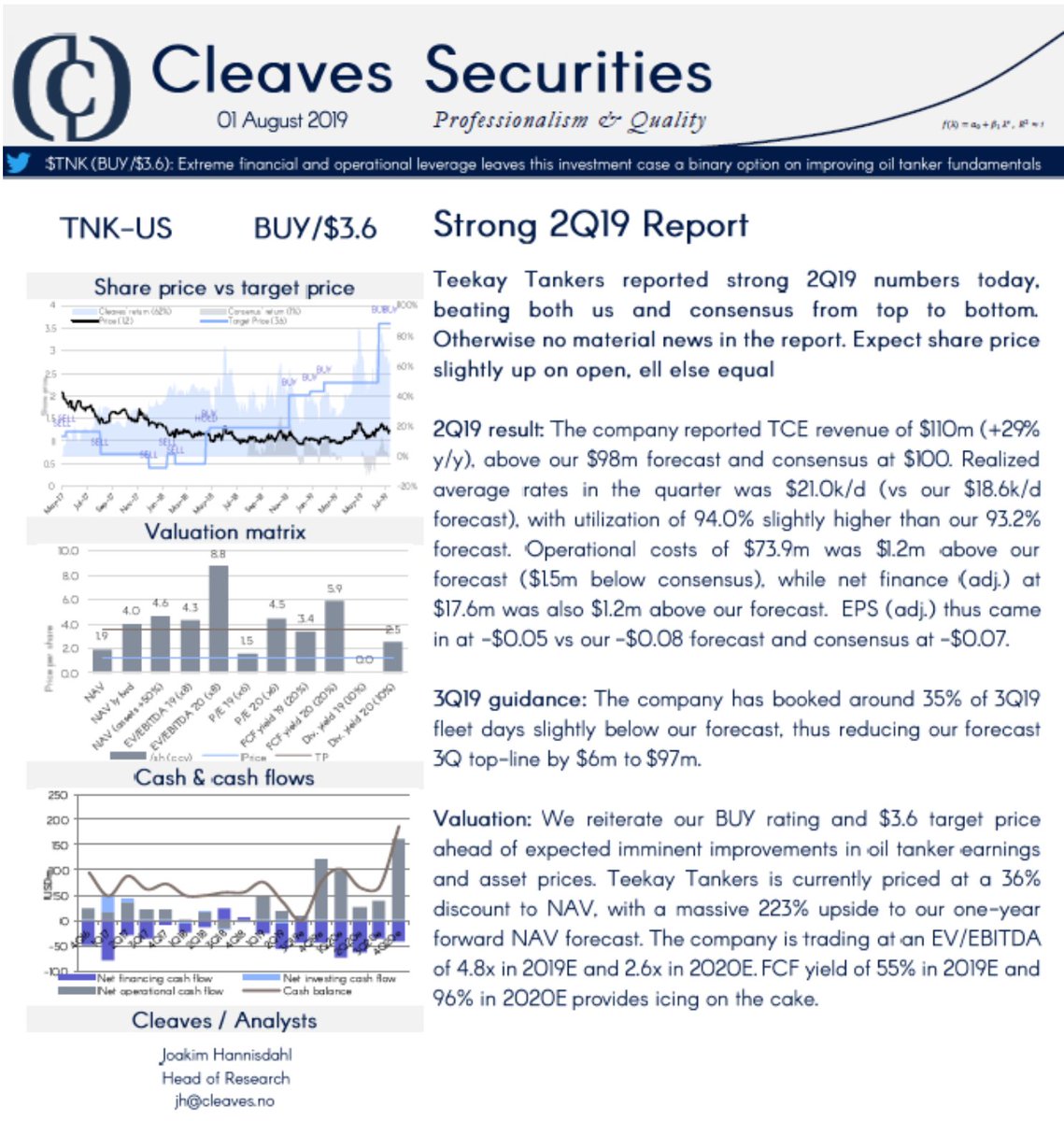

1 yr ago Cleaves had $18.4 PT on $TNK (RS adjusted). At the time, $TNK had many upcoming maturities and had not experienced the Q4-Q2 rate bonanza. After 5c loss in Q219 (better than expectations), Cleaves raised PT to $28.8. Now Cleaves PT is $10. Here's why I find this odd...

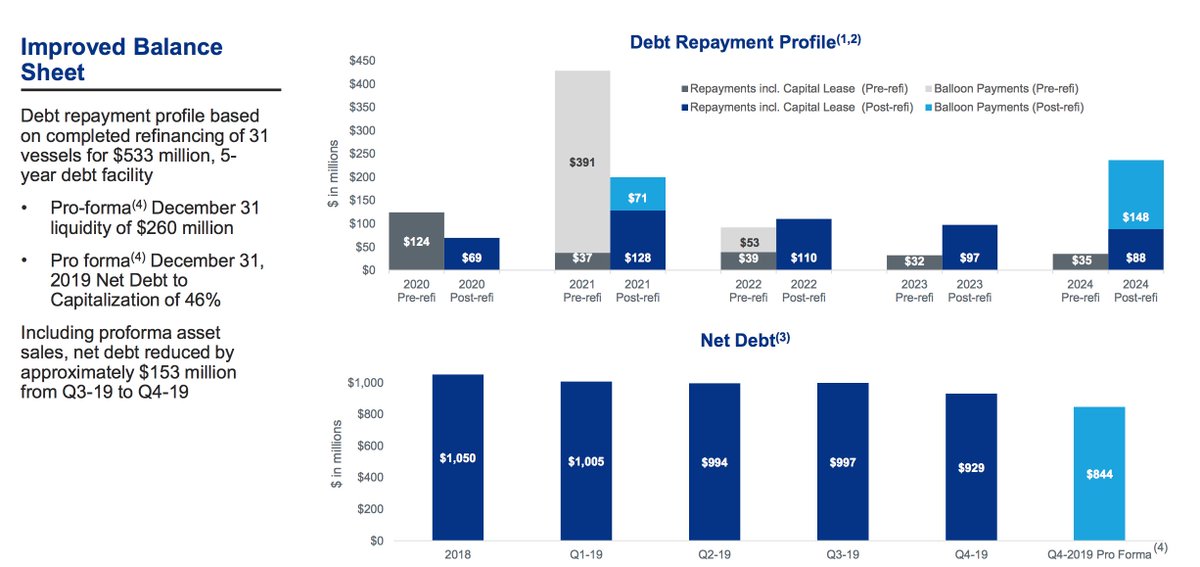

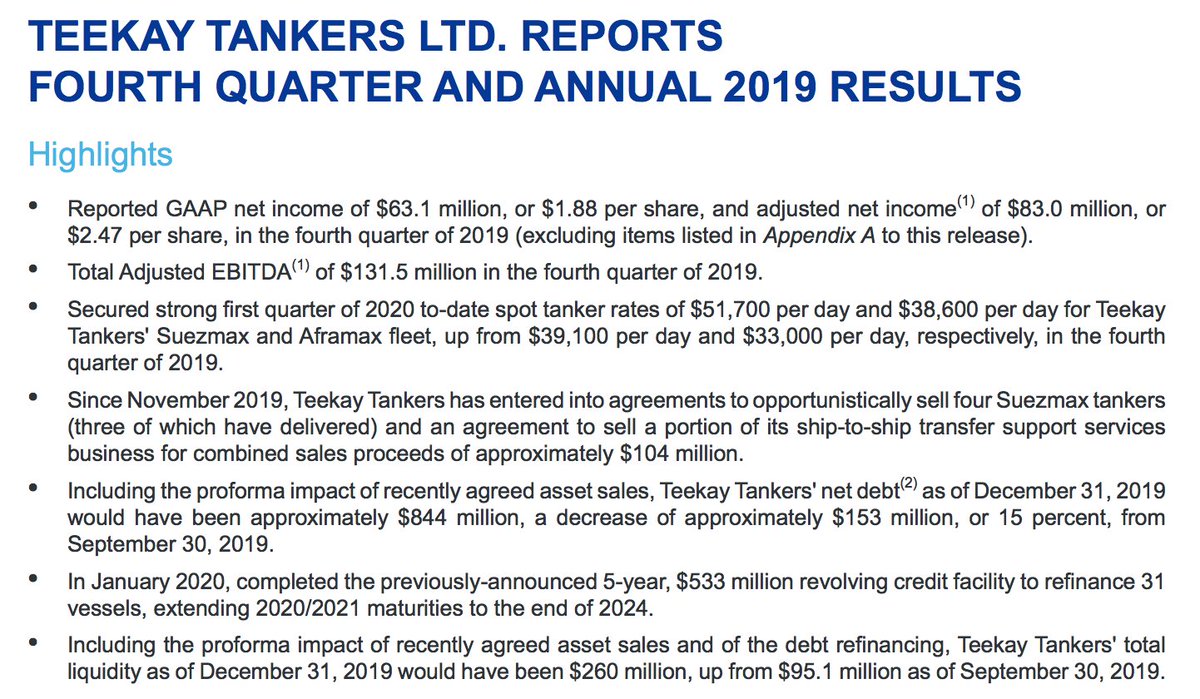

$TNK earned $2.37 in Q4. $TNK debt decreased by 15% in Q4. This was a blowout bonanza noone expected. The company also refinanced 31 vessels and pushed 63% of its remaining debt maturities out four years. 4 Suezmax tankers were sold, plus the cash. $4.5 per share went to debt.

In Q1, $TNK earned another $3.17 per share, and reduced net debt by another 20%.

$5.54 in net earnings in two quarters! Debt repayment profiles pushed out 4 years! Only another $29M is due in 2020! Between Q319 and end April 2020 net debt was reduced by nearly $10 per share!

$5.54 in net earnings in two quarters! Debt repayment profiles pushed out 4 years! Only another $29M is due in 2020! Between Q319 and end April 2020 net debt was reduced by nearly $10 per share!

Taking into account Q2 earnings, which should at least be somewhere between Q4 and Q1 earnings, $TNK will have made somewhere around $8 per share in 3 quarters. Breakeven has been reduced to $10k via charter coverage. The fleet has on average another 8 years of life.

All analysts are calling for an oil demand recovery and tanker "super cycle" starting in 2022 or 2023, $TNK will enter this period with little debt and a fleet primed to capitalize on this bonanza.

Q4-Q2 represented a very material change in the company's fortunes.

Q4-Q2 represented a very material change in the company's fortunes.

So my question is, was Cleaves right a year ago when there was little hope for $TNK? Before Cosco sanctions? Before #IMO2020? Before the storage boom? When he had far lower forecasts for spot rates than were achieved in 2019 and 2020? Or is he right now?

Perhaps the dislocation is the NAV impact on share price? That declining vessel values means a reduction in the value of the share?

Could be, but secondhand tanker values are far closer to trough valuations than peak valuations already!

Could be, but secondhand tanker values are far closer to trough valuations than peak valuations already!

Now, I don't claim to know where share prices will go. But claiming vessel values will go to all time low valuations after the greatest earnings bonanza in over a decade and two years before the beginning of a "super cycle" just seems silly to me.

And as for $TNK? The idea that the company is worth less now than it was a year ago, AFTER adding ~$8 to its balance sheet and reducing its net debt (including recording capital gains on asset sales) by more than $10, just seems crazy.

So you have to ask yourself, if these companies are being driven by a narrative, at what point does the narrative change?

Do investors "start looking forward" 6 months from now? A year from now? If "super cycle" is the 2023 consensus when are we supposed to buy that story?

Do investors "start looking forward" 6 months from now? A year from now? If "super cycle" is the 2023 consensus when are we supposed to buy that story?

Read on Twitter

Read on Twitter