What do I look for when I trade OTC stocks?

I look for a hot sector: Known as "In sympathy"

Low share structure: refer to http://www.otcmarkets.com

Quality Chart/Key signals: http://www.stockcharts.com

Remarks: I like buying stocks when no one else is watching or when they are hated

I look for a hot sector: Known as "In sympathy"

Low share structure: refer to http://www.otcmarkets.com

Quality Chart/Key signals: http://www.stockcharts.com

Remarks: I like buying stocks when no one else is watching or when they are hated

-Pink Current/OTCQB is preferred but not my end all

-I typically hold stocks that hold a Moving average and pattern

- I avoid stocks with over 2 billion a/s or bloated triple zero stocks ( I have taken stocks over like $STWC .0002-.0024)

-Not much of a fan of stocks below .0004

-I typically hold stocks that hold a Moving average and pattern

- I avoid stocks with over 2 billion a/s or bloated triple zero stocks ( I have taken stocks over like $STWC .0002-.0024)

-Not much of a fan of stocks below .0004

I believe in my plays but do not use emotion as my driver

-I create a buy zone

-I Scale into my buy zone based on my entry

-I Set and Scale my sales up for GTC

-If my OTC stock closes below my mental stop on 2 consecutive closes I exit the trade (Same as Small Cap and Option)

-I create a buy zone

-I Scale into my buy zone based on my entry

-I Set and Scale my sales up for GTC

-If my OTC stock closes below my mental stop on 2 consecutive closes I exit the trade (Same as Small Cap and Option)

-I do not join many chatrooms or follow 1,000

(Too much information is noise)

-If I know the share structure is small and it correlates with the Chart I avoid Level 2

-I use Level 2 for entry not my exit

-I avoid IHUB and negative forums

(Too much information is noise)

-If I know the share structure is small and it correlates with the Chart I avoid Level 2

-I use Level 2 for entry not my exit

-I avoid IHUB and negative forums

Tips:

-Have a notebook, create a watch list

-Track people you follow do they really help? or are they inconsistent

-Set profit margins Trade like you tie your sneakers build trading habits

-Buy Zones

-Profit Margins

-Mental Stops

-Patience + Discipline = Profits

-Have a notebook, create a watch list

-Track people you follow do they really help? or are they inconsistent

-Set profit margins Trade like you tie your sneakers build trading habits

-Buy Zones

-Profit Margins

-Mental Stops

-Patience + Discipline = Profits

#Promotion and #SocialNetwork is big piece of the puzzle. Build your #Twitter #Facebook with quality content:

If your a trader focus use #Socialmedia as a tool:

Get your stock info out there for the world to see.

Build a following

Everyone loves a great track record!

If your a trader focus use #Socialmedia as a tool:

Get your stock info out there for the world to see.

Build a following

Everyone loves a great track record!

My thoughts on .0001-.0004 Stocks:

High Risk

High Reward

Trading from .0001 to .0002 is a 100% or higher

Buying a stock at .0002-4 Potential of 50-100% risk of loss

New traders are at risk losing entire capital.

Make sure to check http://www.otcmarkets.com for share structure

High Risk

High Reward

Trading from .0001 to .0002 is a 100% or higher

Buying a stock at .0002-4 Potential of 50-100% risk of loss

New traders are at risk losing entire capital.

Make sure to check http://www.otcmarkets.com for share structure

Share structure:

Authorized Shares

Outstanding Shares

Float

OTC: I typically avoid over 5 billion a/s this is a personal rule of mine.

Typically I look for a reasonable shares

Remarks: Think of laws of economics: Supply and Demand

Lower the Price

Higher Demand

Higher price

Authorized Shares

Outstanding Shares

Float

OTC: I typically avoid over 5 billion a/s this is a personal rule of mine.

Typically I look for a reasonable shares

Remarks: Think of laws of economics: Supply and Demand

Lower the Price

Higher Demand

Higher price

Create a log book and work on a Trading Log:

See how many .0001-.0004 plays have worked.

How many have failed.

How much have you lost.

If you made more and the strategy works, continue

But if you see that its keeping your trading stagnant adding more money to account.

Stop

See how many .0001-.0004 plays have worked.

How many have failed.

How much have you lost.

If you made more and the strategy works, continue

But if you see that its keeping your trading stagnant adding more money to account.

Stop

To my #RSP #Tradingverse

I ensure to give low share structure plays with Chart setup:

Plays are carefully calculated based on Price Pattern Time (Chart)

Rule of 3

Chart

Sector (Catalyst/Sympathy)

Share Structure

Twitter is used to get best info out

#fulltransparency

I ensure to give low share structure plays with Chart setup:

Plays are carefully calculated based on Price Pattern Time (Chart)

Rule of 3

Chart

Sector (Catalyst/Sympathy)

Share Structure

Twitter is used to get best info out

#fulltransparency

The Law Of Infinite Return:

Start off with the Least amount of money Ex. $500

Set a reachable Goal: Ex. 5k

Create a Profit Margin: Keep it personal and close to your heart (Say this number repeatedly) Draw it tape it to your p.c

When you get to 5k take Initial 500 out

Why?

Start off with the Least amount of money Ex. $500

Set a reachable Goal: Ex. 5k

Create a Profit Margin: Keep it personal and close to your heart (Say this number repeatedly) Draw it tape it to your p.c

When you get to 5k take Initial 500 out

Why?

Profit margin will keep you disciplined

Reachable Goal: Will build an excitement to destination

Remove Initial investment to Mathematically never lose money ever again.

This will build unemotional attachment to money

Now you are playing with house money

Reachable Goal: Will build an excitement to destination

Remove Initial investment to Mathematically never lose money ever again.

This will build unemotional attachment to money

Now you are playing with house money

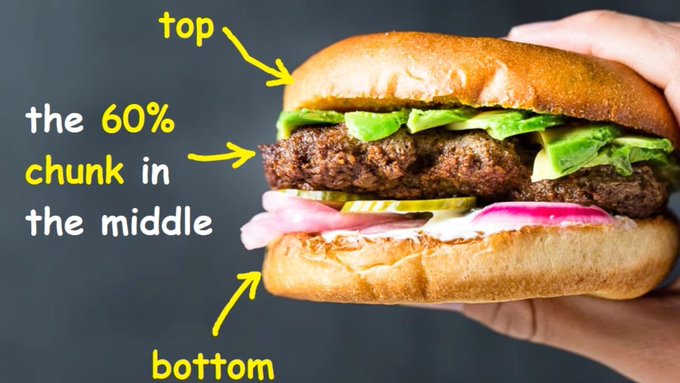

Tip of The Day:

Do not focus into perfect bottom of a run or selling at perfect top of a run:

Focus on the Meat:

- Create a Buy zone use a plan:

- Scale into Buy zone:

- Set your sell orders scaling up into your profit margin

- Mental Stop

#Tradingverse #slowsteady #growth

Do not focus into perfect bottom of a run or selling at perfect top of a run:

Focus on the Meat:

- Create a Buy zone use a plan:

- Scale into Buy zone:

- Set your sell orders scaling up into your profit margin

- Mental Stop

#Tradingverse #slowsteady #growth

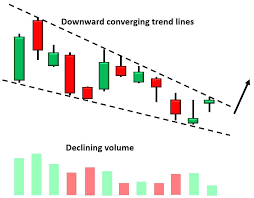

TIP OF THE DAY:

Bullish Signal: Descending wedge break

Remarks: Look for wedge pattern to create buy zones, when a stock breaks above that wedge and confirms usually breaks out

Trade the bullish patterns

#RSP #tradingverse

Bullish Signal: Descending wedge break

Remarks: Look for wedge pattern to create buy zones, when a stock breaks above that wedge and confirms usually breaks out

Trade the bullish patterns

#RSP #tradingverse

TIP OF THE DAY:

IF YOU ARE FOLLOWING SOMEONE AND THEY GIVE YOU A STOCK WITH OVER 5 BILLION A/S , you should re-think the follow:

IF SOMEONE GIVES YOU a stock with 10 billion a/s just unfollow that person

To find out the type in symbol in search box

http://www.otcmarkets.com

IF YOU ARE FOLLOWING SOMEONE AND THEY GIVE YOU A STOCK WITH OVER 5 BILLION A/S , you should re-think the follow:

IF SOMEONE GIVES YOU a stock with 10 billion a/s just unfollow that person

To find out the type in symbol in search box

http://www.otcmarkets.com

How to get passed PDT :Pattern Day Trading

Open Several Accounts:

Open 2 accounts per Broker:

#Etrade: OTC , Small Caps Options

#TDAmeritrade: OTC Small Caps Options

#WeBull: Small Caps Options

Save passwords on P.C:fast login and when you get to 2.5k request Margin upgrade

Open Several Accounts:

Open 2 accounts per Broker:

#Etrade: OTC , Small Caps Options

#TDAmeritrade: OTC Small Caps Options

#WeBull: Small Caps Options

Save passwords on P.C:fast login and when you get to 2.5k request Margin upgrade

Tip Of Day:

Social Media And Forums are A Great Trading Tool:

Content is key:

Focus on:

#Quality Info

#Autotelic realtionship with followers: #Heart and #Mind connection

Avoid:

Low Frequency

#Negativity

#Noise

#Drama

#Arguing

Disputes

#UnconditionalLove #stateofflow

Social Media And Forums are A Great Trading Tool:

Content is key:

Focus on:

#Quality Info

#Autotelic realtionship with followers: #Heart and #Mind connection

Avoid:

Low Frequency

#Negativity

#Noise

#Drama

#Arguing

Disputes

#UnconditionalLove #stateofflow

Tip of the day:

Taking position: Rule of 3 Trade:

1- Do not hesitate : Taka starter ex. 30% of intended trade:

$900 Total : take a starter at $300

Reason: This prevents you from chasing

2- Add a pull back , if the stock pulls back, embrace it and add rest

3: Set sell GTC

Taking position: Rule of 3 Trade:

1- Do not hesitate : Taka starter ex. 30% of intended trade:

$900 Total : take a starter at $300

Reason: This prevents you from chasing

2- Add a pull back , if the stock pulls back, embrace it and add rest

3: Set sell GTC

Executing sells:

Create a Private Profit Margin ride Free shares:

1- Set sells scaling up to your profit margin in lots

ex 1,000,000 shares at .002 Profit Margin 100%

Scale Sell 200k @ .003 Sell 200k @ .0033 Sell 200k @.0036 Sell 200k @.004

Possibly ride 200k Free higher

Create a Private Profit Margin ride Free shares:

1- Set sells scaling up to your profit margin in lots

ex 1,000,000 shares at .002 Profit Margin 100%

Scale Sell 200k @ .003 Sell 200k @ .0033 Sell 200k @.0036 Sell 200k @.004

Possibly ride 200k Free higher

Re entering quality plays:

As I have said in the past , stocks are like vacations;

If the destination was a success you will go back:

Trading is the same way:

Re enter stocks at key levels of support when there is volume interest and solid chart (Rule of 3)

As I have said in the past , stocks are like vacations;

If the destination was a success you will go back:

Trading is the same way:

Re enter stocks at key levels of support when there is volume interest and solid chart (Rule of 3)

Tips on How to Trade using the Rule of 3 methodology:

Those interested in mentorship send a message via d.m to set up an appointment

Limited Time Only:

Please Like Share Comment below:

Those interested in mentorship send a message via d.m to set up an appointment

Limited Time Only:

Please Like Share Comment below:

Read on Twitter

Read on Twitter