Lawmakers should tap their rainy day funds to preserve spending in state budgets that supports families and state economies in a time of crisis. Not doing so will likely make the #COVID19 recession both longer and worse. A thread. / 1 https://www.cbpp.org/blog/3-reasons-why-states-should-tap-rainy-day-funds-now

The pandemic has shut down large sectors of the economy, and that means state tax revenues are way down. We estimate total shortfalls of $615B over the next 3 years. / 2 https://www.cbpp.org/research/state-budget-and-tax/states-continue-to-face-large-shortfalls-due-to-covid-19-effects

Tapping rainy day funds can help lessen COVID-19’s health and economic harm and help states focus their responses on the hardest-hit people and communities and achieve an equitable recovery. / 3 https://www.cbpp.org/research/state-budget-and-tax/3-principles-for-an-anti-racist-equitable-state-response-to-covid-19

Many more people are now relying on economic security programs like health care, food assistance, and cash assistance than in good economic times. Rainy day funds can help ensure these supports are available to families that need them. / 4 https://ccf.georgetown.edu/wp-content/uploads/2020/05/Medicaid-and-COVID-final.pdf

The fastest measures states often take — like drastic budget cuts — can deepen and prolong recessions while further raising barriers to prosperity for low-income people and people of color. Rainy day funds can allow time for more equitable solutions. / 5 https://www.cbpp.org/research/state-budget-and-tax/states-need-significantly-more-fiscal-relief-to-slow-the-emerging-deep

Finally, rainy day funds keep money circulating through the state’s economy. They minimize layoffs and furloughs for first responders, teachers, health care workers, and others who are especially needed during the pandemic. / 6

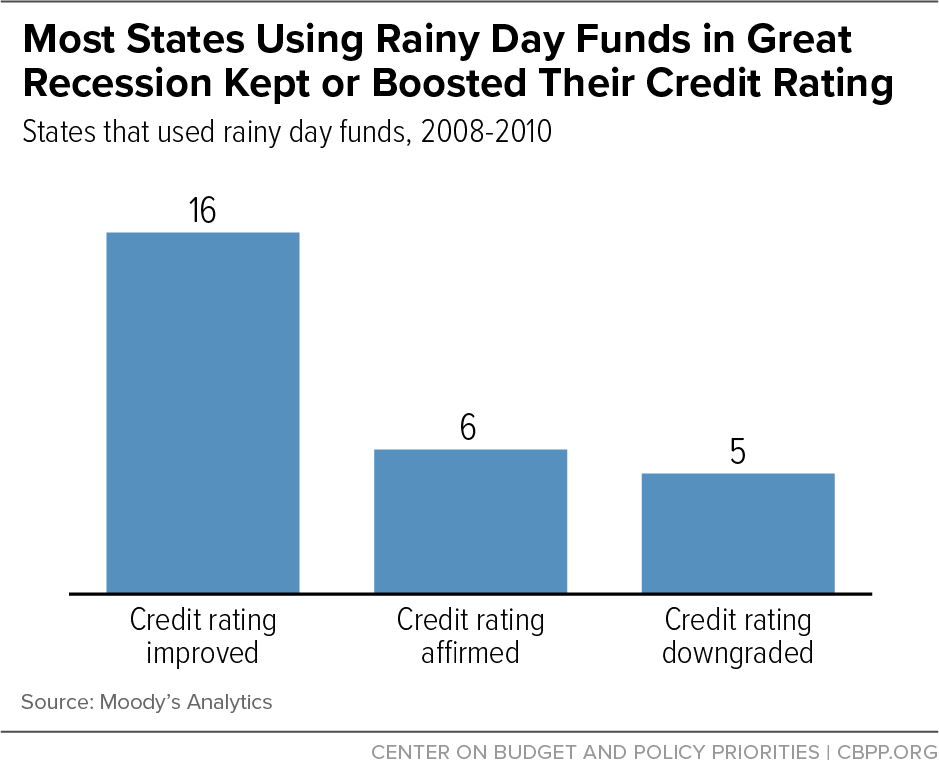

State rainy day funds are at record highs and tapping these funds likely won’t harm states’ bond ratings or ability to borrow. / 7 https://www.pewtrusts.org/en/research-and-analysis/articles/2020/03/18/states-financial-reserves-hit-record-highs

Credit rating agencies generally expect states to draw on the funds during a recession or natural disasters. Forty states tapped their funds from 2008 to 2010 in response to the recession, but only five suffered a credit downgrade from Moody’s Analytics during that time. / 8

Never using a rainy day fund is equivalent to not having one. States risk very little by tapping those funds, which were designed for an emergency like the #COVID19 pandemic. Doing so will move states closer to achieving an equitable recovery that extends to all people. / 9

Read on Twitter

Read on Twitter