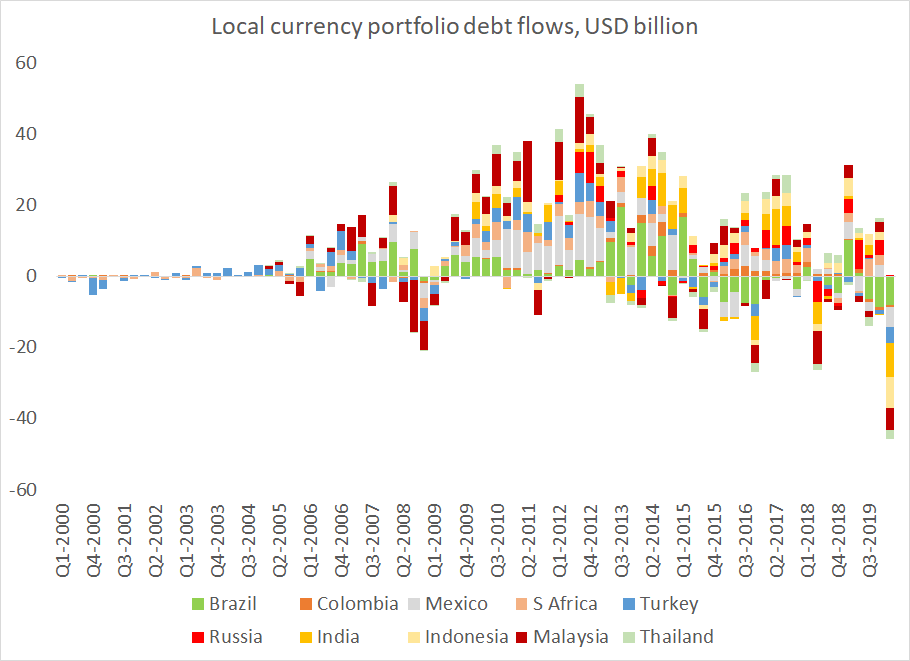

We now have reasonable complete balance of payments data for q1 -- and it is clear that foreign selling of local currency debt was a large source of BoP pressure. Sales in q1 topped peak sales in the global crisis

1/x

1/x

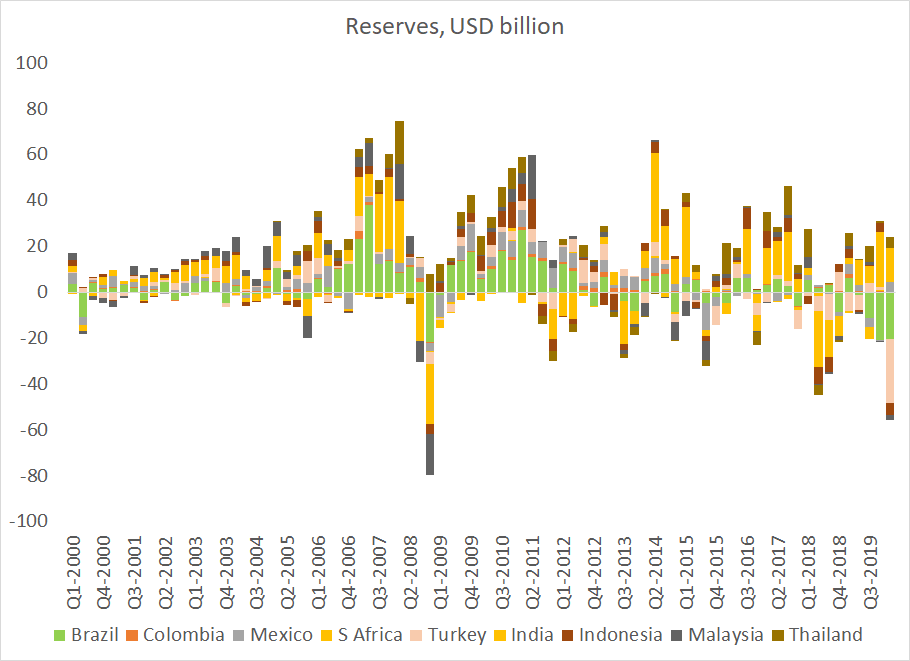

It is of course possible to map these sales to reserve sales from the same set of countries as well ...

(though you need to take Russia out to get a sensible comparison, as Russia went through a ton of reserves in the global crisis)

2/x

(though you need to take Russia out to get a sensible comparison, as Russia went through a ton of reserves in the global crisis)

2/x

The reserve draw was big, though not as big as in 08 (bank flows were more stable, and India is in a different position)

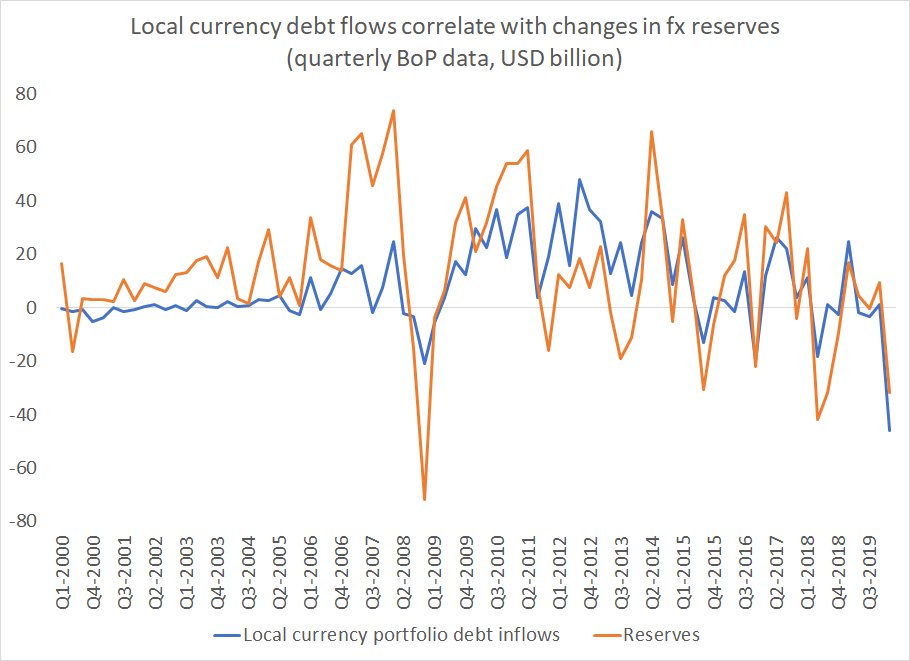

For this set of countries, there has been a fairly strong correlation between reserve changes and local currency portfolio flows over last ten years (the CA and bank flows drove a lot of reserve growth pre-global crisis)

4/n

4/n

I suspect @HyunSongShin would say this is evidence that local currency debt isn't completely risk free -- as countries feel the need to intervene in both directions to limit local financial market impacts

5/n

5/n

While Robin Brooks likely would note that reserve sales were a bit smaller than portfolio outflows, so more pressure was expressed through the exchange rate (less fear of floating).

Both are right in a sense ...

6/n

Both are right in a sense ...

6/n

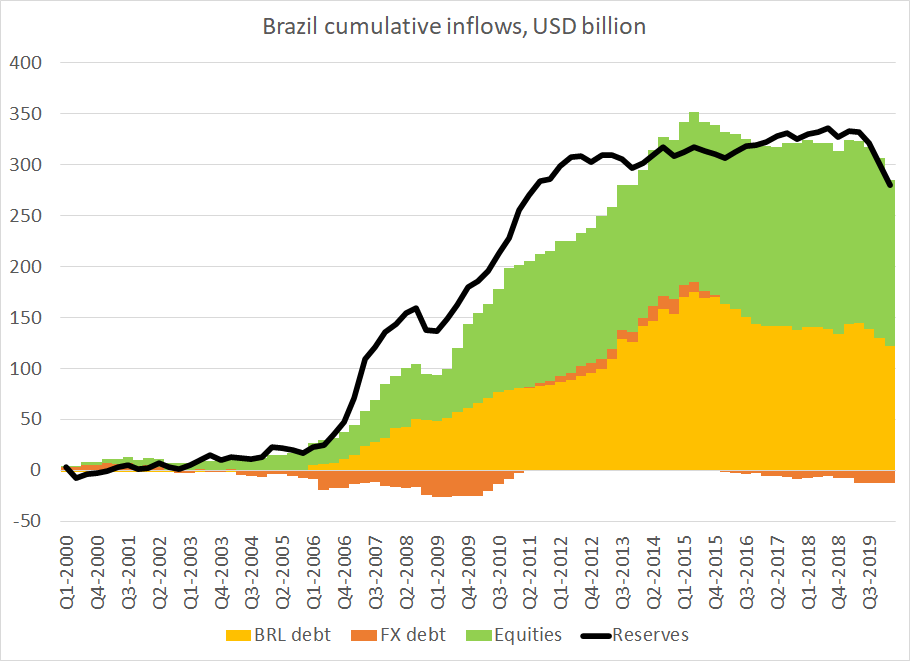

Think Brazil is an interesting case. The correlation between local market outflows and reserve changes has increased recently (local market outflows have generated much larger outflows than maturing fx debt)

7/n

7/n

On a long-term basis though, it is striking how the bulk of the local currency inflow was "saved" in reserves -- that more than anything else has helped it manage the recent shock without risking its (external) solvency.

8/n

8/n

But if safely managing foreign inflows into local markets still requires banking a large share of the inflow in reserves, it does suggest that the shift toward local market debt has changed less than some argue (even if it makes it easier to float down ...)

9/9

9/9

"reasonably" complete ..

need an edit button

need an edit button

Read on Twitter

Read on Twitter