Fairly simple.

All we need is 5 or 6 more record breaking nonfarm payroll gains to justify today’s valuations.

All we need is 5 or 6 more record breaking nonfarm payroll gains to justify today’s valuations.

Hard to see the labor markets going back to normal any time soon.

Capacity utilization has barely picked up in May.

Still at its second worst print in 53 years!

Capacity utilization has barely picked up in May.

Still at its second worst print in 53 years!

As we pointed out before:

Corporate profit margins are plunging.

A staggering divergence from equity prices.

There is no organic growth in sight.

Corporate profit margins are plunging.

A staggering divergence from equity prices.

There is no organic growth in sight.

So all we have left is extreme monetary policies to fund fiscal stimulus.

But that doesn’t fix the economy.

But that doesn’t fix the economy.

Money printing only magnifies inequality problems.

Since QE1 started, the less financially privileged parts of the society have suffered from a shrinkage of wealth relative to the overall pie.

Since QE1 started, the less financially privileged parts of the society have suffered from a shrinkage of wealth relative to the overall pie.

In contrast with all these underlying issues, equity valuations are at record silly levels.

Aggregate enterprise value to EBITDA for the S&P 500 has never been higher.

Markets are being driven by an euphoric false narrative of excess liquidity.

Aggregate enterprise value to EBITDA for the S&P 500 has never been higher.

Markets are being driven by an euphoric false narrative of excess liquidity.

What should also be notable is fragility of the small caps space.

Small caps have never been so indebted relative to EBITDA.

Also, Russell 2000 stocks now trade at a historic 15x EV to 2020 EBITDA estimates!

Stunning level of optimism priced in the markets these days.

Small caps have never been so indebted relative to EBITDA.

Also, Russell 2000 stocks now trade at a historic 15x EV to 2020 EBITDA estimates!

Stunning level of optimism priced in the markets these days.

For “In Fed We Trust” investors:

Government debt overhang is sucking all new liquidity.

The government just borrowed $760B in May alone!

Second largest net issuance of Treasuries in history.

It dwarfed the Fed's stimulus by over $300B.

Government debt overhang is sucking all new liquidity.

The government just borrowed $760B in May alone!

Second largest net issuance of Treasuries in history.

It dwarfed the Fed's stimulus by over $300B.

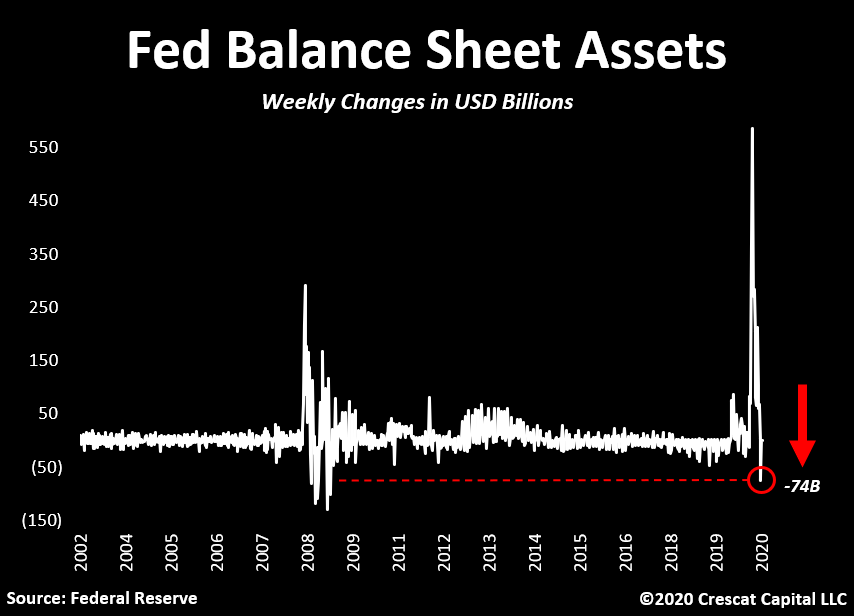

In fact, if monetary stimulus is the reason to be buying stocks:

The Fed’s assets just fell by $74B.

Largest weekly decline since in over a decade.

“Only” difference from back then is that stocks have never been as overvalued as today.

The Fed’s assets just fell by $74B.

Largest weekly decline since in over a decade.

“Only” difference from back then is that stocks have never been as overvalued as today.

When we add to the mix:

-Record global debt to GDP

-Historic US equity valuations

-New fiat money printing across the globe

-Suppressed long term rates

-Commodities to equity ratio at 50-year lows

The macro environment is incredibly bullish for precious metals today.

-Record global debt to GDP

-Historic US equity valuations

-New fiat money printing across the globe

-Suppressed long term rates

-Commodities to equity ratio at 50-year lows

The macro environment is incredibly bullish for precious metals today.

As I pointed out recently:

- Silver is outperforming gold.

- Silver miners are outperforming gold miners.

- Juniors are outperforming seniors.

Exactly how a bull market for precious metals should look.

Silver ready for another major breakout.

- Silver is outperforming gold.

- Silver miners are outperforming gold miners.

- Juniors are outperforming seniors.

Exactly how a bull market for precious metals should look.

Silver ready for another major breakout.

We decided to turn activist in the mining space.

Along with Quinton Hennigh, a world class geologist, we will be broadcasting a series videos profiling our strategy behind each of these companies.

Stay tuned these next days.

Also, for more:

http://www.crescat.net/crescat-turns-activist-on-gold/

Along with Quinton Hennigh, a world class geologist, we will be broadcasting a series videos profiling our strategy behind each of these companies.

Stay tuned these next days.

Also, for more:

http://www.crescat.net/crescat-turns-activist-on-gold/

Read on Twitter

Read on Twitter