A financial crisis is probably the most feared economic event known to man.

I've done (mostly acad.) research on them for over 10 years.

As we are likely closing in on one, a thread on the anatomy of a financial crisis.

The #coronavirus is just a'trigger'.1/16

@GnSEconomics

I've done (mostly acad.) research on them for over 10 years.

As we are likely closing in on one, a thread on the anatomy of a financial crisis.

The #coronavirus is just a'trigger'.1/16

@GnSEconomics

Financial crisis are born of some shock (smaller or larger) to the banking system.

The #coronavirus pandemic has been a rather massive trigger for a latent and overdue banking crisis.

If a banking system is sound and robust, it can usually withstand financial and... 2/

The #coronavirus pandemic has been a rather massive trigger for a latent and overdue banking crisis.

If a banking system is sound and robust, it can usually withstand financial and... 2/

...economic shocks. But a banking system may be fragile.

Usually this is due to high leverage levels, where banks have either lent aggressively or carry risky financial investments on their balance sheets—usually both.

Banks can also have a weak financial position,... 3/

Usually this is due to high leverage levels, where banks have either lent aggressively or carry risky financial investments on their balance sheets—usually both.

Banks can also have a weak financial position,... 3/

... with chronically low profitability and insufficient reserves.

There have been several 'triggers' for a a financial crashes in history.

The 'trigger' for the Great Depression of the 1930s was a recession, which first crashed the U.S. stock market in October 1929 and... 4/

There have been several 'triggers' for a a financial crashes in history.

The 'trigger' for the Great Depression of the 1930s was a recession, which first crashed the U.S. stock market in October 1929 and... 4/

...then started the banking crisis in October 1930.

The financial crisis of Japan in the 1990s started from an asset market crash in 1990.

The -07/-08 Global Financial Crisis had several triggers including the collapse of the... 5/

The financial crisis of Japan in the 1990s started from an asset market crash in 1990.

The -07/-08 Global Financial Crisis had several triggers including the collapse of the... 5/

“High-Grade Structured Credit Strategies Enhanced Leverage Fund” by investment bank Bear Stearns in June 2007, and the collapse of the investment bank Lehman Brothers on 14th October 2008.

The most common trigger is a #recession or the expectation of recession. 6/

The most common trigger is a #recession or the expectation of recession. 6/

A recession leads to diminished income and defaults by both corporations and households.

This increases the share of non-performing loans in bank loan portfolios, reducing the value of loan collateral and increasing bank risks and capital needs. 7/

This increases the share of non-performing loans in bank loan portfolios, reducing the value of loan collateral and increasing bank risks and capital needs. 7/

As write-downs and losses increase, mistrust among other banks and depositors and investors does as well. The bank’s share price will usually start to reflect this.

If suspicion spreads, banks will be apprehensive about counterparty risk and will be unwilling... 8/

If suspicion spreads, banks will be apprehensive about counterparty risk and will be unwilling... 8/

...to lend to one another even on an overnight basis.

If allowed to continue, this will have a calamitous impact on liquidity in money markets. In the worst case, possibly fueled by rumors and insider information, a bank run will ensue, where depositors try to... 9/

If allowed to continue, this will have a calamitous impact on liquidity in money markets. In the worst case, possibly fueled by rumors and insider information, a bank run will ensue, where depositors try to... 9/

...withdraw their money suddenly and simultaneously. In years past, depositors would queue outside of bank offices to obtain cash. Now withdrawals are largely electronic.

At the same time, the bank’s investors and institutional counterparties rush to lower their ... 10/

At the same time, the bank’s investors and institutional counterparties rush to lower their ... 10/

...exposure by frantically selling its stocks and bonds as well as derivatives and other interbank liabilities. If this continues, trust in the bank is broken, and it fails.

Growing speculation about the financial health of both sound and unsound banks,... 11/

Growing speculation about the financial health of both sound and unsound banks,... 11/

...combined with funding issues, eventually triggers a system-wide banking crisis.

What follows the initiation of a banking crisis, which often starts with just one bank, is dependent on the general condition of the banking sector and the response of authorities. 12/

What follows the initiation of a banking crisis, which often starts with just one bank, is dependent on the general condition of the banking sector and the response of authorities. 12/

Bank regulators can take over the failing bank, ensure the payment of deposit guarantees, and arrange for the merger or acquisition of the ailing bank by a stronger financial institution.

This process provides that bank customers, depositors and borrowers,... 13/

This process provides that bank customers, depositors and borrowers,... 13/

...are protected while equity owners, management, and some, or even all, creditors rightly bear the losses. A central bank will usually provide liquidity to facilitate this.

If the problems in the banking sector are limited to one bank, such measures may be sufficient... 14/

If the problems in the banking sector are limited to one bank, such measures may be sufficient... 14/

...to stem the panic.

However, if the banking sector as a whole is compromised or suffering from a significant enough economic shock, even sound policies may not be enough to cover losses without hurting depositors, as happened in the Cypriot crisis. 15/

However, if the banking sector as a whole is compromised or suffering from a significant enough economic shock, even sound policies may not be enough to cover losses without hurting depositors, as happened in the Cypriot crisis. 15/

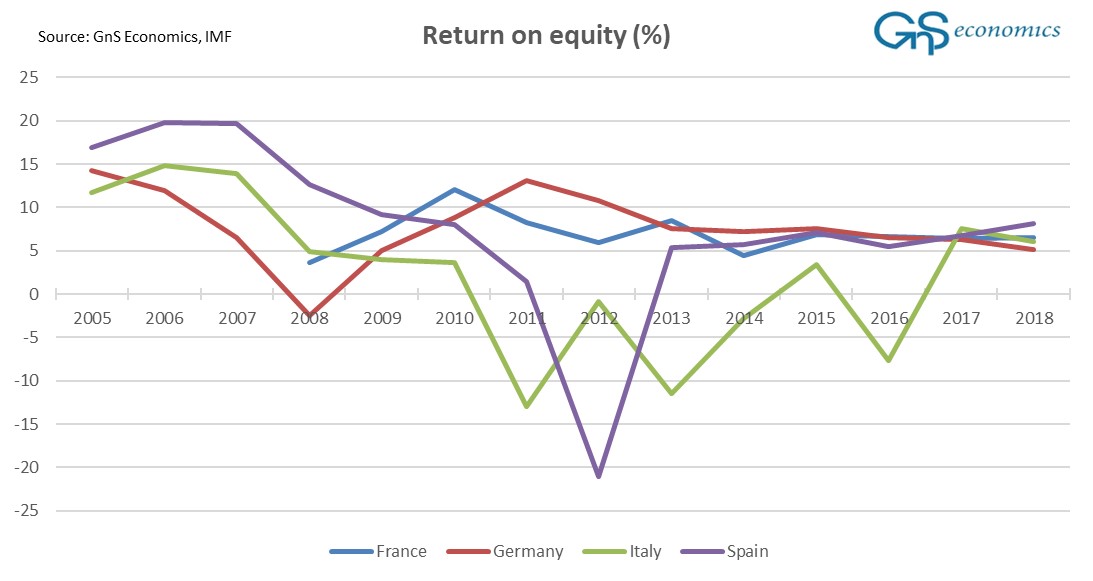

Currently, we consider this to be the case with central and southern European banks.

To learn, why, and how to survive from it, I urge you to read our latest report.

/End

#brace #banking #financialcrisis #eurozone https://gnseconomics.com/2020/06/18/special-report-on-surviving-the-economic-collapse/

To learn, why, and how to survive from it, I urge you to read our latest report.

/End

#brace #banking #financialcrisis #eurozone https://gnseconomics.com/2020/06/18/special-report-on-surviving-the-economic-collapse/

Read on Twitter

Read on Twitter