Kinda surreal to see my BTC on Ethereum this way, but thanks to additional incentives to earn SNX, REN, CRV, BAL, seemed worth a try

Quick thread on the process and risks https://twitter.com/kaiynne/status/1273810341760098304

Quick thread on the process and risks https://twitter.com/kaiynne/status/1273810341760098304

1/ The process was pretty smooth. @renprotocol made it really easy to acquire renBTC from BTC.

1. Deposit BTC into an empty address they provide

2. Connect ETH address via @3boxdb

3. Wait for 6 confirmations and trigger a transaction to send you the renBTC

1. Deposit BTC into an empty address they provide

2. Connect ETH address via @3boxdb

3. Wait for 6 confirmations and trigger a transaction to send you the renBTC

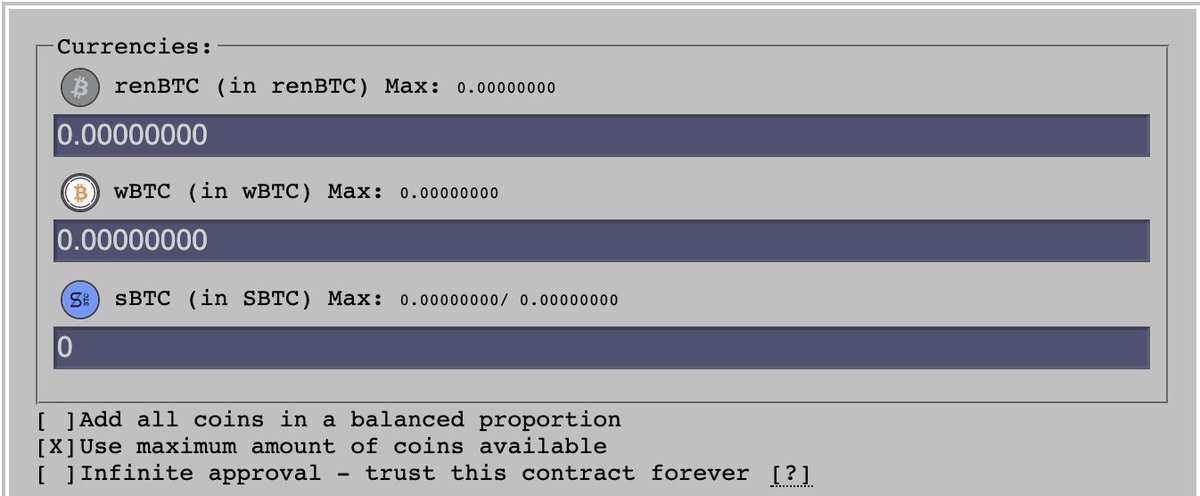

2/ Once you get the renBTC into your ETH wallet, you can provide liquidity to the (sBTC, renBTC, wBTC) pool in one transaction on @CurveFinance

3/ You get crvRenWSBTC tokens that represent the liquidity that you just provided (1 token for 1 BTC)

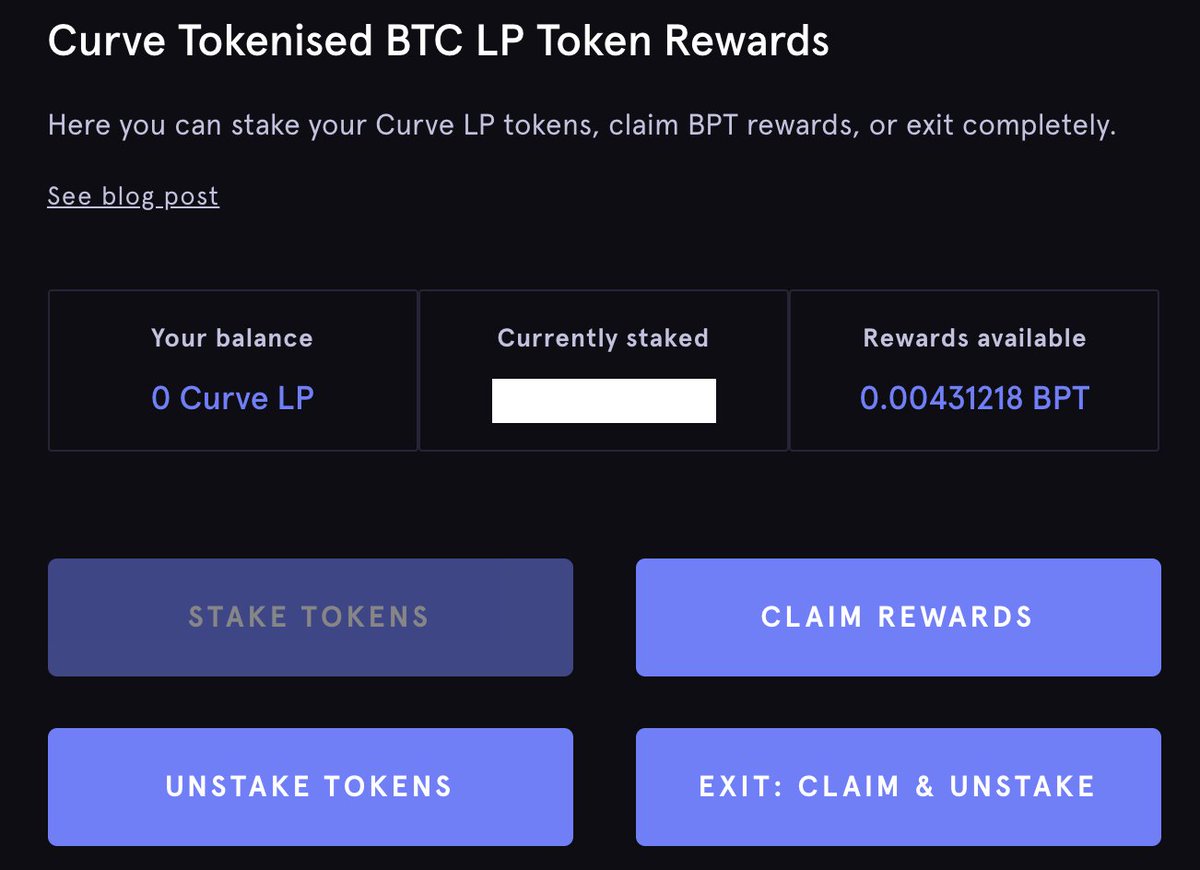

4/ Take this token and stake it on @synthetix_io mintr

5/ The biggest risk here seems to be if the peg breaks in any of the pool of (sBTC, renBTC, wBTC), with wBTC being the most centralized.

6/ If the peg remains intact, you earn market making fees on @CurveFinance in addition to the incentives provided by REN and SNX, and then liquidity mining to earn CRV (in the future) and BAL (probably a very low amount for the BPT pool)

7/ It is an interesting experiment with a very different risk profile than "hodling", but it is nice to see the BTC being "put to work"

Read on Twitter

Read on Twitter