In college, I was a behavioral economics major. Those classes taught me more about investing than any finance class ever did.

Today I want to share some of the things I learned and some studies...

THREAD: PSYCHOLOGICAL BIASES AND INVESTING

THREAD: PSYCHOLOGICAL BIASES AND INVESTING

Today I want to share some of the things I learned and some studies...

THREAD: PSYCHOLOGICAL BIASES AND INVESTING

THREAD: PSYCHOLOGICAL BIASES AND INVESTING

1/ Anchoring.

This is perhaps the most powerful psychological force. Random numbers like your social or your phone number can affect your estimates of value. Studies have shown that a random number spinner affects people’s estimates of country populations!

This is perhaps the most powerful psychological force. Random numbers like your social or your phone number can affect your estimates of value. Studies have shown that a random number spinner affects people’s estimates of country populations!

2/ One of the most dangerous things you can do in investing is look at the stock price before doing any analysis. The price affects your estimates of value.

You can also get anchored to, say, your initial purchase price and this will affect your decisions when stocks move.

You can also get anchored to, say, your initial purchase price and this will affect your decisions when stocks move.

3/ Confirmation Bias.

We tend to seek information that SUPPORTS are beliefs. Not doing so leads to what psychologists call “cognitive dissonance”, the uneasiness we feel when presented with info that goes against our preconceived notions.

We tend to seek information that SUPPORTS are beliefs. Not doing so leads to what psychologists call “cognitive dissonance”, the uneasiness we feel when presented with info that goes against our preconceived notions.

4/

1. If you personally like/use a company’s product...

2. If a friend or family member gave you a stock tip...

3. If you had a favorable experience with a similar company...

You better bet you’ll be biased towards it. Searching for conflicting views is emotionally very hard!

1. If you personally like/use a company’s product...

2. If a friend or family member gave you a stock tip...

3. If you had a favorable experience with a similar company...

You better bet you’ll be biased towards it. Searching for conflicting views is emotionally very hard!

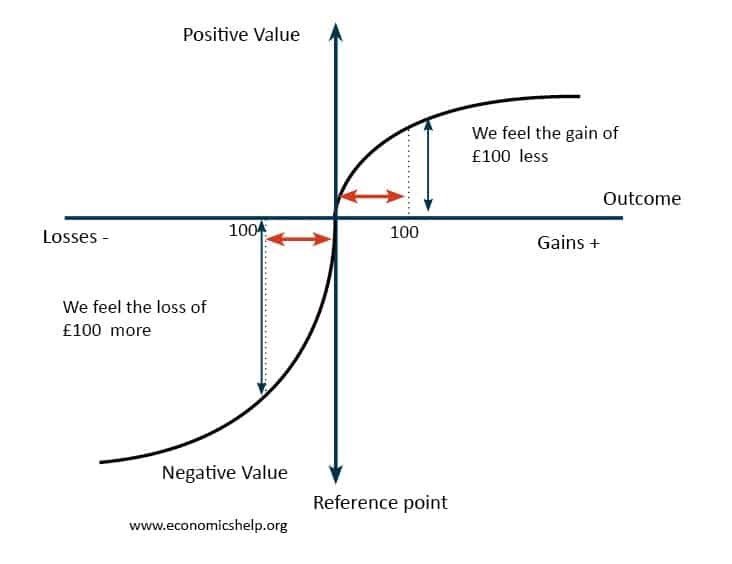

5/ Loss Aversion.

This is one aspect of a very important discovery: Prospect Theory. We hate losses more than we love EQUIVALENT gains. When we are in a “loss” position, we are more likely to gamble to potentially enter positive territory.

This is one aspect of a very important discovery: Prospect Theory. We hate losses more than we love EQUIVALENT gains. When we are in a “loss” position, we are more likely to gamble to potentially enter positive territory.

6/ In investing, we tend to hold onto “losers” with unrealized losses and sell “winners” with unrealized gains. We also “gamble”, or double down on loss positions.

My friend @JamjamJoram also made the interesting observation that even the color red can signal a feeling of loss.

My friend @JamjamJoram also made the interesting observation that even the color red can signal a feeling of loss.

7/ Hindsight Bias/Outcome Bias.

People tend to overestimate their ability to predict an outcome that could not have possibly be predicted. We also tend to judge the quality of decisions by their OUTCOME even though poor decisions can lead to good results and vice versa.

People tend to overestimate their ability to predict an outcome that could not have possibly be predicted. We also tend to judge the quality of decisions by their OUTCOME even though poor decisions can lead to good results and vice versa.

8/ Everyone saying “I knew I should have bought X in March,” is displaying hindsight bias. People who say “I made a good decision b/c this stock is up X%,” is displaying outcome bias.

Using mutual fund returns to identify winners is outcome bias, which is why it doesn’t work!

Using mutual fund returns to identify winners is outcome bias, which is why it doesn’t work!

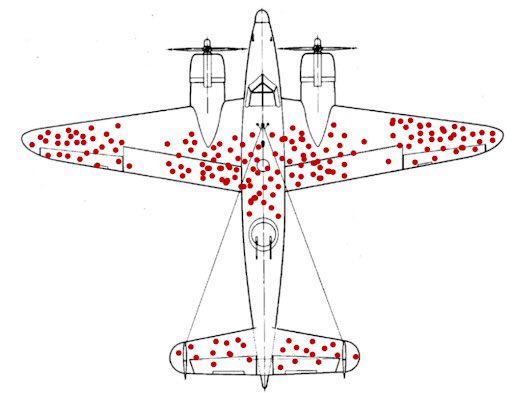

8/ Survivorship Bias.

The world today only shows us the survivors, but we tend to take the traits of these “survivors” to make blanket statements about what works and what doesn’t. We saw this in German planes and we see it in most books on management theory.

The world today only shows us the survivors, but we tend to take the traits of these “survivors” to make blanket statements about what works and what doesn’t. We saw this in German planes and we see it in most books on management theory.

9/ Amazon wasn’t the first company to sell books online. Netflix wasn’t the first streaming service. Wal-Mart wasn’t the first to come up with the superstore. But these are the survivors and we tend to assume there was no way they WOULD NOT succeed!

10/ Bandwagon Effect.

We tend to be really uncomfortable going against the crowd, especially when our actions are public. We would rather be obviously wrong than go against popular belief even for something as simple as picking which line is the longest (see link @ end).

We tend to be really uncomfortable going against the crowd, especially when our actions are public. We would rather be obviously wrong than go against popular belief even for something as simple as picking which line is the longest (see link @ end).

11/ The relevance to investing is obvious from spectacular bull runs to the fact that few are comfortable buying/talking about unloved names. We would much rather discuss mainstream companies that “everyone is buying”. We also feel validated when others endorse us.

12/ Overconfidence.

A very dangerous one. If at any point in this thread, you thought to yourself “This doesn’t apply to me” or “I can control my biases”, then you are displaying overconfidence. 80% of people think they are better than average which is obviously not possible!

A very dangerous one. If at any point in this thread, you thought to yourself “This doesn’t apply to me” or “I can control my biases”, then you are displaying overconfidence. 80% of people think they are better than average which is obviously not possible!

13/ In investing, attachment to an idea or an inability to admit you are wrong when facts change are both signs of overconfident. They are also very dangerous.

Even something as simple as “I can’t get anchored” is a dangerous thought to have when it comes to investing.

Even something as simple as “I can’t get anchored” is a dangerous thought to have when it comes to investing.

14/ The big takeaway is that all these traits are evolutionary. One of the tenants of behavioral economics is that humans deviate from rationality in PREDICTABLE ways and these deviations are INHERENT. That means you can’t NOT display them.

15/ This is very hard for an inherently overconfident species to accept, but science has proven it true in a variety of scenarios from investing to eating cake.

The first step is recognizing that you’re susceptible. Then you’ll be in a position to implement safeguards.

The first step is recognizing that you’re susceptible. Then you’ll be in a position to implement safeguards.

16/ Here are some to get you started...

1. Don’t look at stock prices (anchoring)

2. Create a strict process - if you break it, start over (outcome bias)

3. When researching a stock, only use unbiased sources (I.e. SEC filings) until you form your own opinion.

1. Don’t look at stock prices (anchoring)

2. Create a strict process - if you break it, start over (outcome bias)

3. When researching a stock, only use unbiased sources (I.e. SEC filings) until you form your own opinion.

17/

4. Don’t receive tips from friends and family. Source your own ideas/use random stock generators.

5. Actively seek out cognitive dissonance.

6. Be careful on Echo Chambers like Twitter. Don’t use social media during the research process.

4. Don’t receive tips from friends and family. Source your own ideas/use random stock generators.

5. Actively seek out cognitive dissonance.

6. Be careful on Echo Chambers like Twitter. Don’t use social media during the research process.

18/

7. DON’T PAY ATTENTION TO STOCK CHARTS

8. Only check your portfolio at stated times (I.e. once a month)

9. Recognize your overconfidence - actively instill pessimism in your process

10. Constantly remind yourself of these biases/catch yourself in the act of displaying them

7. DON’T PAY ATTENTION TO STOCK CHARTS

8. Only check your portfolio at stated times (I.e. once a month)

9. Recognize your overconfidence - actively instill pessimism in your process

10. Constantly remind yourself of these biases/catch yourself in the act of displaying them

19/ I’m going to leave you with a whole bunch of resources to research these further:

1. The best resource is Daniel Kahhneman’s book, Thinking Fast and Slow: https://www.amazon.com/Thinking-Fast-Slow-Daniel-Kahneman/dp/0374533555

2. 1974 Paper by Tversky and Kahneman: https://www2.psych.ubc.ca/~schaller/Psyc590Readings/TverskyKahneman1974.pdf

1. The best resource is Daniel Kahhneman’s book, Thinking Fast and Slow: https://www.amazon.com/Thinking-Fast-Slow-Daniel-Kahneman/dp/0374533555

2. 1974 Paper by Tversky and Kahneman: https://www2.psych.ubc.ca/~schaller/Psyc590Readings/TverskyKahneman1974.pdf

20/

3. Asch Conformity Experiment with lines showing the physical difficulty of going against the crowd:

4. A Great New Yorker Article on Confirmation Bias: https://www.newyorker.com/magazine/2017/02/27/why-facts-dont-change-our-minds

3. Asch Conformity Experiment with lines showing the physical difficulty of going against the crowd:

4. A Great New Yorker Article on Confirmation Bias: https://www.newyorker.com/magazine/2017/02/27/why-facts-dont-change-our-minds

21/

5. Original Paper on Prospect Theory by (you guessed it) Tversky and Kahneman: https://courses.washington.edu/pbafhall/514/514%20Readings/ProspectTheory.pdf

6. Richard Thaler on Psychology and Investing: https://onlinelibrary.wiley.com/doi/full/10.1111/j.1540-6261.1985.tb05004.x

5. Original Paper on Prospect Theory by (you guessed it) Tversky and Kahneman: https://courses.washington.edu/pbafhall/514/514%20Readings/ProspectTheory.pdf

6. Richard Thaler on Psychology and Investing: https://onlinelibrary.wiley.com/doi/full/10.1111/j.1540-6261.1985.tb05004.x

22/

Last resource: Me! I studied this for 4 years and it is truly a wonderful world. This thread doesn’t even begin to scratch the surface. Happy to talk about any of this stuff (and others) in more depth!

Happy investing!

Last resource: Me! I studied this for 4 years and it is truly a wonderful world. This thread doesn’t even begin to scratch the surface. Happy to talk about any of this stuff (and others) in more depth!

Happy investing!

Read on Twitter

Read on Twitter