The correlation between Bitcoin & S&P500 gets a lot of attention, & rightfully so.

It's a big reason why $BTC is so attractive to hold in a portfolio.

This is largely because $BTC has been UNcorrelated to other asset classes for it's entirety.

Thread https://twitter.com/100trillionUSD/status/1273202818476892160?s=20

https://twitter.com/100trillionUSD/status/1273202818476892160?s=20

It's a big reason why $BTC is so attractive to hold in a portfolio.

This is largely because $BTC has been UNcorrelated to other asset classes for it's entirety.

Thread

https://twitter.com/100trillionUSD/status/1273202818476892160?s=20

https://twitter.com/100trillionUSD/status/1273202818476892160?s=20

What is correlation?

The strength of a linear relationship between two variables.

For our situation, the relationship between the returns of $BTC vs stocks.

The strength of a linear relationship between two variables.

For our situation, the relationship between the returns of $BTC vs stocks.

Bitcoin has been UNcorrelated almost it's entire life.

This makes sense for a few reasons:

•Different factors driving the valuation of a company vs a new form of money

•Less people/institutions own Bitcoin relative to how many own stocks

•The risks associated are different

This makes sense for a few reasons:

•Different factors driving the valuation of a company vs a new form of money

•Less people/institutions own Bitcoin relative to how many own stocks

•The risks associated are different

Correlation is measured with a coefficient between 1 & -1 which signal a strong positive relationship or a strong negative relationship.

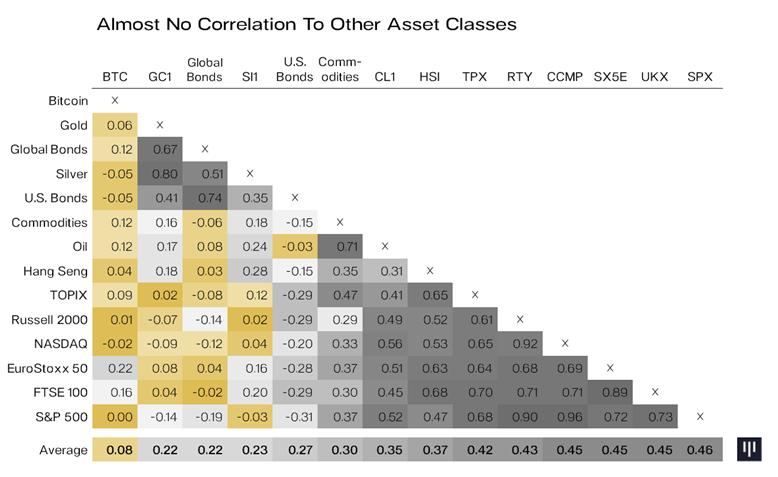

Here's how $BTC stacks up vs every asset for the last 3 years:

• 0 corr to S&P

• .08 avg corr to all other asset classes

Here's how $BTC stacks up vs every asset for the last 3 years:

• 0 corr to S&P

• .08 avg corr to all other asset classes

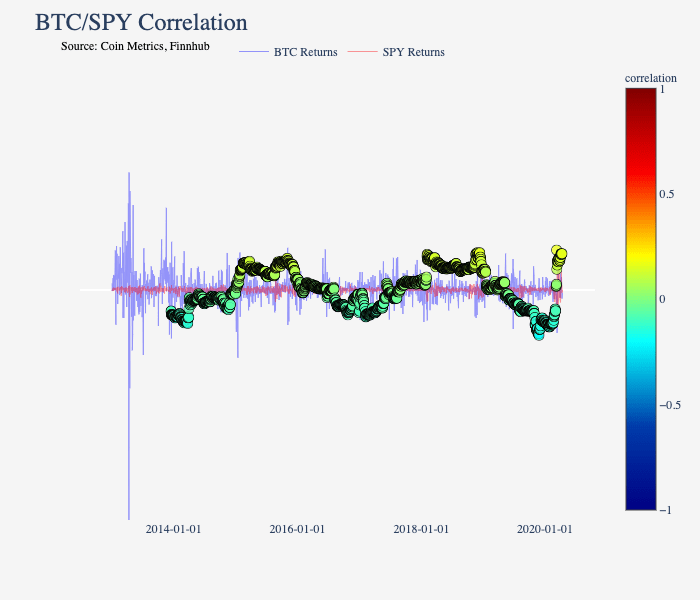

Another way to visualize the how Bitcoin's correlation has oscillated from little-to-no correlation with stocks is to look at how it has evolved over time.

This chart shows 2014-present.

Not a negative corr. Not a positive corr.

Movement from little-to-no corr the entire time.

This chart shows 2014-present.

Not a negative corr. Not a positive corr.

Movement from little-to-no corr the entire time.

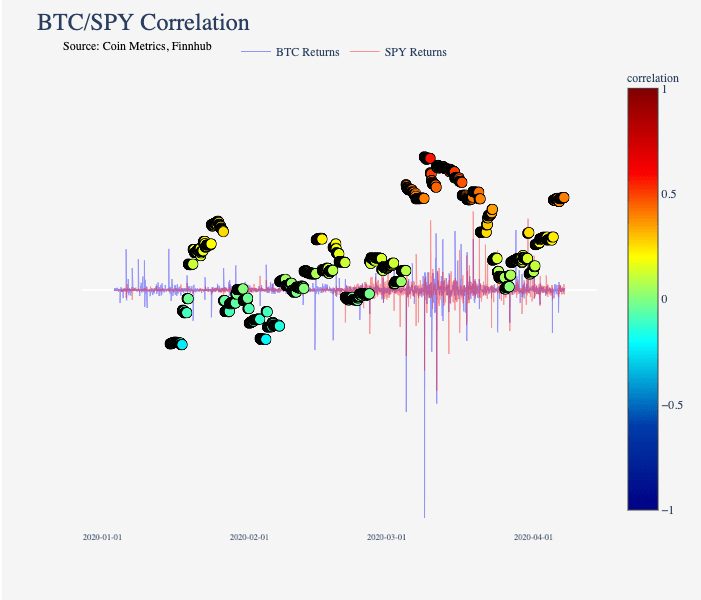

Now, if you zoom in to this year, correlation is slightly higher between the two.

The peak was around March 12th as all "risky" assets sold off together.

(likely reason: In a crisis everything sells off together as the driving force behind that decision is dominated by fear)

The peak was around March 12th as all "risky" assets sold off together.

(likely reason: In a crisis everything sells off together as the driving force behind that decision is dominated by fear)

Now you're probably scratching your head.

Are they uncorrelated like they've been for the majority 5+ years??

Or are they correlated because the chart for both goes up & to the right??

Are they uncorrelated like they've been for the majority 5+ years??

Or are they correlated because the chart for both goes up & to the right??

This is where a little nuance enters the thread.

$BTC & stocks have shown higher correlation recently, at times trading tick-by-tick with each other.

The way I approach this is summarized well by

@AlamedaTrabucco: https://twitter.com/AlamedaTrabucco/status/1272598330418188289?s=20

$BTC & stocks have shown higher correlation recently, at times trading tick-by-tick with each other.

The way I approach this is summarized well by

@AlamedaTrabucco: https://twitter.com/AlamedaTrabucco/status/1272598330418188289?s=20

TLDR:

•Bitcoin & S&P have been largely uncorrelated for years

•The corr moves from slightly positive/negative but mostly near zero

•During panics it will be highly correlated (like everything else)

•Corr has been at all time highs lately, which is not the norm

•Bitcoin & S&P have been largely uncorrelated for years

•The corr moves from slightly positive/negative but mostly near zero

•During panics it will be highly correlated (like everything else)

•Corr has been at all time highs lately, which is not the norm

Things can change but it's reasonable to expect correlation between $BTC & stocks to remain somewhat uncorrelated (despite recent times).

Which is great btw! This makes $BTC incredibly attractive in a portfolio.

Why?

I'll leave you with this from my convo with

@AriDavidPaul:

Which is great btw! This makes $BTC incredibly attractive in a portfolio.

Why?

I'll leave you with this from my convo with

@AriDavidPaul:

Read on Twitter

Read on Twitter