As promised last week .

Here I am starting tread on data driven trading . That means we will trade Based on past data .

I captured Nifty's 13 Years of the data for this study .

We will assume whatever has happened in past will also happen in future .

here we go -

Here I am starting tread on data driven trading . That means we will trade Based on past data .

I captured Nifty's 13 Years of the data for this study .

We will assume whatever has happened in past will also happen in future .

here we go -

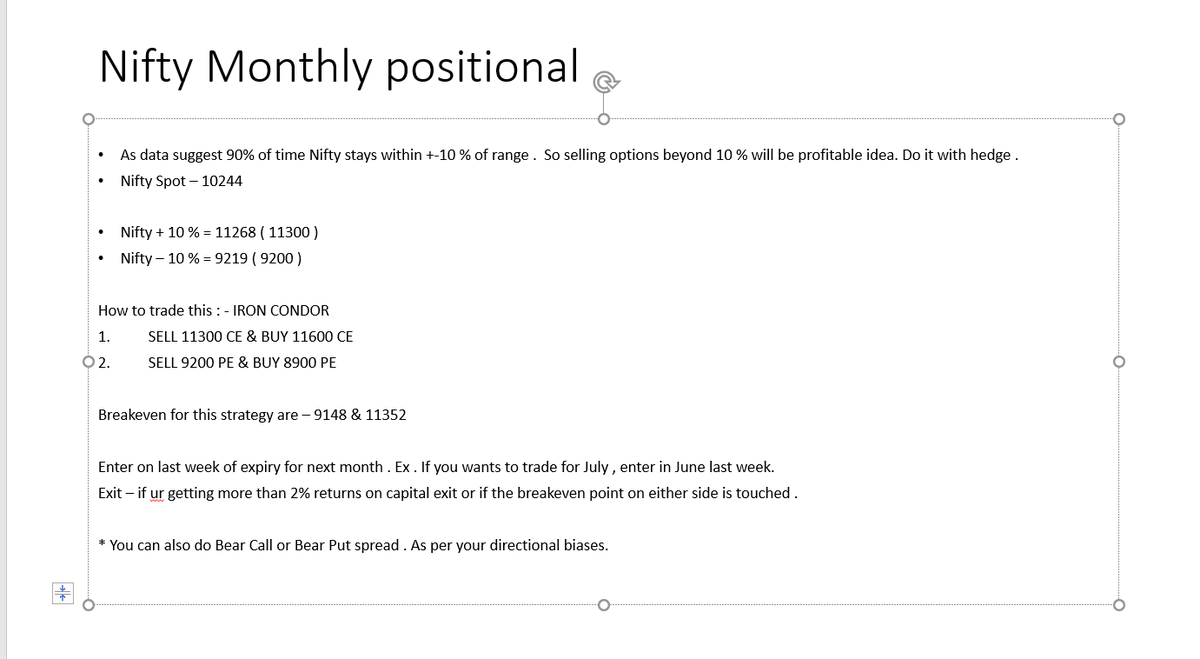

Starting with Nifty Monthly data -

see below pic - Data collected for past 153 months . focus on light blue area . As per data 90% of the time Nifty closed within +-10% range from spot . Also 90% of the time it has not crossed 10% from spot .

see below pic - Data collected for past 153 months . focus on light blue area . As per data 90% of the time Nifty closed within +-10% range from spot . Also 90% of the time it has not crossed 10% from spot .

That Means if we sell options beyond 10% with hedge we can easily earn some profit every month .

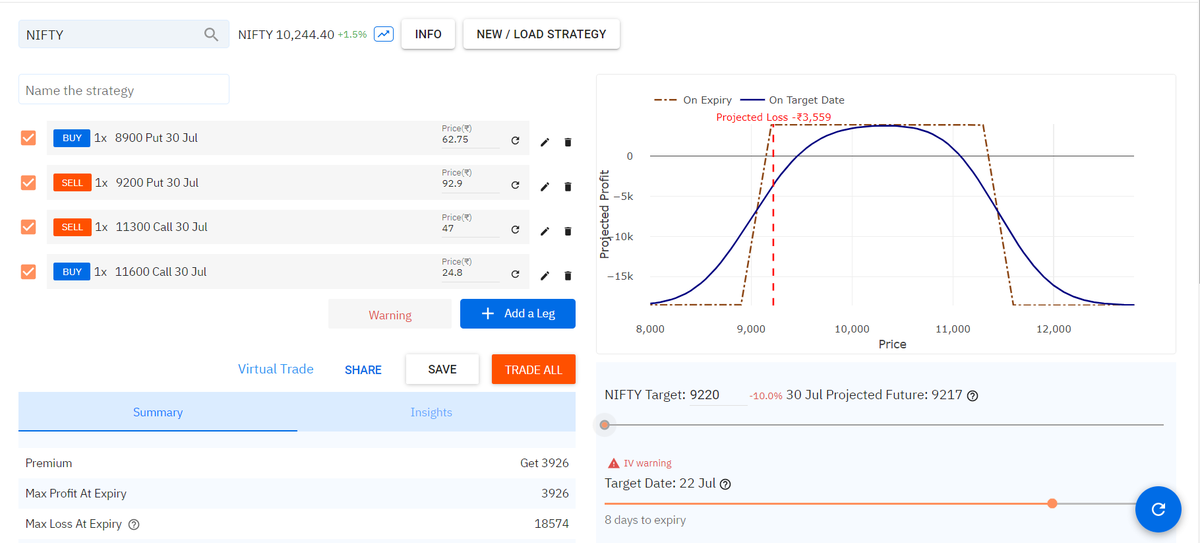

See below pic - for strategy

See below pic - for strategy

See in this strategy , we shorted options beyond 10% . That means we will be accurate 90% of the time as per past data .

also we initiated risk defined strategy , means our loss is also limited if strategy went wrong .

also we initiated risk defined strategy , means our loss is also limited if strategy went wrong .

Now when to enter and when to exit : -

Enter on last week of expiry for next month . Ex . If you wants to trade for July , enter in June last week.

Exit – if ur getting more than 2% returns on capital exit or exit/adjust if the break even point on either side is touched .

Enter on last week of expiry for next month . Ex . If you wants to trade for July , enter in June last week.

Exit – if ur getting more than 2% returns on capital exit or exit/adjust if the break even point on either side is touched .

For monthly strategy this thread ends here .

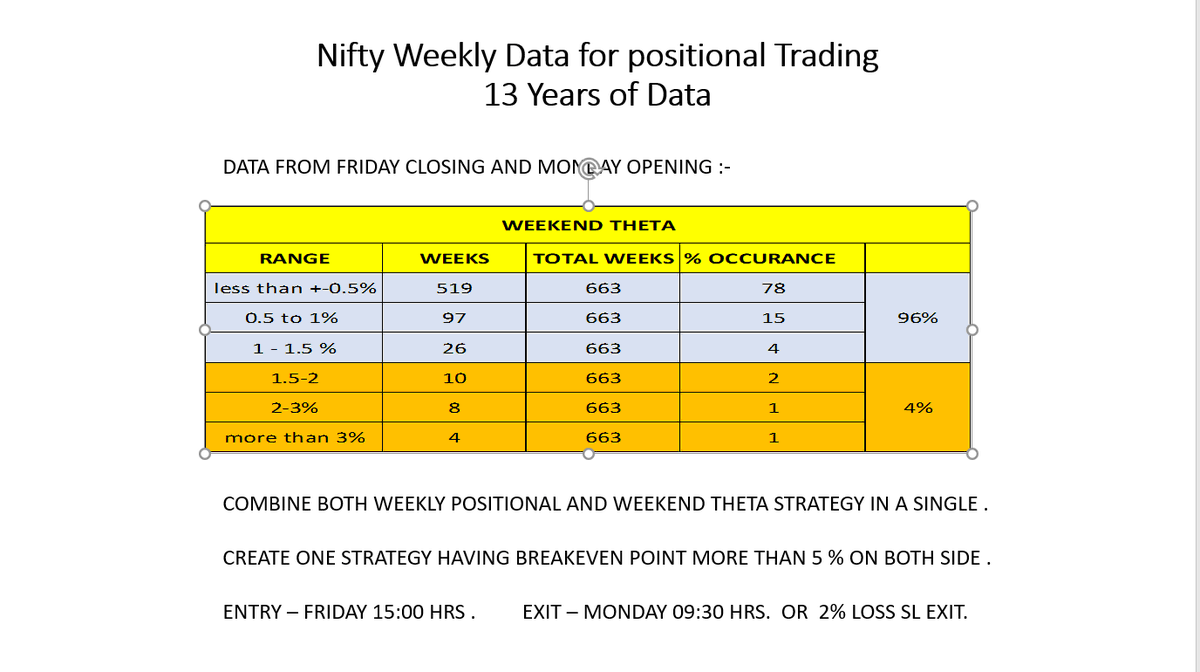

Next is weekly data : -

Next is weekly data : -

See below Pic . 663 Weeks data analysed. As per data 95% of the time Nifty trades withing 5 % range on weekly time frame . That means if we sell nifty weekly options beyond 5% range with hedge we can earn some profit every week .

General observations : -

1. Weekly options are very volatile as compared to monthly .

2. If ur getting 1% return on your strategy just exit and relax

3. If ur getting Max 1-2 % loss on your strategy , just exit and relax .

1. Weekly options are very volatile as compared to monthly .

2. If ur getting 1% return on your strategy just exit and relax

3. If ur getting Max 1-2 % loss on your strategy , just exit and relax .

4. If ur breakeven is more than 5% on both side . you entered on Friday at 15:00 Hrs & Monday opening is flat then you will get 1% returns on Monday itself . So exit and book profit , wait for next Friday.

Risk :- BIG GAP UP OR GAP DOWN .

Risk :- BIG GAP UP OR GAP DOWN .

Good strategies : -

Iron condor

Ratio spreads on both call and put side .

Bear Call and Bull Put spread based on view .

Always create risk defined strategies .

Iron condor

Ratio spreads on both call and put side .

Bear Call and Bull Put spread based on view .

Always create risk defined strategies .

Those who wants to capture weekend Theta following data is for you : -

As per data 90 % of the time Nifty opened flat may be up 0.5% - 1% range from fridays closing .

As per data 90 % of the time Nifty opened flat may be up 0.5% - 1% range from fridays closing .

COMBINE BOTH WEEKLY POSITIONAL AND WEEKEND THETA STRATEGY IN A SINGLE STRATEGY.

CREATE ONE STRATEGY HAVING BREAKEVEN POINT MORE THAN 5 % ON BOTH SIDE .

ENTRY – FRIDAY 15:00 HRS . EXIT – MONDAY 09:30 HRS. OR 2% LOSS SL EXIT.

RISK - BIG GAP-UP / GAP DOWN

CREATE ONE STRATEGY HAVING BREAKEVEN POINT MORE THAN 5 % ON BOTH SIDE .

ENTRY – FRIDAY 15:00 HRS . EXIT – MONDAY 09:30 HRS. OR 2% LOSS SL EXIT.

RISK - BIG GAP-UP / GAP DOWN

Before deploying any strategy please check break-even point are more than 5% away from spot . Exit ur getting profit up to 1% or if ur breakeven point is touched .

This thread ends here . Please feel free to ask for any doubts . Retweet it if you liked .

This thread ends here . Please feel free to ask for any doubts . Retweet it if you liked .

Read on Twitter

Read on Twitter