With people discussing systemic racism and what to do about it, I'm sharing a short story & request regarding the most egregious example I've had the displeasure of getting to know a lot about, which is the tax foreclosure situation in Detroit & Wayne County. #IllegalForeclosures

I'm very respectfully tagging some state & gov leadership in this thread including @GovWhitmer & @LtGovGilchrist, encouraged by @ProfAtuahene & the @illForeclosures coalition who are asking for a task force to review the continued over-assessment of property taxes in Detroit.

For context, @ProfAtuahene recently published this op-ed in the @nytimes on Predatory Cities and the over-assessments in Detroit: https://www.nytimes.com/2020/06/11/opinion/coronavirus-cities-property-taxes.html . No doubt none of us want to see Detroit or Michigan be predatory. This is a time to review and end predatory practices.

For my own part, this is an open letter I wrote to @GovWhitmer and @LtGovGilchrist in January 2019 titled Profiting from Property Distress: A Letter To Governor Whitmer Concerning Michigan’s Predatory Tax Foreclosure & Delinquent Property Tax System: https://medium.com/@jerry_63003/a-letter-to-governor-whitmer-concerning-michigans-tax-foreclosure-and-delinquent-property-tax-5300e445c2a

It's so easy to get lost in all the details of Michigan's tax foreclosure law and how it's executed, so I'll try to keep this thread simple and focused on providing just enough information to help show why a task force or formal government review is warranted.

First, there is a major profit motive for keeping property tax assessments too high and not making it easier for people to pay on time. Wayne County has made hundreds of millions of dollars from interest on late payments on over-assessed taxes & auction sales it can spend freely.

Due to Michigan's Delinquent Tax Revolving Fund system, cities like Detroit get paid the taxes they assess even when property owners don't pay them. At that point the County becomes the debt collector, raking in interest while claiming it has no responsibility for assessing taxes

Since the first tax foreclosure auction in Detroit back in 2002, 150,000-some Detroit properties have been auctioned including more than 50,000 occupied homes (for some context, there are 55,000 properties in Flint total). The majority have been since Detroit's bankruptcy.

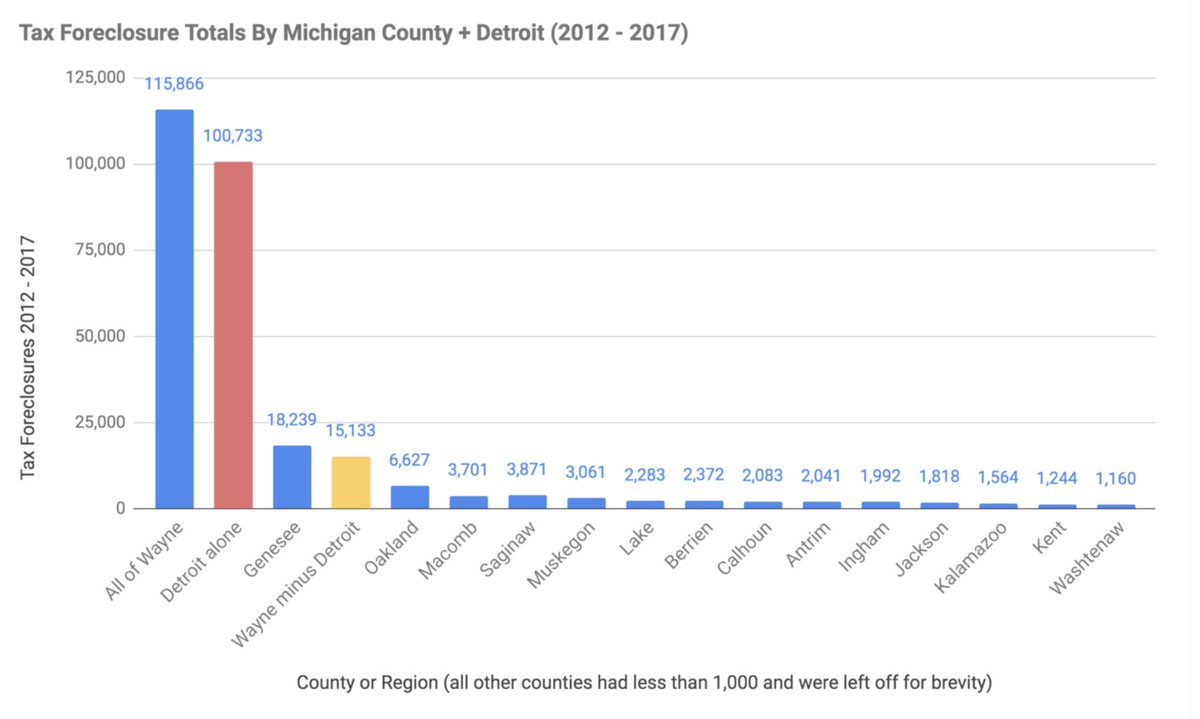

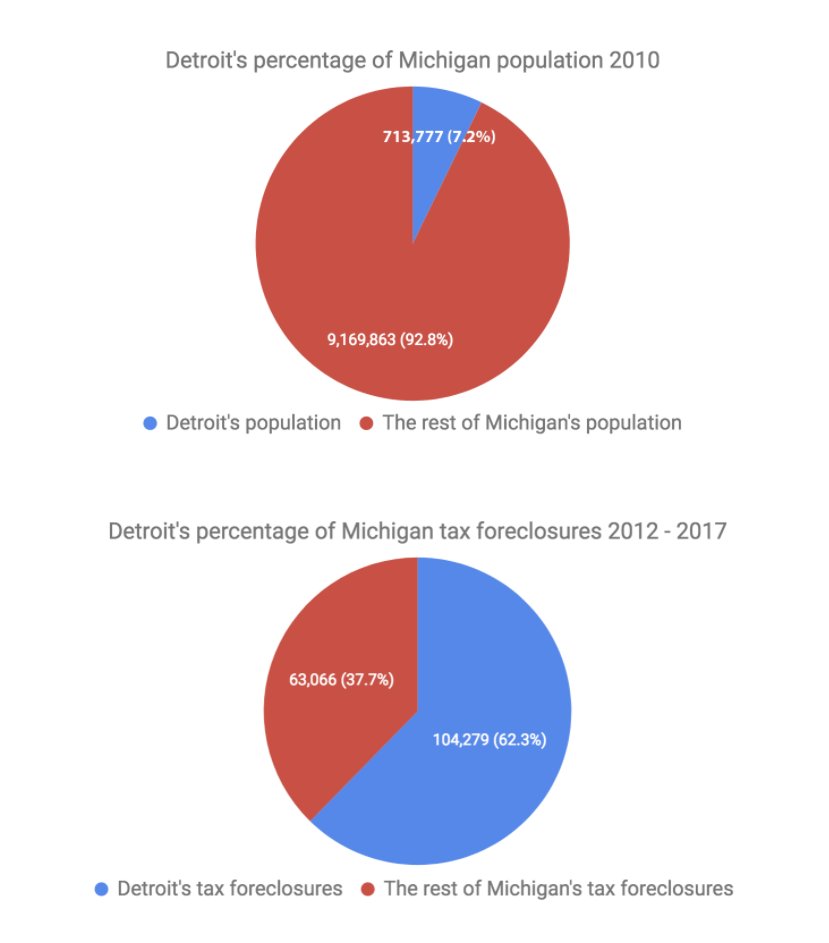

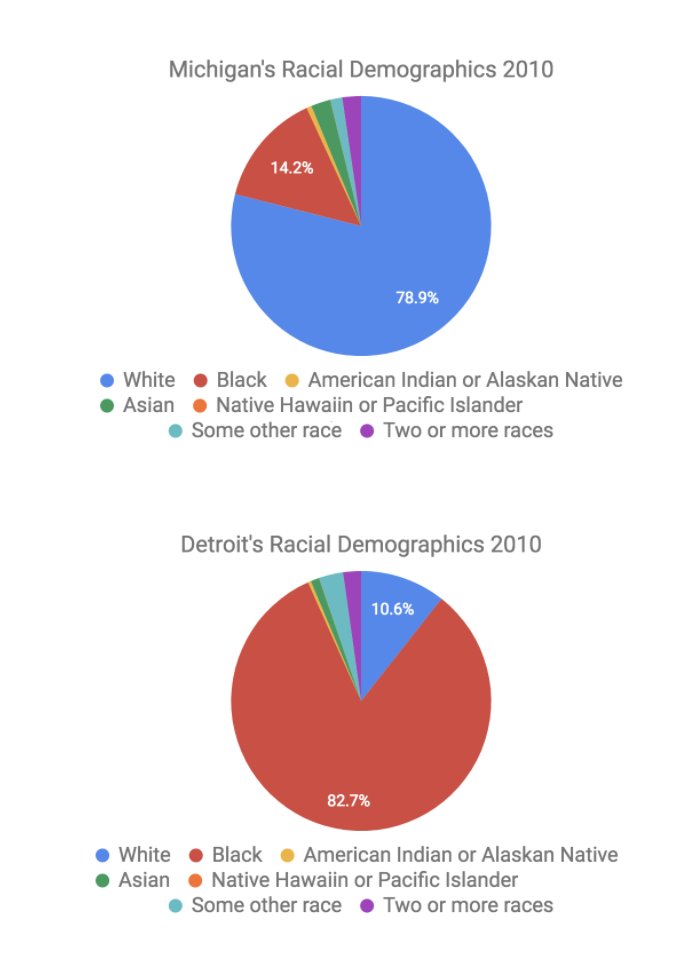

If you want to look at how this compares to the rest of the state in tax foreclosure totals and demographics, according to state data, from 2012 - 2017 62% of Michigan's tax foreclosures happened in Detroit which only has 7% of the state's population and is 80% Black.

By searching Detroit tax foreclosure in the news it's not hard to find a whole range of problems with how things have been conducted, from lack of proper notice to selective enforcement to lack of access to poverty exemptions, to ethical conflicts, to overall deleterious effects

Lastly, it is almost impossible to get real answers out of the Wayne County Treasurer's Office about how things function and how they make decisions, and it's uncomfortable as a citizen to get deeper answers from the city. You can tell that this is sensitive and no one is proud.

For these reasons and more, please consider a formal task force to review and get to the bottom of what has been happening with tax foreclosure, tax assessment, & related policies. A population overtaxed by $600 million while losing homes deserves as much: https://www.detroitnews.com/story/news/local/detroit-city/housing/2020/01/09/detroit-homeowners-overtaxed-600-million/2698518001/

I share this thread with all the respect in the world and hope that it's not too late to muster willpower. cc @GovWhitmer @ZackPohl @MIEubanks @gregbird @jen_flood_ @LaidlawEmily @MarkTottenMI @LtGovGilchrist @stephanielily @Adamant4Detroit @SenatorSantana @BullockSenator

cc @BettyJeanAlex @repyancey @JoeTate02 @RepCAJohnson @GarrettLatanya @DetroitEducator @KayLyme @Statereplove10 @CouncilmanTate @RoyMcCalisterJr @Scottinthe3rd @CouncilmnSpivey @L_Arreguin @Ayers4Detroit @IAmBrendaJones

Thank you all. I'm fully aware it's not always fun to be tagged on Twitter while busy with other things. I simply tagged you in this thread to bring your attention to this issue. Y'all are cool with me, and I hope this is an issue you decide to lean into. Thank you and peace.

Read on Twitter

Read on Twitter