1/XX

A brief history of FX & why we sometimes need to build products for people who aren't our target demographic. (Crypto folks pay attention)

Foreign currency isn't valuable for the same reasons as a regionally adopted currency.

Instead it has value because people:

A brief history of FX & why we sometimes need to build products for people who aren't our target demographic. (Crypto folks pay attention)

Foreign currency isn't valuable for the same reasons as a regionally adopted currency.

Instead it has value because people:

2/XX

1. Have faith in the authority of that currency.

2. Have faith in the stability of that currency.

3. Have reasonable expectation it will be accepted in a currency.

Other than the mercantile gold standard, we didn't see a lot of interest in foreign exchange until 1880.

1. Have faith in the authority of that currency.

2. Have faith in the stability of that currency.

3. Have reasonable expectation it will be accepted in a currency.

Other than the mercantile gold standard, we didn't see a lot of interest in foreign exchange until 1880.

3/XX

In the 1880's Great Britain had 62 colonies, 4 dominions, 1 territory and 1 autonomous region under their control.

While most of these regions had their own regional currency/money (or sometimes multiple) the economic elite of these regions (often trade merchants)

In the 1880's Great Britain had 62 colonies, 4 dominions, 1 territory and 1 autonomous region under their control.

While most of these regions had their own regional currency/money (or sometimes multiple) the economic elite of these regions (often trade merchants)

4/xx

transacted their business operations in the British Pound Stirling, which was valuable to them or their company's back home.

If you wanted to win a deal with one of these merchants to supply your local shop, you had to pay in the Pound Stirling.

transacted their business operations in the British Pound Stirling, which was valuable to them or their company's back home.

If you wanted to win a deal with one of these merchants to supply your local shop, you had to pay in the Pound Stirling.

5/xx

And, why wouldn't you want the Stirling? At the time it was the most stable, respected and widely accepted currency in the world.

But, you have some challenges as a local shopkeeper:

1. You earn your living in your local currency and don't have access to the pound.

And, why wouldn't you want the Stirling? At the time it was the most stable, respected and widely accepted currency in the world.

But, you have some challenges as a local shopkeeper:

1. You earn your living in your local currency and don't have access to the pound.

6/xx

2. More importantly, all your costs are in your local currencies and local retailers don't accept the pound.

So what is a shop keeper to do? Simply visit your local money lender of course.

2. More importantly, all your costs are in your local currencies and local retailers don't accept the pound.

So what is a shop keeper to do? Simply visit your local money lender of course.

7/xx

Regional banks and money lenders quickly caught on that it was easy for them to buy and sell the pound stirling against the local currency at a wide spread margin, in order to facilitate this back and forward business.

Regional banks and money lenders quickly caught on that it was easy for them to buy and sell the pound stirling against the local currency at a wide spread margin, in order to facilitate this back and forward business.

8/xx

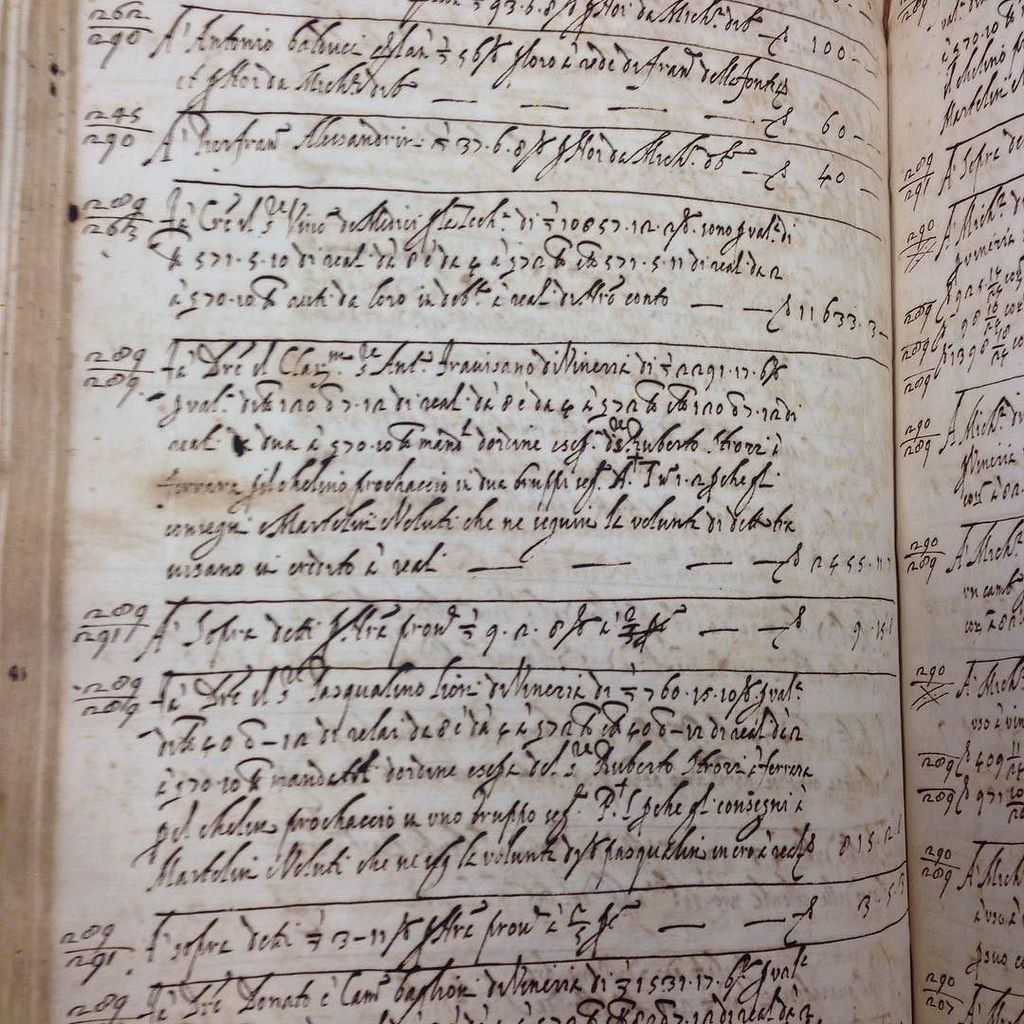

They employed the same methods as the Medici bankers did of having a double-sided ledger system with two currencies. However, in this case they actually physically held both currencies and were happy to exchange them for a profit.

They employed the same methods as the Medici bankers did of having a double-sided ledger system with two currencies. However, in this case they actually physically held both currencies and were happy to exchange them for a profit.

9/xx

Ultimately this was a closed loop system if one merchant bought 100 stirling off you that morning to pay for goods from an overseas trader, you could reasonably bet that trader paid their local crew in stirling and they'd have to come sell you that stirling back as well.

Ultimately this was a closed loop system if one merchant bought 100 stirling off you that morning to pay for goods from an overseas trader, you could reasonably bet that trader paid their local crew in stirling and they'd have to come sell you that stirling back as well.

10/xx

This created the first profitable foreign exchange systems.

What's important to note though, is that any financial market has two key types of transaction:

1. Profitable volume

2. Liquidity volume

This was profitable volume as buyers routinely paid up to 20% on exchange

This created the first profitable foreign exchange systems.

What's important to note though, is that any financial market has two key types of transaction:

1. Profitable volume

2. Liquidity volume

This was profitable volume as buyers routinely paid up to 20% on exchange

11/xx

But, it lacks liquidity volume; and this market did lack liquidity for a number of years.

As the practice grew in scale and became profitable, many of these merchant banks became some of the first regional merchant banks (of which nearly all are now owned by HSBC)

But, it lacks liquidity volume; and this market did lack liquidity for a number of years.

As the practice grew in scale and became profitable, many of these merchant banks became some of the first regional merchant banks (of which nearly all are now owned by HSBC)

12/XX

But it wasn't until stable post war peace time that we saw the forex market explode.

The reason for this is the fact that retail banks are profitable businesses, but, they are only profitable under two conditions:

But it wasn't until stable post war peace time that we saw the forex market explode.

The reason for this is the fact that retail banks are profitable businesses, but, they are only profitable under two conditions:

13/xx

1. They country they are in has a growing economy.

2. The country they are in is stable.

The reason for this is banks don't make money on their (egregious) account fees, but instead on maintaining a fractional reserve.

They invest most of your money and keep the profit.

1. They country they are in has a growing economy.

2. The country they are in is stable.

The reason for this is banks don't make money on their (egregious) account fees, but instead on maintaining a fractional reserve.

They invest most of your money and keep the profit.

14/xx

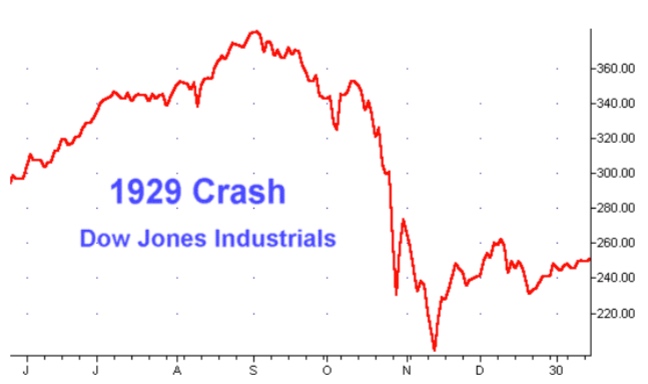

Historically, banks invested locally and only really in the currencies in which they had regular exposure to.

This meant their success was directly tied to the local economy, which lead to devastating depressions when a local economy took a hit.

Historically, banks invested locally and only really in the currencies in which they had regular exposure to.

This meant their success was directly tied to the local economy, which lead to devastating depressions when a local economy took a hit.

15/xx

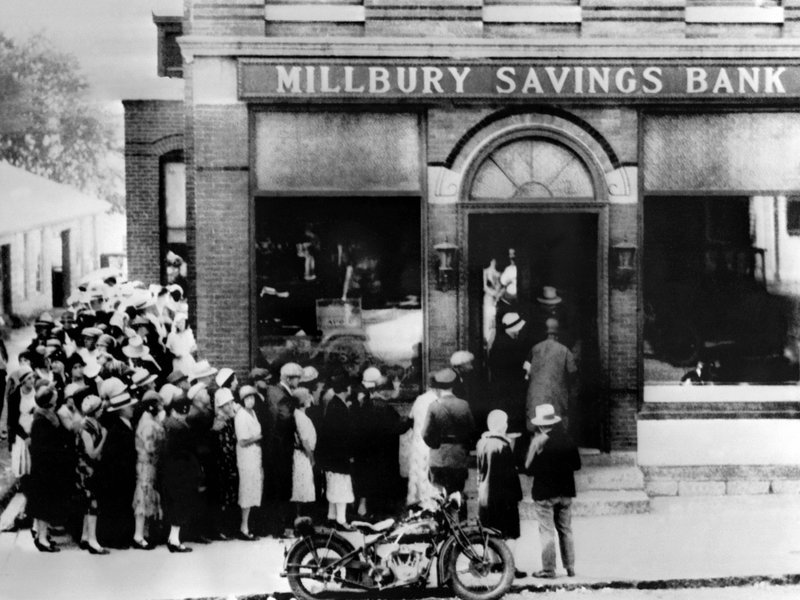

Banks would have to recall debt while trying to fight off a run on the bank, and forcing them to pull money out of investments to cover their debts. All of this leading to downward spirals like the great depression.

Banks would have to recall debt while trying to fight off a run on the bank, and forcing them to pull money out of investments to cover their debts. All of this leading to downward spirals like the great depression.

16/xx

As a country's economic system grows more stable and mature, there is more capital to invest, less risk and so in turn the yield returns drop off. Which means banks have a harder time making money.

So banks began to do two things:

As a country's economic system grows more stable and mature, there is more capital to invest, less risk and so in turn the yield returns drop off. Which means banks have a harder time making money.

So banks began to do two things:

17/xx

1. Expand their investment portfolio to growing/developing nations.

2. Keep some of their cash in foreign currency reserves to hedge against economic collapse regionally.

But, this leaves them with a problem. They need to be able to buy large swaths of foreign currency

1. Expand their investment portfolio to growing/developing nations.

2. Keep some of their cash in foreign currency reserves to hedge against economic collapse regionally.

But, this leaves them with a problem. They need to be able to buy large swaths of foreign currency

18/xx

and because their debts are in their own local currency, it also means they need to be able to redeem the foreign currency as well as sell it quickly if it ever drops below their debt value, all at a commercial scale.

What is a retail bank to do?

and because their debts are in their own local currency, it also means they need to be able to redeem the foreign currency as well as sell it quickly if it ever drops below their debt value, all at a commercial scale.

What is a retail bank to do?

19/XX

Luckily, merchant banks exist and have had a few hundred years of growth making money off of intermingled trade. (That's part of why there are no dedicated exchanger banks left, and they are all under merchant banks like HSBC)

This class of exchanger banks

Luckily, merchant banks exist and have had a few hundred years of growth making money off of intermingled trade. (That's part of why there are no dedicated exchanger banks left, and they are all under merchant banks like HSBC)

This class of exchanger banks

20/xx

has reached a point where they don't operate between two currencies any more, many of them are spread vastly throughout the commonwealth, or Asia or mainland Europe and operate in dozens of different countries.

has reached a point where they don't operate between two currencies any more, many of them are spread vastly throughout the commonwealth, or Asia or mainland Europe and operate in dozens of different countries.

21/xx

They can in turn provide a diverse set of currencies and regional investments to the retail banks, which allows the exchanger bank to make their operations more efficient and profitable.

They can also offer to empower retail banks to offer foreign exchange

They can in turn provide a diverse set of currencies and regional investments to the retail banks, which allows the exchanger bank to make their operations more efficient and profitable.

They can also offer to empower retail banks to offer foreign exchange

22/xx

to emerging classes of retail users such as tourists and multinational businesses, which further adds to the profit and liquidity of the foreign market.

to emerging classes of retail users such as tourists and multinational businesses, which further adds to the profit and liquidity of the foreign market.

23/xx

Over time as travel becomes more ubiquitous and financial borders more opaque, we see other classes like remittances boom in terms of foreign exchange and settlement. Providing more profitable transactions to the world of FX.

Over time as travel becomes more ubiquitous and financial borders more opaque, we see other classes like remittances boom in terms of foreign exchange and settlement. Providing more profitable transactions to the world of FX.

24/XX

When the liquidity of the FX market got large enough, we also began to see some investment banks take billions of dollars in leveraged positions hedging the markets. They trade in FX simply for fractional percentages of profit on multi-billion dollar positions.

When the liquidity of the FX market got large enough, we also began to see some investment banks take billions of dollars in leveraged positions hedging the markets. They trade in FX simply for fractional percentages of profit on multi-billion dollar positions.

25/XX

This class of "liquidity provider" makes the market more efficient, but, they themselves wouldn't have found the FX market useful for hundreds of years, nor would their capital alone have been enough to have a robust global market.

This class of "liquidity provider" makes the market more efficient, but, they themselves wouldn't have found the FX market useful for hundreds of years, nor would their capital alone have been enough to have a robust global market.

26/xx

The global FX market is now robust and autonomous from the exchanger merchant banks where it had its earliest beginnings.

In fact, things have changed so much, that during the COVID market crash in March, FX had its largest volume month this year

The global FX market is now robust and autonomous from the exchanger merchant banks where it had its earliest beginnings.

In fact, things have changed so much, that during the COVID market crash in March, FX had its largest volume month this year

27/XX

And even with trade and travel ground to a halt for a few months after that, the FX market volume hasn't dropped off. It keeps plugging along as there is a robust and profitable market of regional arbitrage to be made.

And even with trade and travel ground to a halt for a few months after that, the FX market volume hasn't dropped off. It keeps plugging along as there is a robust and profitable market of regional arbitrage to be made.

28/XX

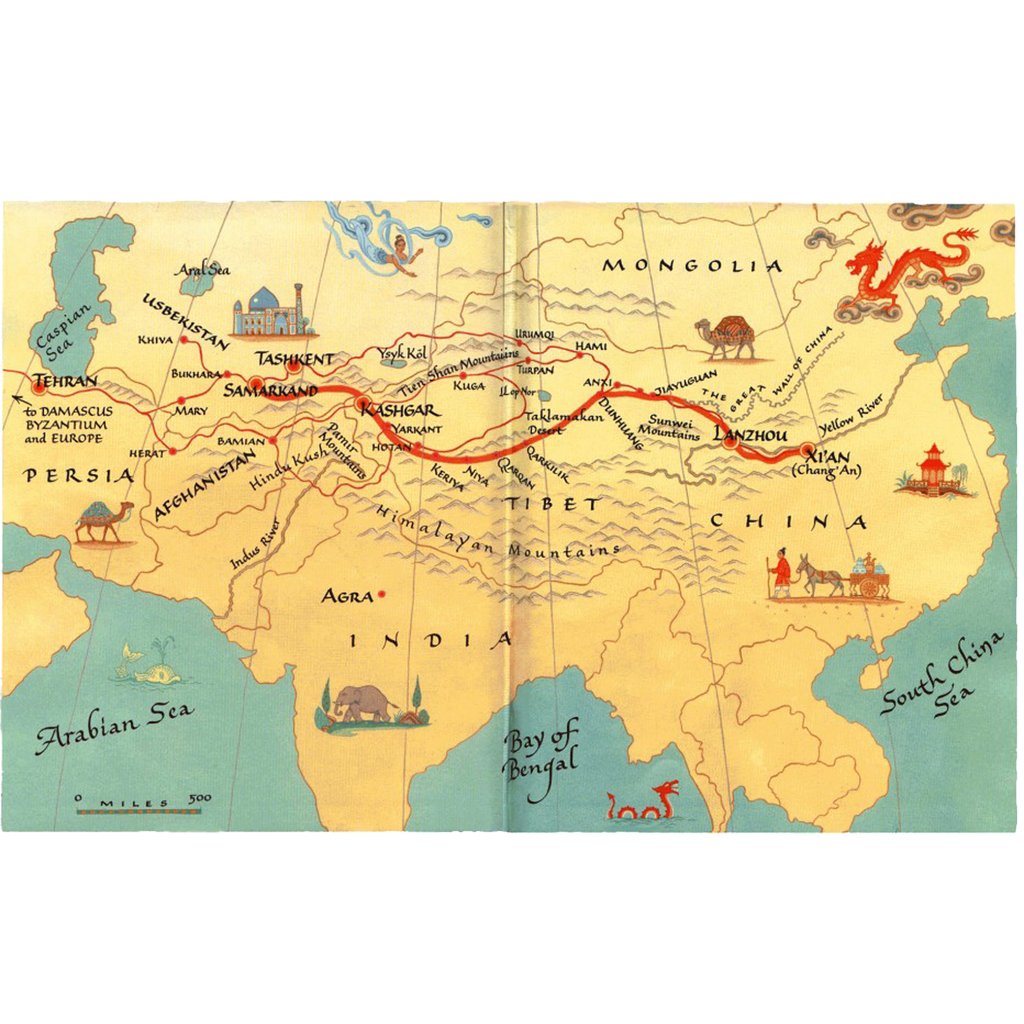

But that market only exists, because once upon a time, people in Britain decided it was super important to get tea and spices from east Asia; and the merchants who built enterprises around that trade had a currency that was regionally trusted and a value proposition

But that market only exists, because once upon a time, people in Britain decided it was super important to get tea and spices from east Asia; and the merchants who built enterprises around that trade had a currency that was regionally trusted and a value proposition

29/xx

That was so lucrative, that it didn't make sense to say no.

The desire for foreign trade has lead us today to a market that does $6.6T/day in turn over, and is now self-reliant.

But it was fueled by a totally different need, different client and different solution.

That was so lucrative, that it didn't make sense to say no.

The desire for foreign trade has lead us today to a market that does $6.6T/day in turn over, and is now self-reliant.

But it was fueled by a totally different need, different client and different solution.

30/XX

A lot of crypto VCs treat crypto like software. "10 year plan, simple vision, software eat the world"

These are the same VCs 10 years in who are asking why crypto hasn't crossed the chasm yet.

A lot of crypto VCs treat crypto like software. "10 year plan, simple vision, software eat the world"

These are the same VCs 10 years in who are asking why crypto hasn't crossed the chasm yet.

31/XX

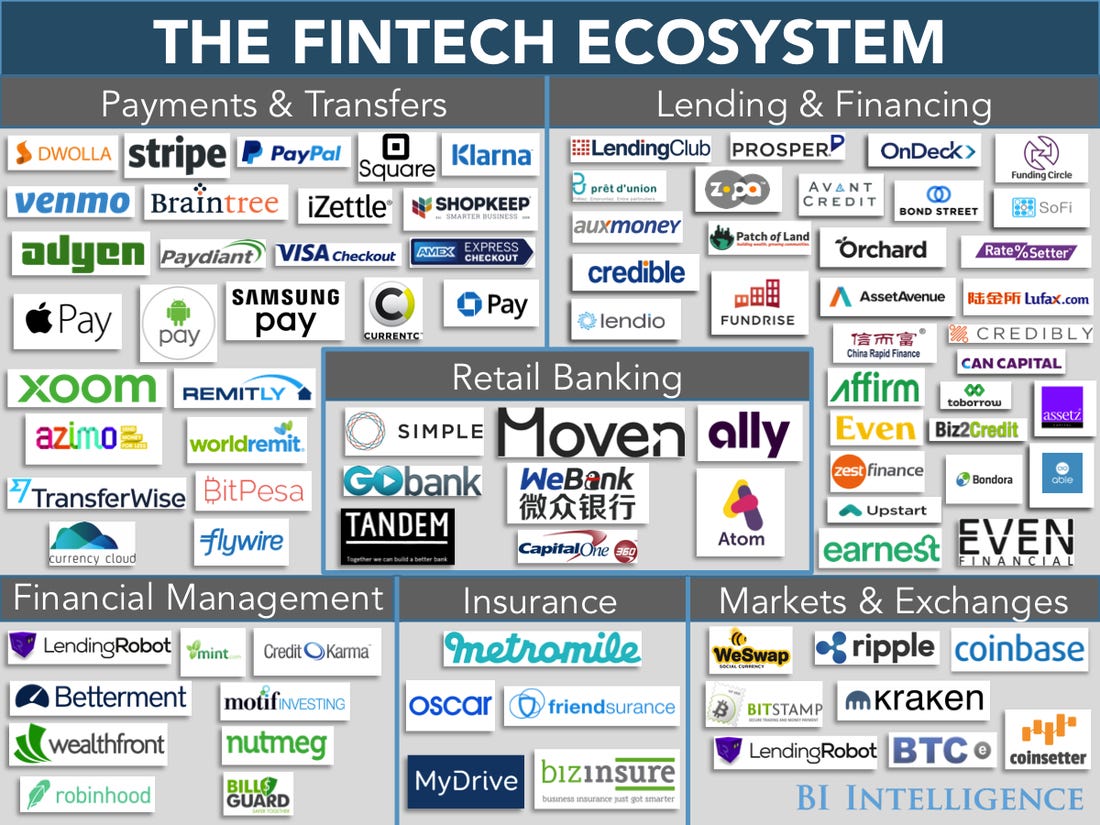

The reality is, when we want to build a robust economic system we aren't likely looking for one customer.

It's an ecosystem of different needs, desires, providers and use cases that needs to get built, and much like our FX market there is probably an intermediary step.

The reality is, when we want to build a robust economic system we aren't likely looking for one customer.

It's an ecosystem of different needs, desires, providers and use cases that needs to get built, and much like our FX market there is probably an intermediary step.

32/XX

Yes, many people will take existing markets like foreign exchange, slap it on a blockchain, make millions and call it a day - but nothing will have fundamentally changed. Wall street will just be running a new tech stack.

Yes, many people will take existing markets like foreign exchange, slap it on a blockchain, make millions and call it a day - but nothing will have fundamentally changed. Wall street will just be running a new tech stack.

33/XX

To build new economic systems, means we need to build new behaviors and bring together new resources, desires and providers before we can ever change that behavior.

To build new economic systems, means we need to build new behaviors and bring together new resources, desires and providers before we can ever change that behavior.

34/XX

So if you are trying to solve a problem in crypto and are feeling that the leap across the chasm is too large - its time to ask yourself, what is the 'tea merchant' for your product.

What is that first version, that addresses one need that you can build on.

So if you are trying to solve a problem in crypto and are feeling that the leap across the chasm is too large - its time to ask yourself, what is the 'tea merchant' for your product.

What is that first version, that addresses one need that you can build on.

35/XX

The reality is that this first product is probably a lot more boring that the long term vision you are going to sell, and the long term vision is too complex for your elevator pitch.

But it's how you build a trillion dollar industry rather than a billion dollar company.

The reality is that this first product is probably a lot more boring that the long term vision you are going to sell, and the long term vision is too complex for your elevator pitch.

But it's how you build a trillion dollar industry rather than a billion dollar company.

36/xx

Jeff Bezo's long term goal was to get to space and when he built a company to fund that vision he started with just one thing - books.

It wasn't his final vision for all he wanted Amazon to be, but it was the way to start the category of online sales.

Jeff Bezo's long term goal was to get to space and when he built a company to fund that vision he started with just one thing - books.

It wasn't his final vision for all he wanted Amazon to be, but it was the way to start the category of online sales.

37/XX

Now of course Amazon is a trillion dollar beast in categories all its own.

Plus, we can't forget the most successful company of all time, a company that was worth 7x the value of Amazon.

Now of course Amazon is a trillion dollar beast in categories all its own.

Plus, we can't forget the most successful company of all time, a company that was worth 7x the value of Amazon.

38/xx

The Dutch East India Company (VOC) which was at its peak worth the equivalent of $7T in today's USD and controlled roughly 0.45% of the world economy.

That doesn't sound like a lot but, if a company had that much of the global economy today, then they'd be worth

The Dutch East India Company (VOC) which was at its peak worth the equivalent of $7T in today's USD and controlled roughly 0.45% of the world economy.

That doesn't sound like a lot but, if a company had that much of the global economy today, then they'd be worth

39/xx

More than $155T.

And what did the VOC do?

Naturally they were an international merchant trader that dealt heavily in both trade and foreign exchange, and eventually become their own self-sovereign country.

More than $155T.

And what did the VOC do?

Naturally they were an international merchant trader that dealt heavily in both trade and foreign exchange, and eventually become their own self-sovereign country.

40/xx

They struggled to raise and grow initially because while people liked the long term vision, they weren't sure of the value of searching for "secret Portuguese trade routes"

You have a choice in crypto products of where to focus.

They struggled to raise and grow initially because while people liked the long term vision, they weren't sure of the value of searching for "secret Portuguese trade routes"

You have a choice in crypto products of where to focus.

41/XX

And sure, focusing on a simple end vision of transacting a product is fine. Building the next $1B company is fine.

Unicorns are nice.

And sure, focusing on a simple end vision of transacting a product is fine. Building the next $1B company is fine.

Unicorns are nice.

Read on Twitter

Read on Twitter