A few charts to assess the backdrop for $gold

Top pane - gold vs UST 5yr real yield (2yr regression shows R^2 at 0.904)...

Middle - 5yr breakevens (blue) vs 5yr nominal yields

Lower - Aggregate $ value of bonds with negative yield

Gold continues to trade as a zero coupon bond

Top pane - gold vs UST 5yr real yield (2yr regression shows R^2 at 0.904)...

Middle - 5yr breakevens (blue) vs 5yr nominal yields

Lower - Aggregate $ value of bonds with negative yield

Gold continues to trade as a zero coupon bond

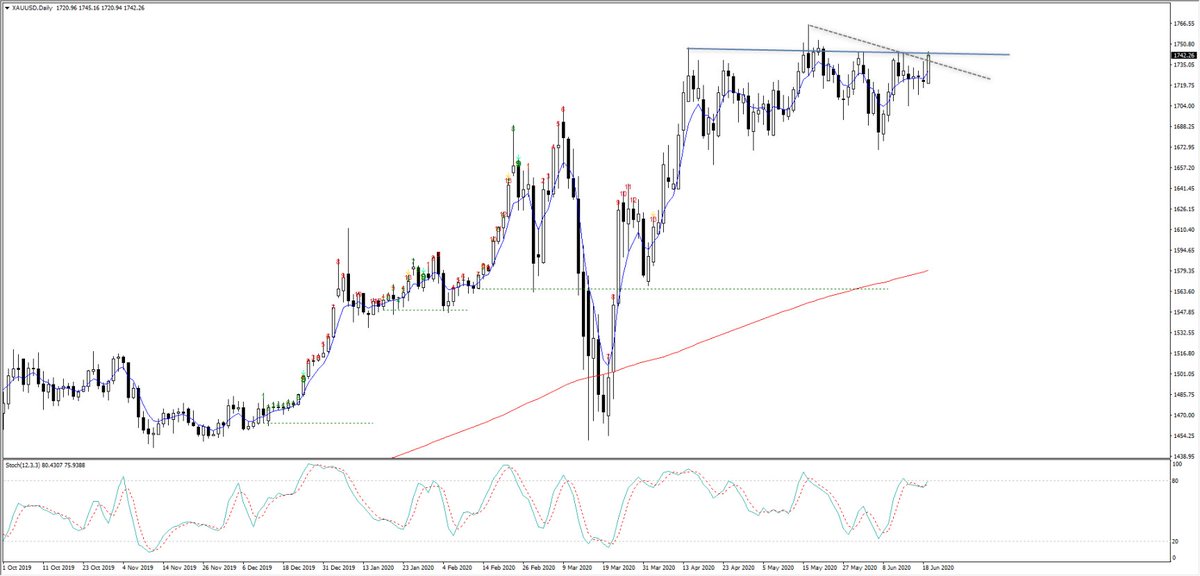

Volmatrix

Upper - Gold 1 week implied vol - 1 year vol - no signs of expected ST explosive move

Middle - 25d 1m riskies - 1m call vol trades at a 1.6vol premium to puts.. neutral

Lower - 6m riskies - neutral

No signs of euphoric conditions at all despite gold testing upper range

Upper - Gold 1 week implied vol - 1 year vol - no signs of expected ST explosive move

Middle - 25d 1m riskies - 1m call vol trades at a 1.6vol premium to puts.. neutral

Lower - 6m riskies - neutral

No signs of euphoric conditions at all despite gold testing upper range

CFTC managed money (futures only) - 105k net long - just under the average (blue) from start of 2000. All pretty neutral

Read on Twitter

Read on Twitter