Today I want to share my (working) mental model for thinking about valuation...

(Warning: this thread is slightly math-y)

THREAD: A FRAMEWORK FOR THINKING ABOUT VALUATION

THREAD: A FRAMEWORK FOR THINKING ABOUT VALUATION

(Warning: this thread is slightly math-y)

THREAD: A FRAMEWORK FOR THINKING ABOUT VALUATION

THREAD: A FRAMEWORK FOR THINKING ABOUT VALUATION

1/ Valuation is a tough concept and until about a year ago, I never quite knew how to go about it. So I started with the basics...

I buy a stock at price “P1” and sell it at price “P2”

(For the sake of simplicity, we will assume no dividends/share repurchases)

I buy a stock at price “P1” and sell it at price “P2”

(For the sake of simplicity, we will assume no dividends/share repurchases)

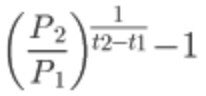

2/ How do I calculate my annual return? It’s a simple formula determined by my holding period “T”

For example: If I buy $AAPL stock at $100 and sell it for $200 5 years later, my annual return is: (200/100)^(1/5)-1=~15%

For example: If I buy $AAPL stock at $100 and sell it for $200 5 years later, my annual return is: (200/100)^(1/5)-1=~15%

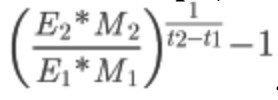

3/ But prices are just multiples of earnings right? A stock trading at $100 is simply it’s EPS of $5 multiplied by a P/E of 20.

So we can represent P1 and P2 by their earnings, “E1” and “E2”, multiplied by some multiple, “M1” and “M2”...

So we can represent P1 and P2 by their earnings, “E1” and “E2”, multiplied by some multiple, “M1” and “M2”...

4/ We have now given our return equation a variable we can measure and predict, EARNINGS! We are getting closer...

Okay simple enough, but we still don’t know the key variables driving our returns. Here I realized “hey, E2 and E1 are RELATED!”

How?

Okay simple enough, but we still don’t know the key variables driving our returns. Here I realized “hey, E2 and E1 are RELATED!”

How?

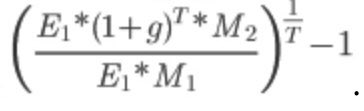

5/ E2 is simply E1 GROWING at an average rate (let’s call it “g”) over your holding period, “T”. In other words...

E2 = E1 * (1+g)^T

For example: EPS of $5 growing at 10% per year becomes 5*(1.1)^5= $8 in 5 years...

E2 = E1 * (1+g)^T

For example: EPS of $5 growing at 10% per year becomes 5*(1.1)^5= $8 in 5 years...

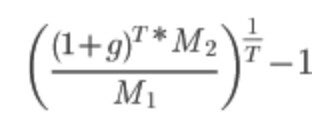

6/ Do you see what we can do here? We have “E1 “ in the numerator and the denominator... these cancel out and we are left with the following equation...

7/ We already see something REMARKABLE!

1. Your return doesn’t depend on today’s earnings

2. In fact, it doesn’t depend on ANY year’s earnings!

All that matters is the growth rate of earnings and the multiple differential when you buy and sell the stock (M2/M1)

1. Your return doesn’t depend on today’s earnings

2. In fact, it doesn’t depend on ANY year’s earnings!

All that matters is the growth rate of earnings and the multiple differential when you buy and sell the stock (M2/M1)

8/ But we aren’t done. What is g?

Companies can do two things with their earnings: reinvest in their biz or return it to shareholders.

When a company reinvests it’s capital, it earns a “return”. What is this return? It is simply the company’s incremental ROE!

Companies can do two things with their earnings: reinvest in their biz or return it to shareholders.

When a company reinvests it’s capital, it earns a “return”. What is this return? It is simply the company’s incremental ROE!

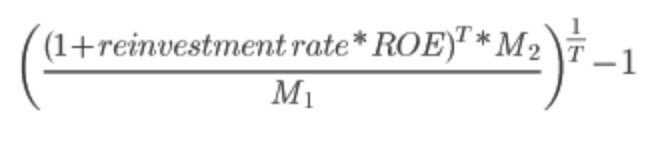

9/ Therefore, g is simply reinvestment rate*ROE. B/c we assumed the company is reinvesting 100% of its capital, the reinvestment rate is 100% and we can remove it from the equation.

10/ After some mathematical simplification, we are left with the equation on the right...

This equation tells us our return is dependent on (1) your ROE, (2) the multiple differential and (3) our holding period.

This equation tells us our return is dependent on (1) your ROE, (2) the multiple differential and (3) our holding period.

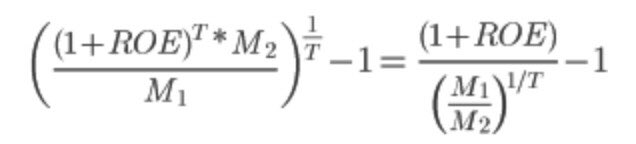

11/ We’re almost there... what happens when your holding period becomes very long?

This is where it gets a little hairy. In mathematical terms, we take the limit as T approaches infinity. This is basically telling us “what happens to this equation as T becomes very very big?”

This is where it gets a little hairy. In mathematical terms, we take the limit as T approaches infinity. This is basically telling us “what happens to this equation as T becomes very very big?”

12/ This, my friends, is our Holy Grail.

As T becomes very large, 1/T becomes very small. So much so that it approaches ZERO! And anything taken to the 0th power is just ONE!

Do you see it? Our (M1/M2) term disappears. It goes to 1 as T goes to infinity!

As T becomes very large, 1/T becomes very small. So much so that it approaches ZERO! And anything taken to the 0th power is just ONE!

Do you see it? Our (M1/M2) term disappears. It goes to 1 as T goes to infinity!

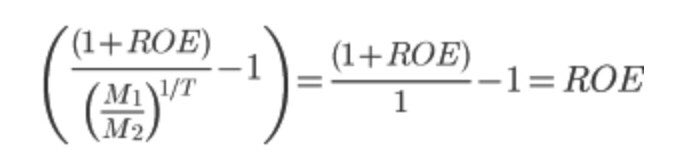

13/ After some mathematical simplification, we see that our return is COMPLETELY DEPENDENT on the company’s ROE.

This is the most IMPORTANT takeaway from this mental exercise...

This is the most IMPORTANT takeaway from this mental exercise...

14/ There are two important caveats to this interesting result. Remember...

1. This ROE term isn’t the current ROE or historical ROE. It’s the average ROE for the FUTURE holding period T!

2. For returns to materialize, the company needs to SURVIVE T years which is very hard!

1. This ROE term isn’t the current ROE or historical ROE. It’s the average ROE for the FUTURE holding period T!

2. For returns to materialize, the company needs to SURVIVE T years which is very hard!

15/ Is this realistic? Sure we focus on ROE only when your holding period is... erm... INFINITY years???

In practice, we can calculate the percentage of returns determined by what I call the “Beauty Contest” factor (M1/M2^(1/T).

In practice, we can calculate the percentage of returns determined by what I call the “Beauty Contest” factor (M1/M2^(1/T).

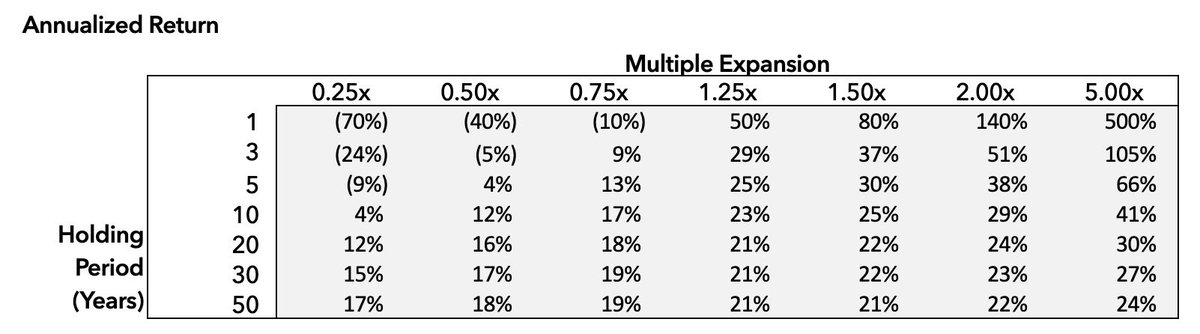

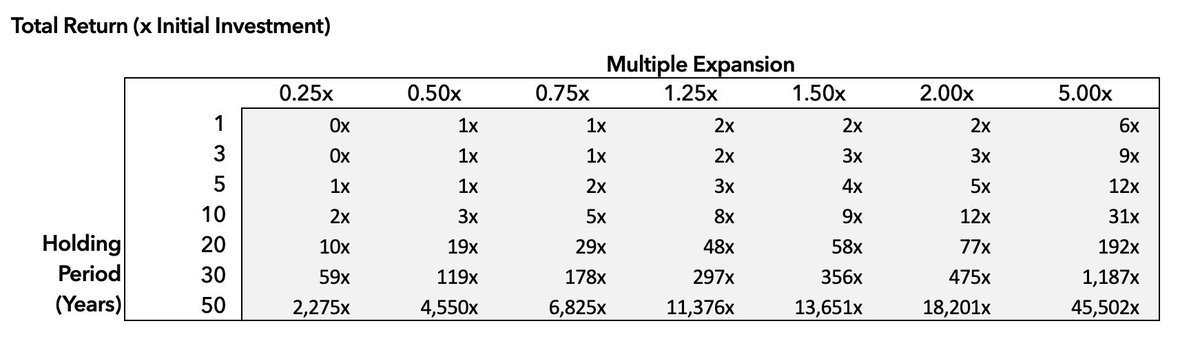

16/ My good friend @933Fund and I calculated your returns over different holding periods and multiple expansions/contractions based on an ROE of 20%.

Here are a few takeaways...

Here are a few takeaways...

17/ As our formula told us, ROE exerts a gravitation force on your annual return. Both the DRAG from multiple contraction and the EXCESS from multiple expansion disappear as your holding period becomes very very long.

18/ For practical purposes, for a holding period of, say, 20+ years, accurately predicting the company’s ROE is far more important than getting the entry multiple right.

19/ At the same time, your Beauty Contest factor is FAR more important than biz fundamentals in a shorter period, say >5 years.

Yup, the math tells us PERCEPTION matters more than FUNDAMENTALS under 5 years, however counterintuitive that may sound...

Yup, the math tells us PERCEPTION matters more than FUNDAMENTALS under 5 years, however counterintuitive that may sound...

20/ Small differences in annual returns result in huge differences in TOTAL returns. This is just compounding at work.

Even after 30 years of compounding, the difference between a 100 baggar and a 1,000 baggar is your multiple...

Even after 30 years of compounding, the difference between a 100 baggar and a 1,000 baggar is your multiple...

21/ How does this mental model help? It lets you DECOMPOSE returns into its constituent parts.

If you’re unsure of ROE, maybe you don’t want to invest if that component has a high weight on returns.

If you can’t predict market perception, maybe increase your holding period...

If you’re unsure of ROE, maybe you don’t want to invest if that component has a high weight on returns.

If you can’t predict market perception, maybe increase your holding period...

22/ At the end of the day, if you can predict any of these factors to a reasonable degree, you should have a stellar investment record:

1. Reinvesment rate/opportunities

2. Return on incremental EQUITY investment

3. Multiple contraction/expansion

1. Reinvesment rate/opportunities

2. Return on incremental EQUITY investment

3. Multiple contraction/expansion

23/ Here are some links that might interest you:

Keynes on the Beauty Contest: https://www.ft.com/content/6149527a-25b8-11e5-bd83-71cb60e8f08c

My article on why I picked ROC as my name that goes through come of these calculations: https://docs.google.com/document/u/2/d/e/2PACX-1vSTAEqeMV3TmdqnRK_y9NoxngpRghInvcxL6u1Kc89sWmOUTnHga2GdLCr1UnyYKA/pub

Keynes on the Beauty Contest: https://www.ft.com/content/6149527a-25b8-11e5-bd83-71cb60e8f08c

My article on why I picked ROC as my name that goes through come of these calculations: https://docs.google.com/document/u/2/d/e/2PACX-1vSTAEqeMV3TmdqnRK_y9NoxngpRghInvcxL6u1Kc89sWmOUTnHga2GdLCr1UnyYKA/pub

Read on Twitter

Read on Twitter