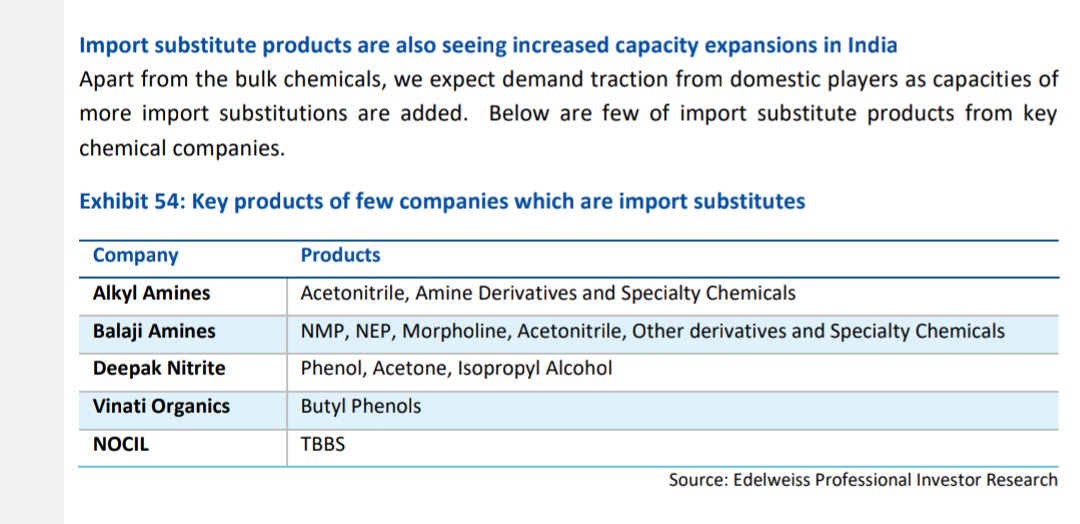

Chemical Companies focussing on import substitutions with significant opportunites awaiting them in export market. Global players de-risking their sourcing strategy would propel growth going forward. India accounts for only 3% of global exports value chain

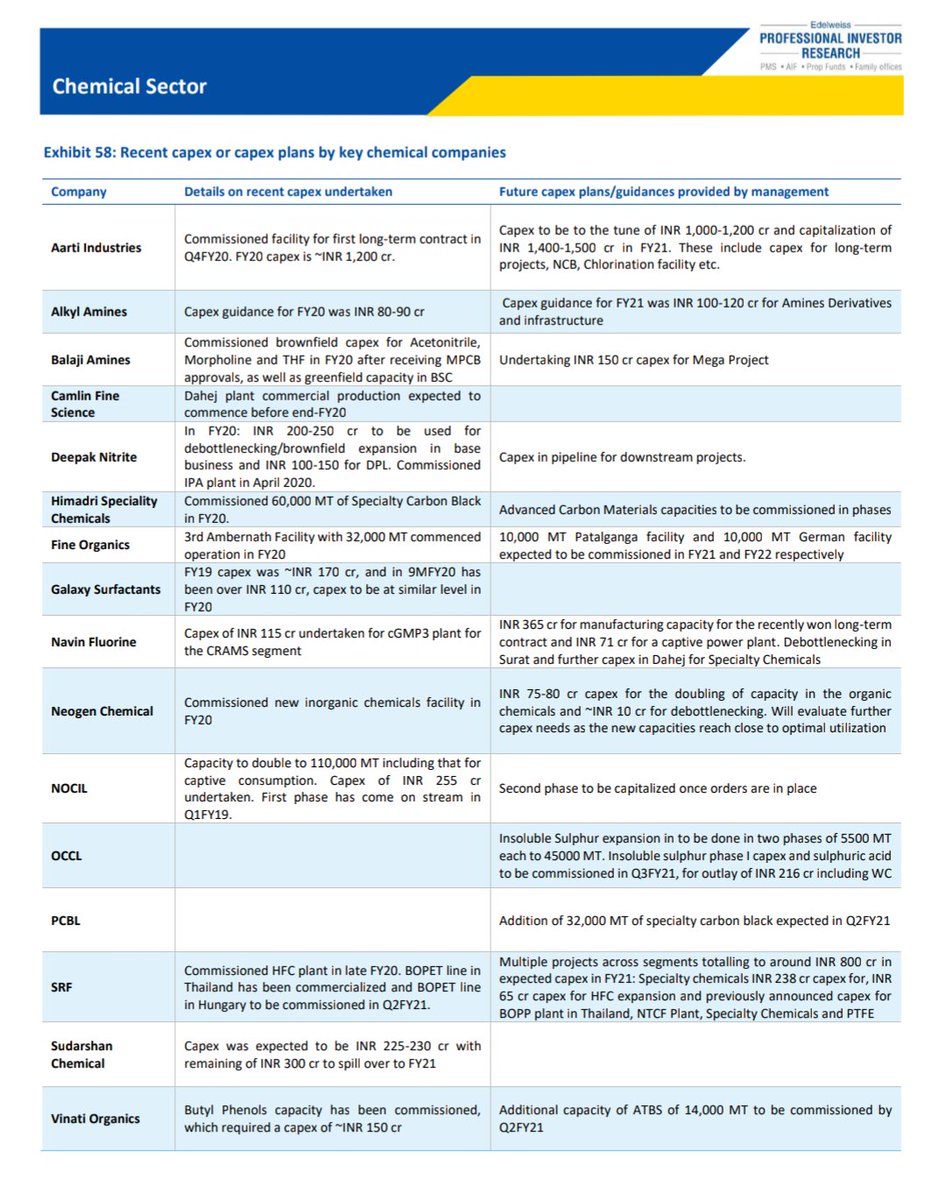

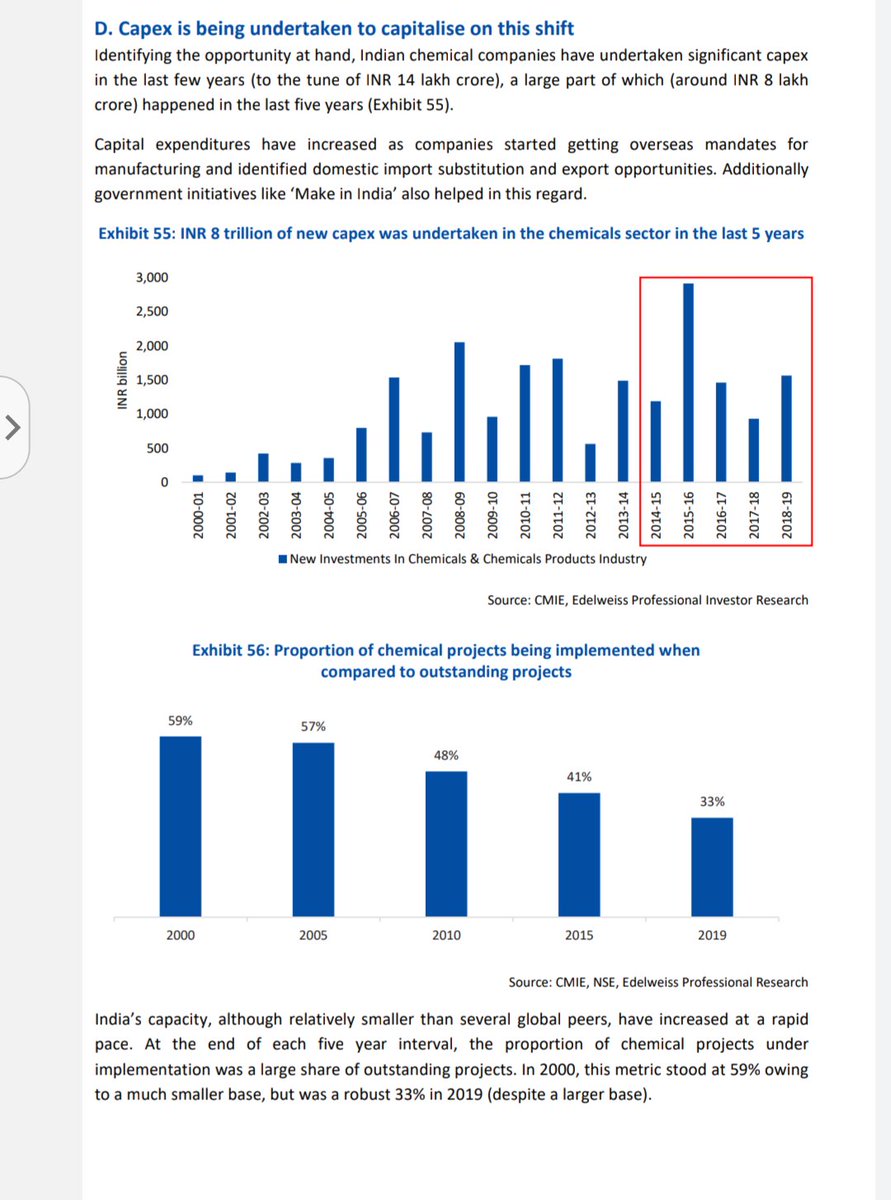

Recent Capex

Edelweiss

Recent Capex

Edelweiss

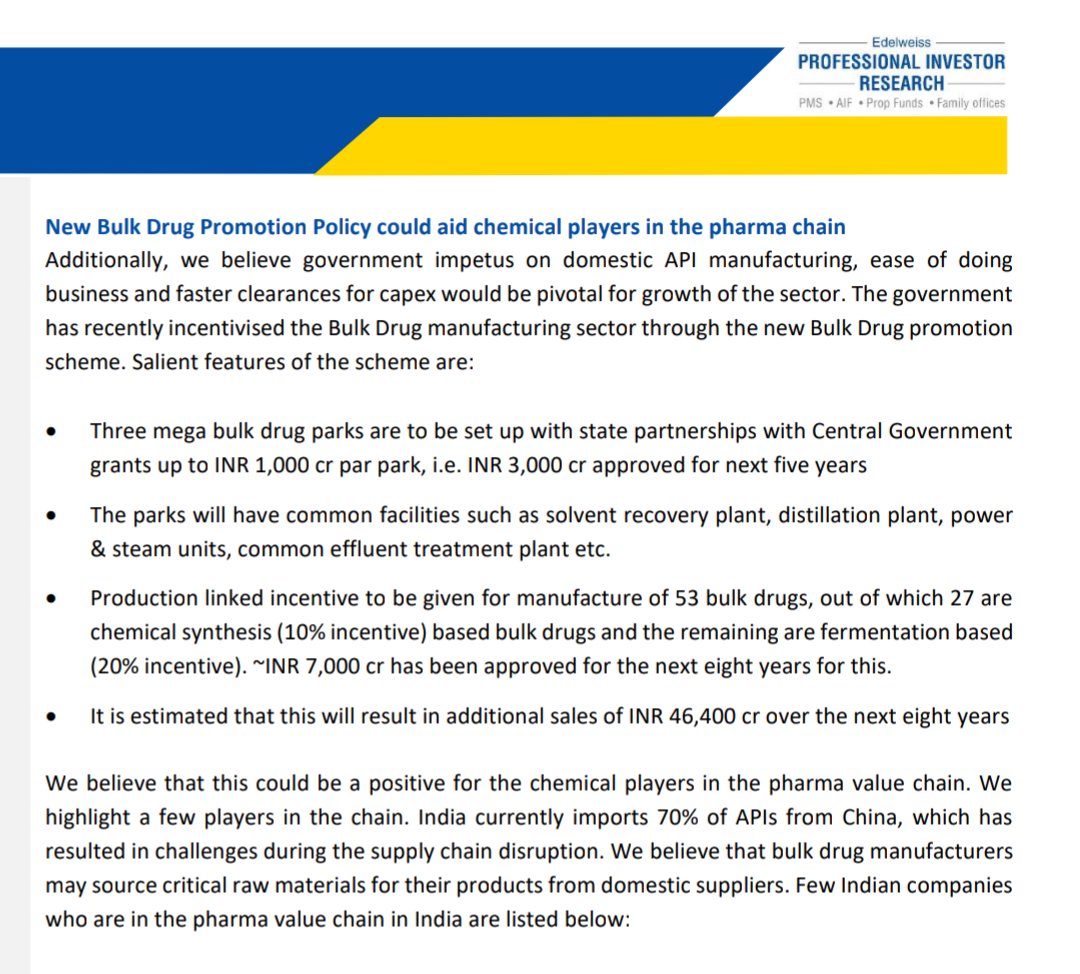

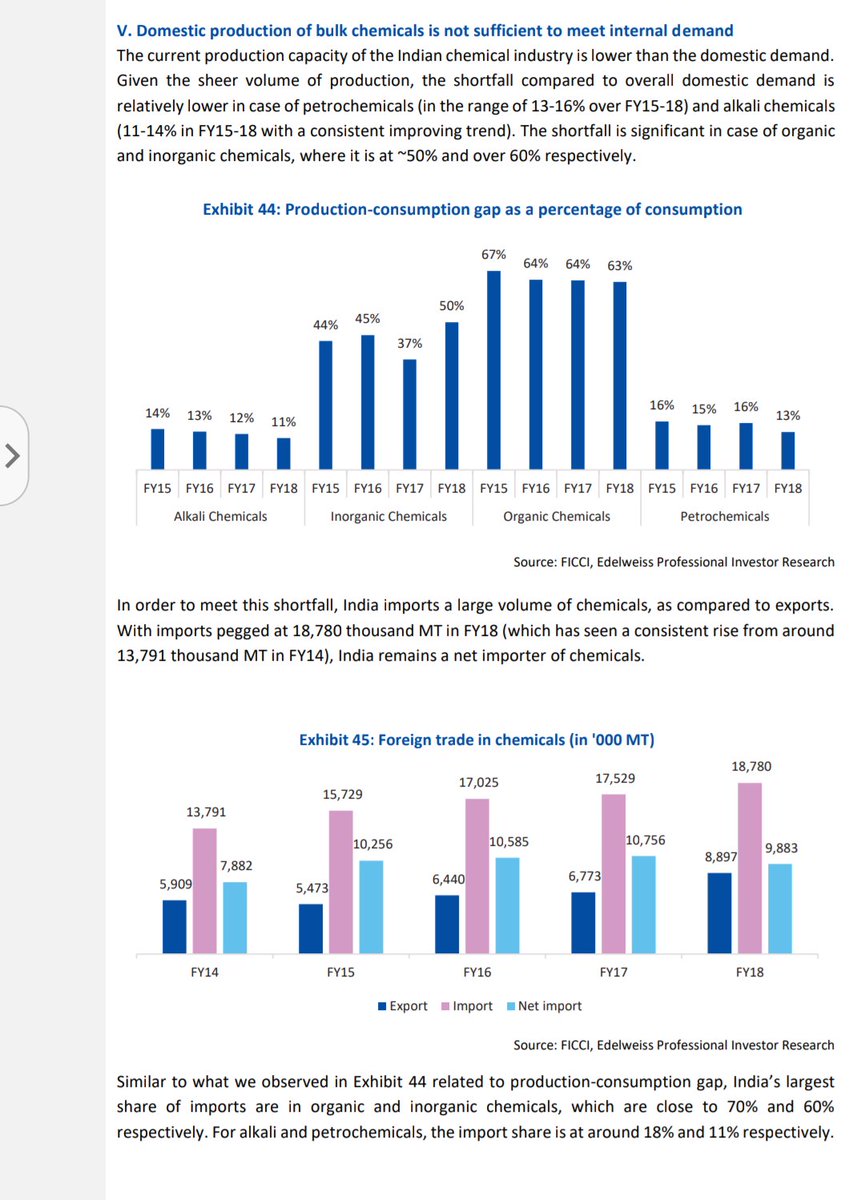

India import a large share of their raw materials and API intermediates from China. Now focus shifts more to manufacture/source RM locally and build a stronger supply chain system.Production linked incentives for twenty-six chemical synthesis-based APIs laid out by Govt

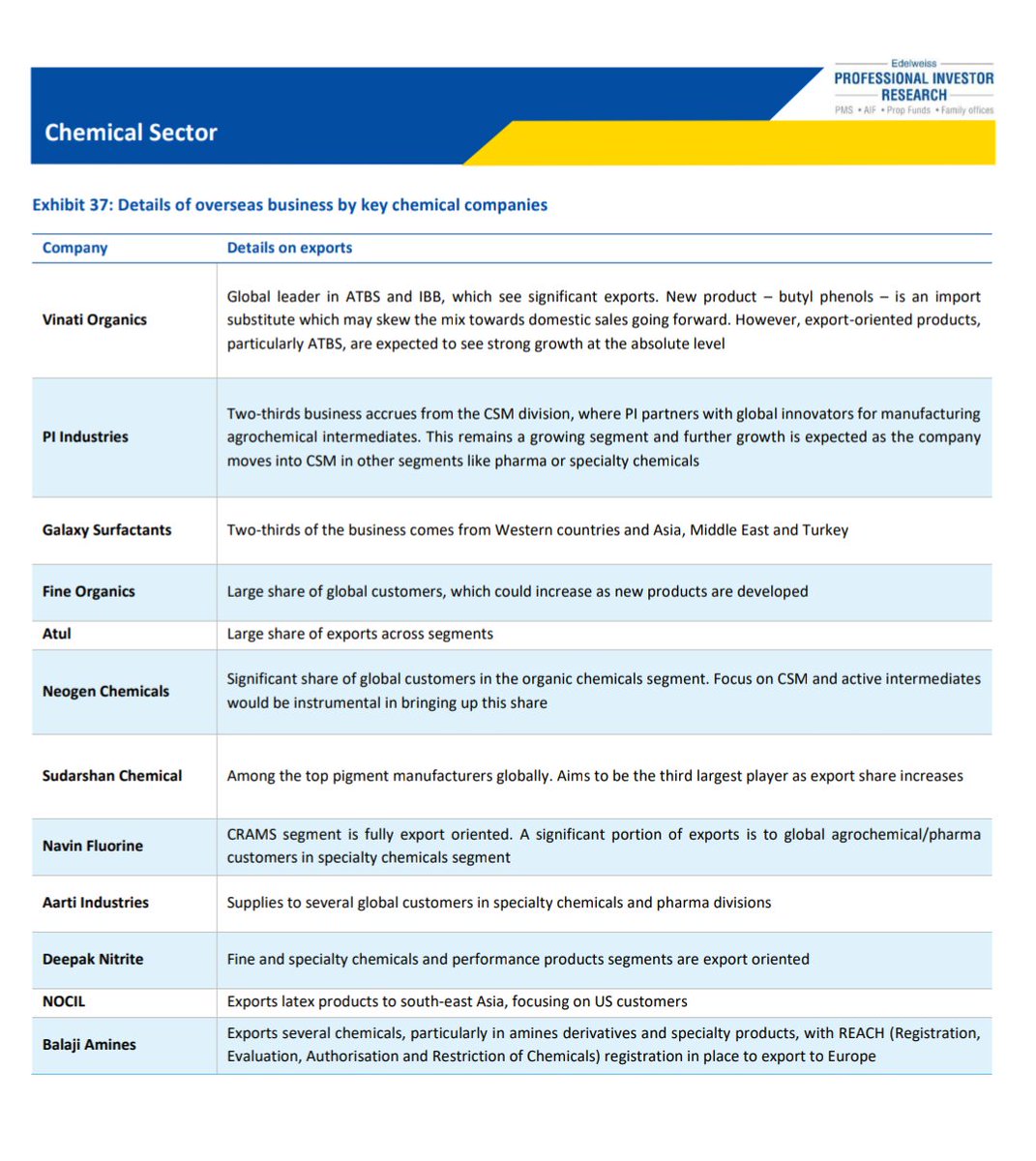

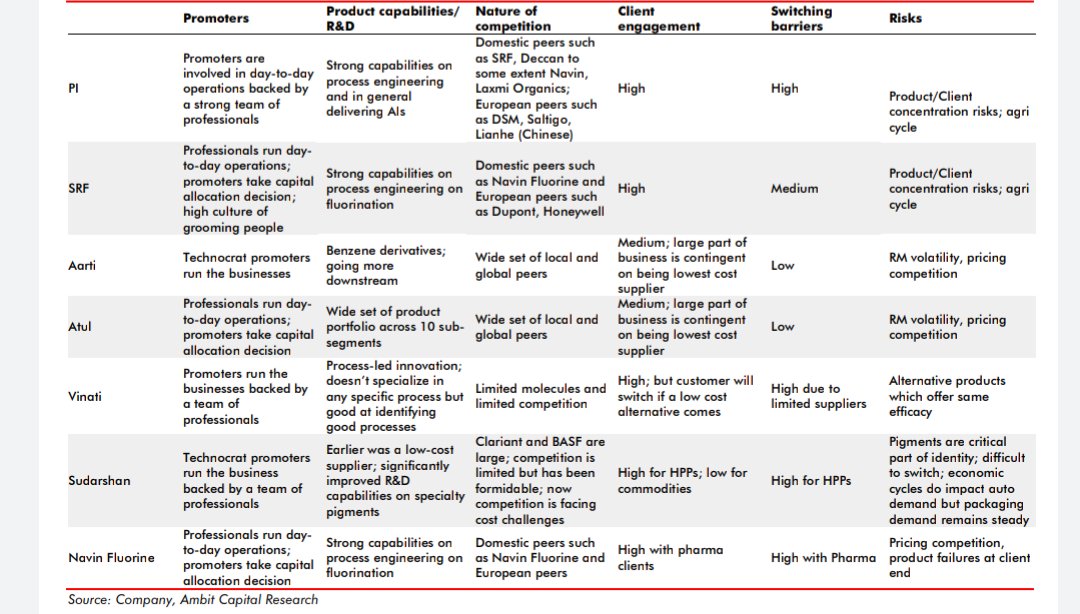

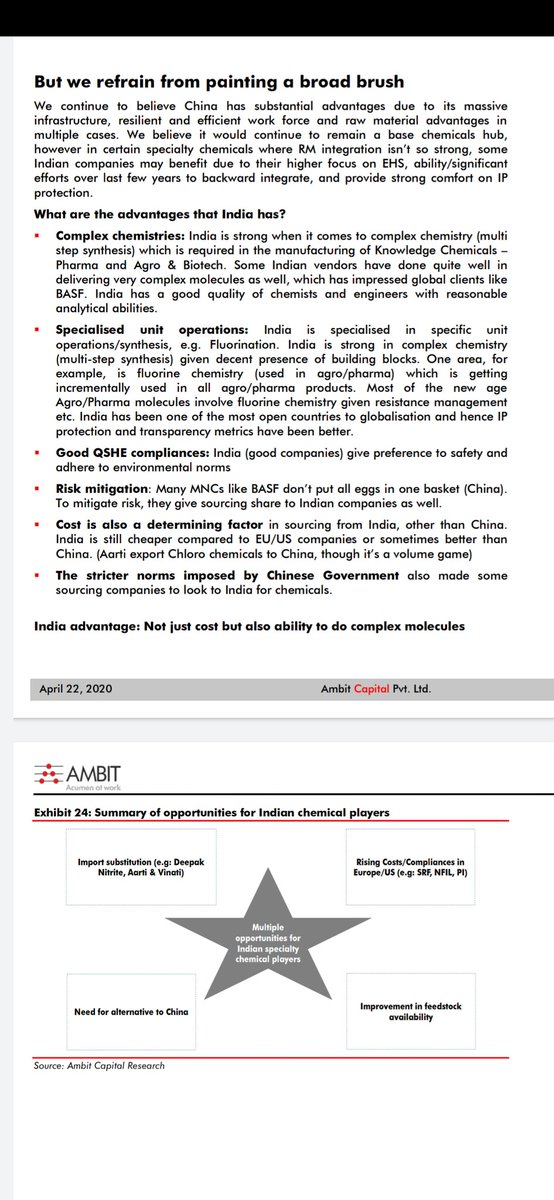

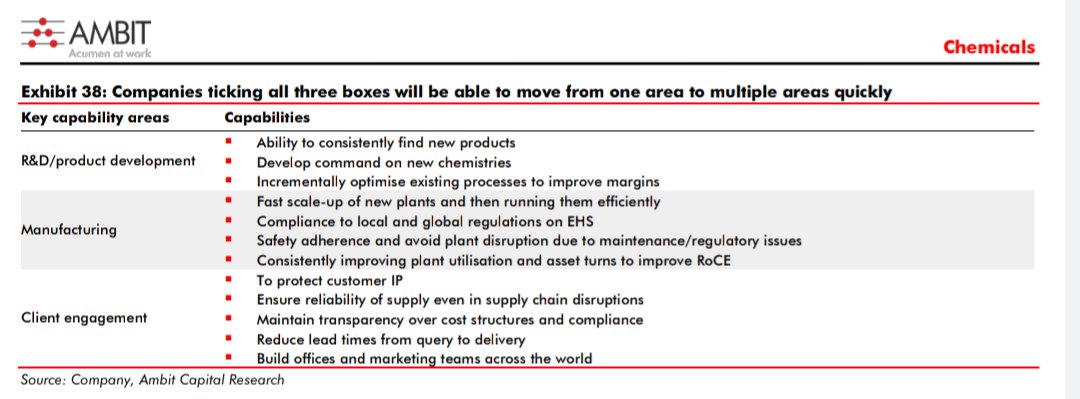

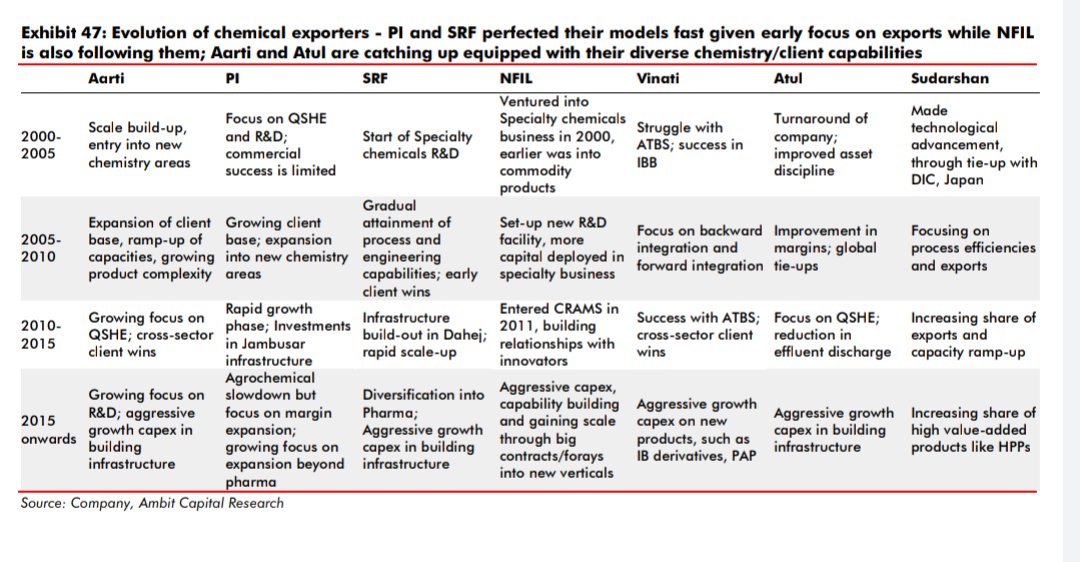

India has the expertise to do complex molecules so it makes sense to bet on companies which enjoy some moat through process innovation and are not merely puppets of China Shortage Issues. Specialised Players have thus outperformed commodity ones in last 5-10 yrs.

Image - Ambit

Image - Ambit

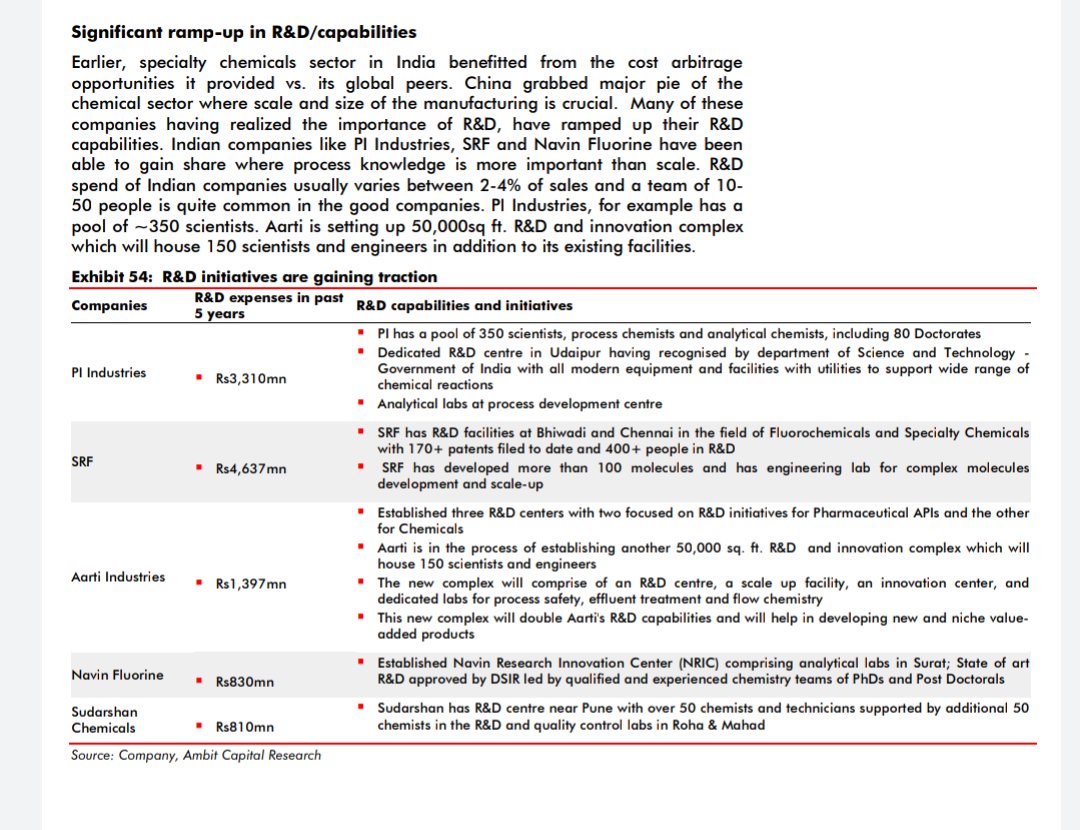

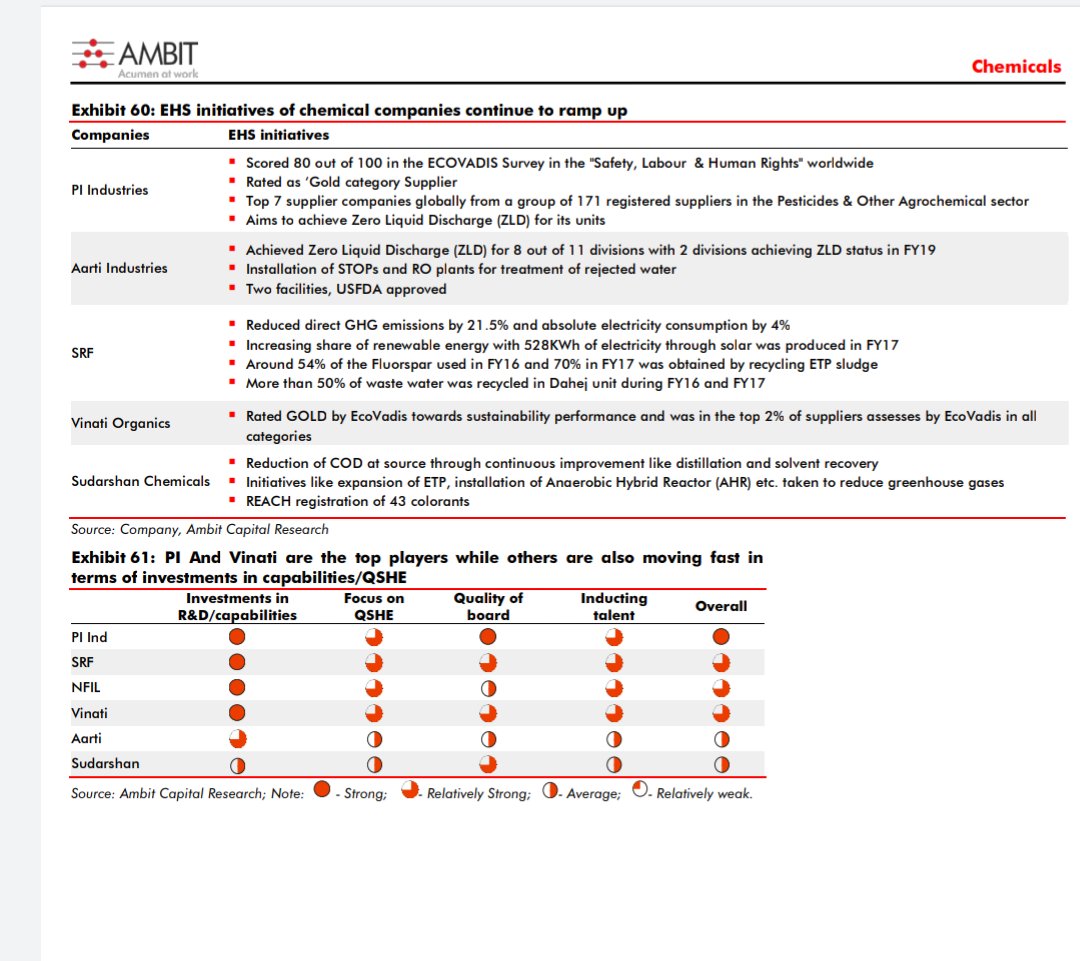

Increase in R&D expenses, Focus on complex molecules and Long Term Contract with Global MNC have placed many indian companies like Navin, Vinati, PI on a strong footing

Image - Ambit

Image - Ambit

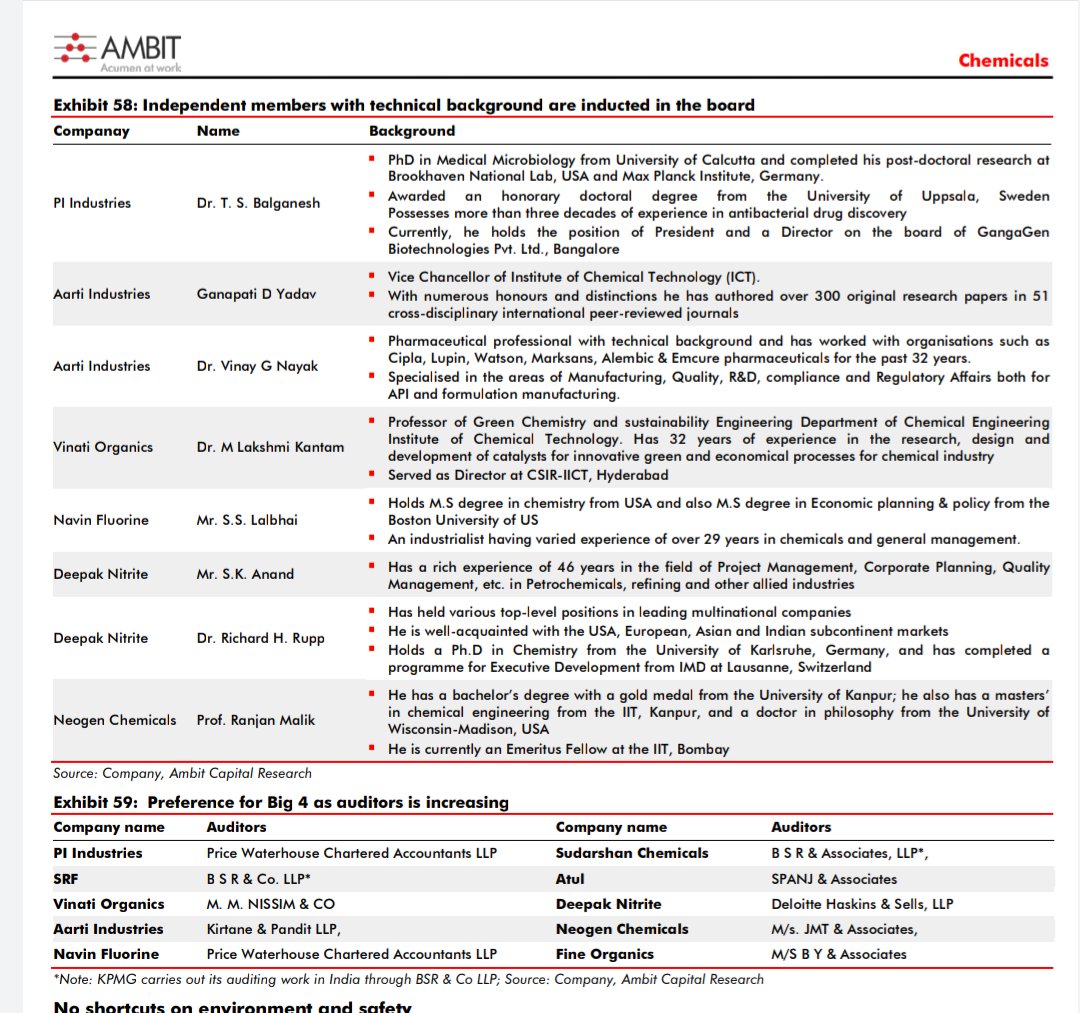

Highly qualified technocrats gradually becoming part of board also improved the Corp Gov standards and technical capabilities. E.g - Case in point Vinati Organics has one of the lowest remenuration in industry and promoter hasn't sold a single stock since listing

Read on Twitter

Read on Twitter