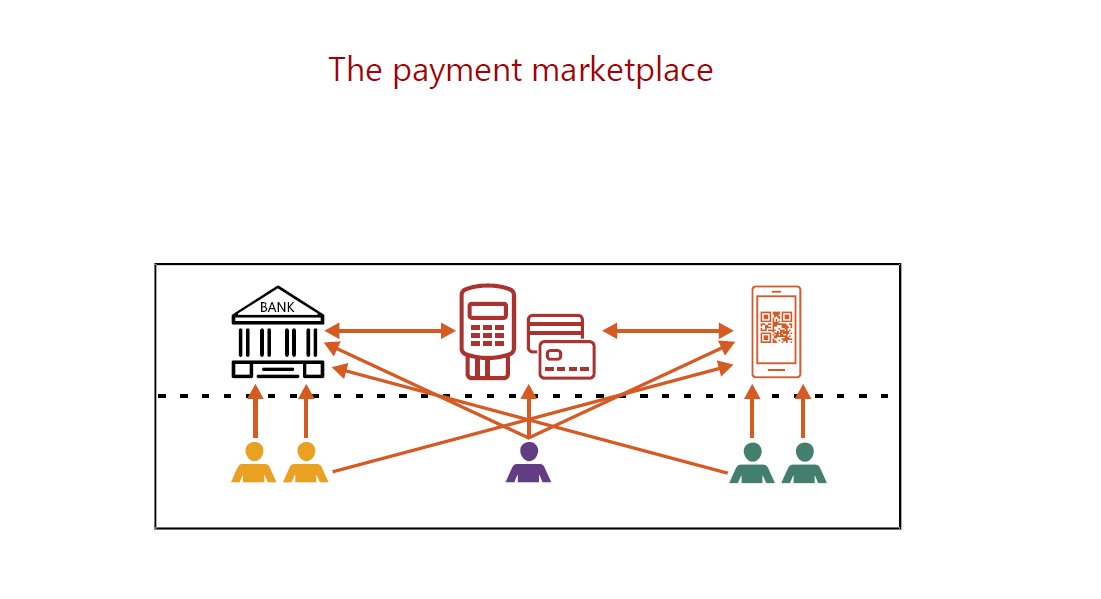

Payment systems give rise to "platform competition", like choice between two full-service department stores; if you're inside one of them, you cannot access the goods in the other store

It gives rise to "walled gardens"; it's quite nice inside at first, but you're cut off from the outside world and you might get trapped

An open market doesn't impose barriers between sellers; but it's a public good that needs constant attention to maintain the public good nature of the market place

The industrial organisation of an open market place for payment services is interesting to think through

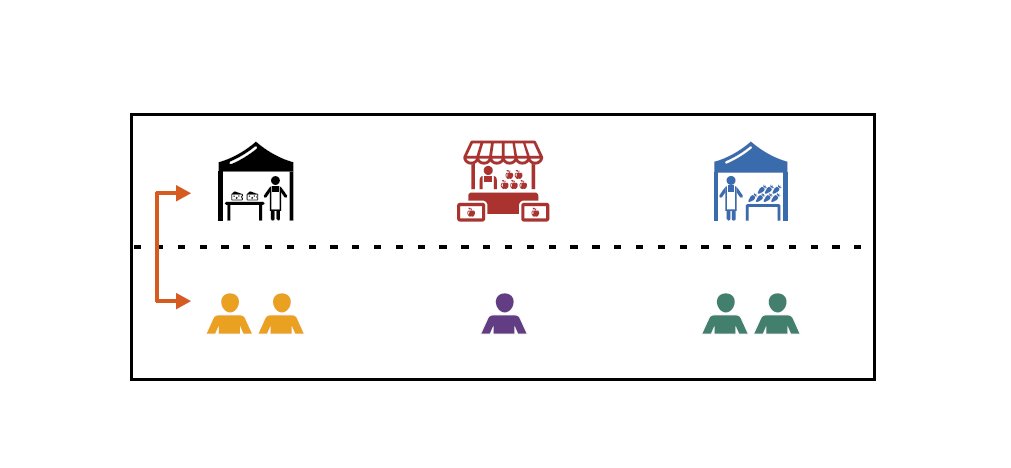

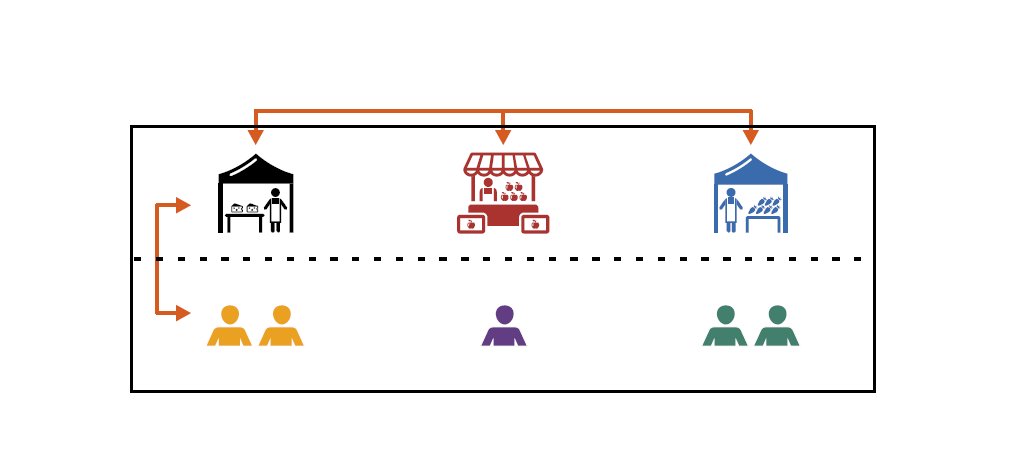

Start with an open market with sellers offering differentiated goods (in this case, cheese, fruit and vegetables)

Start with an open market with sellers offering differentiated goods (in this case, cheese, fruit and vegetables)

There is, first, the usual strategic complementary between buyers and sellers; the more buyers come, the more the sellers come, and vice versa

But the buyers of cheese are also potential customers of fruit and vegetables; so the strategic complementarities also spill over to the sellers' side

Usually, in markets for horizontally differentiated goods, new entry by sellers makes incumbent sellers worse off because the entrant takes customers away; but when new entry also enhances the bustle and vibrancy of the market as a whole, everyone benefits

Payment service providers bundle different services (messaging, e-commerce, takeaway food delivery, etc.) with basic payment functionality

Open markets mean setting and enforcing technical standards, data access requirements through open APIs, etc. that maintain a competitive level playing field and interoperability

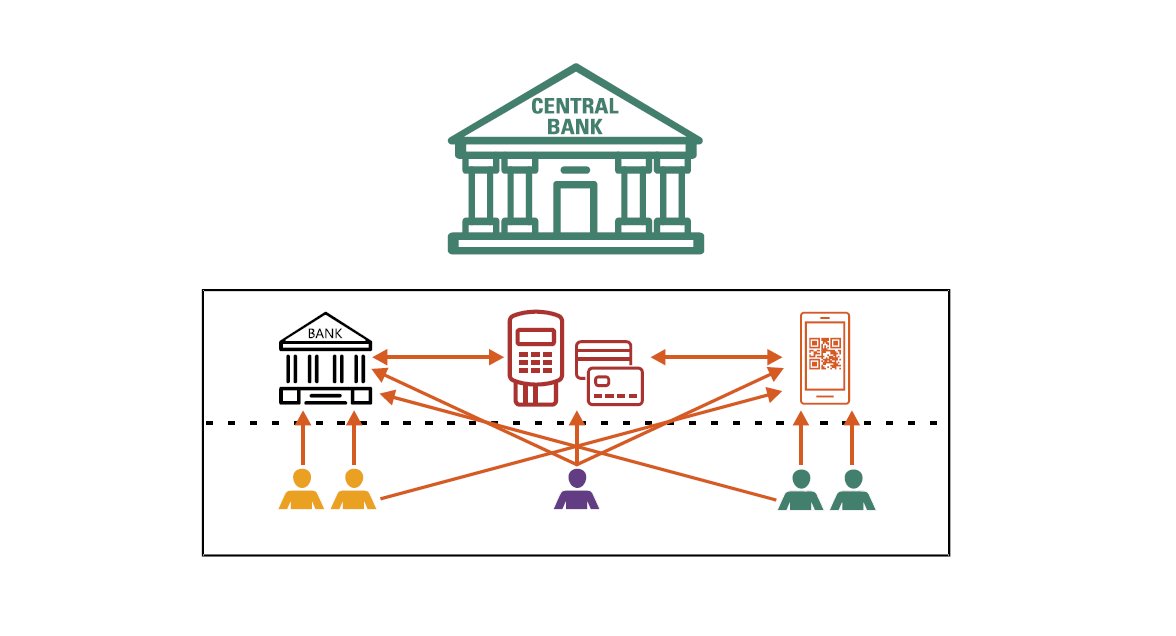

The central bank, as the operator of the payment infrastructure can ensure that everyone sticks to these standards; after all, it issues money, and its settlement accounts is the public town square where payment service providers come together

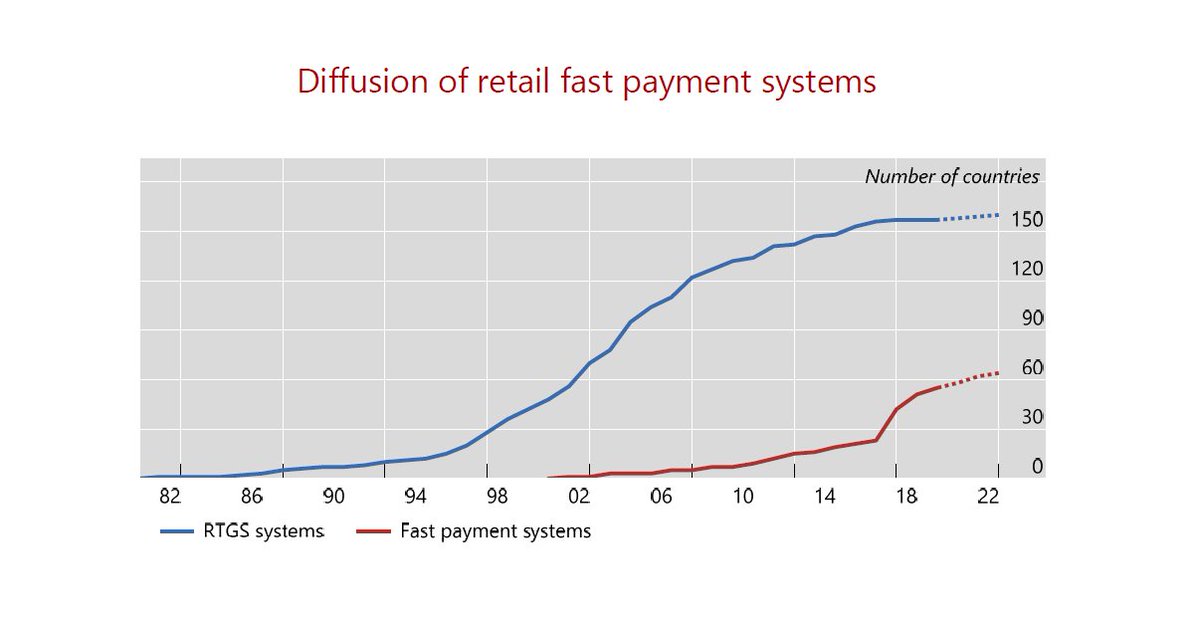

The biggest mark of success is the rapid diffusion of fast retail payment systems operated by central banks directly, or through public utilities that they oversee

Real time gross settlement (RTGS) systems were a novelty when they first appeared in the 1980s, but they are now very well established; the fast retail payment systems are following the same trajectory

This brings us to central bank digital currencies (CBDCs)

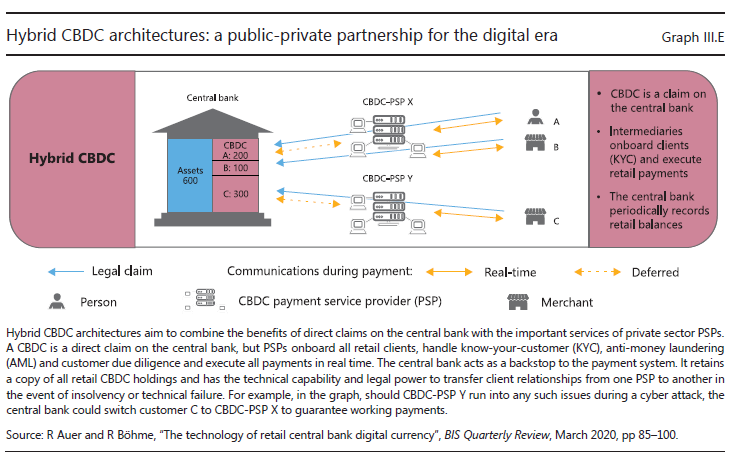

CBDCs are another way for the central bank to play the role of the operator of the payment infrastructure

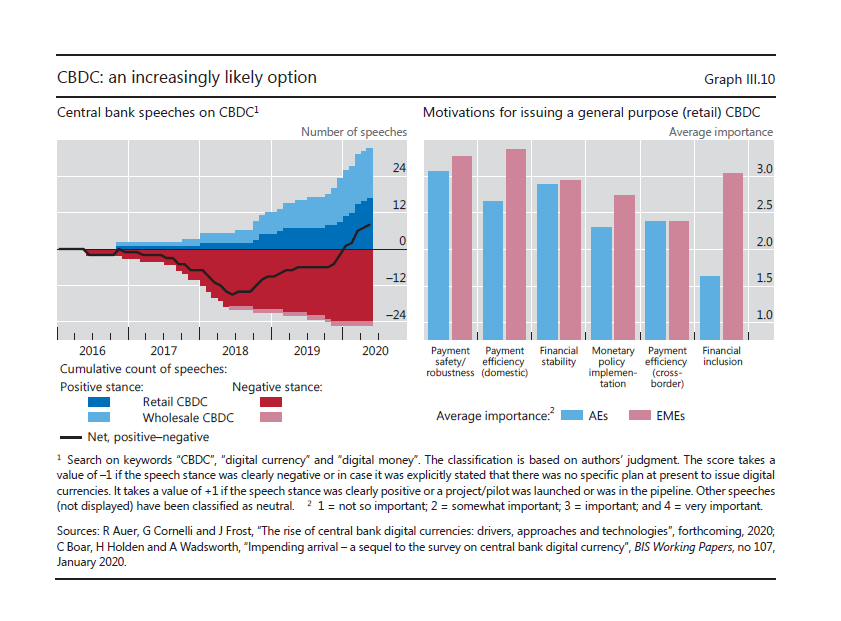

The tone of recent central bank speeches has shifted noticeably more favorably toward CBDCs, as seen in the left-hand panel

The tone of recent central bank speeches has shifted noticeably more favorably toward CBDCs, as seen in the left-hand panel

Work is under way at central banks on the design and use cases for CBDCs, including retail CBDCs that grant access to ordinary users to claims on the central bank in digital form

You could make the argument that this is only an incremental change ("we already have access to cash", etc.)

But it could be something much more consequential...

But it could be something much more consequential...

Because, for the first time ever, technology has enabled the notion of "money as memory"* to take concrete form, rather than as a theoretical notion in abstract economics

* Narayana Kocherlakota (1998) "Money is memory" Journal of Economic Theory

* Narayana Kocherlakota (1998) "Money is memory" Journal of Economic Theory

Whatever form a CBDC takes, it will entail maintaining a ledger of some kind - centralised or decentralised - to keep track of who is the rightful owner of the CBDC https://www.bis.org/publ/qtrpdf/r_qt2003j.htm

It also means that central banks need to choose whether the ledger is maintained by the central bank itself, or delegated in some way

None of these choices are straightforward; the impact on the system needs to be thought through, as well

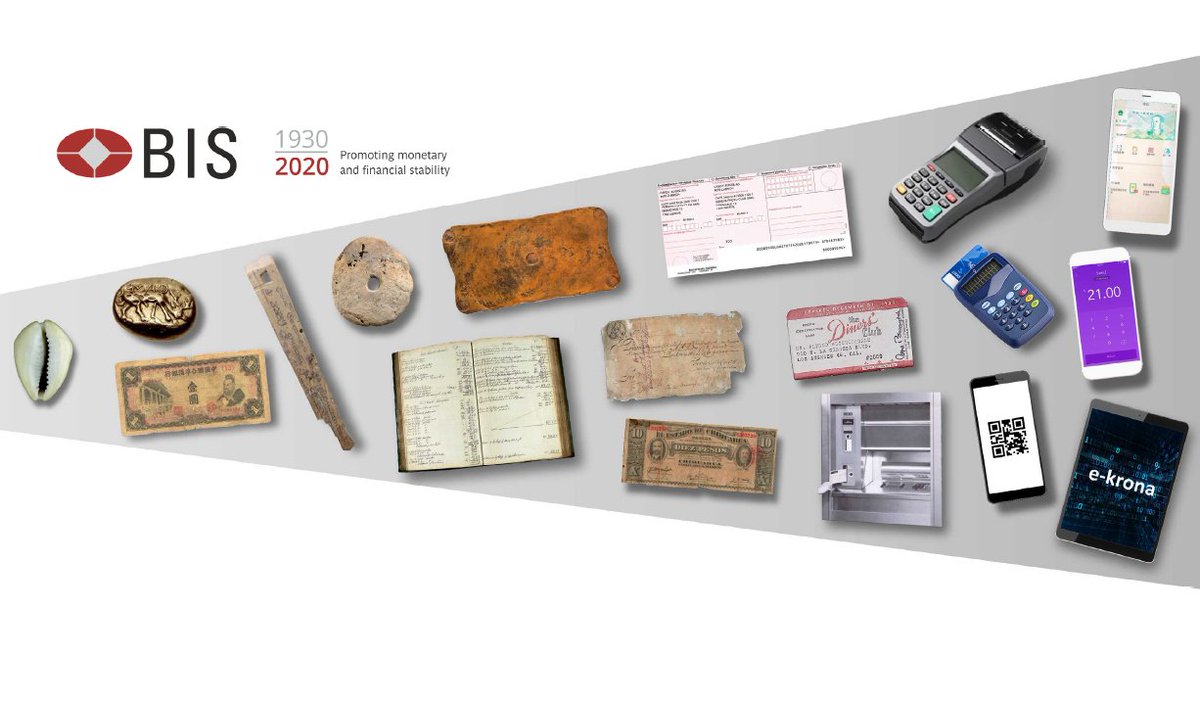

Monetary institutions have constantly evolved with changing technology; we may be on the cusp of another important leap in that journey

https://www.bis.org/publ/arpdf/ar2020e.htm

https://www.bis.org/publ/arpdf/ar2020e.htm

Short introductory video

Update: listen to this full-length podcast by my colleague @BCoeure on the themes touched on in this thread, and on the work of the BIS Innovation Hub

In conversation with Chris Brummer @ChrisBrummerDr https://www.rollcall.com/podcasts/fintech-beat/the-bank-for-international-settlements-tackles-central-bank-digital-currencies/

In conversation with Chris Brummer @ChrisBrummerDr https://www.rollcall.com/podcasts/fintech-beat/the-bank-for-international-settlements-tackles-central-bank-digital-currencies/

Read on Twitter

Read on Twitter