1/ Thread: How $SFIX Is Trying to Shape The Future of Online Shopping

Happy to post my first write-up on this platform. This is a name I don’t see often – let me know your thoughts!

Happy to post my first write-up on this platform. This is a name I don’t see often – let me know your thoughts!

2/ Stitch Fix is misunderstood and a potentially opportunistic, yet very risky, long-term investment.

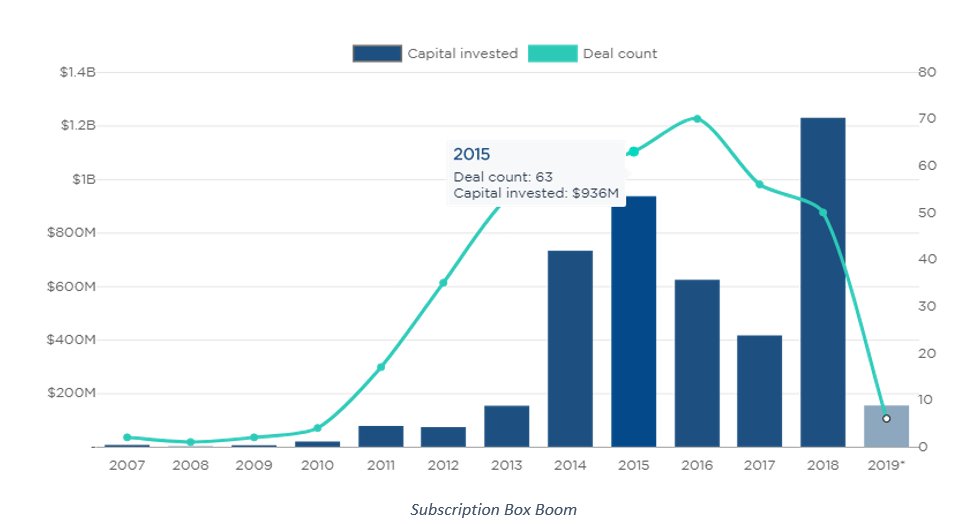

Remember 2015? When everybody and their dog was trying to start a subscription box company?

Remember 2015? When everybody and their dog was trying to start a subscription box company?

3/ This boom saw the likes of Blue Apron, Birch Box, Dollar Shave Club, and many more establish a market for convenient, recurring consumer product deliveries.

VC was pumping money into these companies, some good, some bad.

VC was pumping money into these companies, some good, some bad.

4/ Stitch Fix was founded in 2011 by current CEO Katrina Lake, while attending HBS, as a platform to shop for those too busy or fashion-unconscious to do it themselves. It caught the “subscription box boom” of the mid-2010’s and IPO’d in 2017.

5/ Benchmark invested in its Series B, and Bill Gurley remains extremely invested in the company. Stitch Fix’s stock has remained roughly flat since its IPO, due to its slower-than-most growth for a “growth” company.

6/ Still, from 2016 to 2019, the company has grown its revenue at a CAGR of 29% from $730m to $1.578b, and in the past 15 quarters, there were only two instances of negative EBITDA.

7/ This company has been growing for a while and is profitable, so why is the market largely ignoring it?

I believe Stitch Fix is misunderstood, and the market is not factoring in a massive pivot in the company’s business strategy currently taking place.

I believe Stitch Fix is misunderstood, and the market is not factoring in a massive pivot in the company’s business strategy currently taking place.

8/ The legacy Stitch Fix business model looks like this:

1. Sign up and answer a ton of questions about your style

2. Pay a non-refundable, $20 styling fee (for a stylist)

3. Receive a personalized box of clothes

4. Send back what you don’t want, pay for what you keep

1. Sign up and answer a ton of questions about your style

2. Pay a non-refundable, $20 styling fee (for a stylist)

3. Receive a personalized box of clothes

4. Send back what you don’t want, pay for what you keep

9/ This model has attracted a ton of competition, like Trunk Club (acquired by Nordstrom) and Amazon, who recently entered this space with Personal Shopper.

10/ For Stitch Fix, this model is attractive because massive amounts of data can be collected on individualized customer preferences, so algorithms can be trained very well.

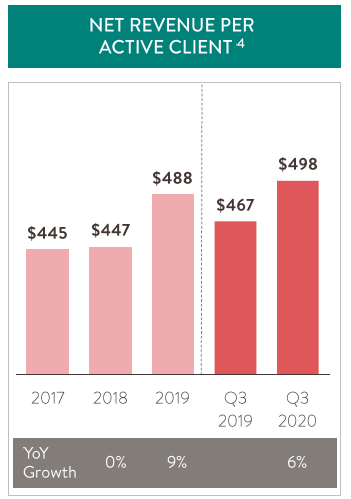

11/ So a flywheel was created for each customer: More orders -> Better predictions -> More orders -> Better predictions….

And this has actually works, as active clients keep on ordering more.

And this has actually works, as active clients keep on ordering more.

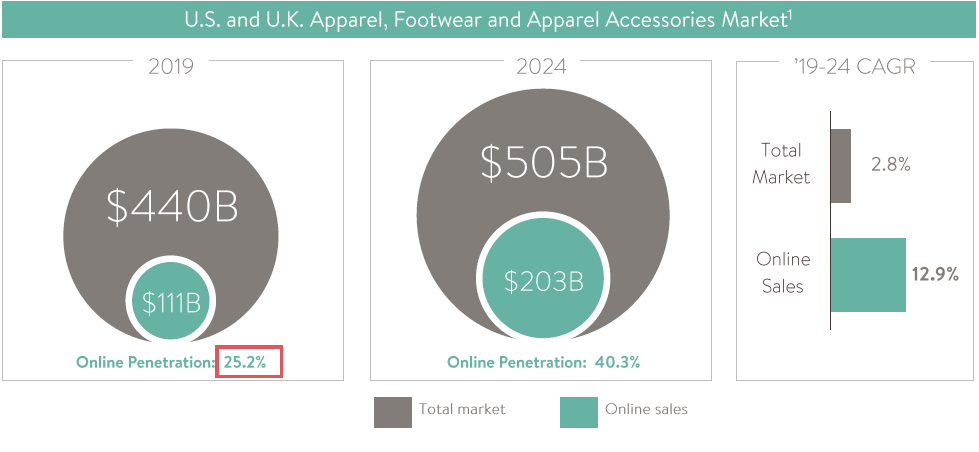

12/ But it’s 2020, not 2015, and the business model needed to be refined. COVID has accelerated the push for online apparel shopping (which is a very different beast than buying household items from Amazon).

13/ But with these industry tailwinds and the collapse of department stores, there is new market share up for grabs. This is sure to attract heavy investment in the online apparel space.

But the future will be different than the present.

But the future will be different than the present.

14/ If you currently log onto Amazon or Macy’s to online shop for clothes, the experience is not personal or efficient. Tens of thousands of items are available, all brands fit differently, and great quality is unassured.

Stitch Fix is trying to remove this pain point.

Stitch Fix is trying to remove this pain point.

15/ Recently, Katrina Lake announced that Stitch Fix will begin offering “Direct Buy” for current customers, where customers will be able to purchase clothes directly from a personalized catalog.

I believe that analysts aren’t paying attention to this new revenue stream enough.

I believe that analysts aren’t paying attention to this new revenue stream enough.

16/ It sounds like traditional ecommerce, but it will use Stitch Fix’s proven data science to offer suggestions, uniquely trained for specific customers. It will also attract customers who don’t like the randomness of Stitch Fix’s legacy box model.

17/ Lake is all about investing with a 10-15 year horizon. The company spends a ton on data science and engineers, which I believe is mainly expansion investment for the future (Direct Buy). This sacrifices short-term profitability.

18/ Stitch Fix is going after a new form of ecommerce that doesn’t exist yet: Online shopping with a personalized, department store feel, for all genders and ages.

No more wasting time scrolling through thousands of items or sending back things that don’t fit!

No more wasting time scrolling through thousands of items or sending back things that don’t fit!

19/ Actual, human stylists for its legacy box business are one of the biggest expense items on its P/L.

I believe that these can eventually be replaced by algorithms, which would further boost profitability.

Stitch Fix wants to run lean.

I believe that these can eventually be replaced by algorithms, which would further boost profitability.

Stitch Fix wants to run lean.

20/ It has a 1.46 Cash-to-total-Debt ratio, and just opened a $90m credit facility for the first time ever, after facing supply-side issues due to COVID. It has liquidity to survive extended lockdowns and no long-term debt.

21/ Katrina Lake, the CEO, thinnks about growth "less about speed, more about long-term sustainability." The management is focused and has some all-stars: Ex-Head of Bain’s Digital Practice, Ex-COO of http://Walmart.com , Ex-VP of Data Science at Netflix.

22/ The board has "know-how" and connections in tech and retail. It consists of Bill Gurley (legendary VC), Steve Anderson (early investor in Instagram & Twitter), Mark Hansen (Ex-Executive of Gap and Banana Republic), Sharon McCollam (Former CFO of Best Buy), and more.

23/ The biggest long-term risk is clear: competition. Amazon is a behemoth entering the space. Traditional department stores are entering as well. The winner will need to partner with the best brands and offer the best experience.

Unclear if there is room for more than one.

Unclear if there is room for more than one.

24/ Another risk is bad data science. If predictions are off, the company will fail, as Stitch Fix’s value prop rests on its historically impressive ability to predict what clothes customers want.

Historically, it has been really, really, good.

Historically, it has been really, really, good.

25/ Another risk: Direct-to-brand shopping getting too popular. Lululemon, Nike, and others all are crushing it in ecommerce.

Why partner with StitchFix for a pay cut? The hedge here for Stitch Fix is that styles are cyclical. Stitch Fix can update its brand portfolio.

Why partner with StitchFix for a pay cut? The hedge here for Stitch Fix is that styles are cyclical. Stitch Fix can update its brand portfolio.

26/ A big short-term risk: Decreased consumer spending for a long period of time, related to COVID or other unseen events.

The M1 Money Supply (consumer money) is at an all-time-high, which is good for companies like Stitch Fix.

The M1 Money Supply (consumer money) is at an all-time-high, which is good for companies like Stitch Fix.

27/ Another risk: The valuation is lofty, but I think that there could be room for P/S multiple expansion as Stitch Fix attempts to be recognized as a true ecommerce platform.

28/ Look – there are a ton of unknowns here, this would be an opportunistic and high-risk bet, as you’re betting on Stitch Fix molding an industry that doesn’t really exist yet.

That is hard.

That is hard.

29/ It is getting valued at a P/S of 1.5 (like a department store) and Mkt Cap of ~$2.5b. The company has been profitable since 2014 and has seen consistent growth.

Stitch Fix is currently pivoting and has long-term ambitions.

Stitch Fix is currently pivoting and has long-term ambitions.

30/ One thing is certain: the online shopping experience for clothes will be different in 10-15 years.

More personal, less time consuming, everyone wins.

More personal, less time consuming, everyone wins.

31/ $SFIX wants to lead that charge, but with the Amazon threat, department stores shifting online, and brands selling direct, can it become the digital mall of the future?

Read on Twitter

Read on Twitter