11 Reasons I will sell a stock:

1: Thesis busted / I made a mistake

I was wrong on the moat $GRUB

Outside forces matter more than I thought $KMI

Management can't execute $TRIP

Brand deteriorates $UA

Company is being disrupted

1: Thesis busted / I made a mistake

I was wrong on the moat $GRUB

Outside forces matter more than I thought $KMI

Management can't execute $TRIP

Brand deteriorates $UA

Company is being disrupted

3: Mega-acquisition I don't like

Big acquisitions tend to destroy value and distract management

AOL / Time Warner = poster child

Relative size of biz is important.

$100 billion biz buys a $3 billion biz = OK.

$4 billion biz buys a $3 billion biz = big deal

Big acquisitions tend to destroy value and distract management

AOL / Time Warner = poster child

Relative size of biz is important.

$100 billion biz buys a $3 billion biz = OK.

$4 billion biz buys a $3 billion biz = big deal

4. Thesis complete with no compelling second act

The company achieves the mission (hooray!) but no second biz line to drive growth

Hard to judge, but if organic rev growth falls below ~5%, I'll move on

Why I sold $AAPL 2 years ago https://www.fool.com/investing/2018/06/10/10-reasons-why-im-selling-all-of-my-apple-stock.aspx

The company achieves the mission (hooray!) but no second biz line to drive growth

Hard to judge, but if organic rev growth falls below ~5%, I'll move on

Why I sold $AAPL 2 years ago https://www.fool.com/investing/2018/06/10/10-reasons-why-im-selling-all-of-my-apple-stock.aspx

5. Culture Deterioration

Glassdoor rating plunge

Mass management exodus

Leadership transition isn't working out

Glassdoor rating plunge

Mass management exodus

Leadership transition isn't working out

6. Extreme valuation compared to the opportunity

Very high valuation + lots of room to run = OK

Very high valuation + running out of room to grow = watch out

Very high valuation + lots of room to run = OK

Very high valuation + running out of room to grow = watch out

7. Too Large of a position for me

I'm OK w/ 15% of my port being in amazing, low risk business like $MA / $AMZN

For an amazing, high-risk business like $TSLA, I'll cap it at 10%

I'm OK w/ 15% of my port being in amazing, low risk business like $MA / $AMZN

For an amazing, high-risk business like $TSLA, I'll cap it at 10%

9. Company acquired

If a company gets bought out and it has a high likelihood of going through, I sell

I don't like it when this happens. I'd rather own a compounder for years instead of getting a 1-time gain.

If a company gets bought out and it has a high likelihood of going through, I sell

I don't like it when this happens. I'd rather own a compounder for years instead of getting a 1-time gain.

10. I need the money for my personal life

Major purchase on the horizon (car, home repair, vacation) and I want to use stock gains to pay for it

Major purchase on the horizon (car, home repair, vacation) and I want to use stock gains to pay for it

11. Tax-loss harvesting

I'll sell losers that I've lost confidence in to lower my tax bill

I'll sell losers that I've lost confidence in to lower my tax bill

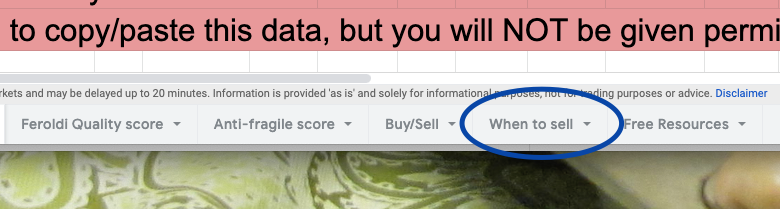

All of these 'rules' are in the "when to sell" tab of my public spreadsheet

https://docs.google.com/spreadsheets/d/1y8quPLqAwNsBGvNUrJuMTqVwz-P59ms1A8ZDLE8Dc24/edit?usp=sharing

https://docs.google.com/spreadsheets/d/1y8quPLqAwNsBGvNUrJuMTqVwz-P59ms1A8ZDLE8Dc24/edit?usp=sharing

What did I miss?

When do you sell?

When do you sell?

Read on Twitter

Read on Twitter