Fed B/S Update

Fed B/S Update Danger, danger will robinhooders!

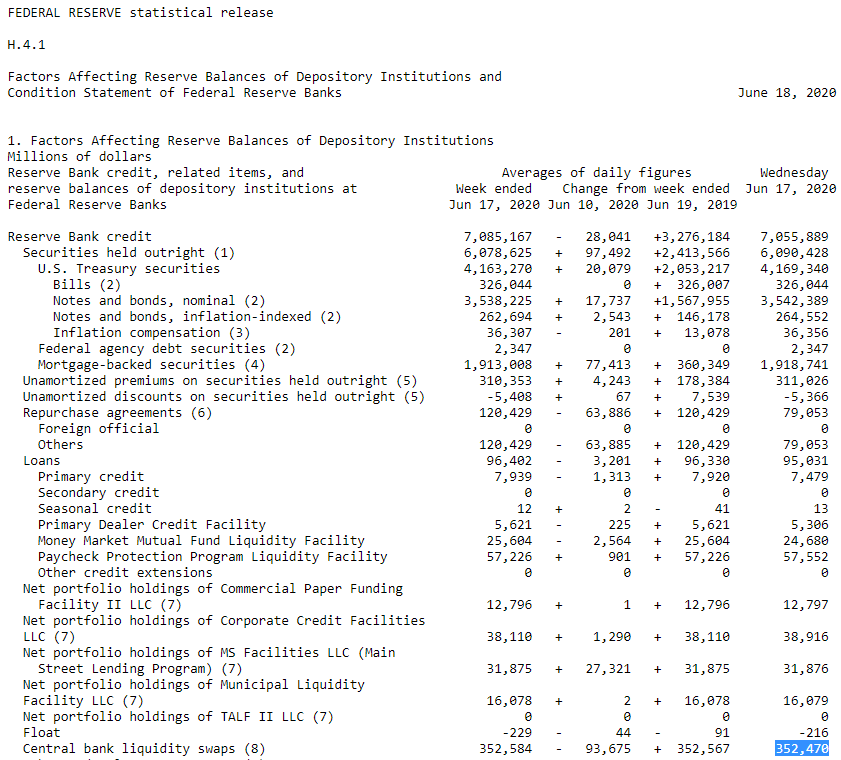

Danger, danger will robinhooders! This week B/S shrunk -$74bn, largest reduction since May 2009 (when it declined by -$100bn). I knew there would be weeks like this! Main reason is a significant decline in usage of the FX swaplines. See interactive guide

1/3 https://twitter.com/federalreserve/status/1273716190335164423

1/3 https://twitter.com/federalreserve/status/1273716190335164423

Repo usage also declined in a big way (basically cut a bit over half to $79bn). Luckily MBS purchases of $83bn hit otherwise the decline in the B/S would have been potentially a new record this week too. The other facilities barely change, we keep getting standard CCF growth. 2/3

Net, what we saw this week was what happened in '09 once liquidity programs began to rolloff resulting in a shrinking of the B/S until they got deep into QE1 buying. Lastly the TGA was topped up again and that plus the reduction in the B/S led to a -$120bn drop in e-reserves! 3/3

Read on Twitter

Read on Twitter