The Federal Reserve is now deep into its “Socialism For The Rich” phase.

A thread. 1/n https://twitter.com/CNBCnow/status/1272589931941109764

A thread. 1/n https://twitter.com/CNBCnow/status/1272589931941109764

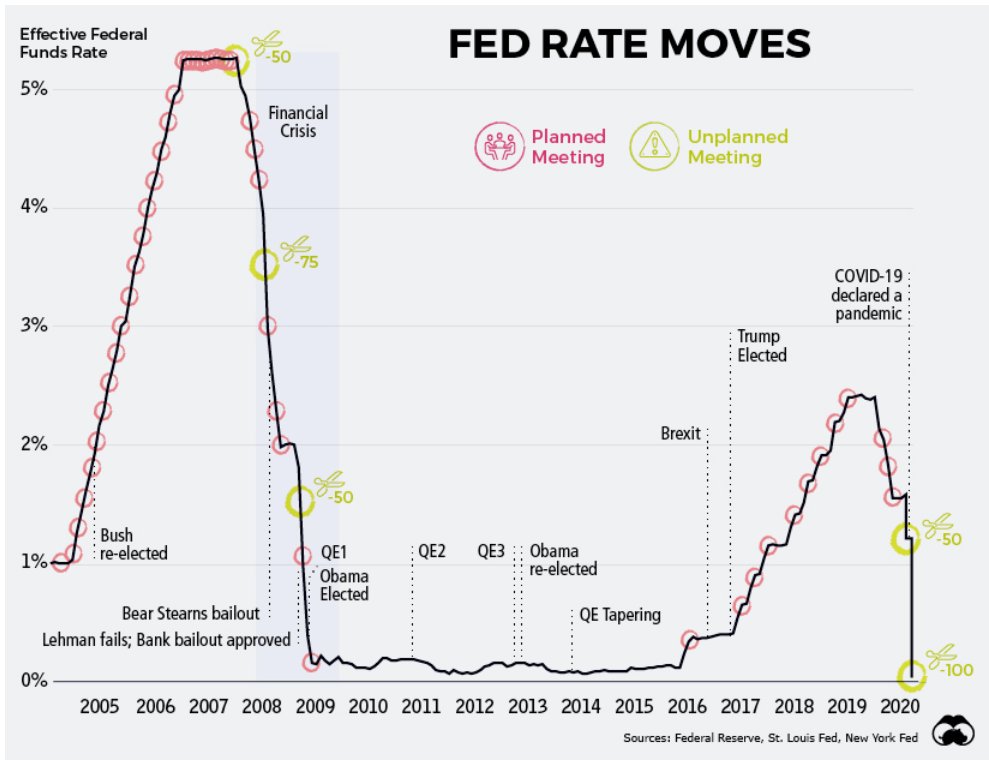

The bailouts after the GFC in 2008-09 and the near zero interest rates for the last 11 years, have basically created an incentive structure that rewards the largest corporations in the US to be reckless by borrowing as much as possible. /1

With money being freer than free, large corporations went on a borrowing spree by issuing new debt (corporate bonds) to buyback their own shares and leaving little free cash flow for a rainy day. This of course have made the executives and other shareholders very very rich. /2

Afterall, they know the Fed is going to bail them out, when the recession eventually hits. This coupled with the index investing phenomenon driven by young retail investors, led to one of the largest stock market rallies in decades. /3

All this while, the number of zombie companies in the US have kept rising. These are companies that have taken on so much credit, that they cannot even service their existing debts anymore. /4 https://twitter.com/Schuldensuehner/status/1271048836631461890?s=20

The biggest beneficiaries from this rally in equities are of course the top 25% of wealthy individuals, and they own a majority of financial assets. With Fed now buying corporate debt, this completes the cycle of charade. /5

Read on Twitter

Read on Twitter