1/ Is This a Stock Market Bubble?

There has been plenty of talk calling our current market environment a “bubble” following its meteoric rise from March lows.

I’d like to take an objective look.

Let’s use @RayDalio’s “7 Classic Signs of a Bubble” as our framework...

There has been plenty of talk calling our current market environment a “bubble” following its meteoric rise from March lows.

I’d like to take an objective look.

Let’s use @RayDalio’s “7 Classic Signs of a Bubble” as our framework...

2/ Sign  - Prices are high relative to traditional measures.

- Prices are high relative to traditional measures.

This is a qualified yes. P:E ratios are broadly quite high, though perhaps misleading given the lack of forward guidance.

Some valuation measures (adjusted for historically low rates) are more reasonable.

- Prices are high relative to traditional measures.

- Prices are high relative to traditional measures.This is a qualified yes. P:E ratios are broadly quite high, though perhaps misleading given the lack of forward guidance.

Some valuation measures (adjusted for historically low rates) are more reasonable.

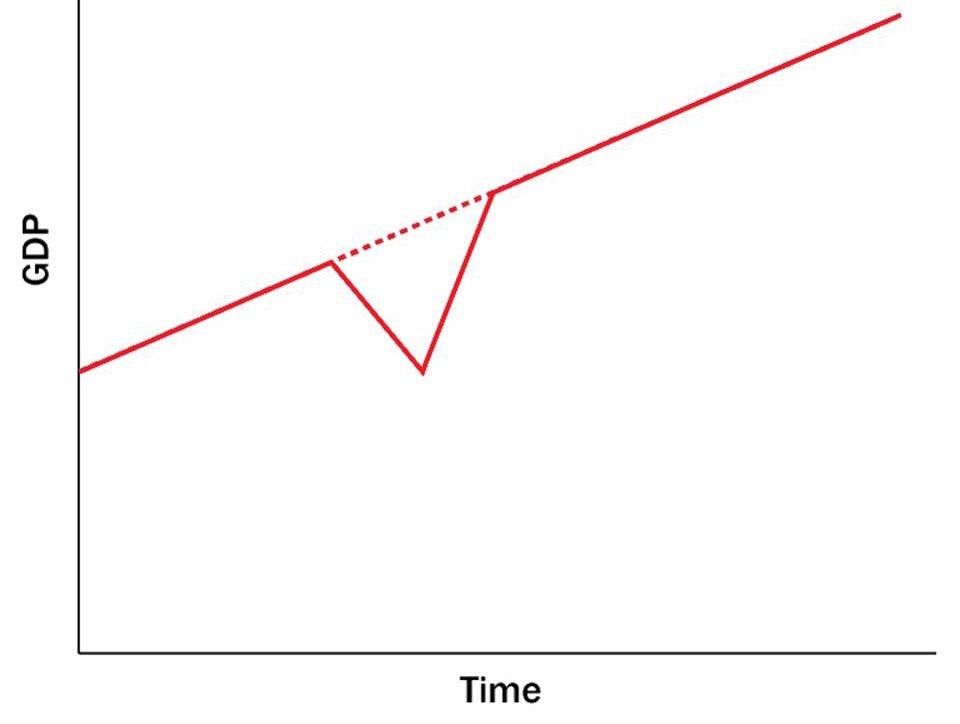

3/ Sign  - Prices discount future rapid price appreciation.

- Prices discount future rapid price appreciation.

Yes. There is a broad-based expectation of rapid, face ripping earnings growth (the “V-shaped recovery” everyone keeps talking about).

We have severely contracted, but the market is expecting massive expansion.

- Prices discount future rapid price appreciation.

- Prices discount future rapid price appreciation.Yes. There is a broad-based expectation of rapid, face ripping earnings growth (the “V-shaped recovery” everyone keeps talking about).

We have severely contracted, but the market is expecting massive expansion.

4/ Sign  - Broad bullish sentiment.

- Broad bullish sentiment.

Yes. Stocks only go up!

Equity put/call ratios hit historically low levels in recent weeks. “Stocks only go up” has become a mantra repeated by bloggers, tweeters, live-streamers and the media alike.

- Broad bullish sentiment.

- Broad bullish sentiment.Yes. Stocks only go up!

Equity put/call ratios hit historically low levels in recent weeks. “Stocks only go up” has become a mantra repeated by bloggers, tweeters, live-streamers and the media alike.

5/ Sign  - Purchases are financed by high leverage.

- Purchases are financed by high leverage.

This is a qualified no. Use of margin (i.e. leverage) has contracted on a YoY basis, though the data is only through April.

Overall economy debt levels are ballooning, but we are just looking at the stock market for now.

- Purchases are financed by high leverage.

- Purchases are financed by high leverage.This is a qualified no. Use of margin (i.e. leverage) has contracted on a YoY basis, though the data is only through April.

Overall economy debt levels are ballooning, but we are just looking at the stock market for now.

6/ Sign  - Buyers have made forward purchases to speculate.

- Buyers have made forward purchases to speculate.

Unclear and a bit hard to determine at a stock market level (vs. in individual industries like housing, etc.).

The use of unemployment and CARES Act benefits to speculate in the markets tilts this one towards a yes.

- Buyers have made forward purchases to speculate.

- Buyers have made forward purchases to speculate.Unclear and a bit hard to determine at a stock market level (vs. in individual industries like housing, etc.).

The use of unemployment and CARES Act benefits to speculate in the markets tilts this one towards a yes.

7/ Sign  - New buyers have entered the market.

- New buyers have entered the market.

Yes - no question.

Robinhood has experienced a massive surge in new account openings, as everyone decides to try their hand at “doing the stocks.” Constant media reporting of the rush and returns further accelerate the trend.

- New buyers have entered the market.

- New buyers have entered the market.Yes - no question.

Robinhood has experienced a massive surge in new account openings, as everyone decides to try their hand at “doing the stocks.” Constant media reporting of the rush and returns further accelerate the trend.

8/ Sign  - Stimulative monetary policy helps inflate the bubble.

- Stimulative monetary policy helps inflate the bubble.

Money printer go “Brrrrrrr!”

Central Banks globally have taken dramatic, unprecedented steps to stabilize financial markets, including through lowering interest rates and massive direct purchases.

- Stimulative monetary policy helps inflate the bubble.

- Stimulative monetary policy helps inflate the bubble.Money printer go “Brrrrrrr!”

Central Banks globally have taken dramatic, unprecedented steps to stabilize financial markets, including through lowering interest rates and massive direct purchases.

9/ So where does this all leave us?

Based on this framework, it seems that most of the signs of a bubble either exist or may exist in the stock market today.

This doesn’t mean that there aren’t opportunities (always money to be made!), but manage risk carefully as you proceed.

Based on this framework, it seems that most of the signs of a bubble either exist or may exist in the stock market today.

This doesn’t mean that there aren’t opportunities (always money to be made!), but manage risk carefully as you proceed.

Read on Twitter

Read on Twitter