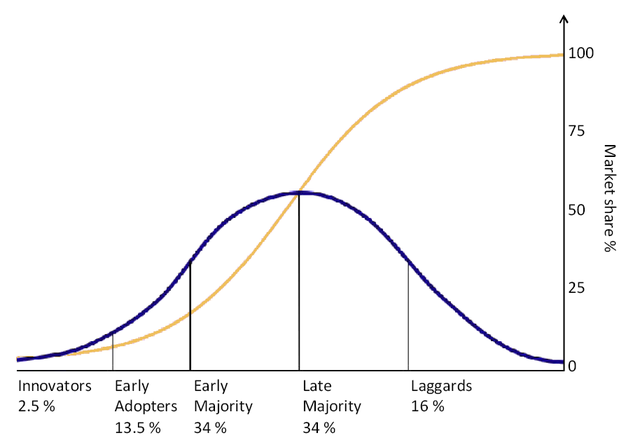

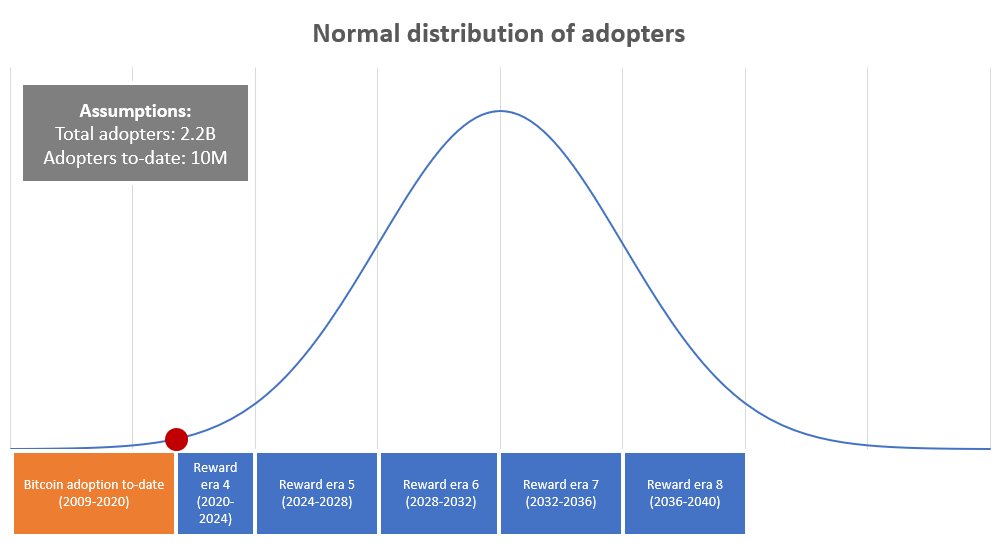

1) Everyone is familiar with @100trillionUSD S2F model. Critics recoil because it seems to scale too rapidly. What they're forgetting is an intangible amplifying force that I wanted to ballpark quantify: the normal distribution of technology adopters.

2) Some very rough assumptions:

a. Bitcoin as preferred money / savings technology has total addressable market of anyone with $10k+ wealth (2.2B, source: https://www.statista.com/statistics/203930/global-wealth-distribution-by-net-worth/). Impoverished communities will also use BTC, but focused on TAM of those with wealth to store

a. Bitcoin as preferred money / savings technology has total addressable market of anyone with $10k+ wealth (2.2B, source: https://www.statista.com/statistics/203930/global-wealth-distribution-by-net-worth/). Impoverished communities will also use BTC, but focused on TAM of those with wealth to store

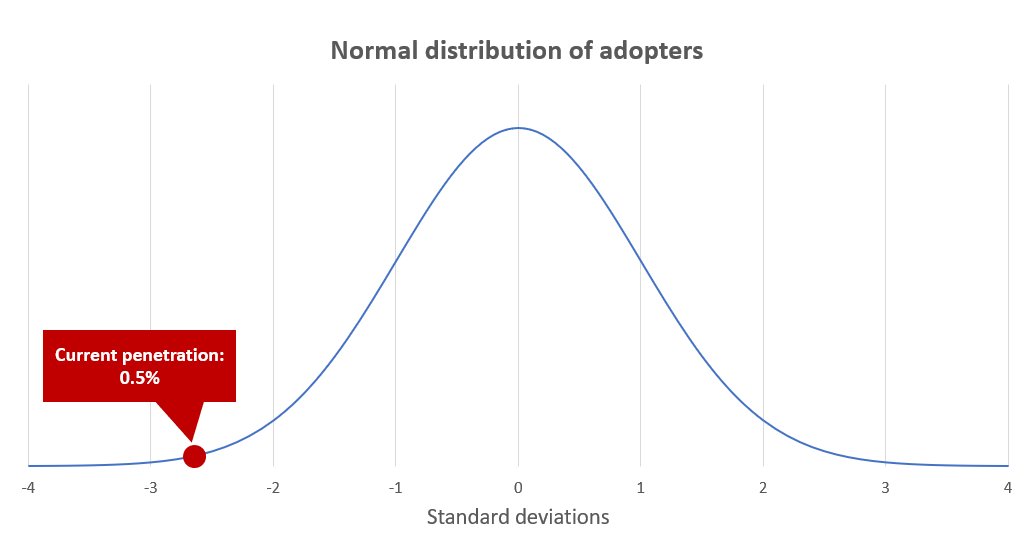

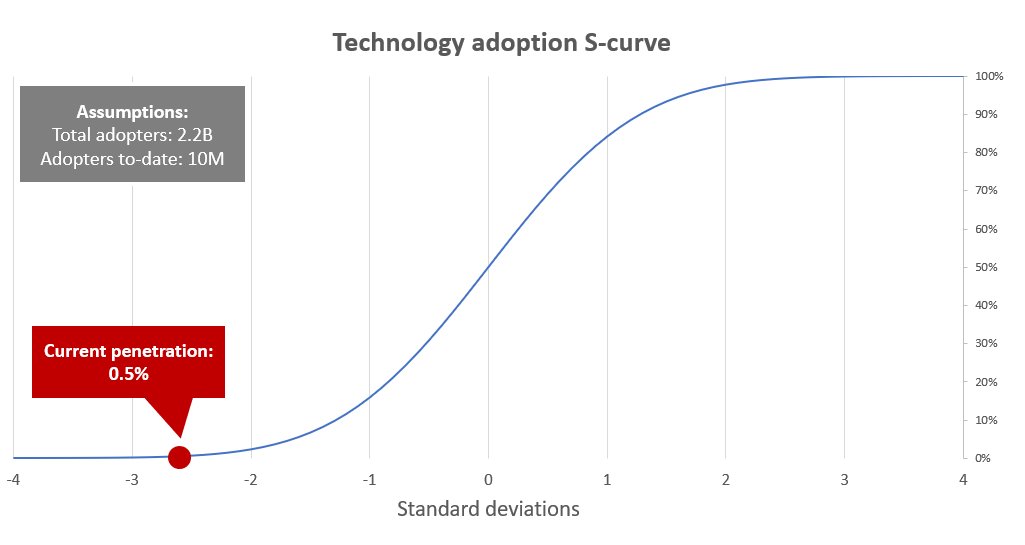

2b. Current penetration is 10M. This is a rough estimate of how many people have $1,000+ stored in BTC, based on 3M addresses with >0.1BTC https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html, and accounting for balances on exchange/GBTC ownership/etc.

4) If Bitcoin as preferred money / savings technology follows the classic adoption curve, that puts us here.

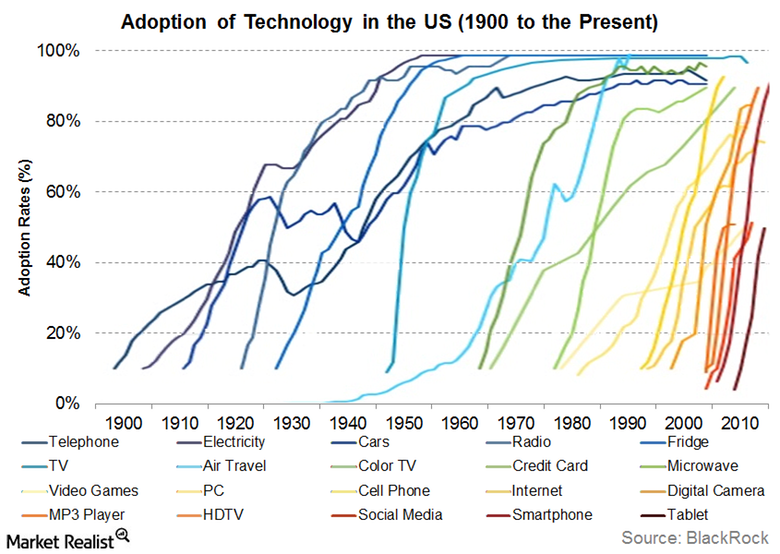

5a) How long this adoption curve might take is the impossible question, of course. Technology adoption in the information age is faster than ever.

5b) However, #Bitcoin  is not a cheap consumer good to buy, it's a paradigm shifting approach to personal finance. We all accept that this transformation may take decades. But I had to pick some rough timeframe to do this analysis...

is not a cheap consumer good to buy, it's a paradigm shifting approach to personal finance. We all accept that this transformation may take decades. But I had to pick some rough timeframe to do this analysis...

is not a cheap consumer good to buy, it's a paradigm shifting approach to personal finance. We all accept that this transformation may take decades. But I had to pick some rough timeframe to do this analysis...

is not a cheap consumer good to buy, it's a paradigm shifting approach to personal finance. We all accept that this transformation may take decades. But I had to pick some rough timeframe to do this analysis...

5c) For my rough estimates I opted to assume each block reward era lines up with an incremental standard deviation slice of the adoption curve. (Also assumed 2020-2024 takes us from -2.6 std dev to a clean -2)

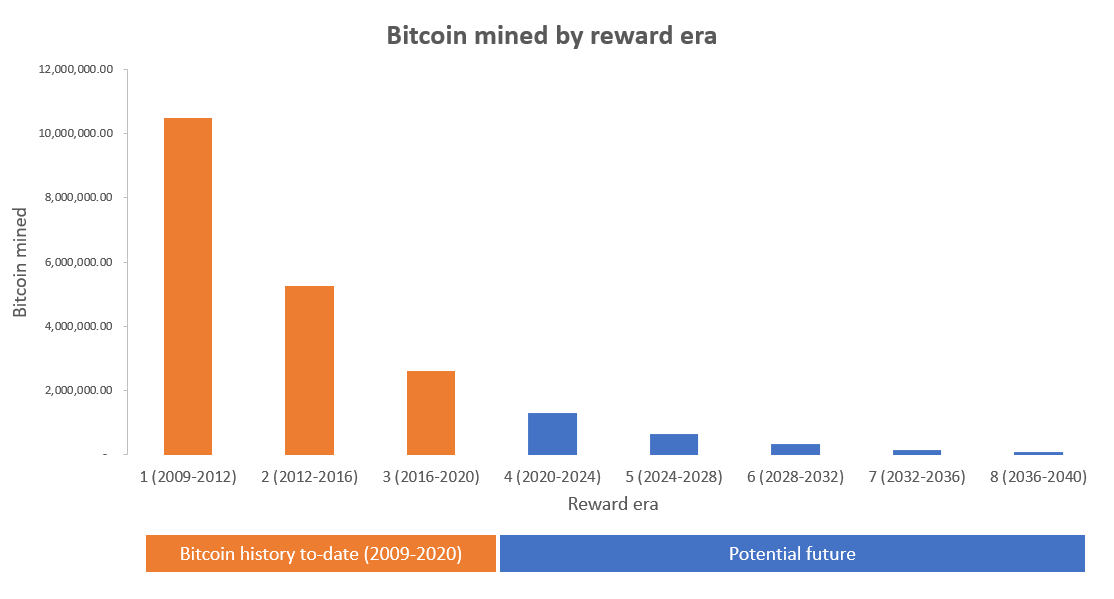

6a) What does this imply about scarcity of newly mined Bitcoin into the future? When we adjust raw # of Bitcoin mined...

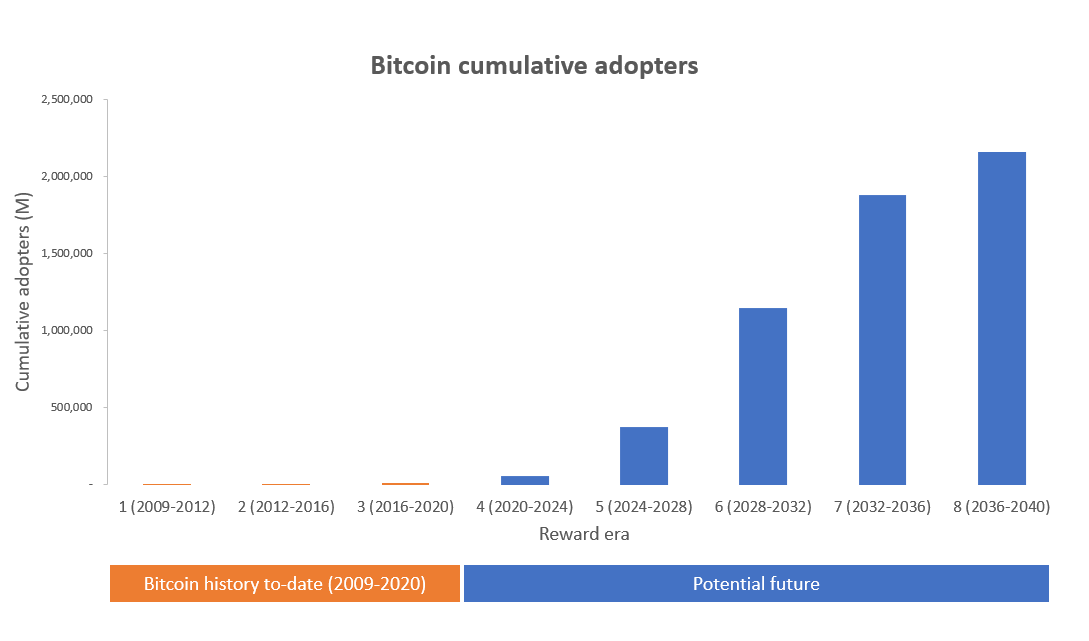

6b) ...by accounting for # of cumulative Bitcoiners by that era (numbers calculated using the normal distribution curve)....

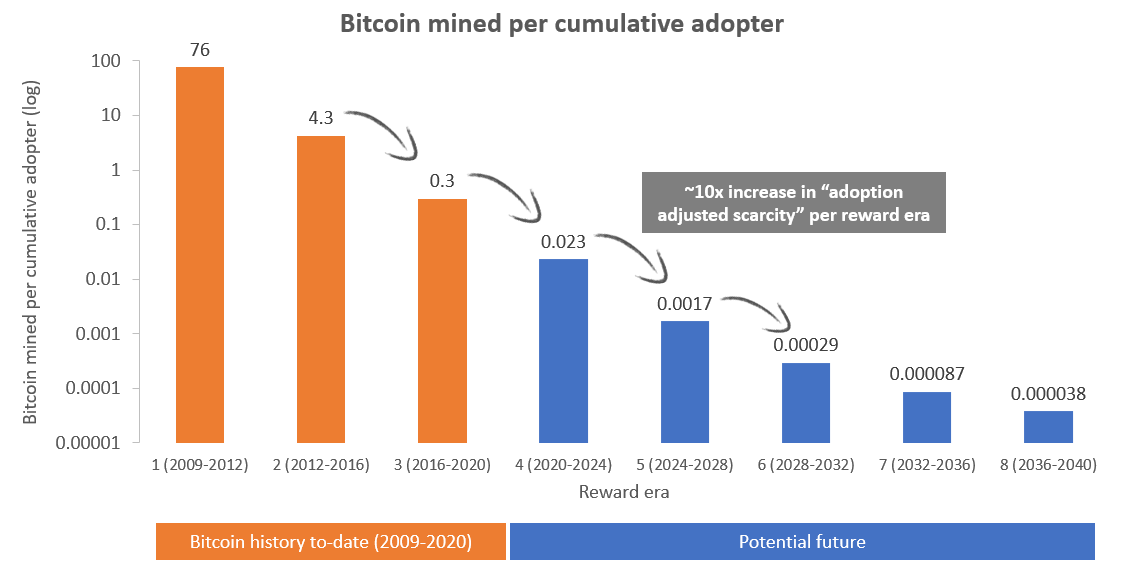

6c) ...the "adoption adjusted scarcity" numbers suggest a level of scarcity much more dramatic than the raw Bitcoin mining numbers convey at face value. Note: chart shown in log.

7) This ballpark exercise is not precise by any means. The intent was simply to factor in how bell curve adoption compounds the exponential decay of block rewards. The result shows a ~10x increase in "adjusted scarcity" per reward era, much like we see in the S2F projections.

@100trillionUSD @PrestonPysh @matt_odell @hodl_american @hodlonaut @BitcoinTina @parkeralewis @coryklippsten @CitizenBitcoin @johnkvallis @MartyBent @phil_geiger @PositiveCrypto @digitalikNet

@Bitcoin @NickSzabo4 @adam3us @Travis_Kling @hansthered @alistairmilne @Breedlove22 @TuurDemeester @realmaxkeiser @bitstein @sthenc @tylerwinklevoss @winklevoss @BMBernstein @APompliano @cryptopoiesis @woonomic @EternalBTC

Read on Twitter

Read on Twitter