The Telegraph's delusion reaches new levels with this report that rents are not going to fall! https://www.telegraph.co.uk/property/uk/coronavirus-will-drive-house-prices-not-rents/

If your rental contract if up for renewal, start the bidding at over 10% off imo

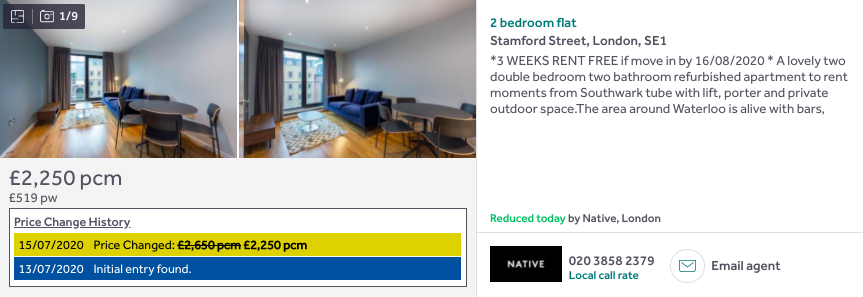

Just as a taster of what's going on here's an ex-Airbnb flat (as pics prove) in London zone 1 with the landlord resorting a 3-week free rent offer to get long-term renters in https://www.rightmove.co.uk/property-to-rent/property-90566822.html

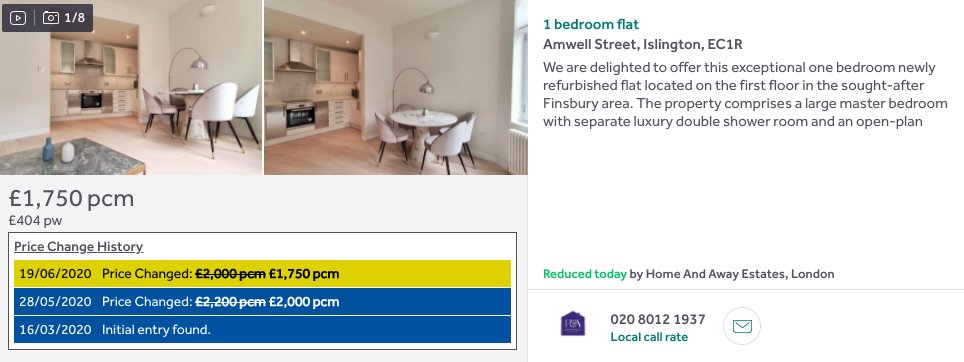

It's been on the market since March, initially at £2,200. Yesterday the asking rent got cut by 17% from that to £1,825.

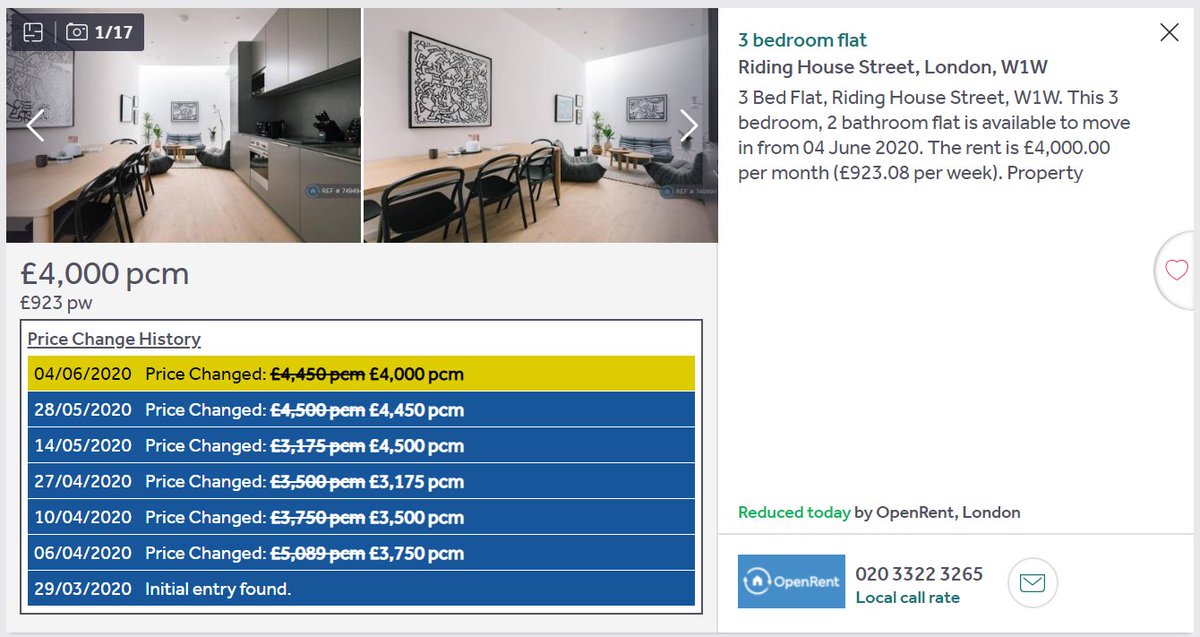

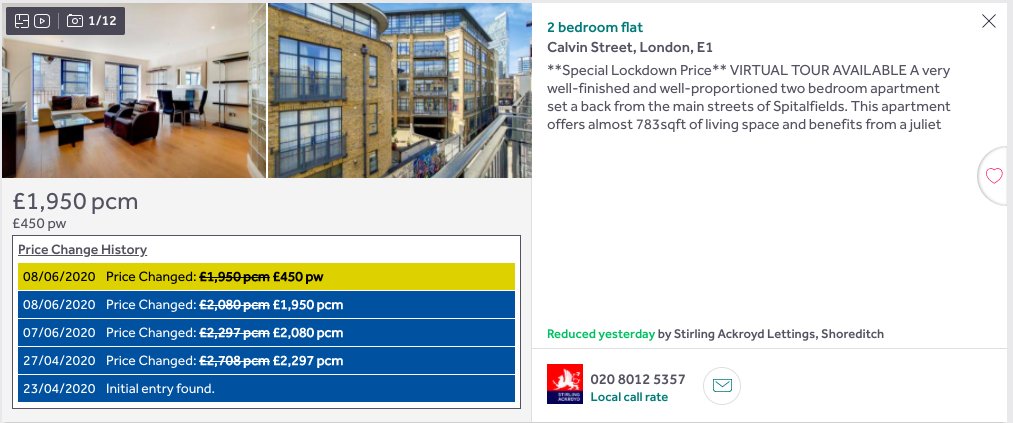

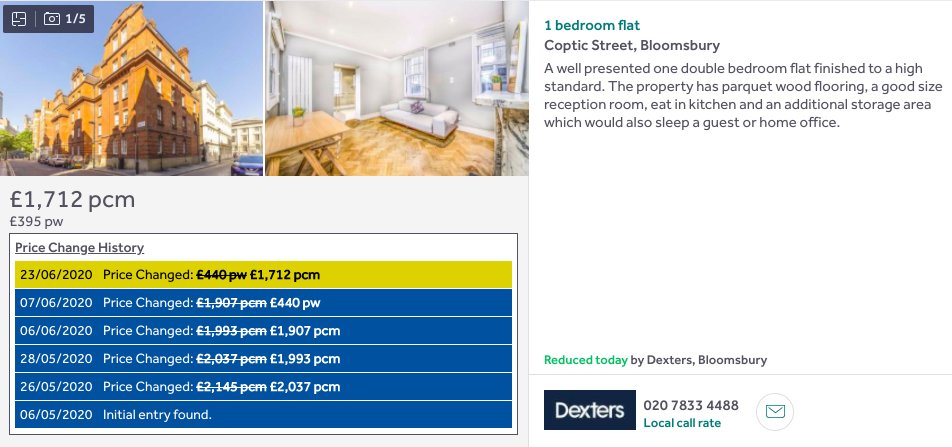

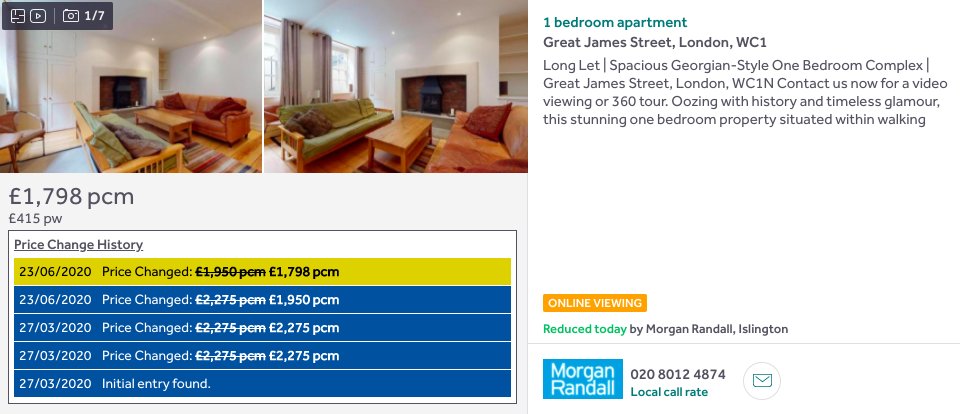

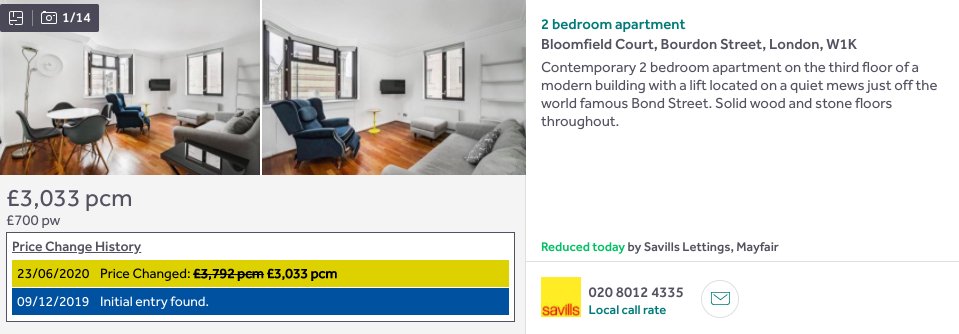

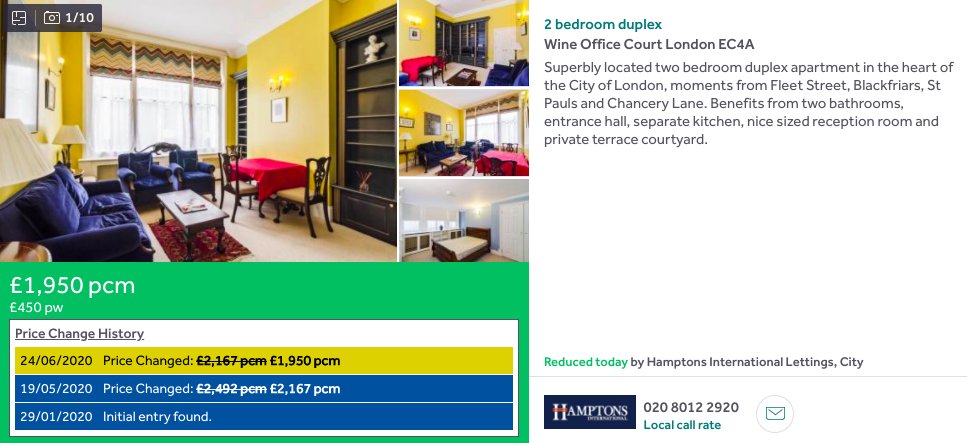

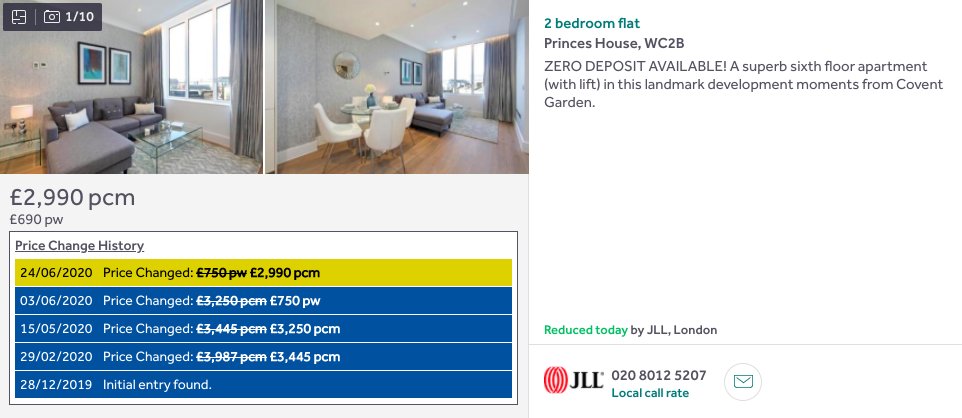

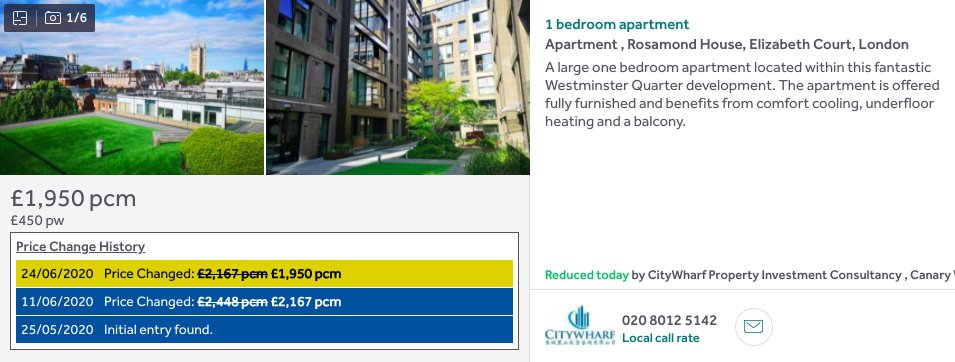

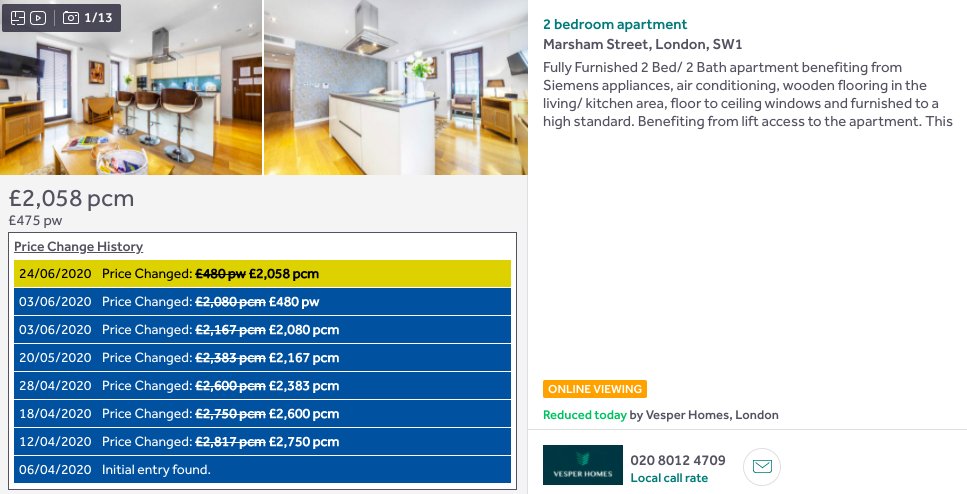

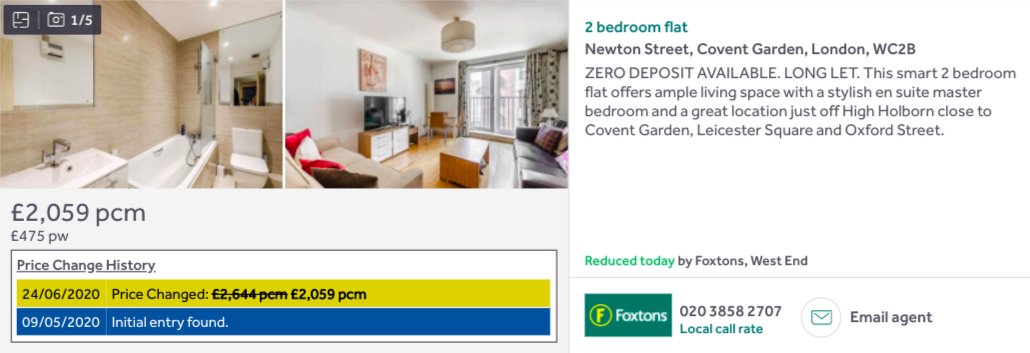

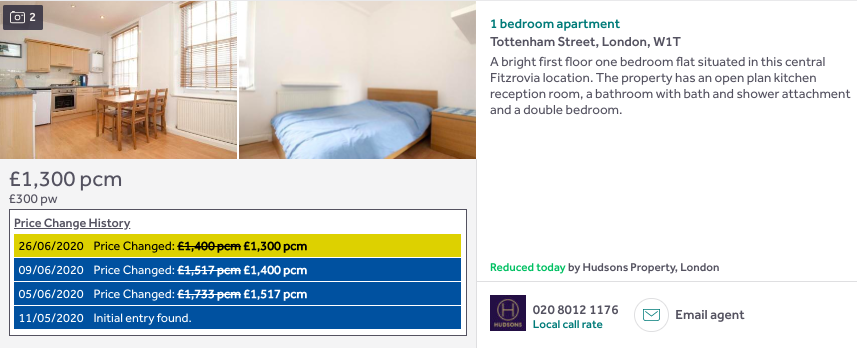

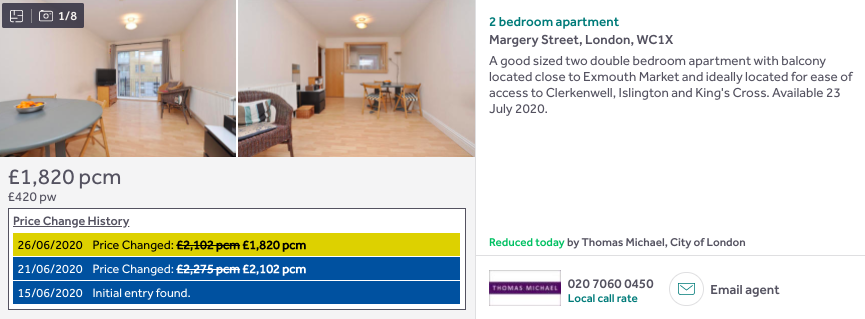

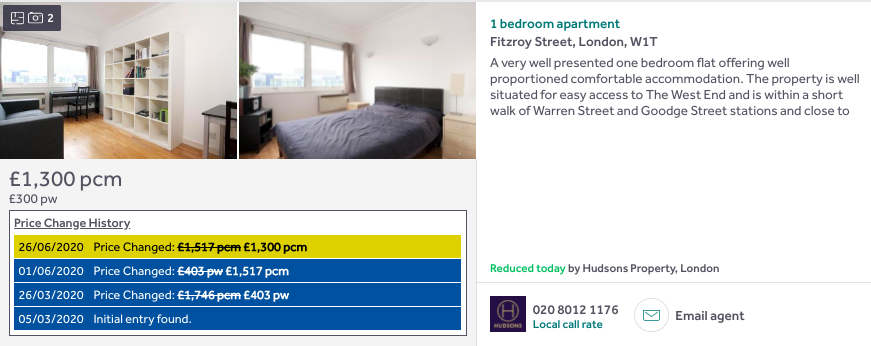

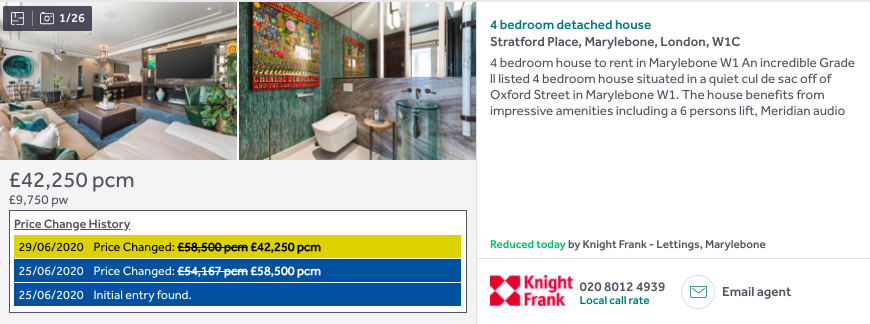

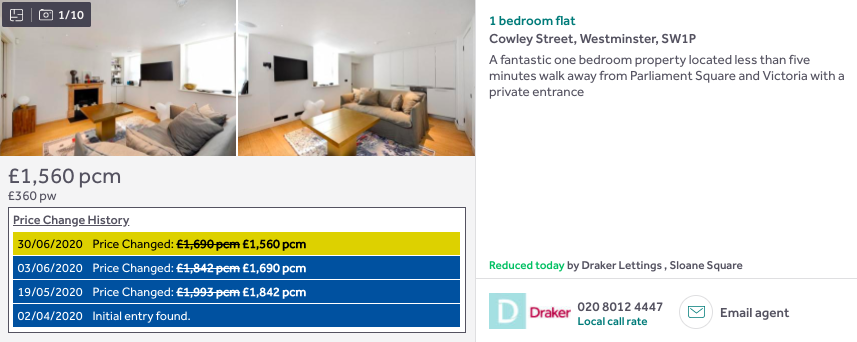

Anyone can keep tabs on these price cuts by using the free [though I've happily donated] Property Log extension for Chrome. https://chrome.google.com/webstore/detail/property-log/jccihedpilhidcbkconacnalppdeecno/related?hl=en-GB Here's what Property Log tells you for this property.

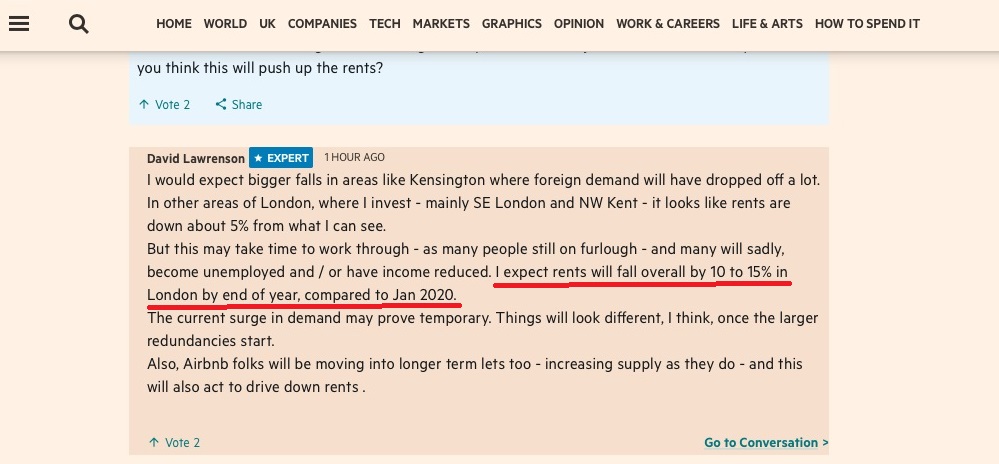

Your landlord will obviously tell you that your property is different. But one veteran landlord has admitted he expects rents in London to fall 10%-15% this year.

In fact he told the Financial Times this yesterday in a Q&A with readers https://www.ft.com/content/65ff4517-91d2-4b5e-b2dd-2f66656c2d73

The context here is not just the temporary tourist rental shock but the longer-term unemployment outlook https://www.theguardian.com/business/2020/jun/03/prepare-for-1980s-level-unemployment-former-chancellors-warn

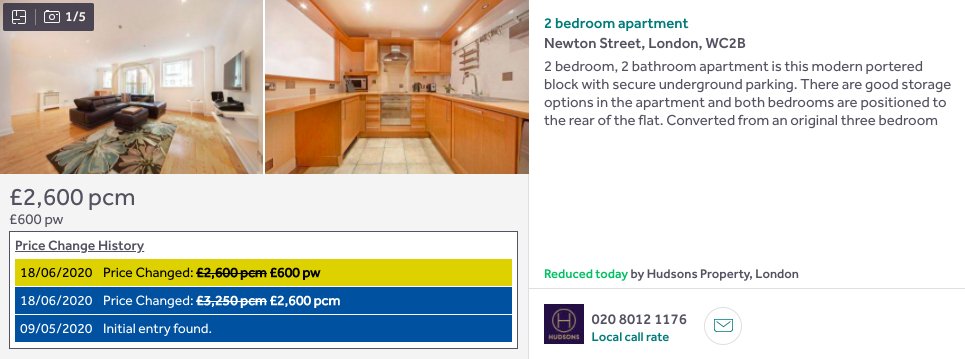

Chucking in another example. Covent Garden = £3,500 in February, apparently, but £2,500 now. https://www.rightmove.co.uk/property-to-rent/property-88381973.html

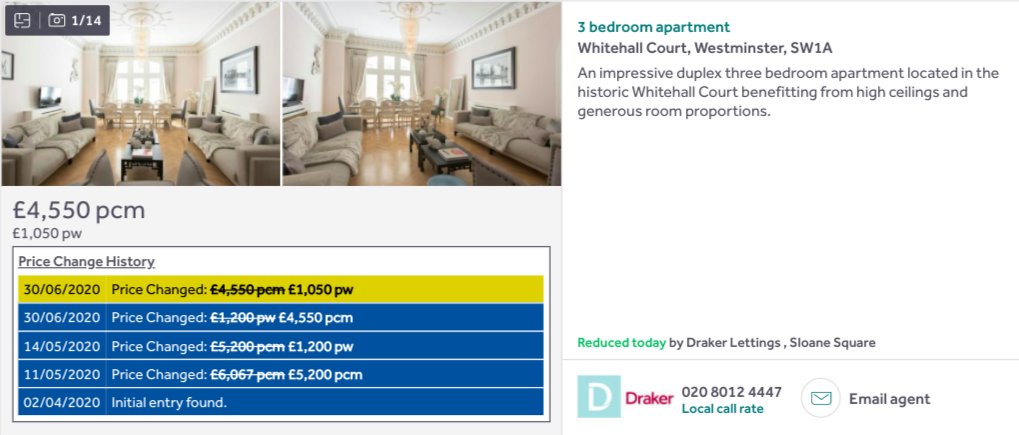

No takers at £5k, no takers at £3k. https://www.rightmove.co.uk/property-to-rent/property-78283522.html

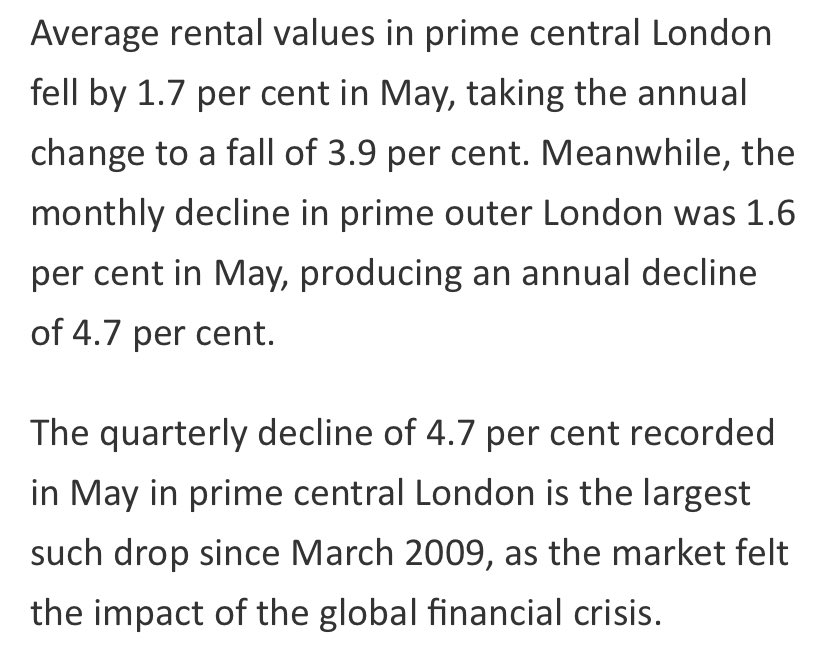

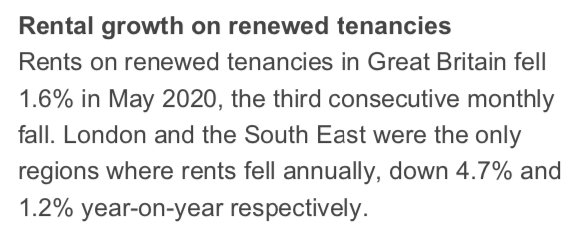

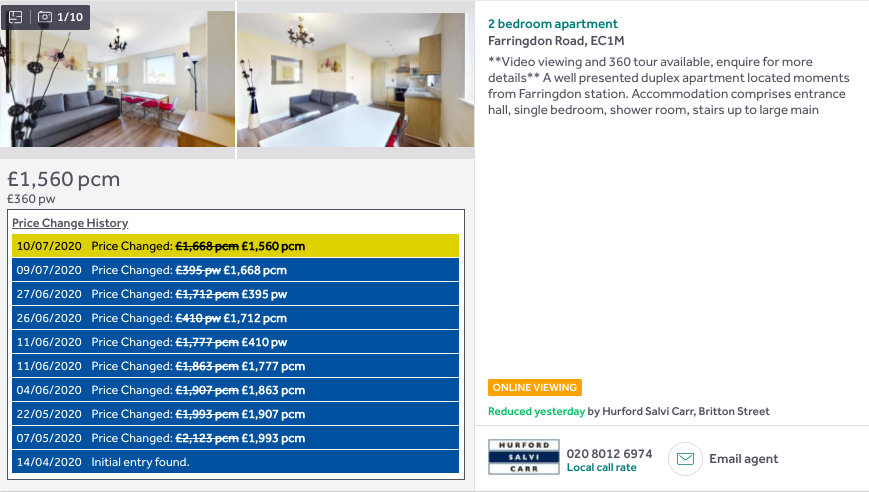

Central London rents drop by 4.7%. From Knight Frank via https://www.lettingagenttoday.co.uk/breaking-news/2020/6/demand-catching-up-with-supply-after-prime-londons-lettings-dip

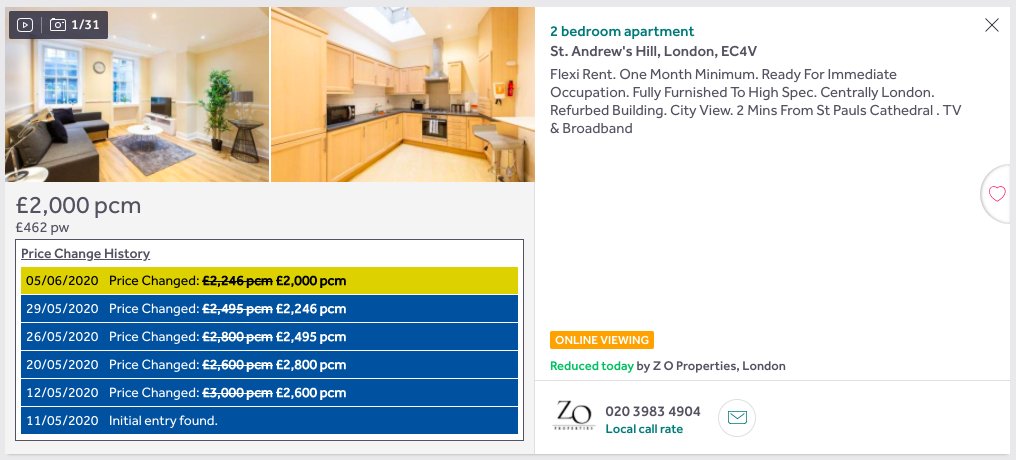

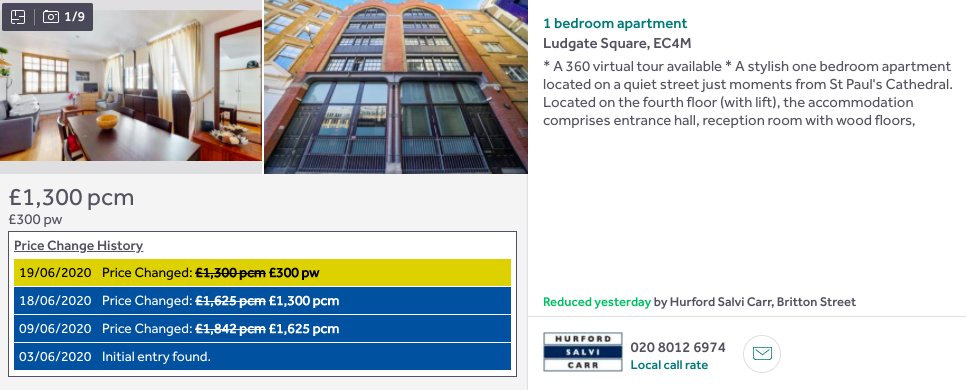

St Paul's. Not sure what 'Flexi Rent' means? Maybe 'We've had to cut the rent by a third'? https://www.rightmove.co.uk/property-to-rent/property-92154884.html

Worth noting that the Bank of England’s recent reforms to force buy-to-let lenders to use more prudent lending criteria will allow most landlords to dramatically reduce rents and still remain profitable

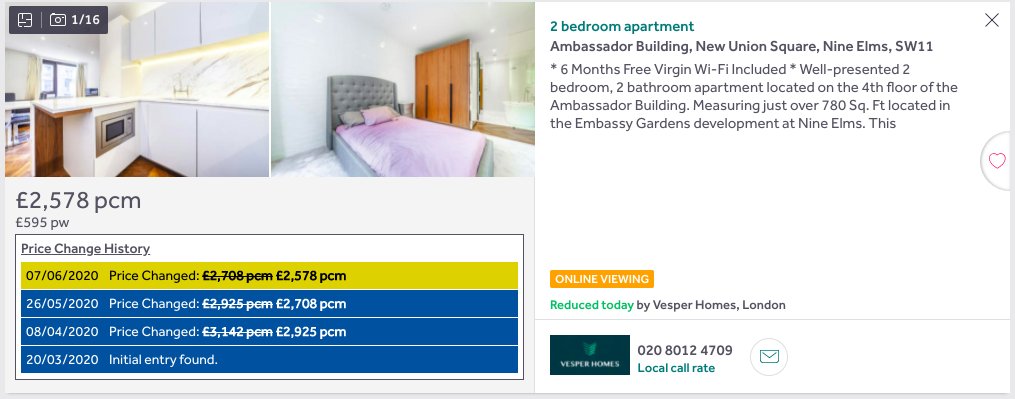

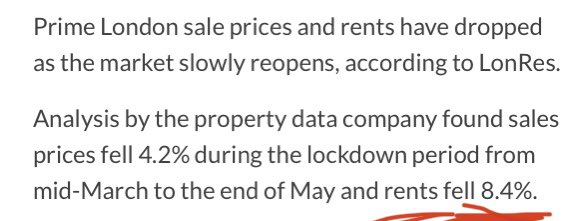

More data - prime London rents down 8.4% https://propertyindustryeye.com/london-sales-and-lettings-listings-return-but-sold-prices-are-down/

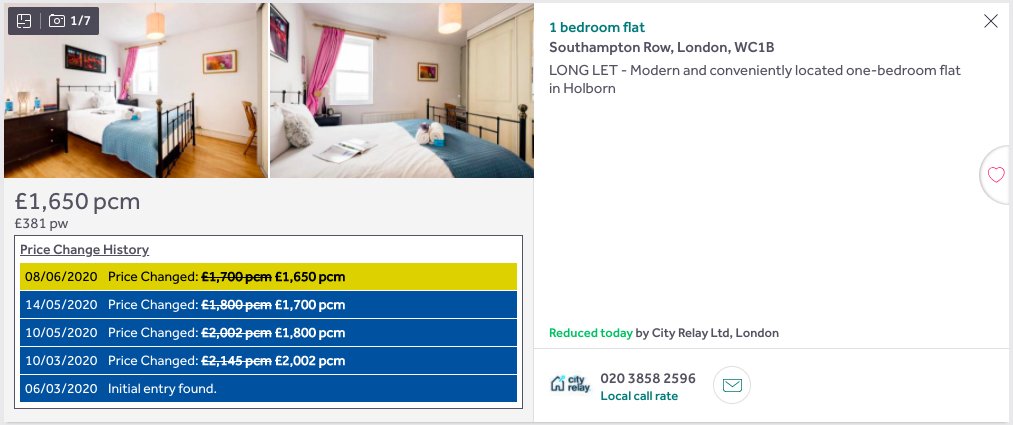

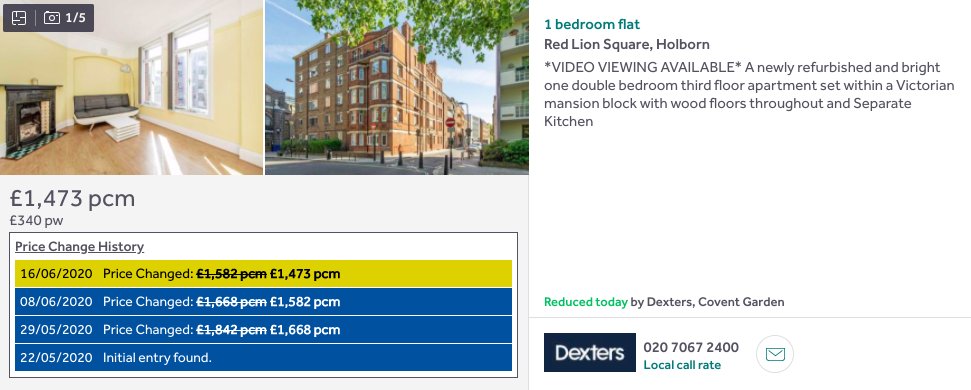

Holborn, down 23%. https://www.rightmove.co.uk/property-to-rent/property-68760018.html

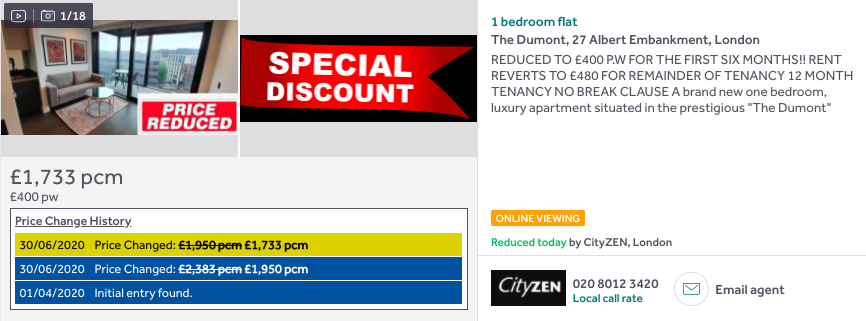

Someone's resorting to the red SALE! stickers https://www.rightmove.co.uk/property-to-rent/property-92810864.html

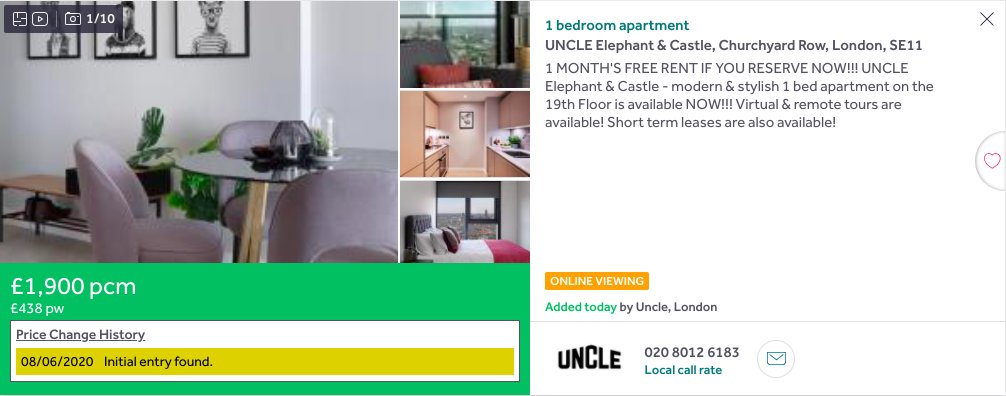

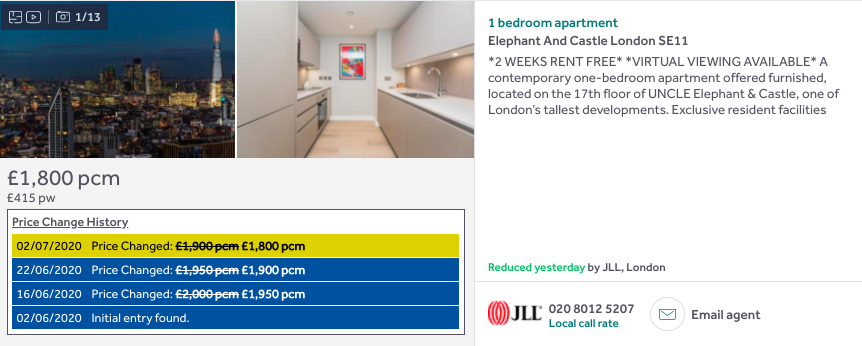

Another ONE MONTH FREE RENT offer - but actually the bigger sign of trouble for the landlord is their explicitly stating that they're now offering short leases https://www.rightmove.co.uk/property-to-rent/property-93250595.html

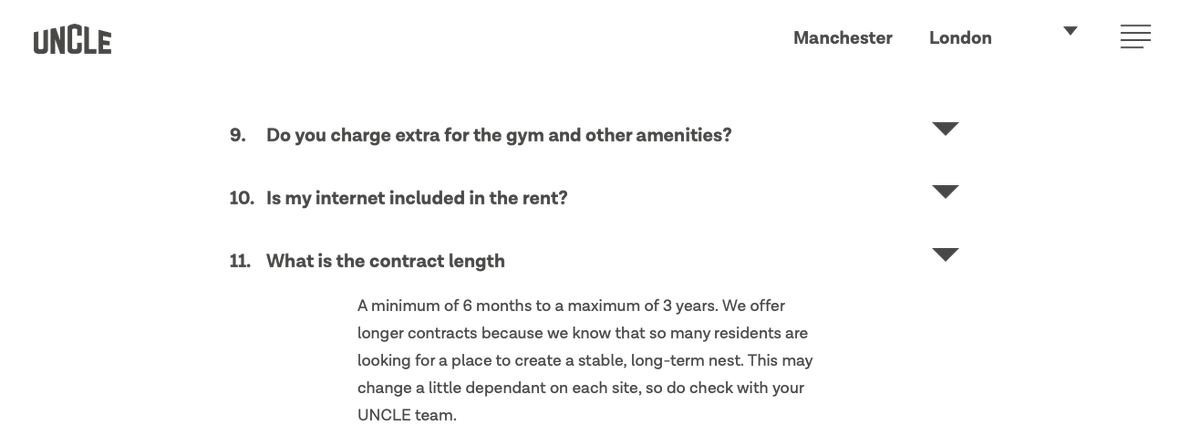

(Uncle is an institutional build-to rent company which normally prefers long leases, as per its company FAQs)

Here's a residential management company with 29% of its monthly rent in arrears last month and payouts to investors suspended for six months https://www.propertypartner.co/blog/ceo-update-may-2020/

https://www.landlordtoday.co.uk/breaking-news/2020/6/btl-landlords-are-accepting-lower-rental-offers-to-avoid-void-periods "A growing number of buy-to-let landlords with empty homes are looking to avoid lengthy void periods ... in the current economic climate by accepting lower rental offers on their properties ... according to UK Sotheby’s International Reality."

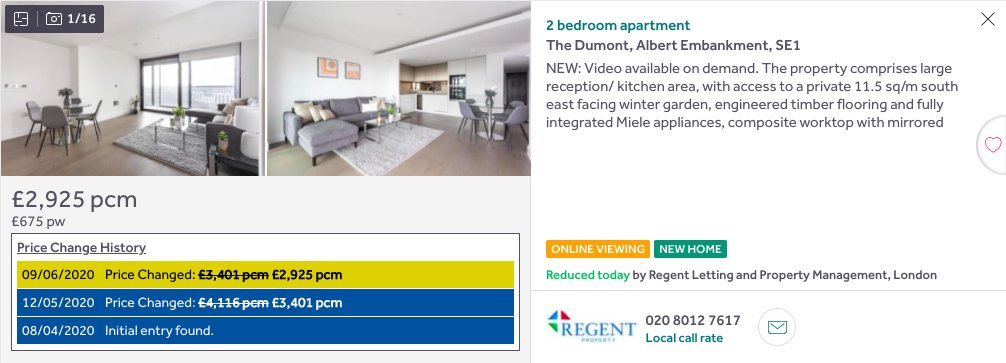

Newbuild opposite Houses of Parliament. Down 29%. https://www.rightmove.co.uk/property-to-rent/property-90427766.html

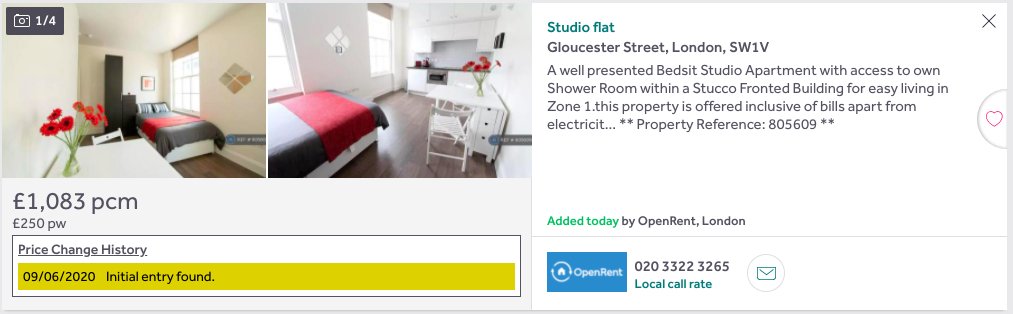

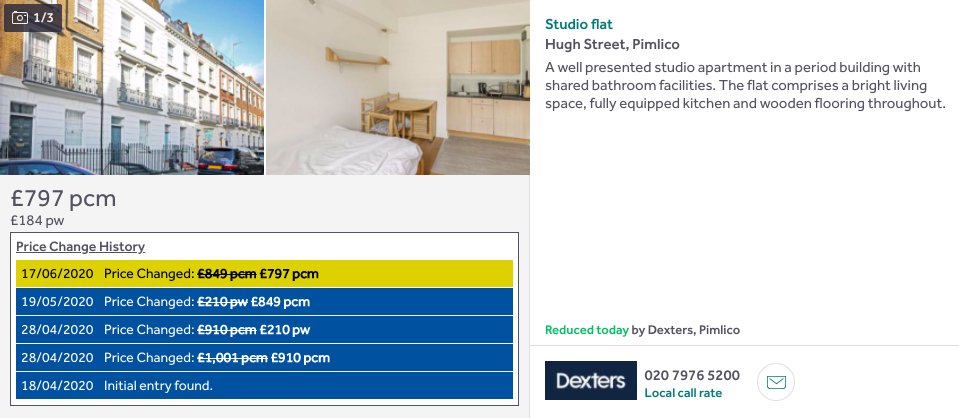

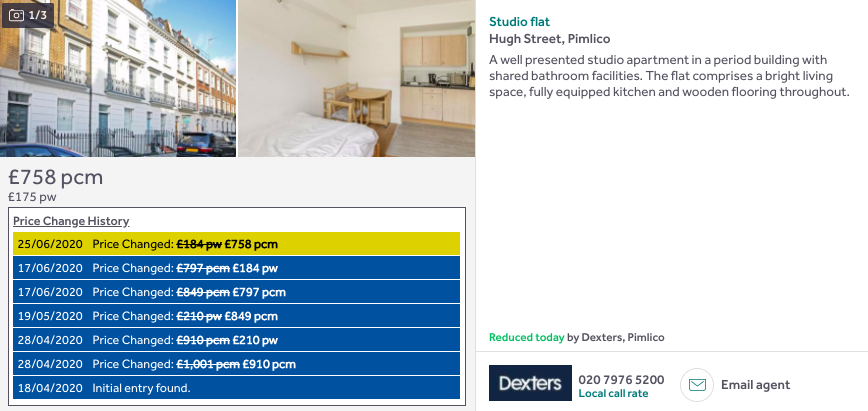

Pimlico studio flat nearly under £1,000 per month, probable ex-Airbnb https://www.rightmove.co.uk/property-to-rent/property-80694730.html

"Special lockdown price". Spitalfields, down 28%. https://www.rightmove.co.uk/property-to-rent/property-78807136.html

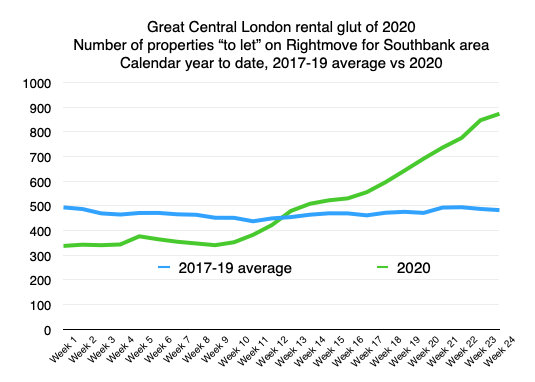

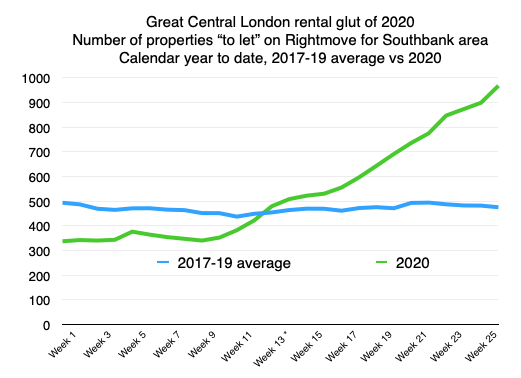

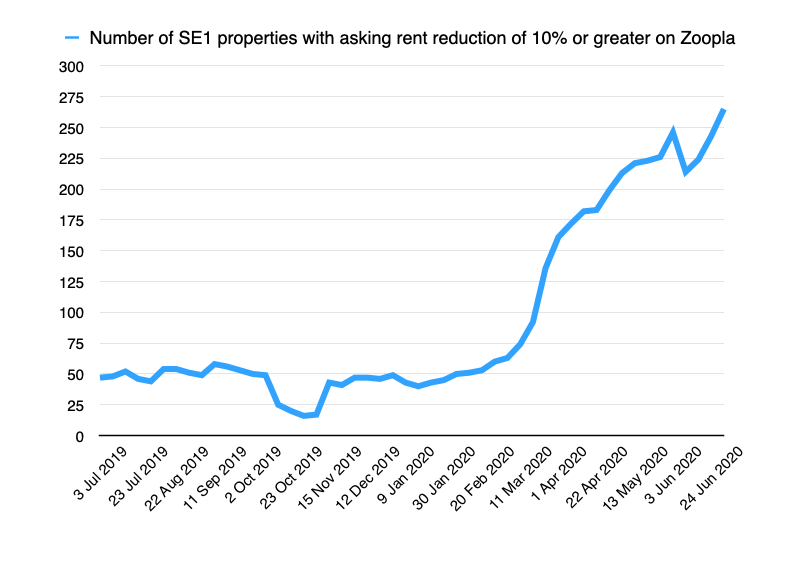

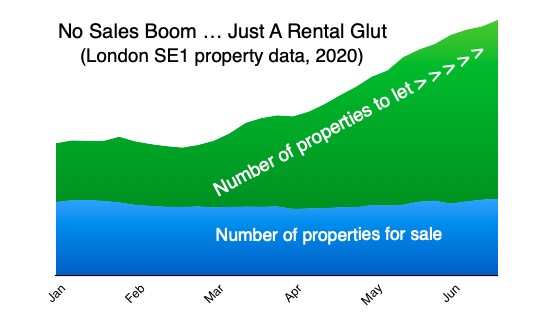

Some perspective on the glut of rental property in central London. Amount of property "to let" in SE1/Southbank area is rising to almost double its recent average

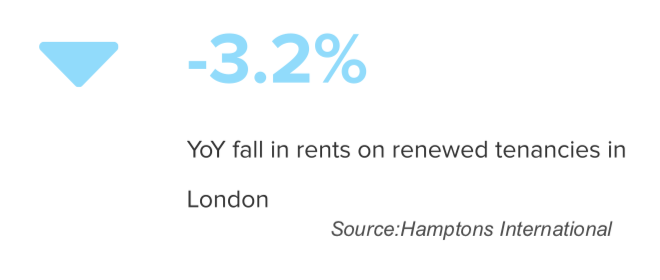

More data: London rents down 3.2% in April https://www.hamptons.co.uk/research/articles/2020/Lettings-index-april-2020.pdf/

Clapham Common, down 9%, right next to tube https://www.rightmove.co.uk/property-to-rent/property-78444970.html

Also some choice quotes from estate agents on the ground in London in today's RICS market survey https://www.rics.org/globalassets/rics-website/media/knowledge/research/market-surveys/uk-residential-market-survey-may-2020.pdf. For example:

- Rental levels are under pressure

- Rents are down for sure also. Makes Brexit look like a picnic! 1/x

- Rental levels are under pressure

- Rents are down for sure also. Makes Brexit look like a picnic! 1/x

(cont.)

- We are seeing some tenants fall into arrears. We have also seen a high number of European tenants give notice to vacate. There are presently high levels of available rental stock in our market.

- new instructions on the up, while tenant numbers appear to be slowing 2/x

- We are seeing some tenants fall into arrears. We have also seen a high number of European tenants give notice to vacate. There are presently high levels of available rental stock in our market.

- new instructions on the up, while tenant numbers appear to be slowing 2/x

(cont.)

- In Central London, we’ve had lots of enquiries from potential tenants but negligible commitment. 3/3

- In Central London, we’ve had lots of enquiries from potential tenants but negligible commitment. 3/3

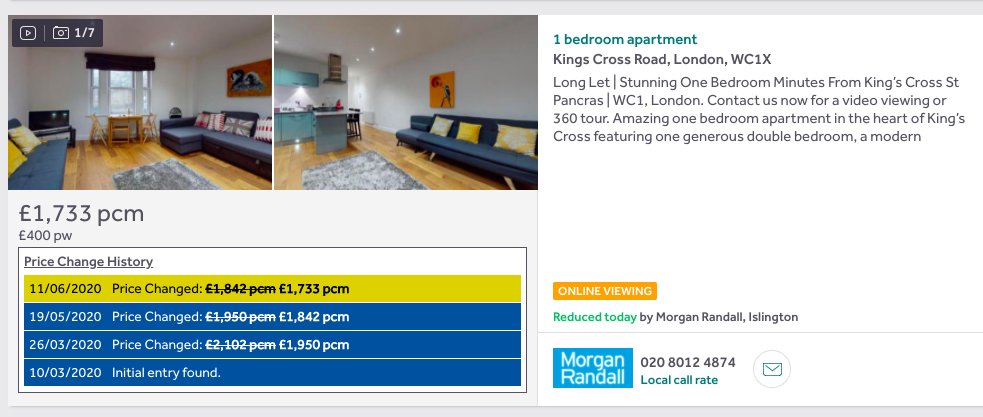

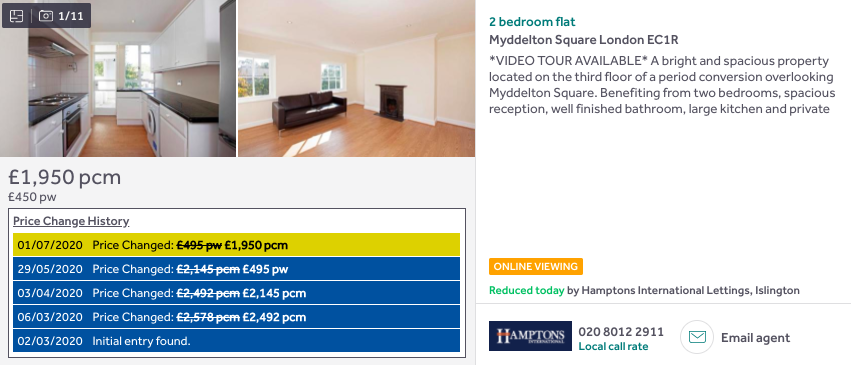

Kings Cross, down 18% https://www.rightmove.co.uk/property-to-rent/property-90297308.html

Wahey! The Telegraph has caught on https://www.telegraph.co.uk/property/renting/rents-plunge-8pc-london-lockdown-tenants-demand-discounts-landlords/?utm_content=telegraph&utm_medium=Social&utm_campaign=Echobox&utm_source=Twitter#Echobox=1591877526

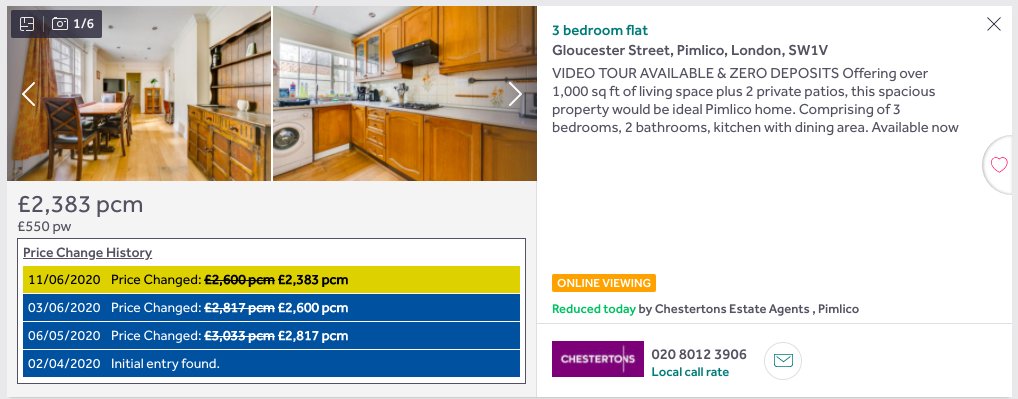

Pimlico, available for short let (down 33% ) or long let (down 21%)

Short: https://www.rightmove.co.uk/property-to-rent/property-90377231.html

Long: https://www.rightmove.co.uk/property-to-rent/property-90377225.html

Short: https://www.rightmove.co.uk/property-to-rent/property-90377231.html

Long: https://www.rightmove.co.uk/property-to-rent/property-90377225.html

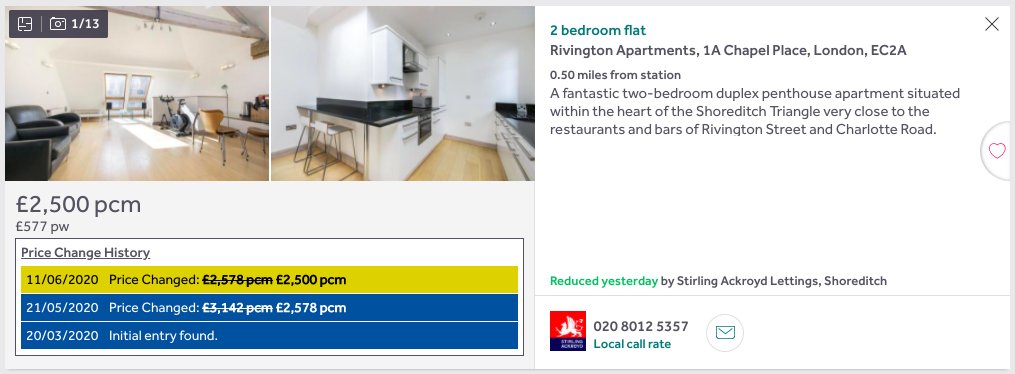

Shoreditch penthouse down 20% https://www.rightmove.co.uk/property-to-rent/property-78307723.html

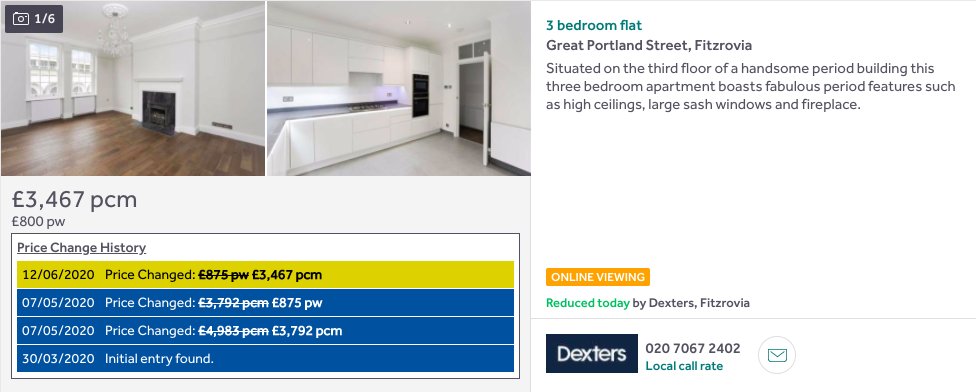

Fitzrovia 3-bed down 30% https://www.rightmove.co.uk/property-to-rent/property-90380672.html

Ex-Airbnb Westminster down 18% https://www.rightmove.co.uk/property-to-rent/property-79863046.html

More data: in London rents on renewal alone were down 4.7% year-on-year in May (imagine how bad new lets will be?) according to Hamptons https://www.rightmove.co.uk/property-to-rent/property-79863046.html

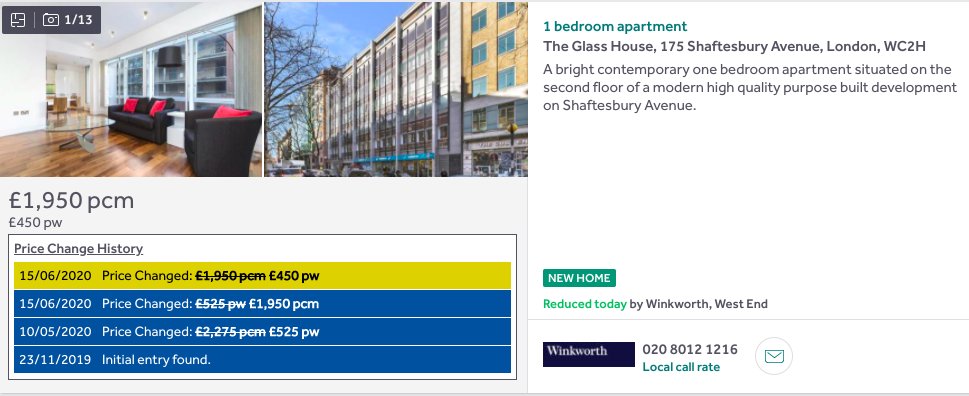

Shaftesbury Avenue, down 23% https://www.rightmove.co.uk/property-to-rent/property-86811581.html

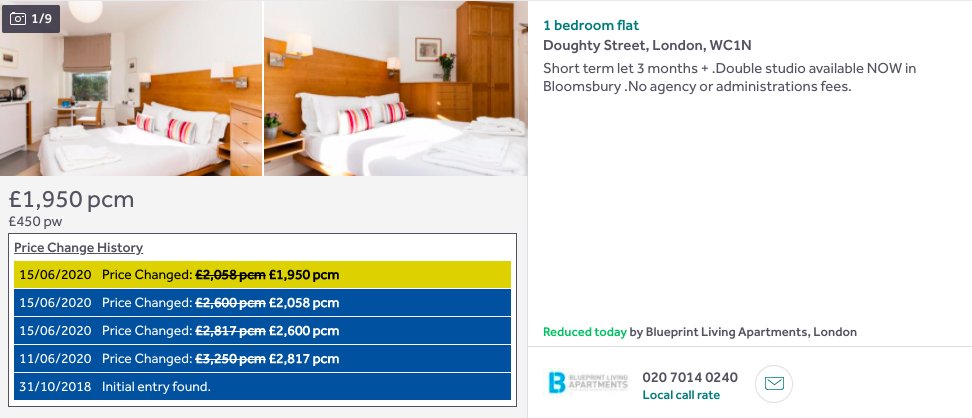

Bloomsbury short let, down 40% https://www.rightmove.co.uk/property-to-rent/property-69486482.html

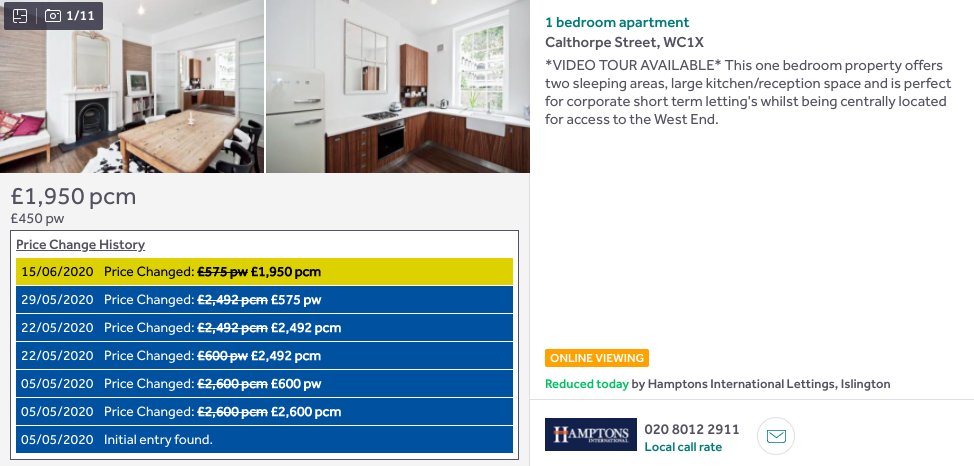

Clerkenwell, with outside space, down 25% https://www.rightmove.co.uk/property-to-rent/property-91967348.html

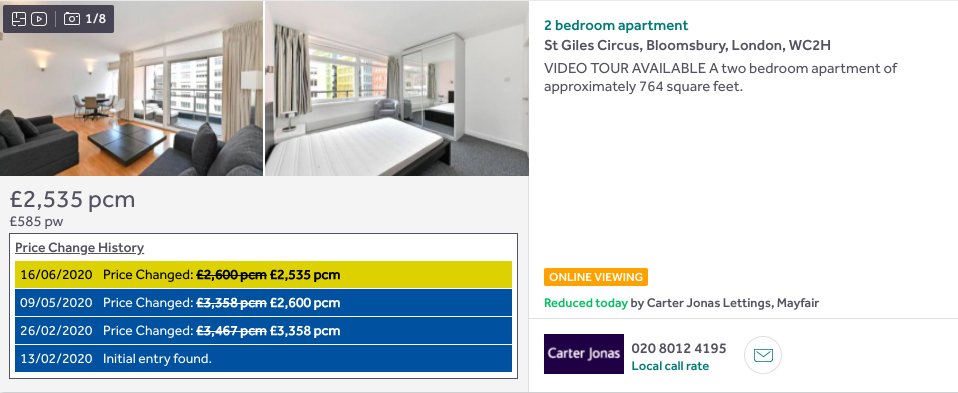

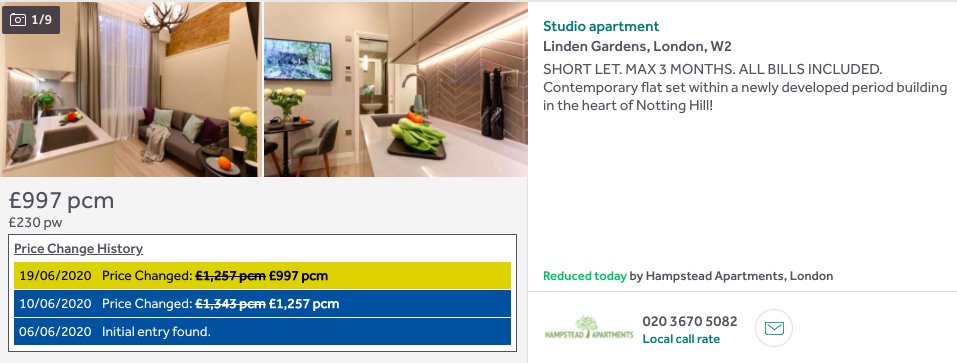

Tottenham Court Rd tube, down 27% https://www.rightmove.co.uk/property-to-rent/property-88431092.html

Holborn, down 20% https://www.rightmove.co.uk/property-to-rent/property-92587259.html

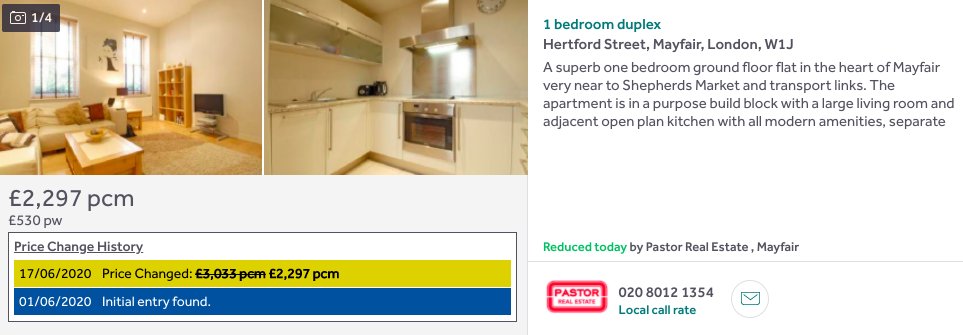

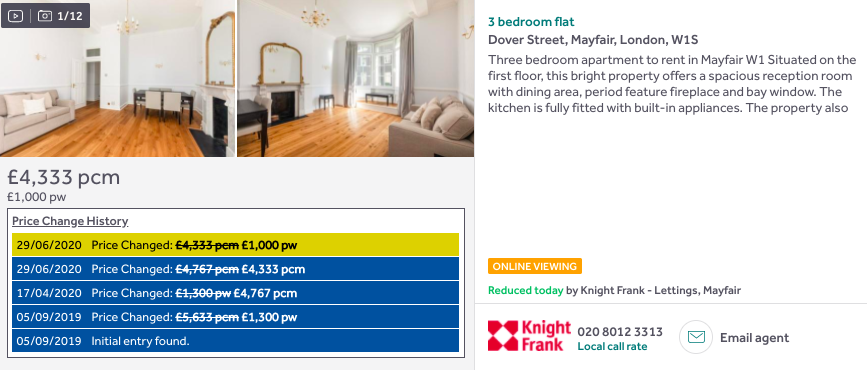

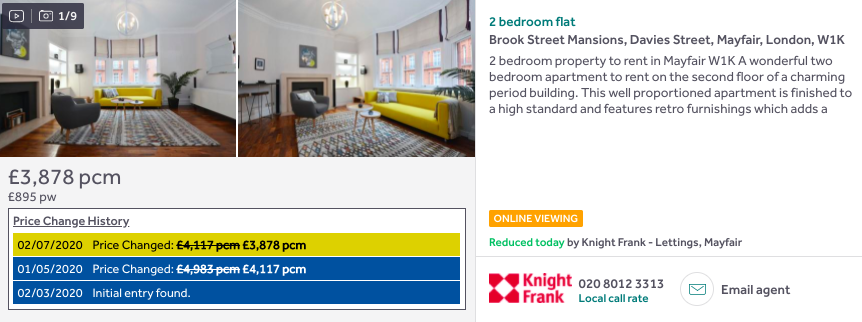

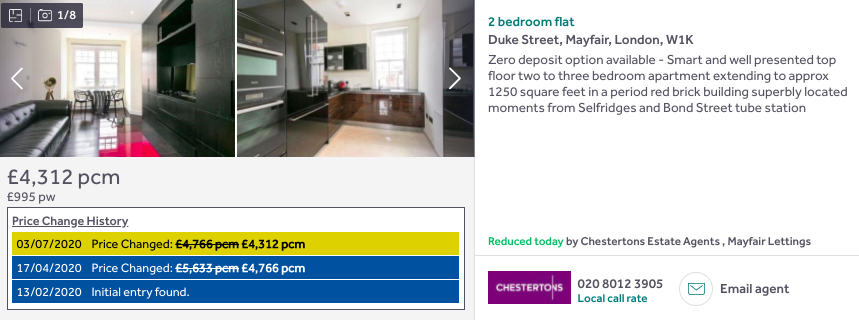

Mayfair, down 24% https://www.rightmove.co.uk/property-to-rent/property-80361025.html

Tourists won’t bite – renters’ delight

Zone 1 rents falling – landlords’ warning

Zone 1 rents falling – landlords’ warning

What do you do? Cut rents in central London. Zone 1 for the price of Zone 2.

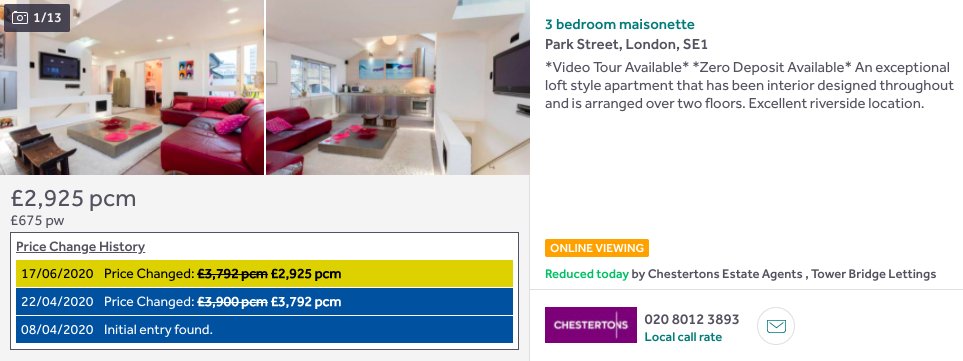

Borough Market, down 25% https://www.rightmove.co.uk/property-to-rent/property-78782230.html

Pimlico studio, down 20% https://www.rightmove.co.uk/property-to-rent/property-69703140.html

Holborn, down 20% https://www.rightmove.co.uk/property-to-rent/property-79111381.html

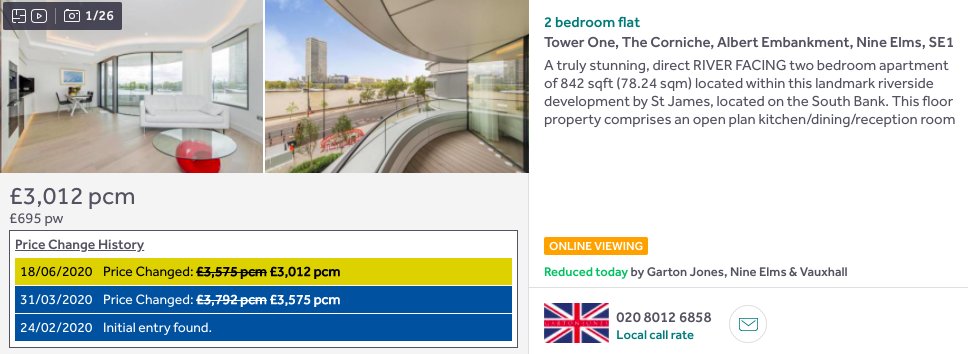

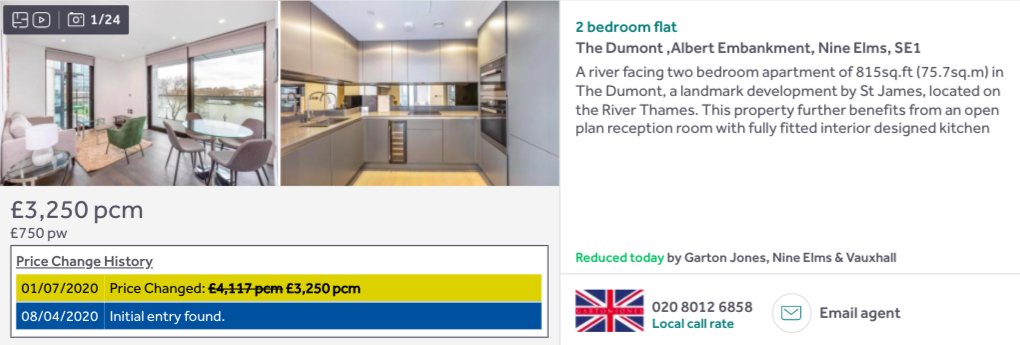

Albert Embankment, down 21% https://www.rightmove.co.uk/property-to-rent/property-89423318.html

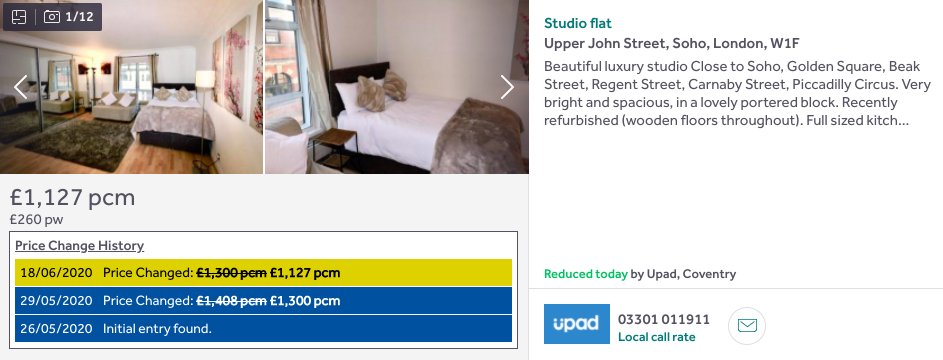

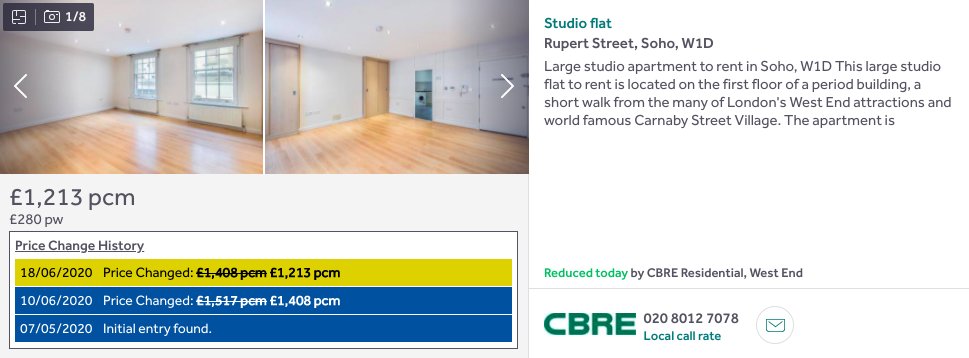

Soho studio, down 20% https://www.rightmove.co.uk/property-to-rent/property-92716379.html

Another Soho studio, also down 20% https://www.rightmove.co.uk/property-to-rent/property-79052128.html

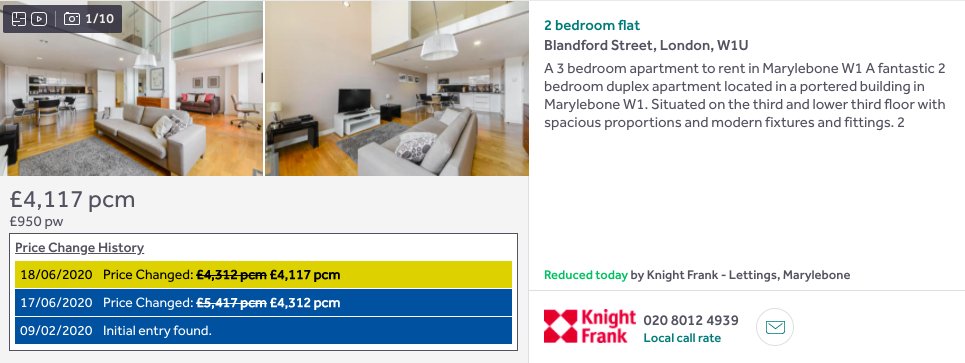

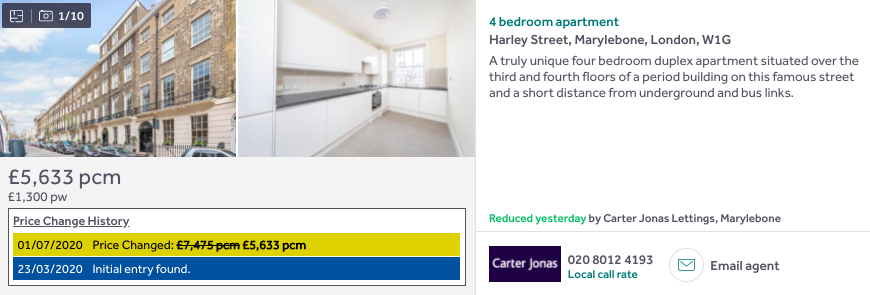

Marylebone, down 24% https://www.rightmove.co.uk/property-to-rent/property-77312329.html

St Paul's, down 29% https://www.rightmove.co.uk/property-to-rent/property-93059771.html

Clerkenwell, down 20% https://www.rightmove.co.uk/property-to-rent/property-78179287.html

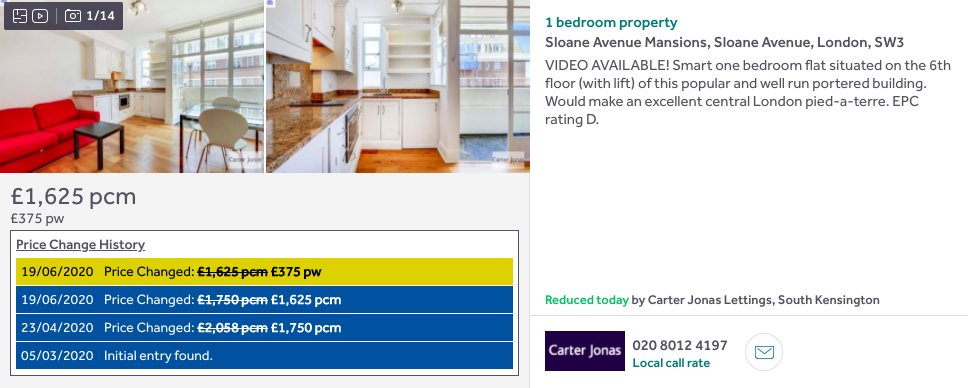

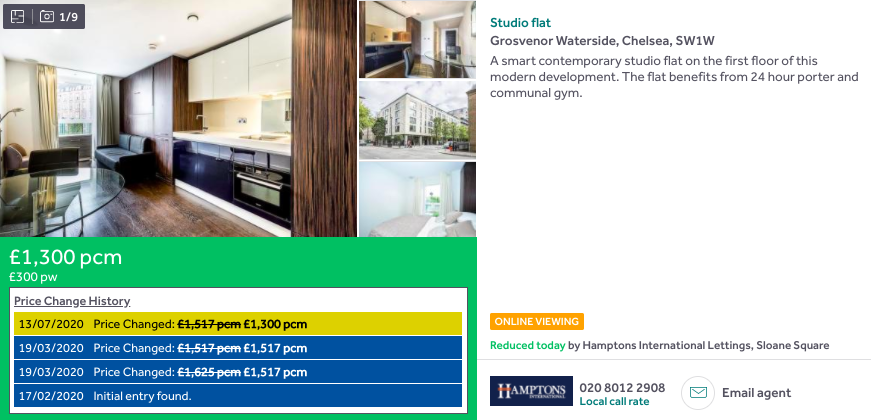

Sloane Square, down 21% https://www.rightmove.co.uk/property-to-rent/property-67698759.html

Notting Hill short let, down 26% https://www.rightmove.co.uk/property-to-rent/property-93171263.html

This Notting Hill studio is actually cheaper to rent than the latest @vice 'rental opportunity of the week' in Cricklewood in Zone 3 https://www.vice.com/en_uk/article/889x5k/studio-flat-cricklewood-rental-opportunity

This Notting Hill studio is actually cheaper to rent than the latest @vice 'rental opportunity of the week' in Cricklewood in Zone 3 https://www.vice.com/en_uk/article/889x5k/studio-flat-cricklewood-rental-opportunity

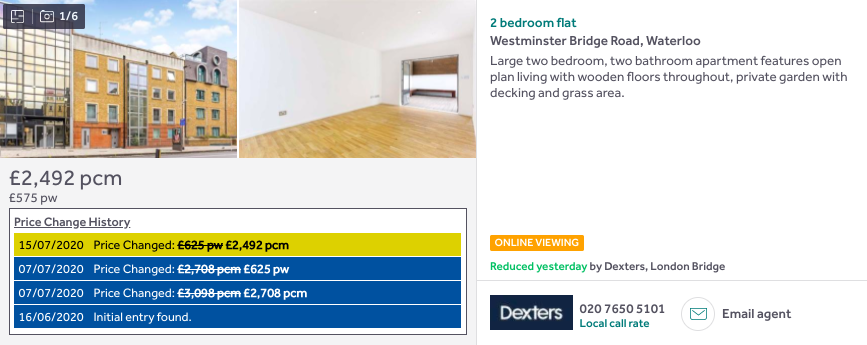

Waterloo, down 20% https://www.rightmove.co.uk/property-to-rent/property-89392028.html

Tottenham Court Road, down 27% https://www.rightmove.co.uk/property-to-rent/property-71716411.html

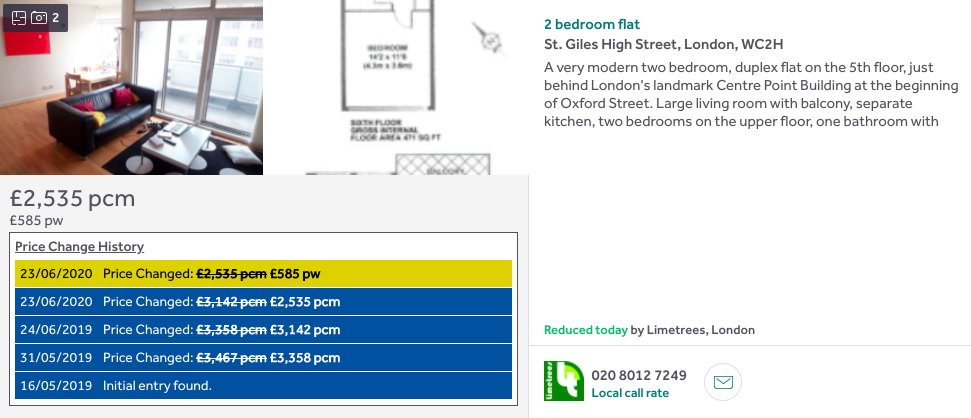

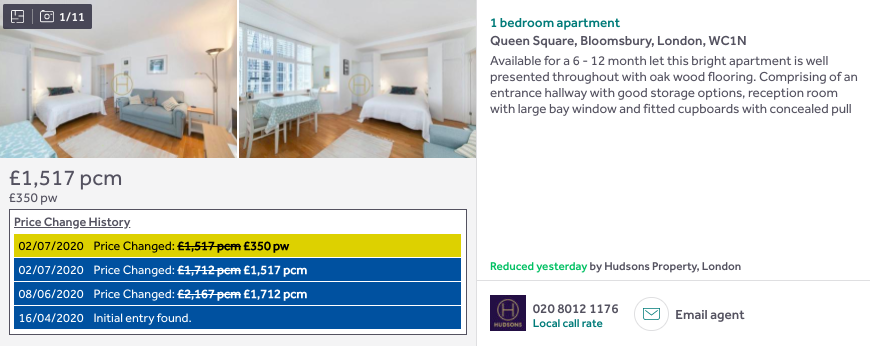

Bloomsbury, down 20% https://www.rightmove.co.uk/property-to-rent/property-79308931.html

Holborn, down 21% https://www.rightmove.co.uk/property-to-rent/property-78420778.html

So have the properties I've listed in this thread been let yet? The scores on the doors:

Let agreed - 9%

Delisted - 24%

Still available - 67%

Let agreed - 9%

Delisted - 24%

Still available - 67%

Bond Street, down 20% https://www.rightmove.co.uk/property-to-rent/property-87309698.html

More perspective on the glut of rental property in central London. Amount of property "to let" in SE1/Southbank area is now over double its recent average

Fleet Street, down 22% https://www.rightmove.co.uk/property-to-rent/property-67949895.html

Covent Garden, down 25% https://www.rightmove.co.uk/property-to-rent/property-87369974.html

Westminster, down 20% https://www.rightmove.co.uk/property-to-rent/property-79994614.html

Westminster, down 27% https://www.rightmove.co.uk/property-to-rent/property-69213597.html

Zone 1 for the price of Zone 2

Covent Garden, down 22% https://www.rightmove.co.uk/property-to-rent/property-91851254.html #zone1forthepriceofzone2

More data. Over the past 10 days on Zoopla.

Number of London properties to let or let agreed:

by 7,041 (6.1%) to 115,712

by 7,041 (6.1%) to 115,712

Average per-week asking rent:

by £15 (2.4%) to £638

by £15 (2.4%) to £638

Number of London properties to let or let agreed:

by 7,041 (6.1%) to 115,712

by 7,041 (6.1%) to 115,712Average per-week asking rent:

by £15 (2.4%) to £638

by £15 (2.4%) to £638

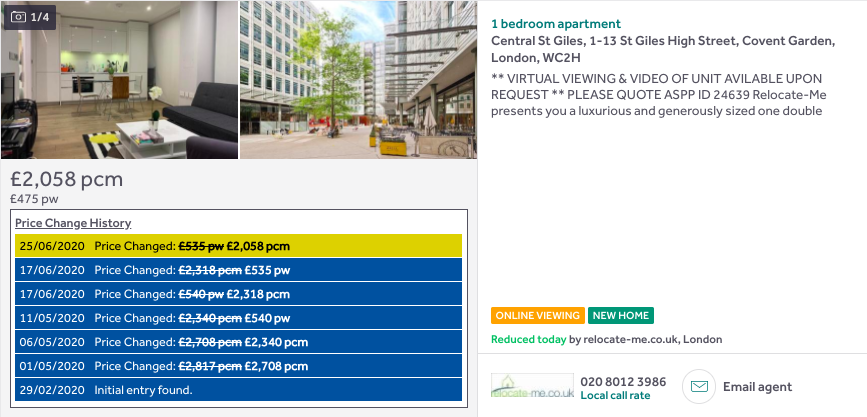

Central St Giles, down 27% https://www.rightmove.co.uk/property-to-rent/property-77358946.html

Pimlico, down 24% https://www.rightmove.co.uk/property-to-rent/property-69703140.html

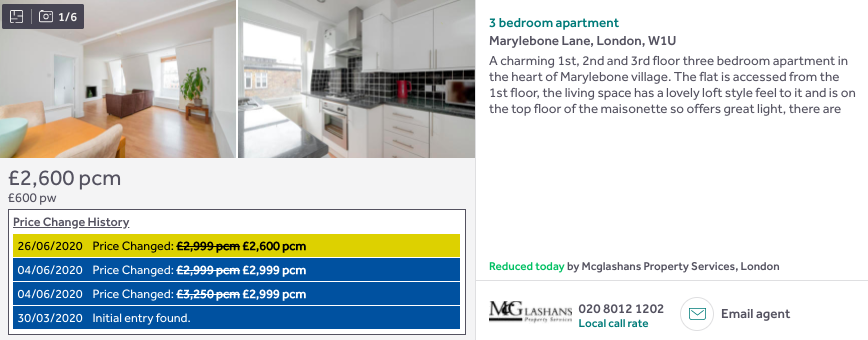

Marylebone, down 20% https://www.rightmove.co.uk/property-to-rent/property-90833243.html

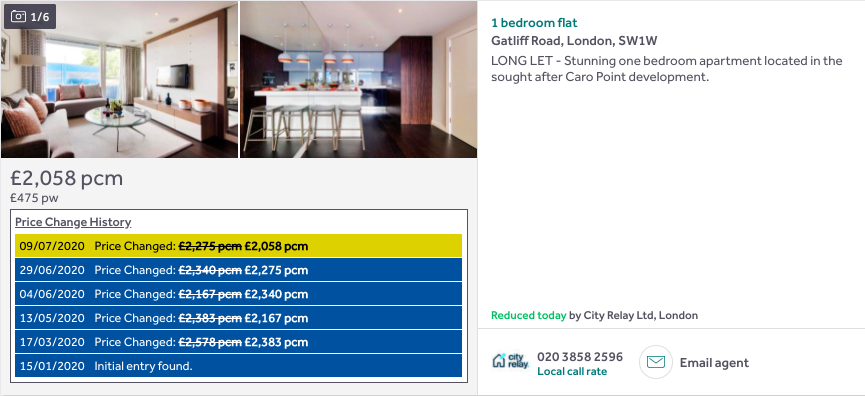

Farringdon, down 22% https://www.rightmove.co.uk/property-to-rent/property-92297345.html

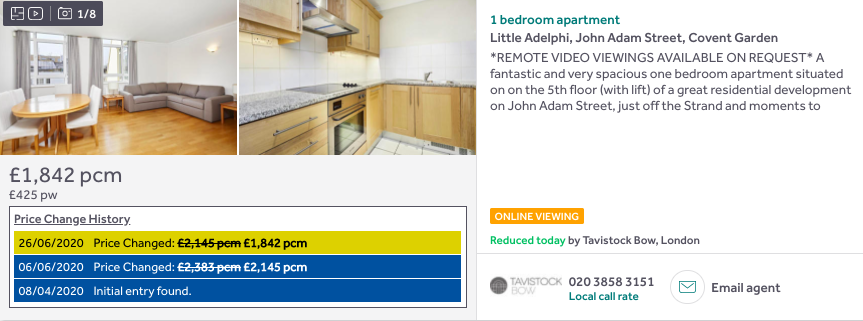

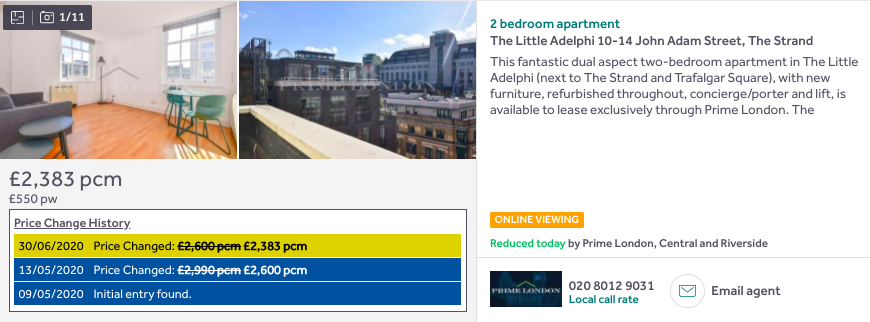

Just off The Strand, down 23% https://www.rightmove.co.uk/property-to-rent/property-90250772.html

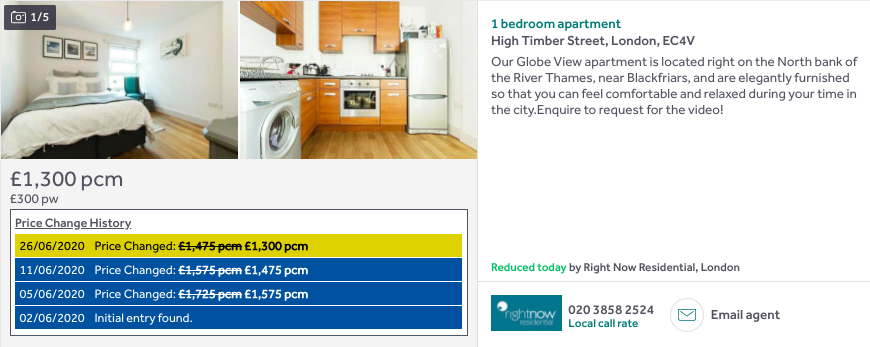

Blackfriars/Cannon Street, down 25% https://www.rightmove.co.uk/property-to-rent/property-93036728.html

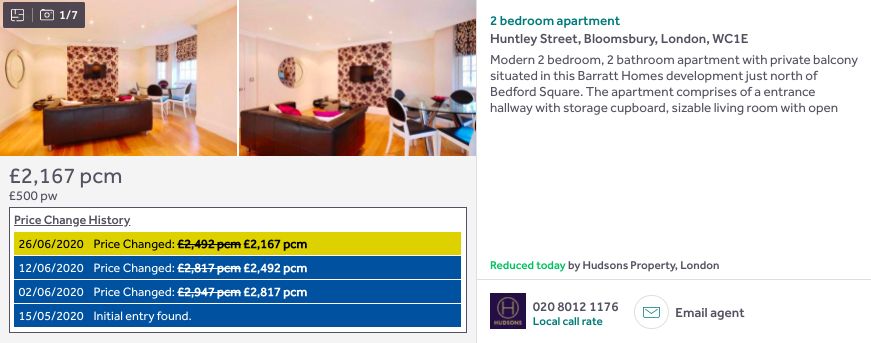

Bloomsbury, down 26% https://www.rightmove.co.uk/property-to-rent/property-79706572.html

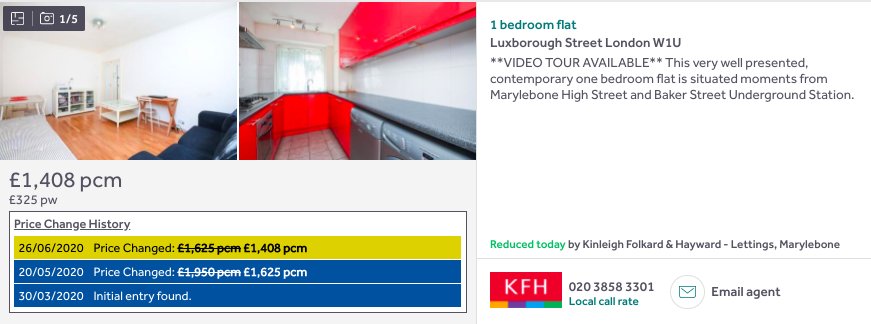

Baker Street, down 28% https://www.rightmove.co.uk/property-to-rent/property-69008130.html

Goodge Street, down 25% https://www.rightmove.co.uk/property-to-rent/property-79157842.html

Clerkenwell, down 20% https://www.rightmove.co.uk/property-to-rent/property-93535826.html

Fitzrovia, down 25% https://www.rightmove.co.uk/property-to-rent/property-77239813.html

Marylebone, down 27% https://www.rightmove.co.uk/property-to-rent/property-81307582.html (yes, that really does say £42,250 per month)

Mayfair, down 23% https://www.rightmove.co.uk/property-to-rent/property-84459305.html

Borough Market, down 33% https://www.rightmove.co.uk/property-to-rent/property-78782230.html

Marylebone, down 20% https://www.rightmove.co.uk/property-to-rent/property-67217510.html

The Strand, down 20% https://www.rightmove.co.uk/property-to-rent/property-70291143.html

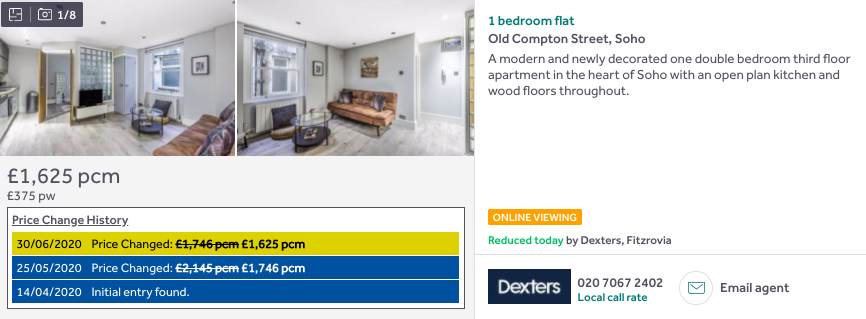

Old Compton St 1-bed, down 24% https://www.rightmove.co.uk/property-to-rent/property-91385567.html

Westminster 1-bed, down 22% https://www.rightmove.co.uk/property-to-rent/property-90606524.html

Victoria, down 24% https://www.rightmove.co.uk/property-to-rent/property-83219714.html

Whitehall, down 25% https://www.rightmove.co.uk/property-to-rent/property-90893897.html

Albert Embankment, down 21% https://www.rightmove.co.uk/property-to-rent/property-88972091.html

More data. Amount of available rental stock on London's South Bank now 109% above its recent average

More data. Asking rent reductions in the wider area covered by the SE1 postcode appear not to have peaked yet.

To add, data from @GShoneEG shows the whole of central London is experiencing a surge in the amount of property needing to be let https://twitter.com/GShoneEG/status/1278276689131376646?s=20

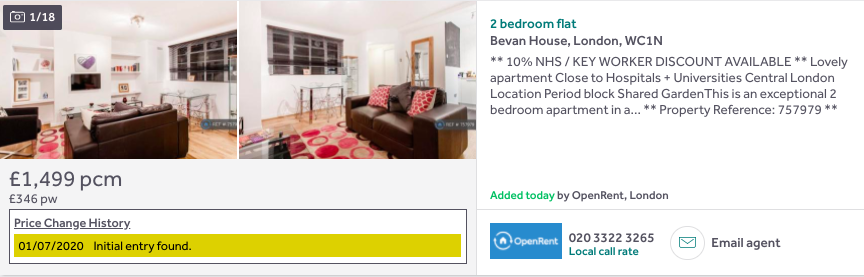

NHS/Key worker discount on what looks to be a former Airbnb near Holborn

NHS/Key worker discount on what looks to be a former Airbnb near Holborn

https://www.rightmove.co.uk/property-to-rent/property-81555508.html

https://www.rightmove.co.uk/property-to-rent/property-81555508.html

Mayfair, down 22% https://www.rightmove.co.uk/property-to-rent/property-86341175.html

Covent Garden, down 27% https://www.rightmove.co.uk/property-to-rent/property-92172368.html

Fitzrovia, down 28% https://www.rightmove.co.uk/property-to-rent/property-74308813.html

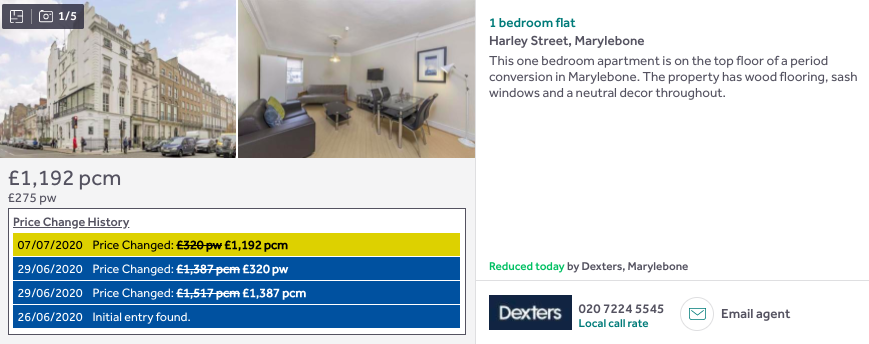

Harley Street, down 25% https://www.rightmove.co.uk/property-to-rent/property-90766412.html

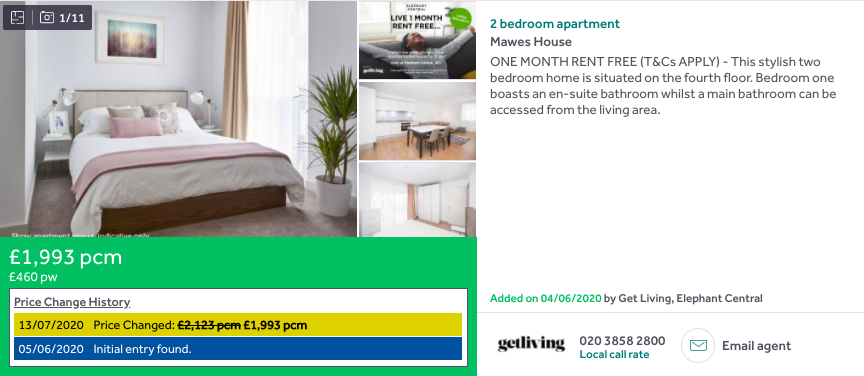

Elephant, down 10% and with a 2 weeks rent free offer https://www.rightmove.co.uk/property-to-rent/property-80144482.html

More data, from Goodlord, on June rents in London:

Average rent down 2.8% year-on-year to £1,576.

Average void days up 64% year-on-year to 23.

Average rent down 2.8% year-on-year to £1,576.

Average void days up 64% year-on-year to 23.

Elephant, down 20% https://www.rightmove.co.uk/property-to-rent/property-93915764.html

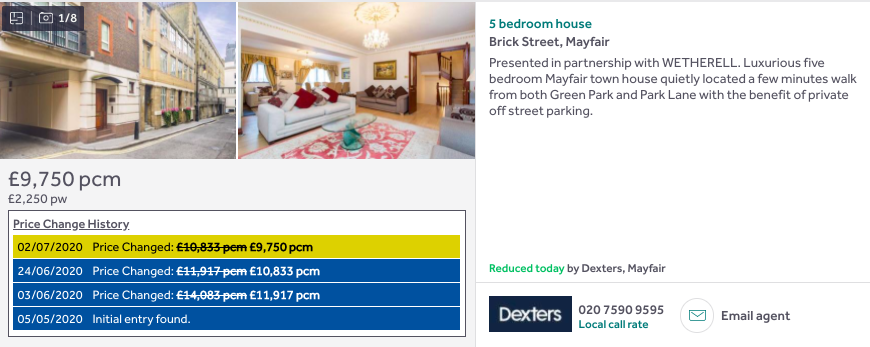

Mayfair, down 31% https://www.rightmove.co.uk/property-to-rent/property-91926449.html

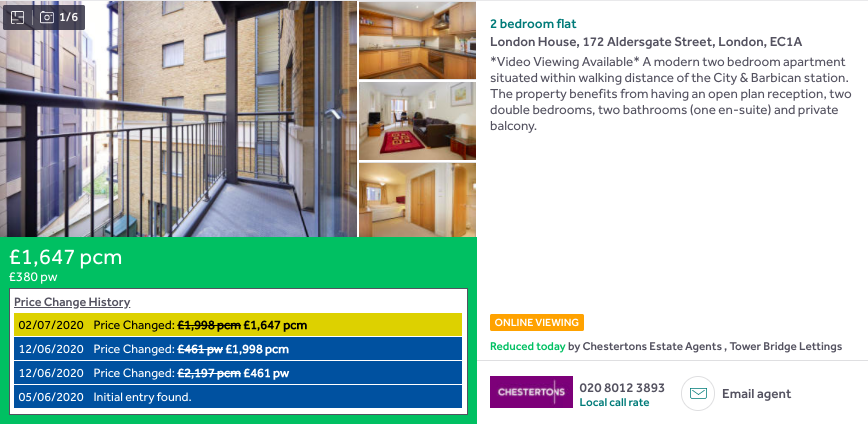

Barbican, down 25% to £1,647 https://www.rightmove.co.uk/property-to-rent/property-80516944.html

Belgravia, down 20% to £4,312 https://www.rightmove.co.uk/property-to-rent/property-89669009.html

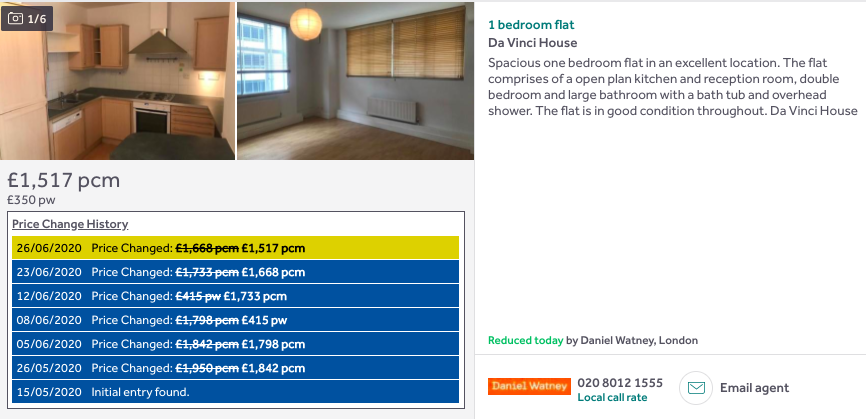

Bloomsbury, down 30% to £1,517 https://www.rightmove.co.uk/property-to-rent/property-78940531.html

Covent Garden, down 24% to £2,383 https://www.rightmove.co.uk/property-to-rent/property-92588447.html

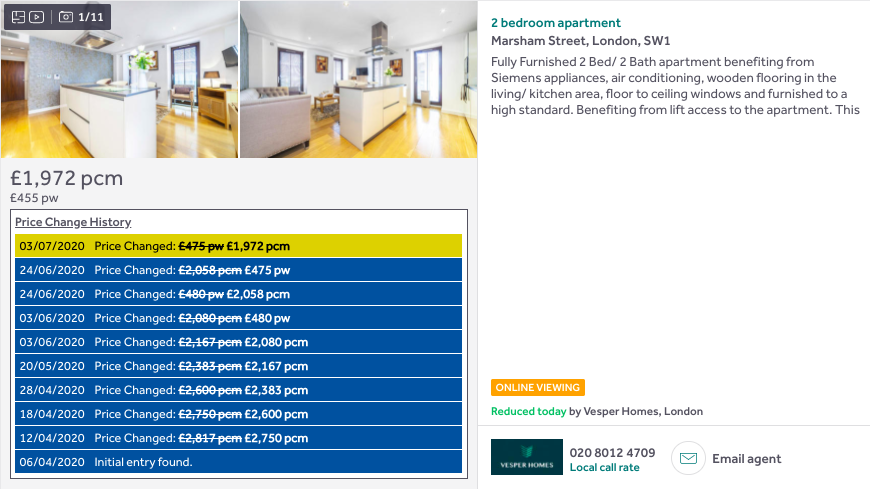

Millbank, down 30% to £1,972 https://www.rightmove.co.uk/property-to-rent/property-69213597.html

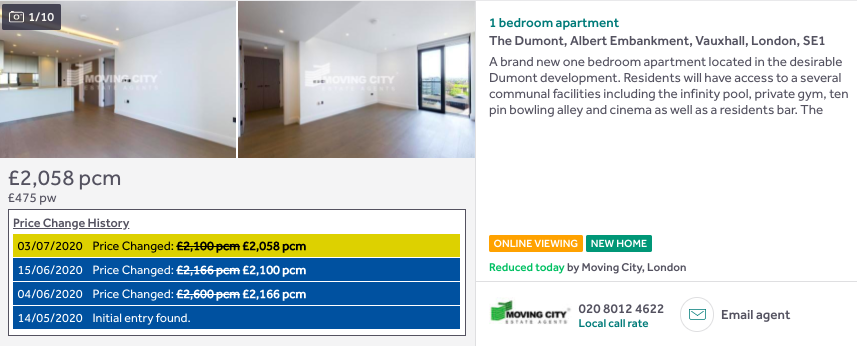

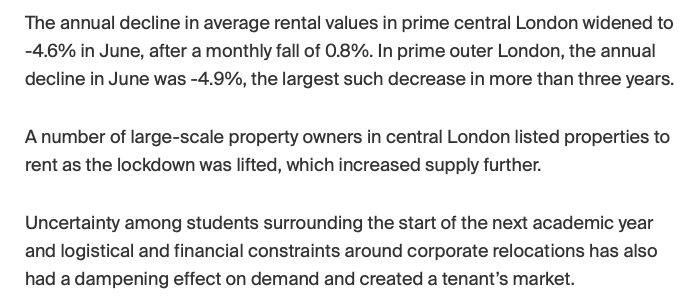

Albert Embankment, down 21% to £2,058 https://www.rightmove.co.uk/property-to-rent/property-92240117.html

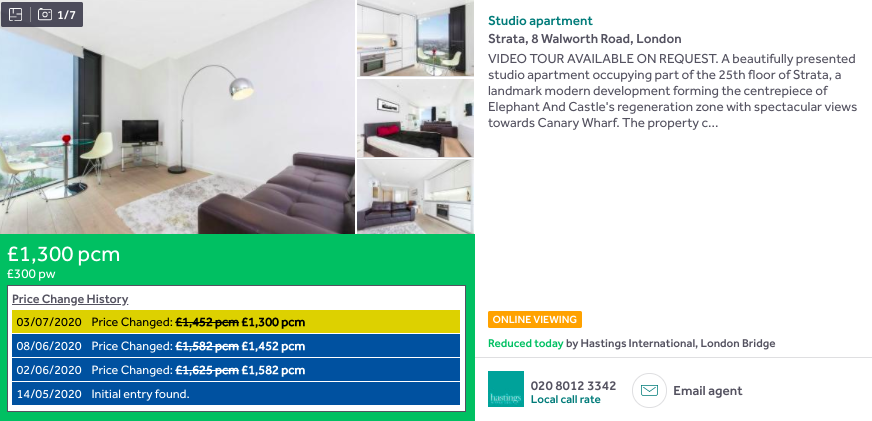

Elephant, down 20% to £1,300 https://www.rightmove.co.uk/property-to-rent/property-70492641.html

Mayfair, down 23% to £4,312 https://www.rightmove.co.uk/property-to-rent/property-77374792.html

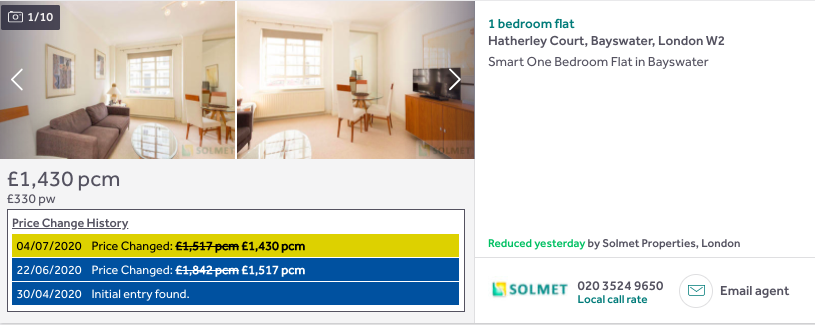

Bayswater, down 22% to £1,430 https://www.rightmove.co.uk/property-to-rent/property-79261657.html

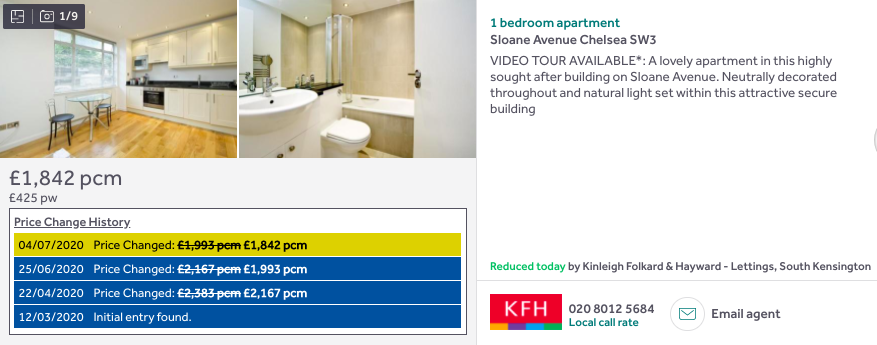

Chelsea, down 23% to £1,842 https://www.rightmove.co.uk/property-to-rent/property-89586221.html

Westminster, down 25% to £1,499 https://www.rightmove.co.uk/property-to-rent/property-77375473.html

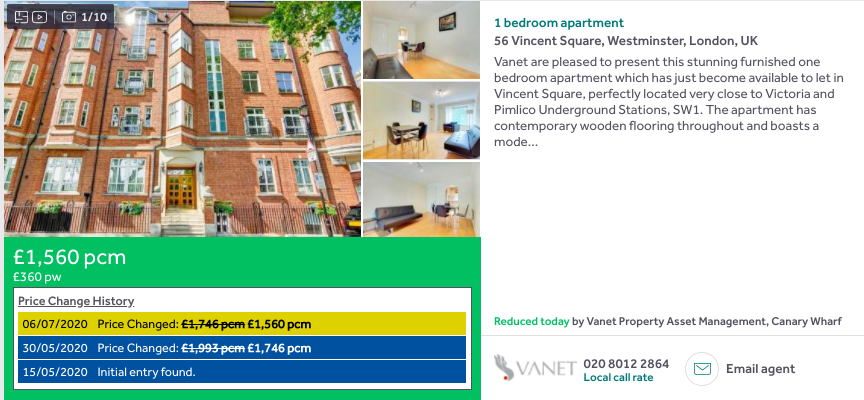

Westminster, down 22% to £1,560 https://www.rightmove.co.uk/property-to-rent/property-91788005.html

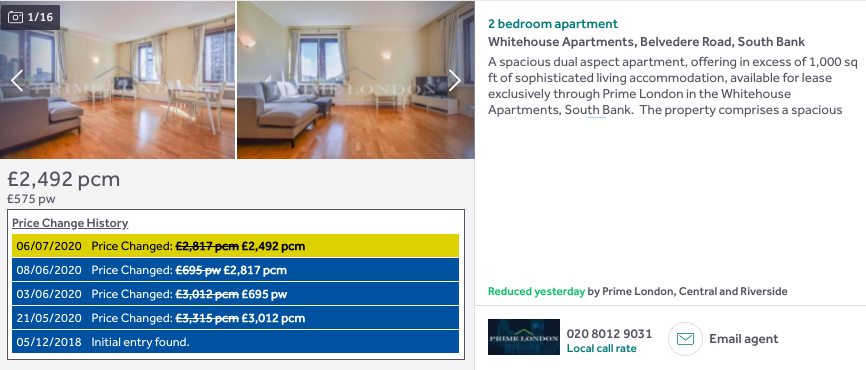

South Bank, down 25% to £2,492 https://www.rightmove.co.uk/property-to-rent/property-58603317.html

Thousands more flats coming to London https://twitter.com/peterproperty/status/1280082642701029376?s=20

Lambeth North, down 10% to £1,434, with no rent to pay for first two weeks https://www.rightmove.co.uk/property-to-rent/property-69482058.html

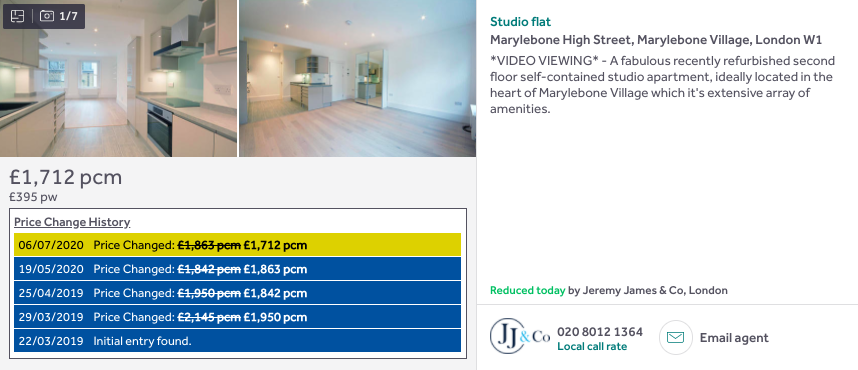

Marylebone, down 20% to £1,712 https://www.rightmove.co.uk/property-to-rent/property-61151202.html

More data - central London rents drop 10%, according to estate agent Chestertons https://www.landlordtoday.co.uk/breaking-news/2020/7/rents-have-dropped-10-in-central-london

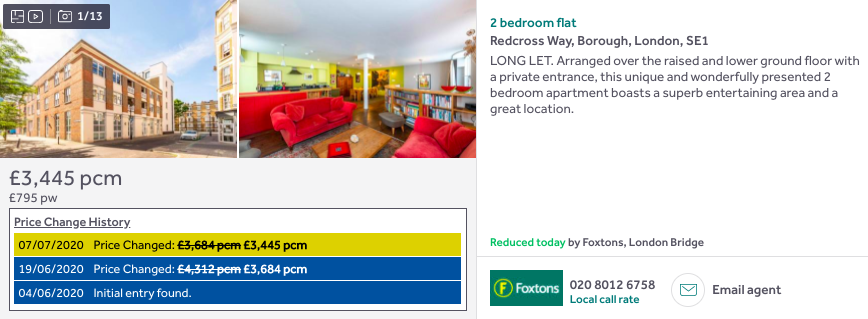

Borough, down 20% to £3,445 https://www.rightmove.co.uk/property-to-rent/property-80475970.html

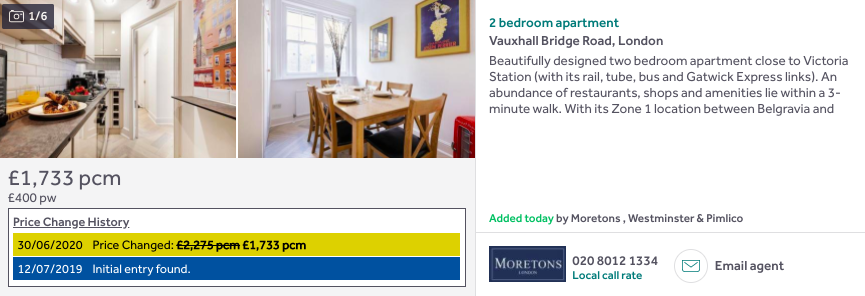

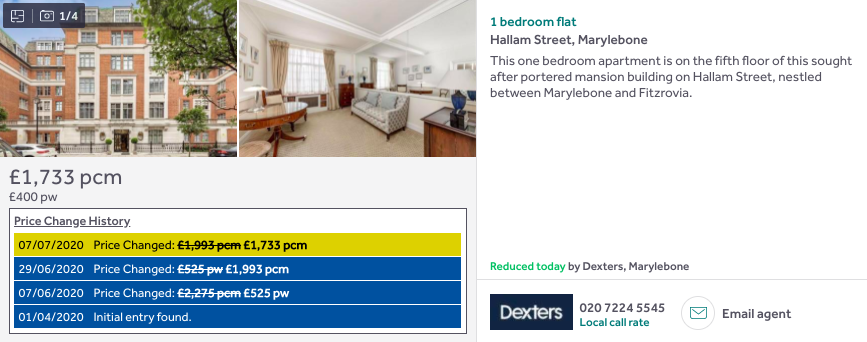

Marylebone, down 24% to £1,733 https://www.rightmove.co.uk/property-to-rent/property-69436650.html

More data. In the past 3 weeks:

Number of properties to let in London has increased by 15,000 to 123,230 (includes let agreed).

Average London asking rent has decreased by 4% to £628 per week.

Source: https://www.zoopla.co.uk/to-rent/

Number of properties to let in London has increased by 15,000 to 123,230 (includes let agreed).

Average London asking rent has decreased by 4% to £628 per week.

Source: https://www.zoopla.co.uk/to-rent/

Harley Street, down 21% to £1,192 https://www.rightmove.co.uk/property-to-rent/property-71479080.html

Prime central London rents down 4.6% annually.

Prime outer London rents down 4.9% annually.

Source: Knight Frank https://www.knightfrank.co.uk/research/article/2020-07-07-prime-london-lettings-report-june-2020

Prime outer London rents down 4.9% annually.

Source: Knight Frank https://www.knightfrank.co.uk/research/article/2020-07-07-prime-london-lettings-report-june-2020

Greater London rents down 1.7% annually.

South East England rents down 1.3% annually.

Source: HomeLet https://homelet.co.uk/homelet-rental-index

South East England rents down 1.3% annually.

Source: HomeLet https://homelet.co.uk/homelet-rental-index

One Blackfriars, down 24% to £4,442 https://www.rightmove.co.uk/property-to-rent/property-82870064.html

More data - the London rental market is seeing the weakest tenant demand relative to landlord supply since 2016, according to RICS.

However, the overall picture favours further falls in rents. The question 'do you expect rents in your area to be up / down / unchanged over the next 3 months' produced the biggest number of 'down' answers of any quarter since the survey started in 2014.

Anyway, back to documenting significant rent reductions in Zone 1. Chelsea(-ish) down 20% to £2,058 https://www.rightmove.co.uk/property-to-rent/property-88213874.html

Soho, apparently "one of London's most talked about new buildings ... with hotel style service", down 31% to £5,352 https://www.rightmove.co.uk/property-to-rent/property-90748136.html

This seems to have slipped under the radar - estate agent forecasts UK rents to drop 5-7% and London rents to drop 10-12% in 2020. Source: https://chips.chestertons.com/assets/downloads/www-che/68092/8da65df2c02cf008a3d2ed992b33a739/The%20Impact%20of%20Covid_19%20on%20The%20Property%20Market%20_%20June%202020.pdf

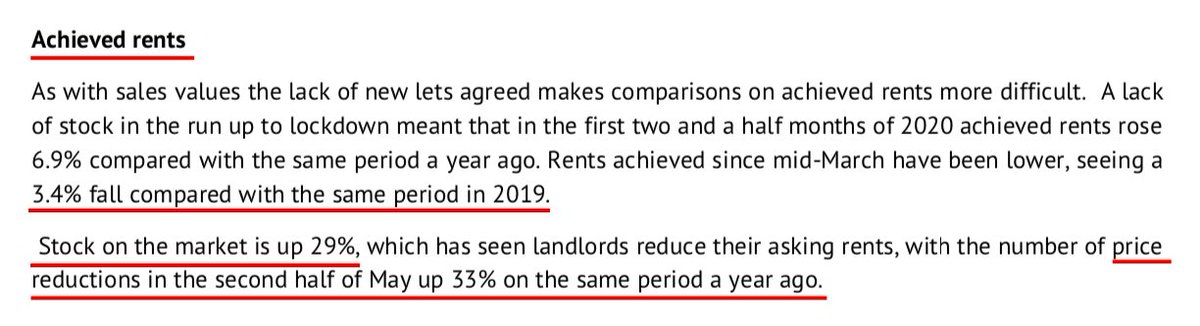

It's a month old, but interesting: "Lockdown caused the number of new tenancies in central London to fall by around 54% between March and May and the result of this was 29% more properties available on the market at the beginning of June compared to the same time last year."

"The fall in demand reflects a combination of factors:

– The overseas student market has dried up as students no longer know if they will be able to study in September

– Corporate relocations are very low as companies exercise tighter cost control and homeworking has increased

– The overseas student market has dried up as students no longer know if they will be able to study in September

– Corporate relocations are very low as companies exercise tighter cost control and homeworking has increased

– Existing tenants delaying committing to new leases as they consider cheaper accommodation options in light of falling rents

– Tenants renegotiating lower rents with their landlords to avoid the hassle, cost and risks associated with moving.

– Tenants renegotiating lower rents with their landlords to avoid the hassle, cost and risks associated with moving.

The imbalance between supply and demand and the caution on the part of many tenants means that landlords are now having to discount their properties by 10-15% in order to secure a tenant, or risk facing a lengthy void period with no rental income."

A 10-second video on falling rents in London

Rule of thumb seems to be that rents drop ~1% for each ~3% increase in properties available

Would have been nice if we had come by these cheaper rents by, you know, a competent national government having got a lot more housing built, rather than blundering into a global pandemic and a recession ...

Back to the reductions. 27% off the rent for this large adn totally new studio on the South Bank, where the LL's service charges costs - pool, spa, concierge, gym (who knows if they're usable atm?) - are prob around £400 per month. But there's a catch ... https://www.rightmove.co.uk/property-to-rent/property-71749245.html

... "This [£1,950] is a reduced asking price due to the current situation. The original rent for this flat is £2,700. The owner is looking for a flexible contract with a 6 months break."

A good deal for the right person though and definitely cheap for the building

A good deal for the right person though and definitely cheap for the building

Farringdon, awkward 2-bed, down 27% to £1,560 after three months on the market https://www.rightmove.co.uk/property-to-rent/property-91186811.html

Chelsea studio, down 20% to £1,300 https://www.rightmove.co.uk/property-to-rent/property-89500544.html

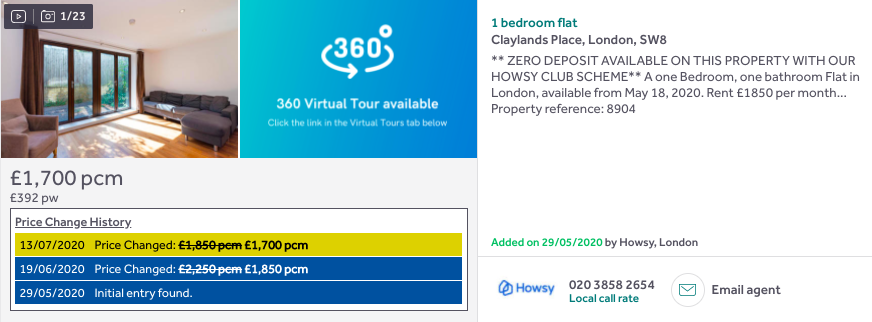

Oval, 1-bed with small garden, down 24% to £1,700 https://www.rightmove.co.uk/property-to-rent/property-70786188.html

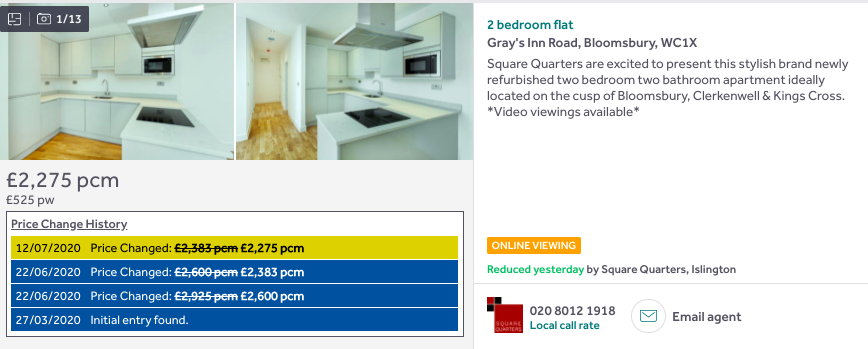

Gray's Inn Road 2-bed, down 22% to £2,275 https://www.rightmove.co.uk/property-to-rent/property-63443793.html

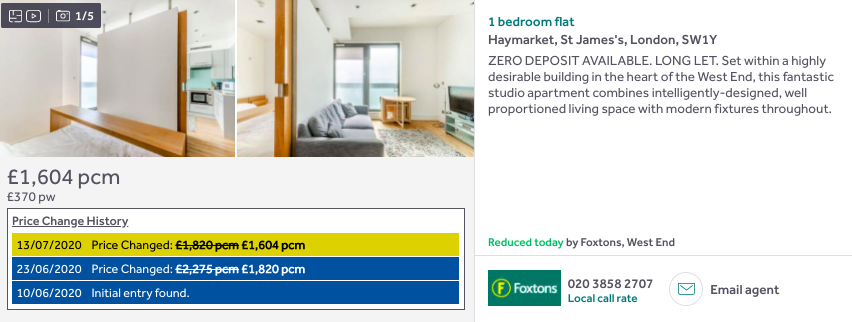

Studio a stone's throw from Piccadilly Circus, down 29% to £1,604 https://www.rightmove.co.uk/property-to-rent/property-93357368.html

Elephant, 2-bed reduced 6% to £1,993 with 'one month rent free' offer https://www.rightmove.co.uk/property-to-rent/property-80500393.html

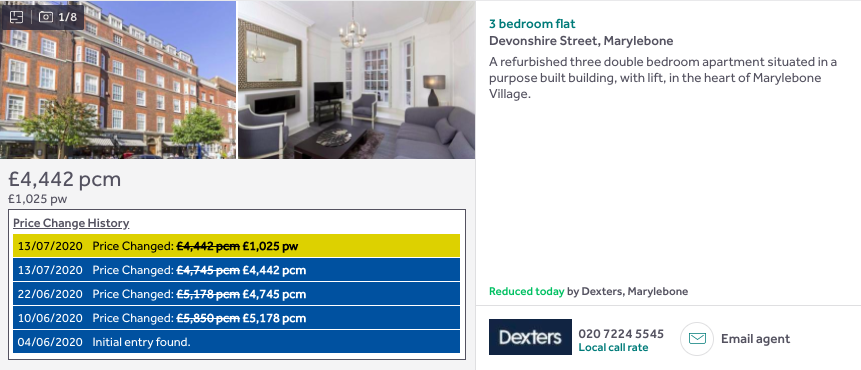

Marylebone, 3-bed reduced 24% to £4,442 https://www.rightmove.co.uk/property-to-rent/property-70936641.html

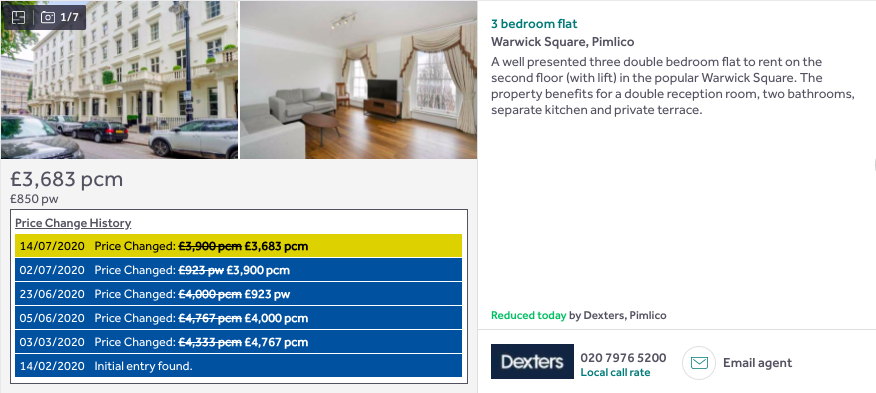

Pimlico 3-bed reduced 23% to £3,683 https://www.rightmove.co.uk/property-to-rent/property-68376414.html

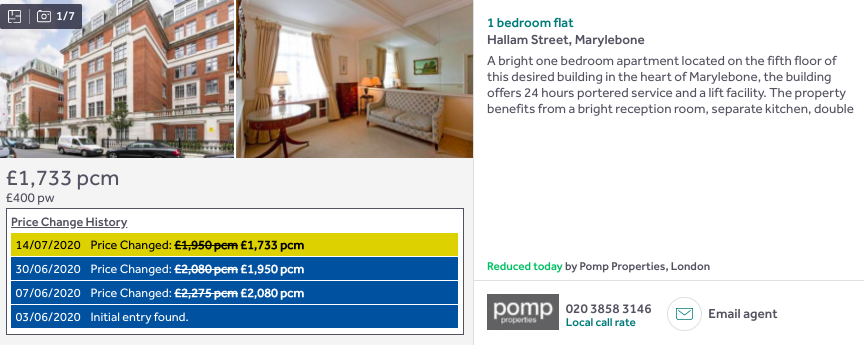

Marylebone 1-bed down 24% to £1,733 https://www.rightmove.co.uk/property-to-rent/property-93083522.html

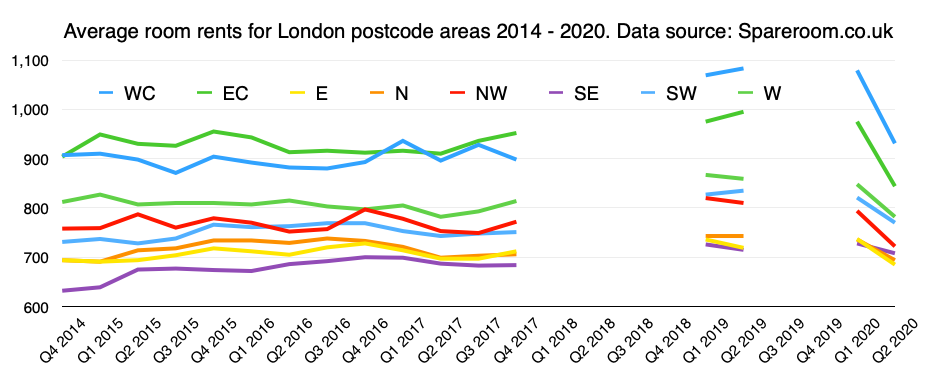

More data - average monthly rent for a room in Q2 2020 according to http://Spareroom.co.uk :

London down 7% annually to £725

Rest of UK up 2% annually to £489

Source: https://www.spareroom.co.uk/media/rental-index

London down 7% annually to £725

Rest of UK up 2% annually to £489

Source: https://www.spareroom.co.uk/media/rental-index

Annual room rent decreases by London postcode area:

EC down 15% to £844

WC down 14% to £931

NW down 11% to £722

W down 9% to £782

SW down 8% to £770

N down 7% to £694

E down 5% to £685

SE down 1% to £708

Source: https://www.spareroom.co.uk/media/rental-index

EC down 15% to £844

WC down 14% to £931

NW down 11% to £722

W down 9% to £782

SW down 8% to £770

N down 7% to £694

E down 5% to £685

SE down 1% to £708

Source: https://www.spareroom.co.uk/media/rental-index

So I reckon that makes average room rents in the following London postcode areas cheaper than they have been at any point since at least 2014:

E

EC

W

NW

E

EC

W

NW

Some trivia for the Sarf London massive ...

The SE postcode area is no longer Inner London's cheapest, having just gotten more expensive than E and N London in terms of average cost to rent a room

The SE postcode area is no longer Inner London's cheapest, having just gotten more expensive than E and N London in terms of average cost to rent a room

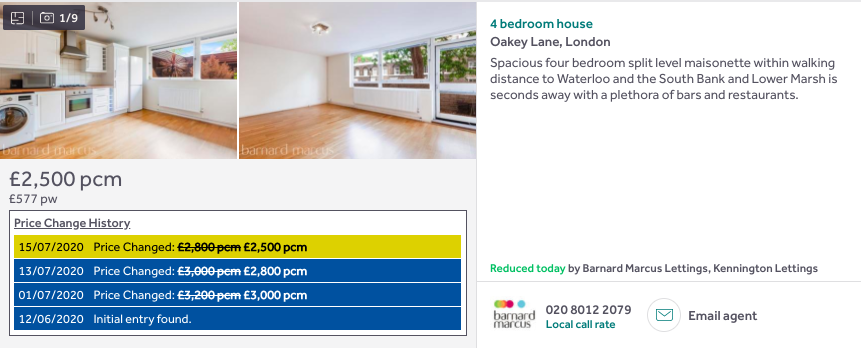

Lambeth North 4-bed, down 22% to £2,500 https://www.rightmove.co.uk/property-to-rent/property-93419816.html

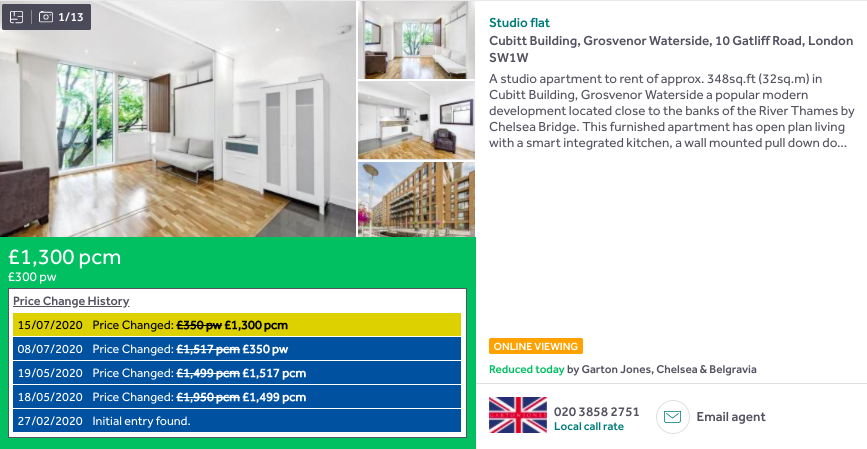

Chelsea/Pimlico no man's land studio down 33% to £1,300 https://www.rightmove.co.uk/property-to-rent/property-68680611.html

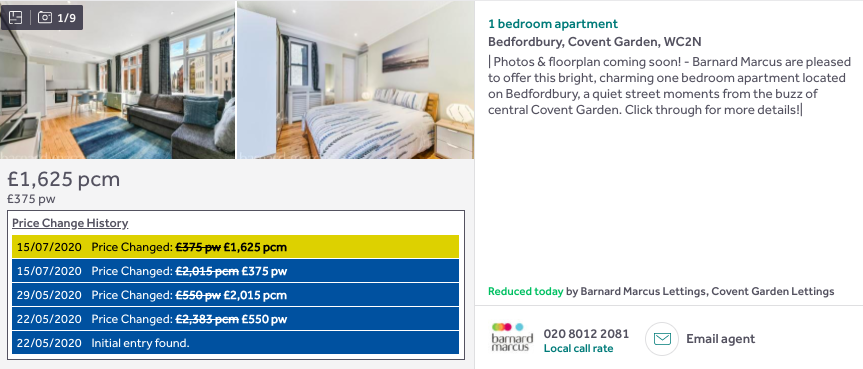

Covent Garden 1-bed, down 32% to £1,625 https://www.rightmove.co.uk/property-to-rent/property-92569880.html

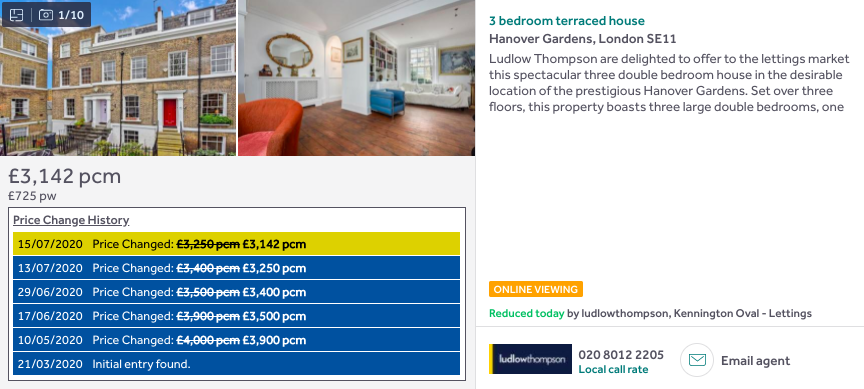

Oval, 3-bed house with garden down 21% to £3,142 https://www.rightmove.co.uk/property-to-rent/property-90663323.html

Southbank, 2-bed with a 3 weeks rent free offer down 15% to £2,250 https://www.rightmove.co.uk/property-to-rent/property-94771613.html

And some more data on falling rents, from LCP, which is a prime central London property adviser. It says properties let to new tenants in June attracted on average 14.7% less rent than the previous tenancy.

Also some Q2 data from Rightmove:

- London av. asking rent down 0.6% yr on yr

- London available rental stock up 41% yr on yr "fuelled in-part by a surge in long-term rental supply from the curtailed holiday short-let market"

- Ex-London av. asking rent up 3.4% yr on yr

- London av. asking rent down 0.6% yr on yr

- London available rental stock up 41% yr on yr "fuelled in-part by a surge in long-term rental supply from the curtailed holiday short-let market"

- Ex-London av. asking rent up 3.4% yr on yr

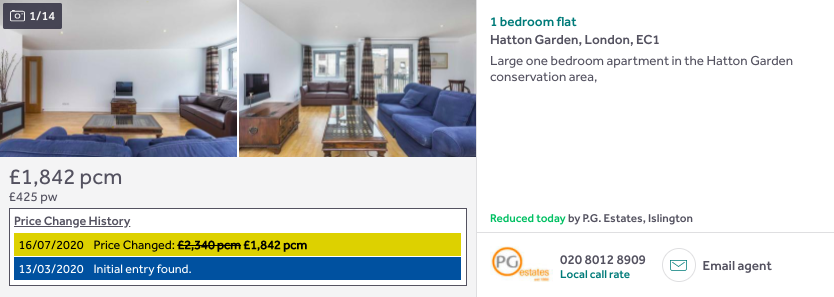

Back to the reductions. Hatton Garden 1-bed with balcony down 21% to £1,842 https://www.rightmove.co.uk/property-to-rent/property-69064089.html

Waterloo 2-bed with garden down 20% to £2,492 https://www.rightmove.co.uk/property-to-rent/property-93570689.html

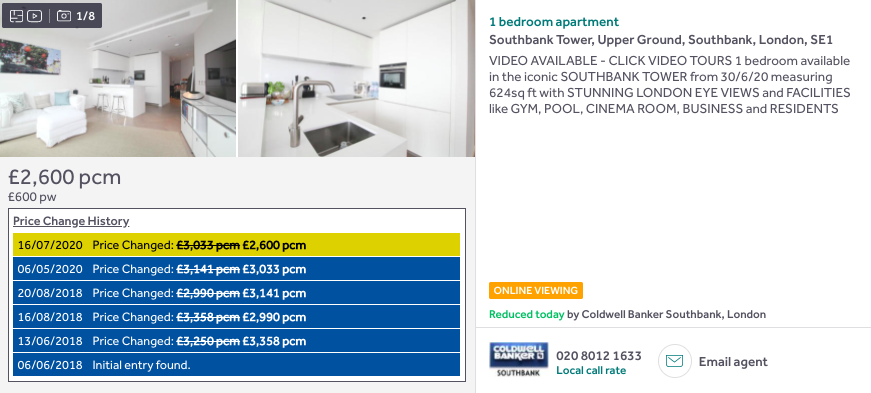

Southbank Tower 1-bed down 20% to £2,600 (probably a new low price for this development) https://www.rightmove.co.uk/property-to-rent/property-73660913.html

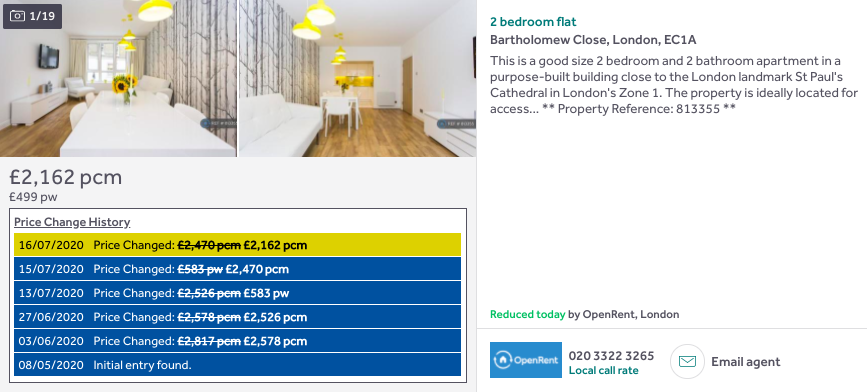

Barbican tube, 2-bed flat down 23% to £2,162 https://www.rightmove.co.uk/property-to-rent/property-79266907.html

June data from LonRes on prime central London:

- rents down 4.6% year on year

- supply up 53% year on year

- "prospective tenants have choice and are in a strong position ... negotiating an average of 7.1% off initial asking rents, up from 4.5% a year ago"

- rents down 4.6% year on year

- supply up 53% year on year

- "prospective tenants have choice and are in a strong position ... negotiating an average of 7.1% off initial asking rents, up from 4.5% a year ago"

Pimlico 3-bed house down 25% to £3,497 https://www.rightmove.co.uk/property-to-rent/property-90337355.html

Pimlico studio down 21% to £949 https://www.rightmove.co.uk/property-to-rent/property-80224729.html

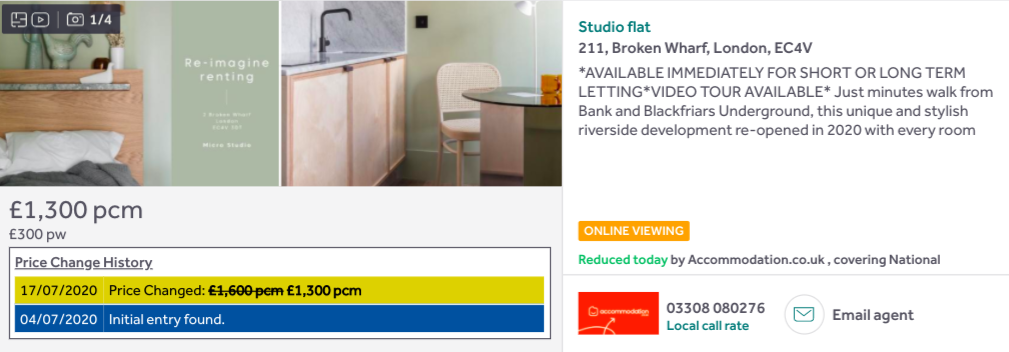

Would normally filter stuff like this out as even the price it's come down to is ridiculous - but here you go, here's a "micro studio" near Blackfriars that was £1,600 (Were they ill?), down 19% to £1,300 (Are they high?) https://www.rightmove.co.uk/property-to-rent/property-94379408.html

"Do you hate everybody and also yourself? You do? Well come and live in my £1,600 per month micro studio!"

Read on Twitter

Read on Twitter![Anyone can keep tabs on these price cuts by using the free [though I've happily donated] Property Log extension for Chrome. https://chrome.google.com/webstore/detail/property-log/jccihedpilhidcbkconacnalppdeecno/related?hl=en-GB Here's what Property Log tells you for this property. Anyone can keep tabs on these price cuts by using the free [though I've happily donated] Property Log extension for Chrome. https://chrome.google.com/webstore/detail/property-log/jccihedpilhidcbkconacnalppdeecno/related?hl=en-GB Here's what Property Log tells you for this property.](https://pbs.twimg.com/media/EZqcTF7WkAEPFw_.jpg)