1/Today, @BalancerLabs launched $BAL and it has been extremely interesting in terms of platform metrics.

Here's an update to the thread I posted earlier in the month! https://twitter.com/jbrukh/status/1270105731602305025

https://twitter.com/jbrukh/status/1270105731602305025

Here's an update to the thread I posted earlier in the month!

https://twitter.com/jbrukh/status/1270105731602305025

https://twitter.com/jbrukh/status/1270105731602305025

2/To recap, mid-May the project announced that they would allocate 145K $BAL tokens per week to incentivize liquidity provision in Balancer pools.

The #LiquidityMining program launched at the end of the month, on May 29th. https://medium.com/balancer-protocol/balancer-liquidity-mining-begins-6e65932eaea9

The #LiquidityMining program launched at the end of the month, on May 29th. https://medium.com/balancer-protocol/balancer-liquidity-mining-begins-6e65932eaea9

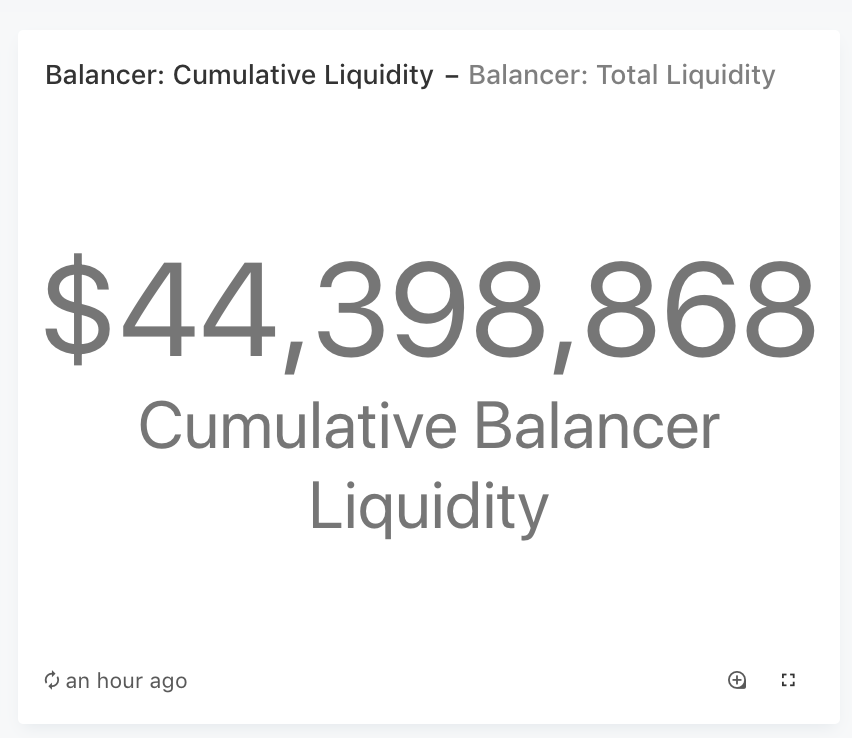

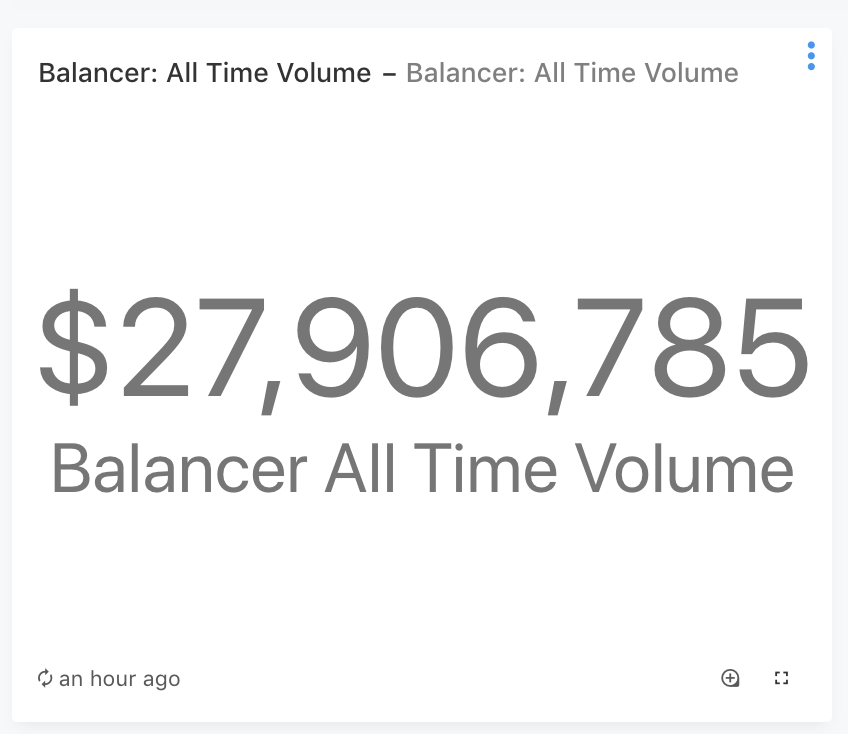

3/On June 8th, we saw a spike to about 28M of cumulative volume. 15 days later, we now have a growth of about 58.5%. . .

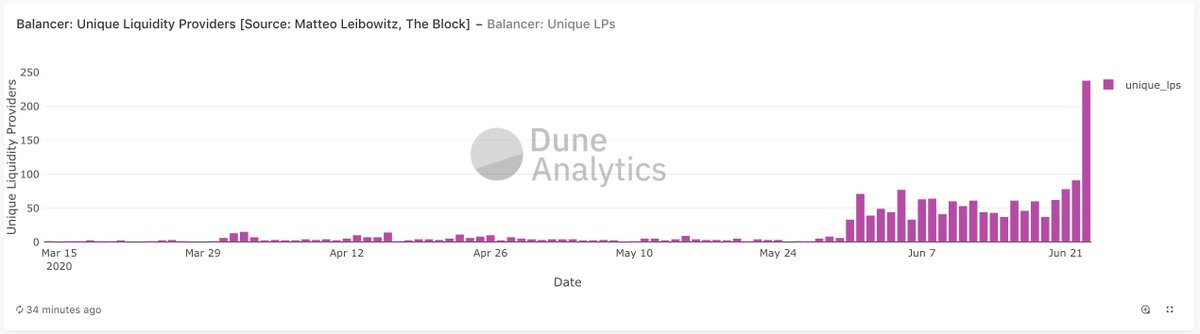

4/The liquidity mining program created a ~10x growth in daily LPs, and this growth has been sustained for the last weeks. . . until today: the launch of $BAL tokens.

Today, Balancer added 238 LPs in a single day, 2.6x the highest increase in LPs since the program began.

Today, Balancer added 238 LPs in a single day, 2.6x the highest increase in LPs since the program began.

6/So what's happening here?

I think we're seeing a really impressive demonstration of decentralized networks using speculative economics to bootstrap real activity & fundamental value.

LPs are rushing to claim $BAL rewards by depositing all kinds of esoteric assets into pools.

I think we're seeing a really impressive demonstration of decentralized networks using speculative economics to bootstrap real activity & fundamental value.

LPs are rushing to claim $BAL rewards by depositing all kinds of esoteric assets into pools.

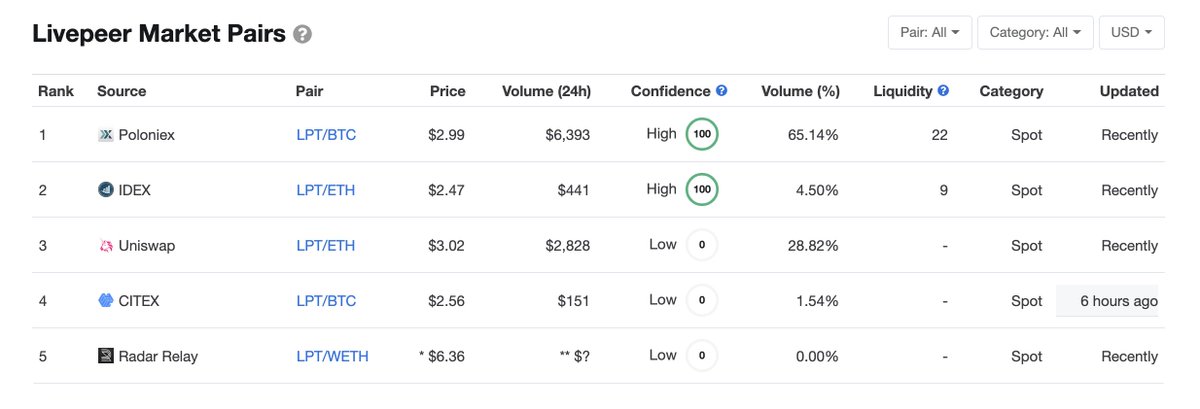

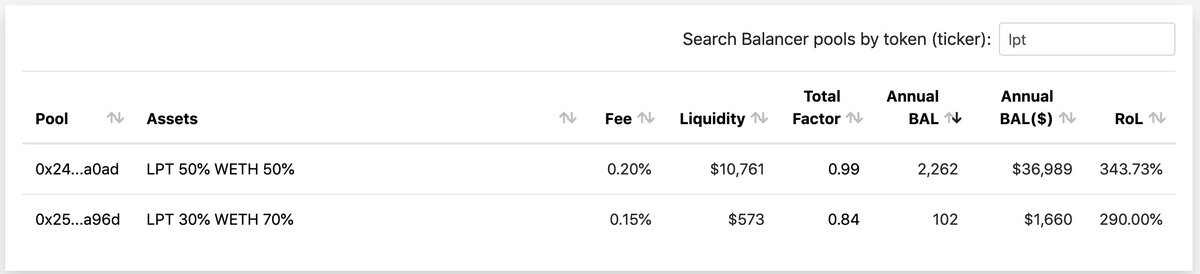

7/My favorite example of this is @LivepeerOrg.

Livepeer's $LPT has been illiquid on dexes for the last ~2 years partially due to the fact that Livepeer staking rewards are attractive: as much as ~100% that first year!

Here's what $LPT liquidity has looked like until today:

Livepeer's $LPT has been illiquid on dexes for the last ~2 years partially due to the fact that Livepeer staking rewards are attractive: as much as ~100% that first year!

Here's what $LPT liquidity has looked like until today:

8/Many LPs would rather speculate on the future of $LPT and maximize their position through staking than to trade that in for exchange fees during Crypto Winter.

But now, someone providing liquidity to the a Livepeer Balancer pool might be making 300%+ ROI on their deposit.

But now, someone providing liquidity to the a Livepeer Balancer pool might be making 300%+ ROI on their deposit.

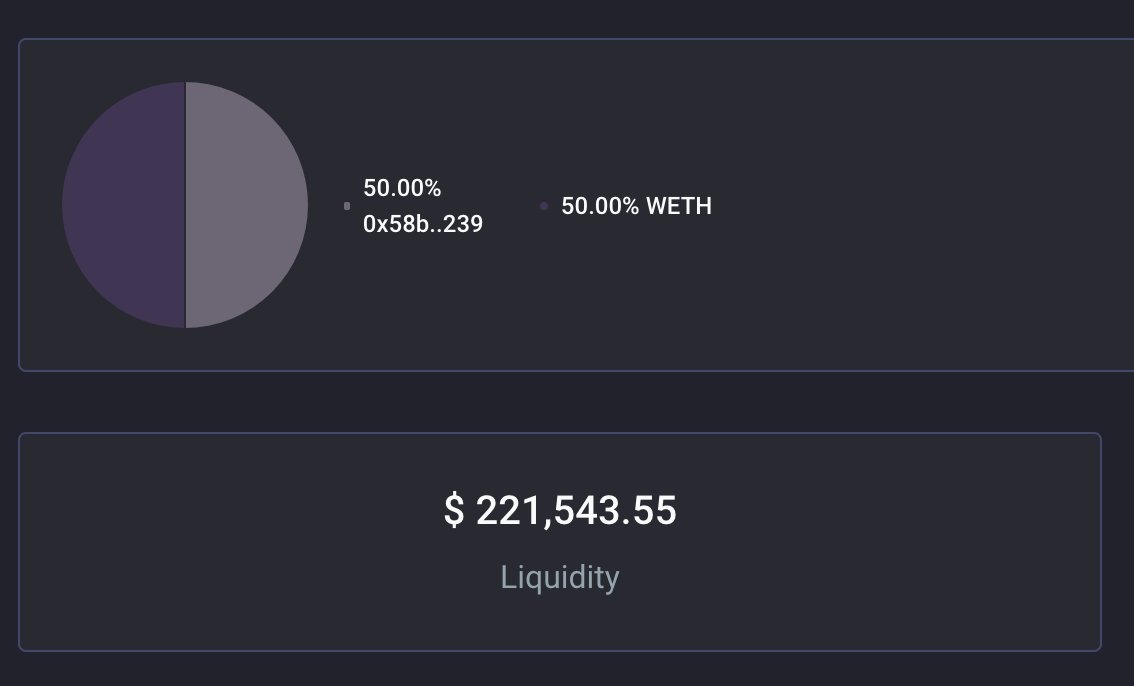

9/Amazingly, the highest liquidity public market for @LivepeerOrg now lives on @BalancerLabs! That's an impressive demonstration of decentralized networks in action.

Boom!

Boom!

10/The end.

Check out the $LPT pool here: https://pools.balancer.exchange/#/pool/0x24d97eed6e171e70c82bc60afd37c7d1e549a0ad

Estimate rewards here: http://www.predictions.exchange/balancer/None

Check out the @teo_leibowitz's @DuneAnalytics Balancer dashboard here: https://explore.duneanalytics.com/dashboard/balancer

Check out the $LPT pool here: https://pools.balancer.exchange/#/pool/0x24d97eed6e171e70c82bc60afd37c7d1e549a0ad

Estimate rewards here: http://www.predictions.exchange/balancer/None

Check out the @teo_leibowitz's @DuneAnalytics Balancer dashboard here: https://explore.duneanalytics.com/dashboard/balancer

Read on Twitter

Read on Twitter