Let’s shake a table

Bitcoin

Ethereum

Cryptocurrency

By now you must have heard someone tell you to invest in Bitcoin, Ethereum or another cryptocurrency. Before you put your money there, quickly read this thread.

First off, I need to clarify that this thread is about actual

Bitcoin

Ethereum

Cryptocurrency

By now you must have heard someone tell you to invest in Bitcoin, Ethereum or another cryptocurrency. Before you put your money there, quickly read this thread.

First off, I need to clarify that this thread is about actual

cryptocurrency trade. I’ve seen this trend about this “Ethereum trade” that you have to invite people to get profit. That is NOT cryptocurrency trade. That is very likely a Ponzi scheme and that’s not what this thread is about. Now that that’s out of the way, let’s go into the

real gist. What are cryptocurrencies, a case of Bitcoin, notable mention of Ethereum, should you invest in them and tips for investing in cryptocurrencies.

What is a cryptocurrency? In simple terms, cryptocurrency is a type of virtual money. It works like normal money e.g.

What is a cryptocurrency? In simple terms, cryptocurrency is a type of virtual money. It works like normal money e.g.

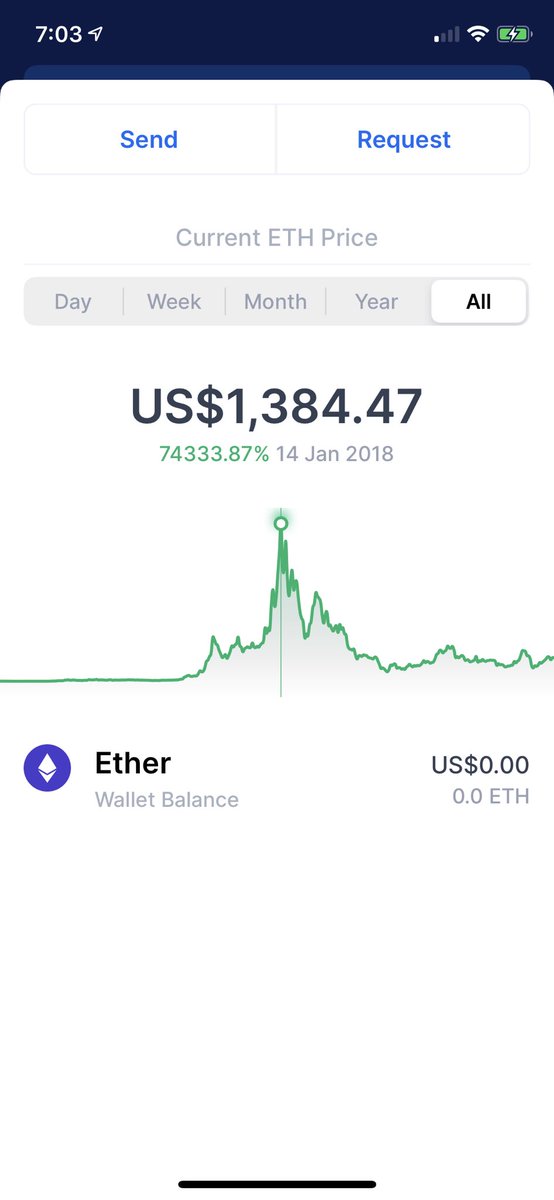

naira, pounds, dollars etc. but it has no physical substance. Unlike your normal money, you cannot carry it in notes or coins. Some would argue that Bitcoin peaked in late 2017 – early 2018. With Bitcoin price at over $17,000 in December 2017 and till date, it still has not

reached that price and Ethereum price at $1,300 in January 2018.

To help you better understand how cryptocurrency prices work, think of it like buying a share in a company. Among several other things, the share price is determined by the demand and supply for that share. The

To help you better understand how cryptocurrency prices work, think of it like buying a share in a company. Among several other things, the share price is determined by the demand and supply for that share. The

same thing for cryptocurrency. If a lot of people start buying Ethereum, then the price of Ethereum would rise and if a lot of people sell their Ethereum without a larger number of people looking to buy, then the price of Ethereum would fall.

Since cryptocurrencies are not

Since cryptocurrencies are not

issued/regulated by any government, this means that there is a lot of room for price manipulations. There have been cases in the past where large corporations dump a large amount of their cryptocurrency (thereby causing the price of that cryptocurrency to fall) and later buying

back that cryptocurrency at the fallen price and causing the price to rise again so they can sell at a high price and make a lot of profit in the process.

These price manipulations cannot really happen with shares because there are heavy regulations for the stock market but

These price manipulations cannot really happen with shares because there are heavy regulations for the stock market but

with cryptocurrency, the laws are still a bit murky so it allows some corporations to profit from this.

Cryptocurrencies can be very unstable.

Bitcoin (BTC)

Bitcoin or BTC is the oldest and most expensive cryptocurrency that is commonly considered as digital gold. Like actual

Cryptocurrencies can be very unstable.

Bitcoin (BTC)

Bitcoin or BTC is the oldest and most expensive cryptocurrency that is commonly considered as digital gold. Like actual

gold, BTC is mined; just not physically. The process of BTC mining is pretty intricate and really isn’t the point of this thread but what you need to know is this, when a new block of BTC is mined, the miner receives additional BTC as rewards. Like gold, the creators made BTC

made BTC have a fixed supply of 21 million units. Currently, about 18 million units of BTC are in circulation and at the current rate, it is estimated that the last unit of BTC would be mined in the year 2140. So, in our lifetime, the supply of BTC should continue to increase.

By now you might be thinking, if there are only 3 million Bitcoin that are yet to be mined, why is it estimated to take about 120 years before the last BTC would be mined when it only took 11 years since when BTC was created in 2009 for 18 million units to be mined?

If you’ve

If you’ve

been doing any research around BTC in the last 2 months, you would have heard of something called “Bitcoin halving”. If you don’t already know, well here’s what that means.

Remember when I said that BTC miners receive additional Bitcoin as rewards when they mine new Bitcoin?

Remember when I said that BTC miners receive additional Bitcoin as rewards when they mine new Bitcoin?

Well the halving is simply a reduction in the BTC rewards given when new BTC is mined by half. The halving was programmed to occur after ever 210,000 blocks of Bitcoin have been mined. It is estimated that a new block of Bitcoin is mined every 10 minutes which means that the

halving event occurs every 4 years. every 10 minutes which means that the halving event occurs every 4 years.

In 2009, the reward for mining Bitcoin was 50 BTC for every block mined. In 2012 when the 1st halving occurred, the reward was halved to 25 BTC. In 2016 it was reduced

In 2009, the reward for mining Bitcoin was 50 BTC for every block mined. In 2012 when the 1st halving occurred, the reward was halved to 25 BTC. In 2016 it was reduced

to 12.5 BTC and in May 2020 it is now at 6.25 BTC. The more halvings we have, the less BTC would be mined thus increasing the amount of time before all the BTC will be mined. Also, the creators of BTC made it in such a way that the more BTC is mined, the more difficult it is to

mine new BTC, also reducing the speed at which new BTC can be mined.

If you already knew about the halving before reading this thread, you might have heard that after the halving, Bitcoin price would rise but that hasn’t happened yet, why is that?

Well, I believe the answer

If you already knew about the halving before reading this thread, you might have heard that after the halving, Bitcoin price would rise but that hasn’t happened yet, why is that?

Well, I believe the answer

lies in demand & supply. Since the halving, you would notice that immediately BTC price reaches $10,000 the price falls to around $8-9k, why? Because miners who already mined BTC before the halving are offloading their inventory whenever they see the price hits $10k. If you look

at the charts, you would notice that the supply of bitcoin increases sharply once BTC hits $10k and reduces once it falls below that price. Simple principle of demand & supply: when the price rises, the supply rises as well but since the demand is not increasing at the same time

as quickly as the price rises, the price would fall to reflect the fact that there are many sellers and limited number of buyers.

Eventually, these miners’ stock would run out and speculators estimate that when this happens, this would allow the post halving price rally that

Eventually, these miners’ stock would run out and speculators estimate that when this happens, this would allow the post halving price rally that

you’ve been hearing so much about.

If you Google Bitcoin predictions, you would find some people predicting the price would get up to $100,000 $200,000 or even $300,000 for 1 BTC in the next 6-12 months. Whose report shall you believe? The truth is, no one truly KNOWS for a

If you Google Bitcoin predictions, you would find some people predicting the price would get up to $100,000 $200,000 or even $300,000 for 1 BTC in the next 6-12 months. Whose report shall you believe? The truth is, no one truly KNOWS for a

fact what the price would be. All the predictions are just that, predictions.

A number of the predictions seem to be based on some reasons like BTC is outperforming the stock markets; institutional adoption of BTC is growing and of course the simple principle of demand & supply

A number of the predictions seem to be based on some reasons like BTC is outperforming the stock markets; institutional adoption of BTC is growing and of course the simple principle of demand & supply

Since the supply of BTC has reduced due to the halving, as long as the demand remains constant, the price should at the very least increase but if the predicted increase in demand by people the “cryptoverse” refer to as “Bitcoin Hodlers” (which are people that buy BTC to hold it

instead of selling it) actually happens, the price might actually rise significantly.

The thing with predictions is the more predictions you have, the higher your likelihood of being correct so when people tell you that their previous predictions have turned out to be right,

The thing with predictions is the more predictions you have, the higher your likelihood of being correct so when people tell you that their previous predictions have turned out to be right,

take that with a pinch of salt. There are so many positive predictions to convince you to buy today but before you buy, consider evaluating the facts and thinking of it on your own. Do you think 1 unit of a currency would suddenly become so popular that people would be willing to

spend the equivalent of a house just to buy it? How likely do you think that is to happen?

Ethereum (ETH)

The new messiah investment that most people are pushing on WhatsApp. Most of the ones I’ve seen on WhatsApp where you get money for referring people aren’t really Ethereum

Ethereum (ETH)

The new messiah investment that most people are pushing on WhatsApp. Most of the ones I’ve seen on WhatsApp where you get money for referring people aren’t really Ethereum

trading. That’s more like a Ponzi scheme. If you buy a cryptocurrency, you should only get the number of units you paid for and sell what you have. There’s no bonus for inviting people.

The recent excitement around Ethereum is a bit difficult to ignore. ETH was initially

The recent excitement around Ethereum is a bit difficult to ignore. ETH was initially

released in 2015. If you check the price history, you would see that there was a time when it was trading at $1,300 but as at the time I am writing this, it is trading at $230

Without getting too technical about the definition, I’ll just say this, ETH is like Bitcoin only that

Without getting too technical about the definition, I’ll just say this, ETH is like Bitcoin only that

it does not have a halving event and it does not have a fixed supply.

Tips for cryptocurrency investment

1. Like every other investment, strive to understand it before putting your money in it. Cryptocurrencies are high risk and complex investments but not too complex that you

Tips for cryptocurrency investment

1. Like every other investment, strive to understand it before putting your money in it. Cryptocurrencies are high risk and complex investments but not too complex that you

cannot understand. Read articles online or Watch YouTube videos. Most of what you need to know is available online for free.

2. Don’t invest any amount you you are not willing to lose. As I said, the price of cryptocurrency is very unstable. One day it can increase by $1,000 and

2. Don’t invest any amount you you are not willing to lose. As I said, the price of cryptocurrency is very unstable. One day it can increase by $1,000 and

the next week it can reduce by $4,000. When such things happen, you can get scared, sell out of panic and end up losing a lot of money only to discover next month that the currency has recovered. When you invest money that you are willing and ready to lose, it allows you to be

patient and calm when the storms come trust me, the storms WILL come.

3. Don’t invest out of FOMO. Like I said at the start, there seems to be this excitement about cryptocurrencies that comes around every few months. Don’t get carried away. Like I said in this tweet, there are https://twitter.com/JE_dna/status/1264104256593899520

3. Don’t invest out of FOMO. Like I said at the start, there seems to be this excitement about cryptocurrencies that comes around every few months. Don’t get carried away. Like I said in this tweet, there are https://twitter.com/JE_dna/status/1264104256593899520

many opportunities to make money in this life. If you don’t do one, you will not die. Invest only in what you understand and what you are comfortable with and not because you are scared you will miss out on an opportunity to “cash-out”.

4. The best investment strategy is to buy

4. The best investment strategy is to buy

and hold. Invest for the long term and because this is the best investment strategy, don’t just pick ANY cryptocurrency that you see is gaining traction especially if you are a beginner. You might end up as a late buyer and you might just end up losing. See the price of Ethereum

in Jan 2018, over $1,300 and today it’s just a few hundred dollars or Bitcoin in Dec 2017 at over $17,000 and today it’s still hasn’t reached that amount. Imagine if you had bought Ethereum/Bitcoin when it was at that price expecting it to keep rising and now, years later you

still haven’t recovered half of your money. That would just be an unfortunate situation.

5. If you MUST jump on any new happening cryptocurrency that is showing 200% returns in 1 week, have a strategy for it and RESIST THE URGE TO BE GREEDY. Know when to take your win and go.

5. If you MUST jump on any new happening cryptocurrency that is showing 200% returns in 1 week, have a strategy for it and RESIST THE URGE TO BE GREEDY. Know when to take your win and go.

Don’t get too excited by the gains. If your goal was to make $1,000; as soon as you make that amount, don’t let greed make you stay. Stop, critically think about whether you should wait to see if you would make more money or just take your win and go

Depending on who you ask,

Depending on who you ask,

some would say cryptocurrency is a façade, it’s not an investment because it’s not backed up by any asset. Others would say it’s the “messiah of investments”, “the future of money”. I’m somewhere in the middle. I don’t necessarily think ALL cryptocurrencies are fake and I don’t

have sufficient reasons to believe it’s the future of money or the messiah. I think it could be a good investment opportunity to consider for those who are willing to put in the work to understand it.

But at the end of the day, before you invest in something, ask yourself;

But at the end of the day, before you invest in something, ask yourself;

“WHAT DO I THINK?” It doesn’t matter what your friend, family or some random person on the internet thinks, based on what you know, what do you think? Like I said on the thread, cryptocurrencies are very unstable. There are a lot more stable investments that you can do and still

get decent returns. You can check my pinned thread for more info about those platforms or send me a DM. My DMs are always open for SERIOUS discussion. Don’t just send “hi” or “hello”, follow up immediately with why you are sending a DM and you’ll be sure to get a response ASAP.

Read on Twitter

Read on Twitter