Good summary of Stripe vs Adyen

Would tag onto this with some observations which may add the “why” to “how” the two are different:

TLDR:

1) regional starting point: US out vs EU > AP > US in

2) gateway (plus) vs full(er) stack

3) developer-first ethos vs enterprise focus https://twitter.com/compound100x/status/1274306091279478784

Would tag onto this with some observations which may add the “why” to “how” the two are different:

TLDR:

1) regional starting point: US out vs EU > AP > US in

2) gateway (plus) vs full(er) stack

3) developer-first ethos vs enterprise focus https://twitter.com/compound100x/status/1274306091279478784

Main differences stem from their origins and DNA:

Stripe grew out of SV seeded by Y Combinator with early backing from Thiel, Musk, Sequoia, SV Angels, A16Z and was initially called itself /dev/payments, clearly strong “for developers by developers” ethos https://web.archive.org/web/20140407071804/http://startupgrind.com/2012/02/true-startup-story-the-collison-brothers-and-stripe-com

Stripe grew out of SV seeded by Y Combinator with early backing from Thiel, Musk, Sequoia, SV Angels, A16Z and was initially called itself /dev/payments, clearly strong “for developers by developers” ethos https://web.archive.org/web/20140407071804/http://startupgrind.com/2012/02/true-startup-story-the-collison-brothers-and-stripe-com

On the other hand, Adyen literally means “to start again”, a second act for founders who previously led payments pioneer Bibit, which they sold to RBS and is the foundation of WorldPay’s e-comm offering. No institutional capital until 8 yrs after founding https://www.google.com/amp/s/www.forbes.com/sites/arielshapiro/2019/01/18/cofounders-of-netflix-and-spotifys-e-payment-firm-adyen-are-new-billionaires/amp

Stripe spread organically through developers, initially targeted US-based mobile-first apps and marketplace platforms. Many early clients scaled rapidly (Lyft, Shopify, Postmates, Instacart) but bread-and-butter is startups seeking to enable payments programmatically in minutes

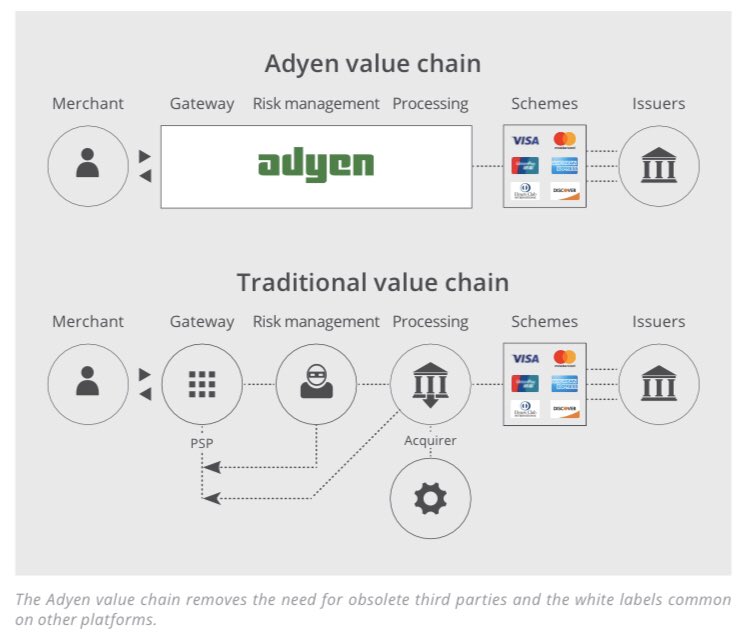

Adyen’s origins in EU where payments is more fragmented necessitated its need to accept a wide range of payment methods. It also took a full stack approach and gained a direct acquiring license in EU and subsequently many other key int’l markets to enable an end-to-end offering

While Stripe scaled with US centric customers and grew outwards internationally to serve non-US equivalents, Adyen did the same starting in EU and was also a perfect partner for global cross-border e-comm participants needing a payments partner with a local acquiring footprint

While both are developer friendly payment stacks built from ground up (vs legacy stacks cobbled together thru M&A), Stripe has a clear and deliberate focus on the developer (back to its ethos). This explains why Stripe has millions of customers (very long tail) vs Adyen’s 3,500+

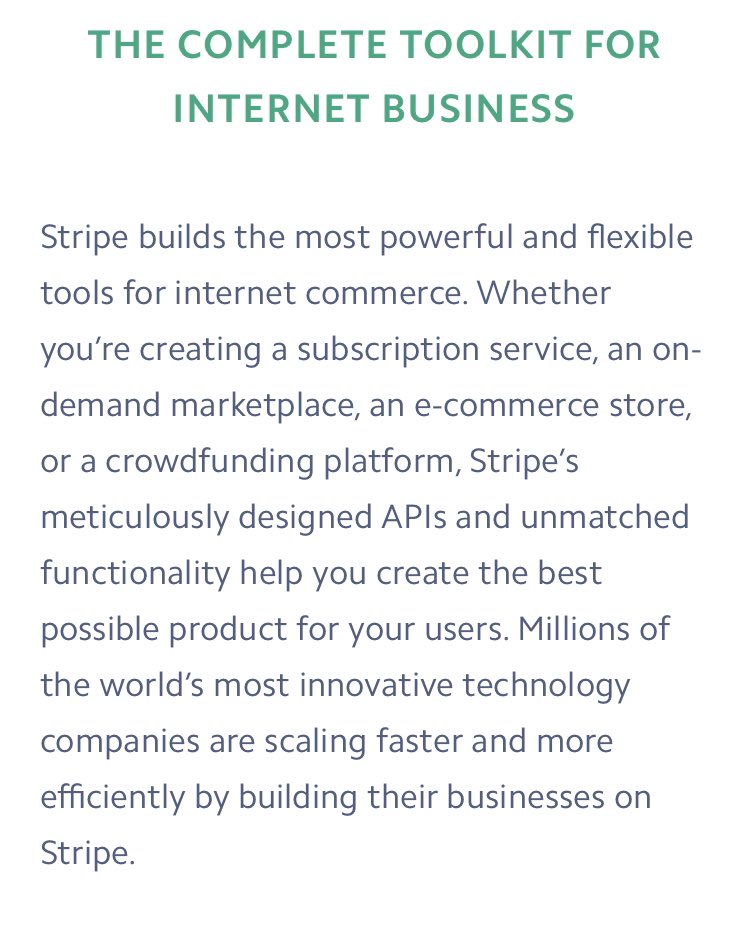

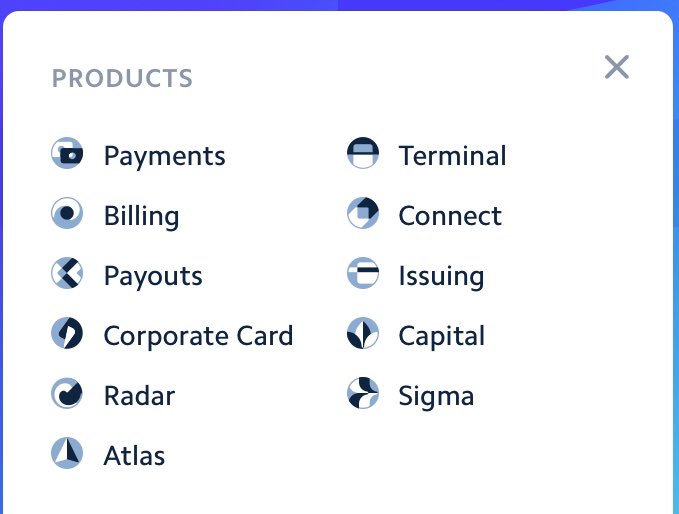

Therefore, while Stripe leads with payments (gateway), it goes to market as “the complete toolkit for internet businesses” and has branched into a wider offering of products to help its predominantly SMB customers, including Atlas, Capital, Sigma, Corp Cards, etc (gateway plus)

Instead, Adyen has oriented itself to serving sophisticated, larger enterprise merchants operating globally. It’s payments focus, global acquiring and full stack offering enables a unique proposition, and increasingly relevant beyond pure online e-comm into omni/unified commerce

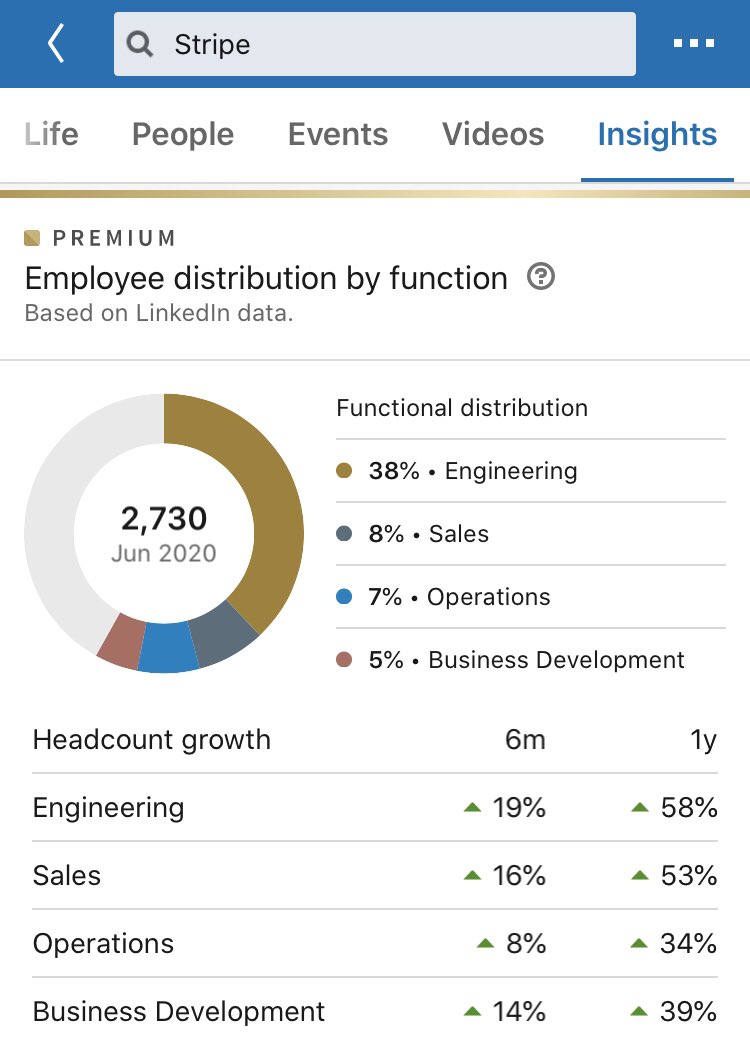

A peak at their employee base also supports what/where each is emphasizing (directionally):

Stripe has 2,700+ people today, heavier investment on engineering across multiple product initiative, lighter on sales/BD <15% of workforce given more developer-led distribution to SMBs

Stripe has 2,700+ people today, heavier investment on engineering across multiple product initiative, lighter on sales/BD <15% of workforce given more developer-led distribution to SMBs

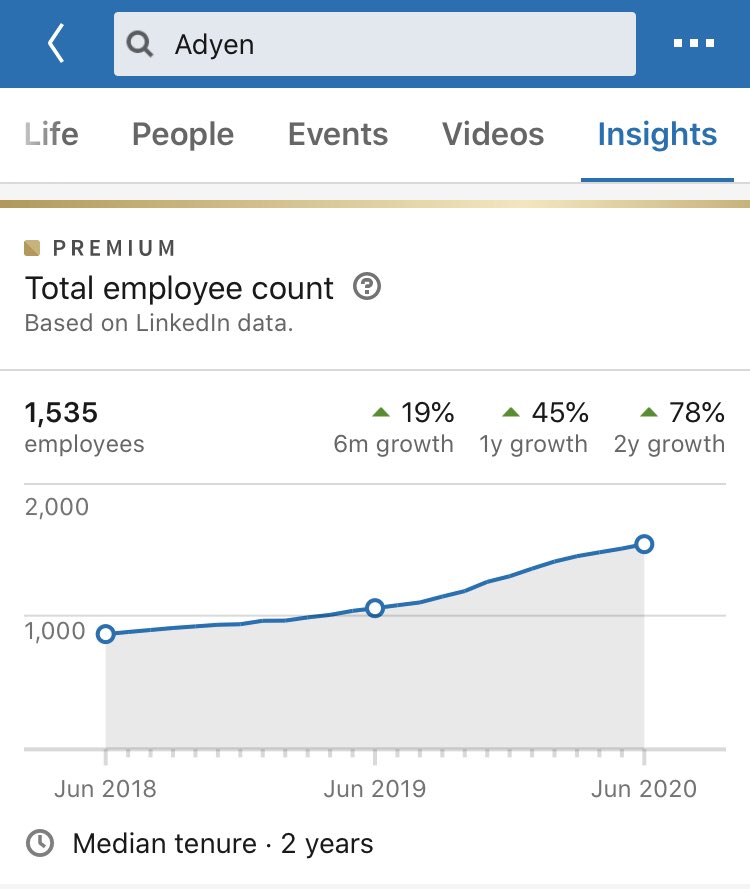

Adyen is leaner with 1,500+ people, growing headcount less rapidly, but equally strong investment in engineering and unsurprisingly a bit more weighted to sales/BD given its enterprise merchant focus approaching 30% of workforce

Both incredible businesses that have scaled quickly to become leaders in a dynamic and continuously evolving payments ecosystem

For all the differences noted above, there are many similarities which have contributed to their success

Will be enjoyable to watch things develop!

For all the differences noted above, there are many similarities which have contributed to their success

Will be enjoyable to watch things develop!

Read on Twitter

Read on Twitter