1/n

Let’s talk about Tesla Warranty Reserves (WR). Q seems to think Tesla is massively under-reserving for future warranty expenses with too little WR, increasing margins and net income along the way. Mark says they are overstating income by $200 million a quarter!

Let’s talk about Tesla Warranty Reserves (WR). Q seems to think Tesla is massively under-reserving for future warranty expenses with too little WR, increasing margins and net income along the way. Mark says they are overstating income by $200 million a quarter!

He and others quote examples in Montana’s articles disingenuously. Montana himself says “Are those the actual numbers at work with Tesla? No.” Revenue, CoGS and Warranty numbers in this thread are pulled from each company’s 10-k.

2/n

2/n

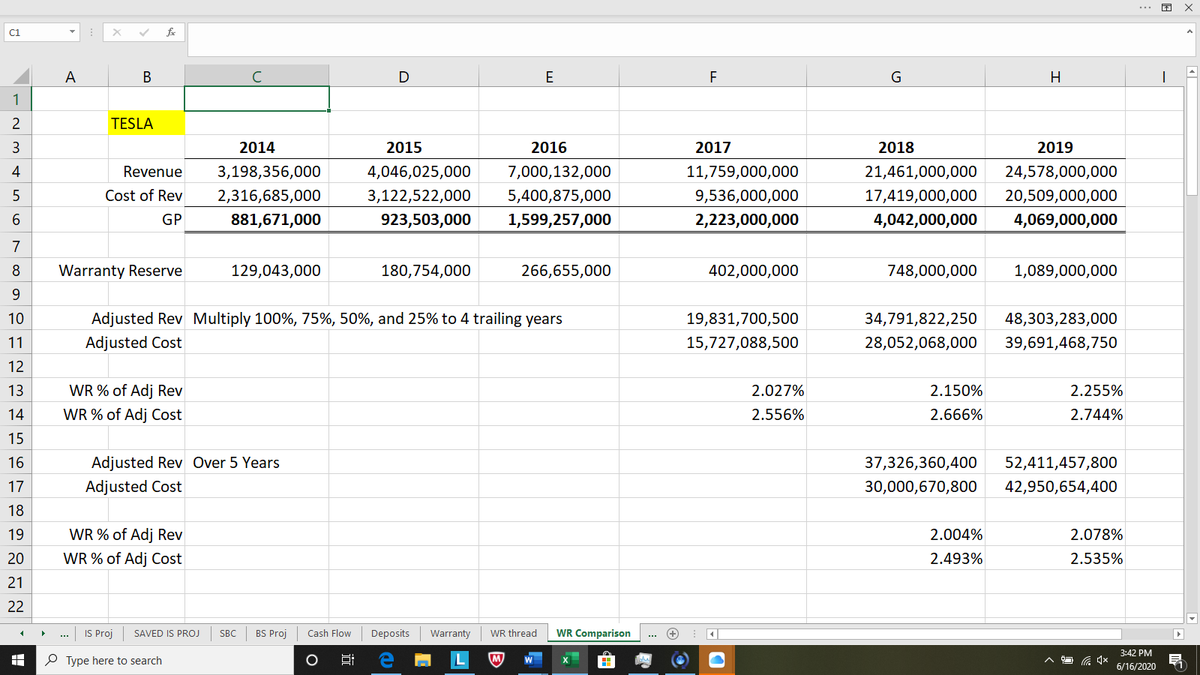

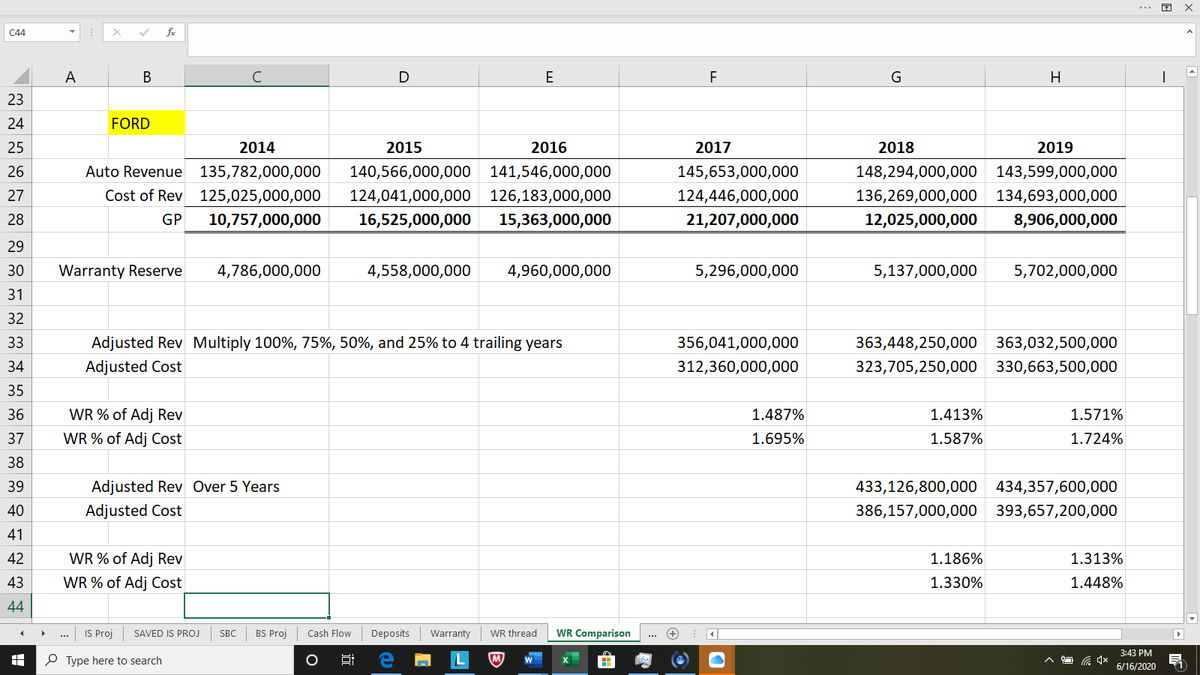

I wanted to have a relatively simple formula for tracking WR that allows for both watching Tesla trends over time (are they becoming more aggressive or more conservative, etc.) and lends itself to comparative analysis with other automakers.

3/n

3/n

In simple terms, WR is the total amt the corp expects to spend on warranty work for all products currently under warranty. Leased vehicles are not included in the reserve. Lease warranty work is expensed as performed, matching the lease income being recognized over its term.

4/n

4/n

Note that WR is an estimate. There is no way for any company, especially not a manufacturer of products as complicated as automobiles, to have a perfect WR. I am not here to say Tesla’s WR is perfect. I am here to say it seems reasonable to me.

5/n

5/n

I am also only looking at the reserve at year ends. Some quarters may be higher or lower and I wanted to keep this as simple as possible. No need to argue why one quarter is higher than normal or lower than normal when annual amounts balance out the quarters.

6/n

6/n

I measure WR as a % of adjusted Cost of Goods Sold (CoGS). Not using Sales as corps may change pricing. I don’t think those price changes should affect the WR. Others measure $ per car, but w/different models at different prices, this doesn’t seem reasonable to me, either.

7/n

7/n

A percentage of the manufacturing costs seems most reasonable to me. As warranties are utilized over time, I have chosen to look back over a 5 year period. I am adjusting CoGS by the following percentages: 100% current year, 80%, 60%, 40%, and 20% to fifth year.

8/n

8/n

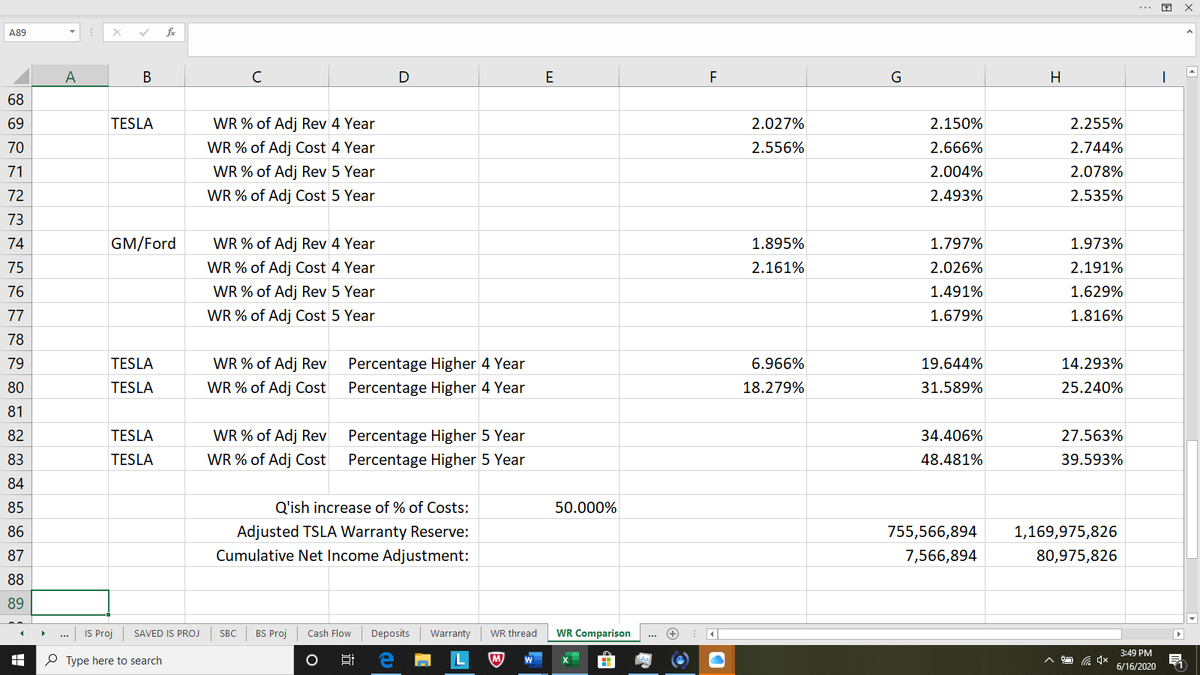

I have also included 4 year (100%, 75%, 50%, 25%) spreads as well as percentages of revenue if you like. Note that both GM and Ford seemed to reduce their reserves in 2018 as Tesla continued to increase theirs.

9/n

9/n

% of Adjusted CoGS over 4 year periods (2017, 2018, 2019)

Tesla – 2.556%, 2.666, 2.744

GM – 2.627, 2.464, 2.658

Ford – 1.695, 1.587, 1.724

14/n

Tesla – 2.556%, 2.666, 2.744

GM – 2.627, 2.464, 2.658

Ford – 1.695, 1.587, 1.724

14/n

Same data over 5 year periods (2018 & 2019):

Tesla – 2.493%, 2.535

GM – 2.027, 2.184

Ford – 1.33, 1.448

15/n

Tesla – 2.493%, 2.535

GM – 2.027, 2.184

Ford – 1.33, 1.448

15/n

Many in Q will comment on their anecdotal evidence of poor manufacturing quality. Tesla is a younger company pushing the bounds of technology. I’ll say that’s a reasonable assumption. How much more? I don’t know for sure, but I think 25% is reasonable.

16/n

16/n

At an attempt to answer my critics, let’s see how much net income would be impacted by having Tesla reserve 50% more than the average of GM and Ford. Note that Mark and others claim hundreds of millions PER QUARTER in overstated net income.

17/n

17/n

Here are averages for GM and Ford over those periods along with how much higher Tesla exceeds those rates. Also note that if Tesla were to have reserved at a 50% higher rate, their net income would have been overstated (CUMULATIVELY through 2018) by only $8 million.

18/n

18/n

Due to GM & Ford increasing in 2019, Tesla would have only overstated NI by $81mil(for all their existence). I’m not saying I think they overstated income due to WR, I’m saying even if Q is right abt an overstatement, it is orders of magnitude less than $100s of mil per qtr.

19/n

19/n

I'm not disregarding warranty repairs as being expensed as goodwill repairs. I'm sure there are some that go through there, just as I'm sure there are at other manufacturers, too. If this was a major hole, to me, the net loss in services would continue to inc as sales grew.

20/n

20/n

Thank you for reading … look forward to your comments.

21/21

21/21

Read on Twitter

Read on Twitter