So much bubble talk percolating in this market again, spoken by those who seem not to grasp what a true bubble looks like.

(One way to know we're not in a bubble is to observe the swarm of replies to this tweet insisting that we are.)

New column. https://cnb.cx/3ejTHSJ

(One way to know we're not in a bubble is to observe the swarm of replies to this tweet insisting that we are.)

New column. https://cnb.cx/3ejTHSJ

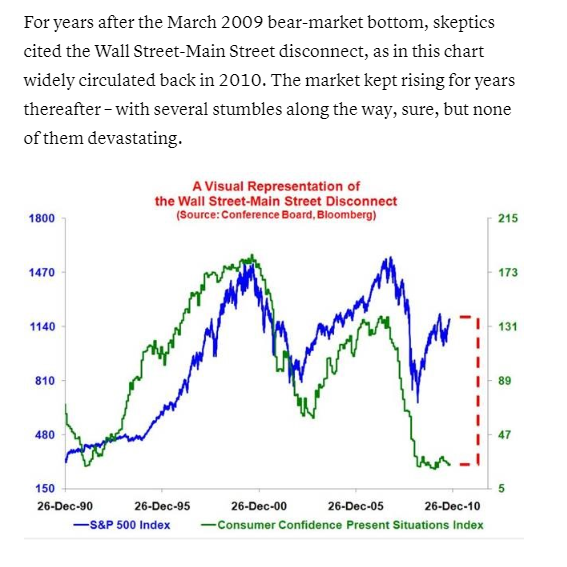

Stocks have run ahead of the economic recovery for sure - as they do. They appear expensive, maybe are priced for poor forward returns. But those things don't amount to a bubble, given mixed investor sentiment, no pervasive greed narrative, outflows from equity funds, etc....

"But the Robinhood/day-trading mania," you say.

I'd argue the magnitude of the appalled, scolding response to the recent burst of amateur speculative action has more than offset the frothy sentiment implications of the action itself. It's added to the collective wall of worry.

I'd argue the magnitude of the appalled, scolding response to the recent burst of amateur speculative action has more than offset the frothy sentiment implications of the action itself. It's added to the collective wall of worry.

"The real bubble is in bonds, stoked by the Fed," others will argue.

Clearly Fed support is underwriting a lubricious corporate-debt market and compressing risk spreads.

But is that the bubbly greed story: "I feel forced to by high-grade paper at 2.2%?" Nah...

Clearly Fed support is underwriting a lubricious corporate-debt market and compressing risk spreads.

But is that the bubbly greed story: "I feel forced to by high-grade paper at 2.2%?" Nah...

And finally, a legitimate argument rages over whether equities have overshot the most plausible path for the economy from here.

But it's nothing new to have folks whingeing over a Wall Street-Main Street disconnect around cycle turns. Look at the dates on this chart...

But it's nothing new to have folks whingeing over a Wall Street-Main Street disconnect around cycle turns. Look at the dates on this chart...

And, to be clear, absence of a bubble doesn't mean the market's set up to plow higher. Tape's a bit hinky, correcting under the surface for now, Covid case count harder to ignore, seasonals turn less friendly. Would be no injustice or surprise for the S&P to be off 10% quick...

But that's the same as a bubble, which would imply a high chance of calamitous losses simply due to a letup in delusional speculative buying.

Read on Twitter

Read on Twitter