Third edition of our Macroeconomics of COVID in India weekly series with @tulsipriya_rk

#EconTwitter

Macro of Covid needs an unusual federal perspective since our urban areas( growth engines) are Covid hotspots. What may be hotspots of economic recovery amid reverse migration?

#EconTwitter

Macro of Covid needs an unusual federal perspective since our urban areas( growth engines) are Covid hotspots. What may be hotspots of economic recovery amid reverse migration?

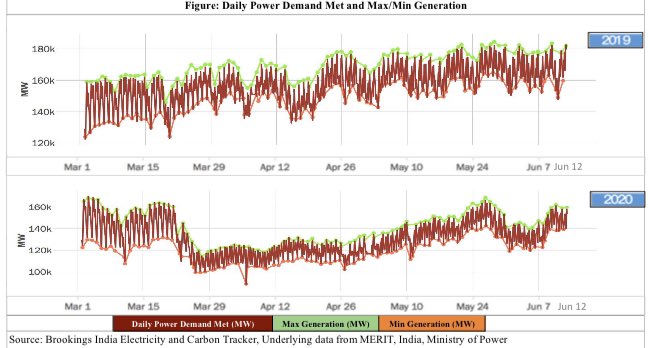

Prior to COVId, power consumptn of majority states was healthy. Moderate improvement from May to June relative to 2019 across all states including COVID hotspots. In second week of June, BHR, JH, SKM and NL show greatest improvement, DNH sharpest YoY contraction @tulsipriya_rk

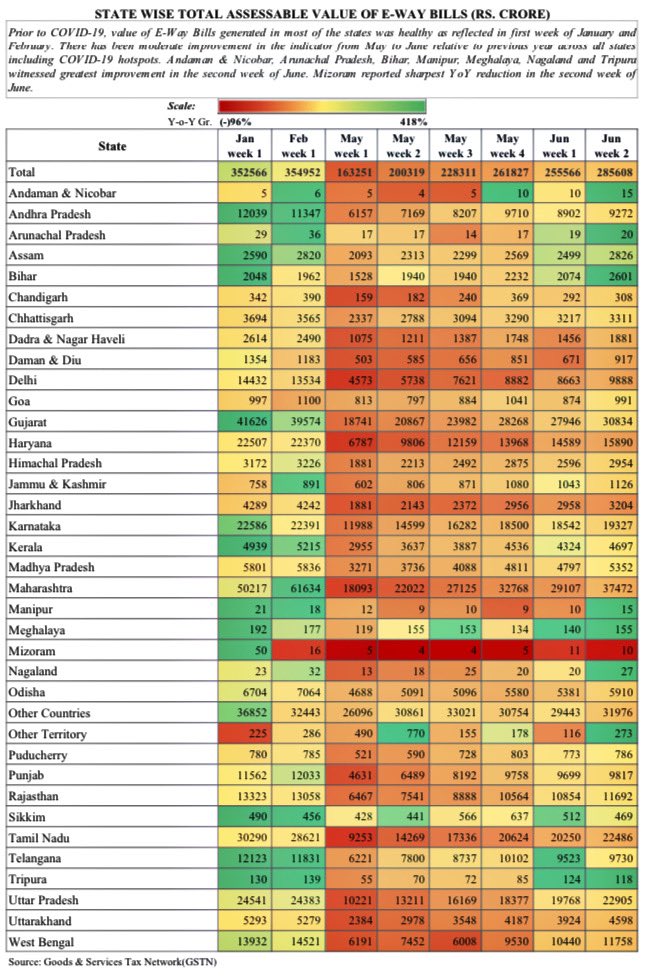

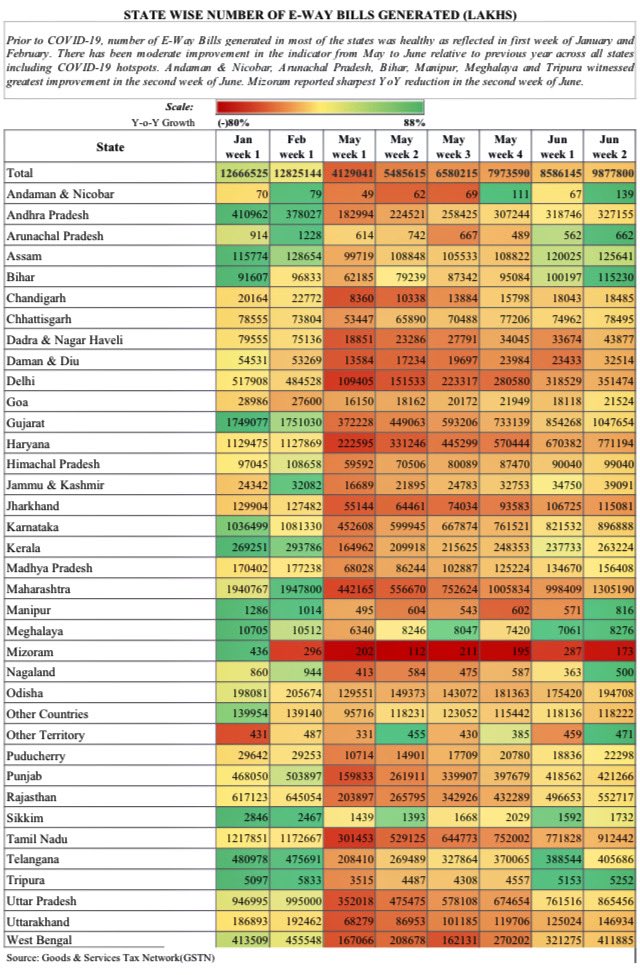

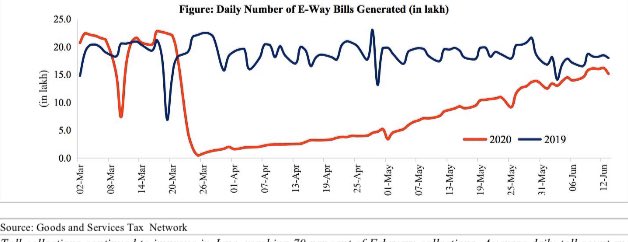

Moderate improvement in number and value of E-Way bills in May across all states including Covid hotspots. In 2nd wk of June, Bihar and many NE states show best improvement. Mizoram sharpest YoY reduction. BHR receiving highest reverse migration, a recovery hotspot? @tulsipriya_rk

While total COVID cases continue to rise, recovery rate remains strong at 50.9%. Growth in active cases fell to 2.05% in the week ending 14th June from 3.95% in the preceding week. @tulsipriya_rk

Electricity generation is gradually approaching pre-lockdown levels; it grew by 5.8% in the week gone by, after recording a deceleration of 10.5% in the first week of June possibly due to relatively cool weather in the first week. @tulsipriya_rk

E-Way bills generated picked up by 196% in May compared to April , though lower than previous year and pre- lockdown levels. They increased by 15% in 2nd week of June over 1st week, inching towards 2019 levels. @tulsipriya_rk

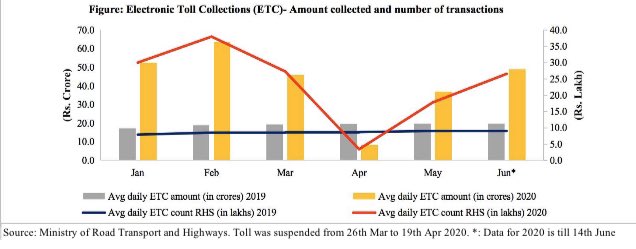

Toll collections continued to improve in June, reaching 70 per cent of February collections. A verage daily toll count and collections increased by 9.6% and 6.35% respectively in the 2nd week of June compared to 1st week. @tulsipriya_rk

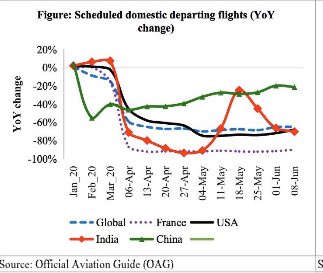

India's domestic aviation activity remained muted in the week gone by, growing at (-)70.2% relative to previous year. @tulsipriya_rk

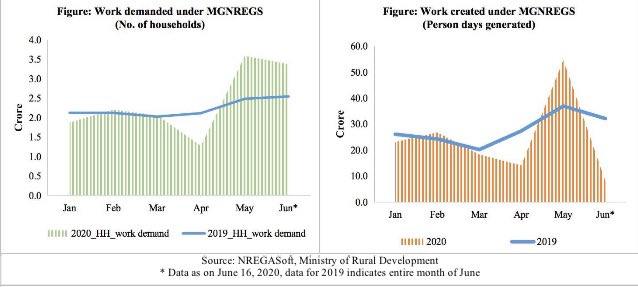

Household demand for MGNREGA work in the first half of June was 3.4 crore, higher than full month demand of previous year, 76.8 crore person days have been generated so far in FY 2020-21 (till June 16). @tulsipriya_rk

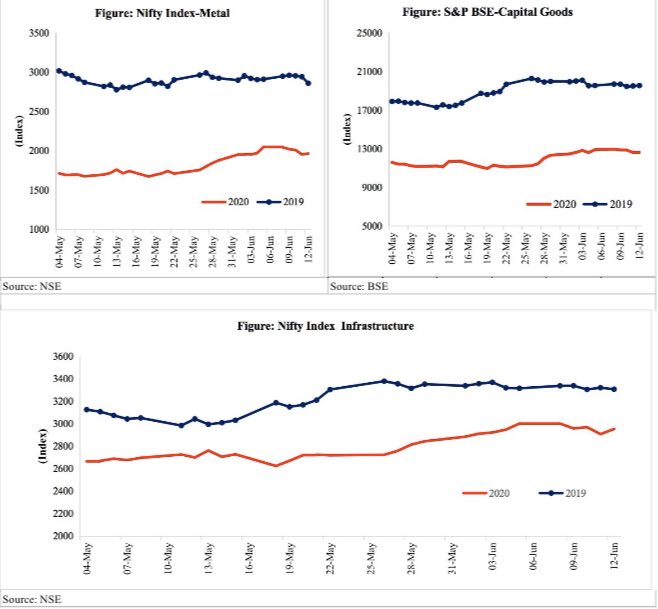

Nifty 50 and Sensex reported losses of (-)1.7% and (-)1.5% respectively in 2nd week of June over 1st week amid fear of resurgence of COVID @tulsipriya_rk

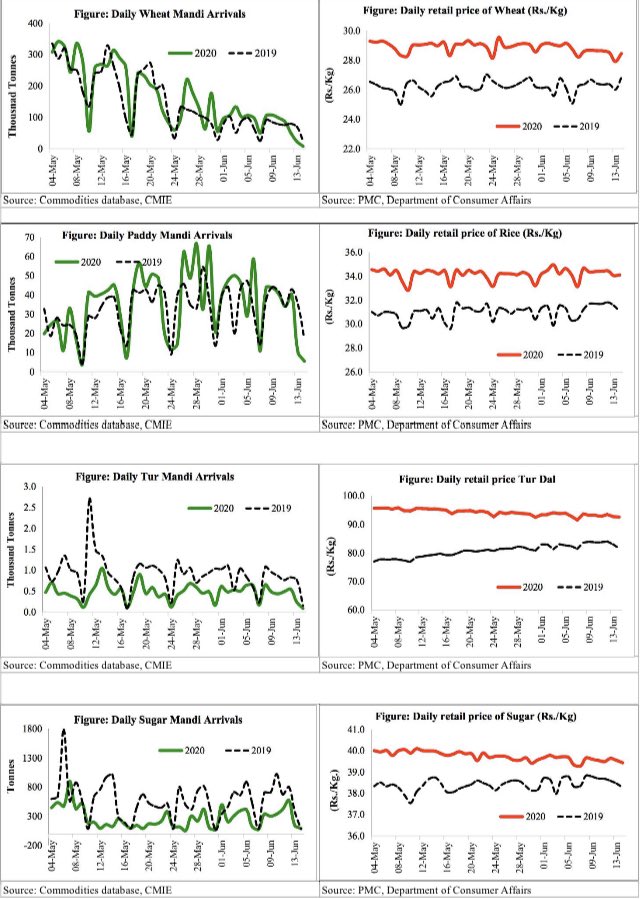

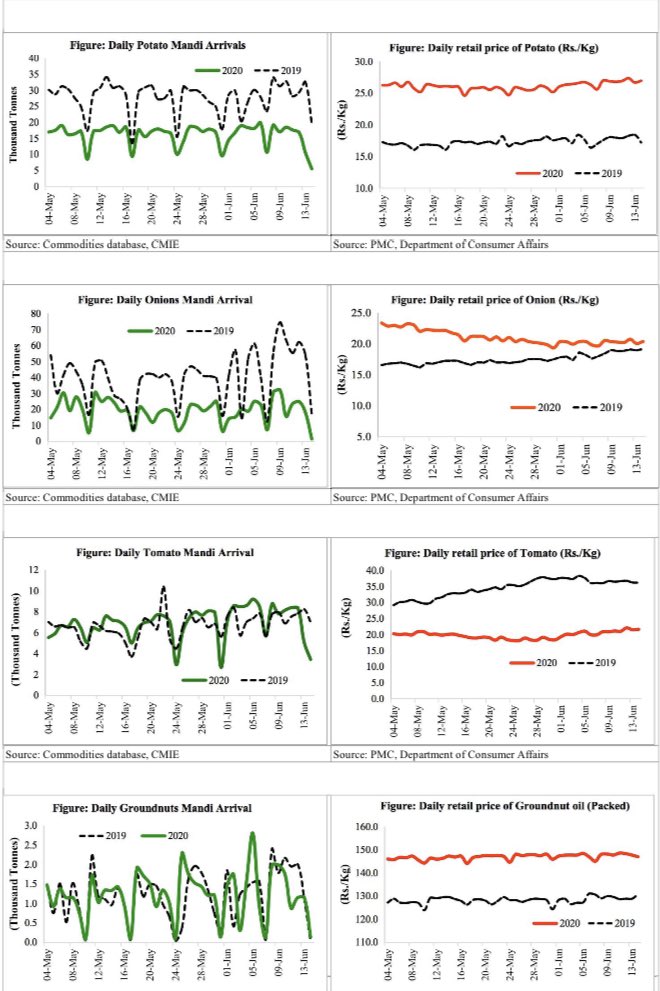

Though Mandi arrivals of major essential agricultural commodities dropped in the week gone by, most of them indicated convergence to 2019 levels except for tomato, onion and potato. Retail prices remained elevated in the week gone by. @tulsipriya_rk

Forex reserves crossed half a trillion mark as on 5th June. Rupee marginally depreciated in the week gone by. FPI witnessed net inflows, both in equities and debt last Friday after mid week sell-offs. @tulsipriya_rk

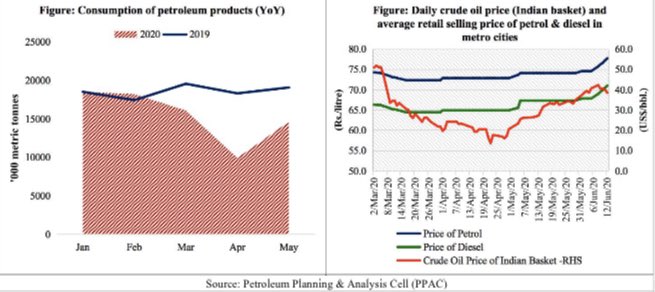

Petroleum consumption increased by 47.4% in May over April, reaching 77% of previous year levels. India's crude oil price dropped by 5.5% in the week gone by.Prices of petrol and diesel increased by 4.2% and 4.7% respectively. @tulsipriya_rk

While India's gold imports increased in May over April, Y oY contraction was 98.4%. Gold futures price increased by 1.7% in the week gone by. @tulsipriya_rk

Vehicle registrations increased by 180% in the first half of June over May, with greatest pick up seen in Motor cycle/S cooters.Consumptn and FMCG equity indices fell by 2.1% and 1.3% respectively in the week gone by, tracking global fear of second COVID wave. @tulsipriya_rk

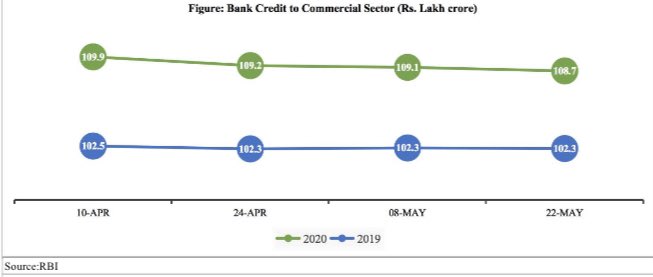

Growth of bank credit to commercial sector low at 6.3% (YoY ) in the fortnight ending 22nd May,compared to 6.5% in the previous fortnight.Metal equities fell by 4.1% in the wk. with rising COVID cases in China. K goods & infra equities fell by 4.5% & 1.6%rspctvly @tulsipriya_rk

Banks continued to park funds in RBI’s reverse repo,low risk appetite.Avg daily net absorptn rose to Rs4.8 lakh crore in week ending 7 June, relative to Rs3.9 lakh crore in previous http://week.Call money rate fell and at 40 bps below repo on 5th June. @tulsipriya_rk

Read on Twitter

Read on Twitter