Bitcoin is confusing.

Mental Models can help frame it.

What are they?

'Thinking tools that you use to understand life, make decisions, and solve problems. Learning a new mental model gives you a new way to see the world’ - @JamesClear

Let's explore.

1/

Mental Models can help frame it.

What are they?

'Thinking tools that you use to understand life, make decisions, and solve problems. Learning a new mental model gives you a new way to see the world’ - @JamesClear

Let's explore.

1/

2/ Bitcoin requires an interdisciplinary approach-

software, hardware, economics, governance, cryptography, mathematics, monetary policy, etc

Assessing it solely through a narrow lens of expertise means failing to see the wider system.

software, hardware, economics, governance, cryptography, mathematics, monetary policy, etc

Assessing it solely through a narrow lens of expertise means failing to see the wider system.

3/ Your initial conclusions about new technologies are often incorrect or incomplete, but you’re still likely to defend them. This ultimately disadvantages you.

To be truly secure in your conclusions, a neutral curiosity is required, as is regularly testing your assumptions.

To be truly secure in your conclusions, a neutral curiosity is required, as is regularly testing your assumptions.

4/ Bitcoin is antifragile.

“a mechanism by which the system regenerates itself continuously by using, rather than suffering from, random events, unpredictable shocks, stressors, and volatility.”

- @nntaleb

“a mechanism by which the system regenerates itself continuously by using, rather than suffering from, random events, unpredictable shocks, stressors, and volatility.”

- @nntaleb

5/ Investments are choices and choices are trade-offs.

"Doing one thing means not being able to do another. We live in a world of trade-offs, and the concept of opportunity cost rules all." - @farnamstreet

"Doing one thing means not being able to do another. We live in a world of trade-offs, and the concept of opportunity cost rules all." - @farnamstreet

6/ Born out of the Global Financial Crisis, Bitcoin challenges the current system of central banking, accelerated by every financial crisis since.

Genesis Block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. - Satoshi Nakamoto

Genesis Block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. - Satoshi Nakamoto

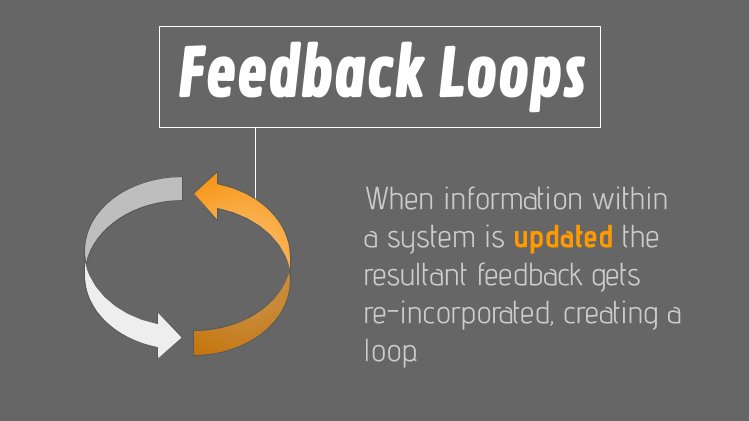

7/ Bitcoin’s boom  and bust

and bust  cycles are the result of multiple reinforcing feedback loops.

cycles are the result of multiple reinforcing feedback loops.

i.e.

Δdemand Δprice

Δprice  Δliquidity

Δliquidity

Δminer profitability Δinvestment

Δinvestment  Δhashpower

Δhashpower  Δblock time

Δblock time  Δdifficulty adjustment

Δdifficulty adjustment

Δprice Δawareness

Δawareness  Δdemand

Δdemand

and bust

and bust  cycles are the result of multiple reinforcing feedback loops.

cycles are the result of multiple reinforcing feedback loops. i.e.

Δdemand

Δprice

Δprice  Δliquidity

Δliquidity

Δminer profitability

Δinvestment

Δinvestment  Δhashpower

Δhashpower  Δblock time

Δblock time  Δdifficulty adjustment

Δdifficulty adjustment

Δprice

Δawareness

Δawareness  Δdemand

Δdemand

8/ Two fish are swimming along and run into an older fish who says to them “Morning, boys. How’s the water?”

One turns to the other and says “What the hell is water?”

-D.F.W

We live in a fiat money world, but in 5,000+ years of monetary history, it's only existed for 50.

One turns to the other and says “What the hell is water?”

-D.F.W

We live in a fiat money world, but in 5,000+ years of monetary history, it's only existed for 50.

9/ Building networks without oversight requires an incentive system to reward honesty and punish dishonesty.

Within Bitcoin, the mechanism of mining ‘aligns the actions of miners with the security of the network, while simultaneously implementing the monetary policy’ @aantonop

Within Bitcoin, the mechanism of mining ‘aligns the actions of miners with the security of the network, while simultaneously implementing the monetary policy’ @aantonop

10/ In an interconnected world, languages and platforms trend to a few dominant varieties (common protocols) due to the benefits of being able to communicate with the largest/widest group of users.

Money, as a language for communicating value, also follows this law.

Money, as a language for communicating value, also follows this law.

11/ "It is simply structural to the system architecture. No one picks winners and losers. Decentralization eliminates moral hazard... At all times, network participants are maximally accountable for their own errors. There are no bailouts."

- @parkeralewis

- @parkeralewis

12/ Bitcoin reduces the friction of moving value.

“Everything that moves has to move through something, including information.

Shaping our environment to reduce the challenges of opposing forces is a key to improving productivity.”

-Farnam Street

“Everything that moves has to move through something, including information.

Shaping our environment to reduce the challenges of opposing forces is a key to improving productivity.”

-Farnam Street

13/ Many of the ripple effects caused by Bitcoin's existence are yet to be known or fully understood.

“Changing some aspect of a complex system always introduces Second-Order Effects, some of which may be antithetical to the original intent of the change."

- @joshkaufman

“Changing some aspect of a complex system always introduces Second-Order Effects, some of which may be antithetical to the original intent of the change."

- @joshkaufman

14/ Innovation is continually shifting our behavior, which disrupts existing business models.

"Creative destruction doesn’t happen at a steady rate over time. At certain points in history, there is more opportunity for entrepreneurs to create disruption.”

- @JeffBooth

"Creative destruction doesn’t happen at a steady rate over time. At certain points in history, there is more opportunity for entrepreneurs to create disruption.”

- @JeffBooth

15/ The number of Bitcoiners is visibly increasing, but most significant is how few denounce Bitcoin after understanding it.

“What I observed with bitcoin is that it's following a very time-honored path of disruptive innovation."

- @B3_MillerValue

“What I observed with bitcoin is that it's following a very time-honored path of disruptive innovation."

- @B3_MillerValue

16/ Scarce resources incite competition over their possession, reflected through market price signals.

“Bitcoin is the first example of absolute scarcity, the only liquid commodity (physical or digital) with a set fixed quantity that cannot be conceivably increased.” - @saifedean

“Bitcoin is the first example of absolute scarcity, the only liquid commodity (physical or digital) with a set fixed quantity that cannot be conceivably increased.” - @saifedean

17/ “Bitcoin offers a way of converting energy into a small part of a specific number. A mathematical battery, if you will.

[expressing] how much energy that was sacrificed in order to acquire a share of a limited supply.” - @knutsvanholm

[expressing] how much energy that was sacrificed in order to acquire a share of a limited supply.” - @knutsvanholm

18/ "What if we consider the...equilibrium of two societies with different values?

It is hard to keep groups of people from sharing ideas, customs or languages..

A group...will undergo changes in custom based on who they interact with outside of their group.” - @farnamstreet

It is hard to keep groups of people from sharing ideas, customs or languages..

A group...will undergo changes in custom based on who they interact with outside of their group.” - @farnamstreet

19/ Comparing bitcoin to other assets based on unit price is illogical as it fails to account for total circulating supply (e.g. 1 btc vs 1 oz. gold).

The overall marketcap of an asset provides a more complete picture from which to assess size, adoption or valuation.

The overall marketcap of an asset provides a more complete picture from which to assess size, adoption or valuation.

20/ Many elements of bitcoin’s journey have experienced exponential growth. Viewing/charting these data points or indicators on a log-scale (rather than linear) can help us with understanding its trajectory so far, and as a potential guide for the future.

21/ "Bitcoin is not a stock, nor is it a startup, or an investment fund. It's a monetary good.

This is a completely different animal than the other types of assets that people are trying to compare it to. You need to view it through a different lens."

@MartyBent

This is a completely different animal than the other types of assets that people are trying to compare it to. You need to view it through a different lens."

@MartyBent

Read on Twitter

Read on Twitter

![17/ “Bitcoin offers a way of converting energy into a small part of a specific number. A mathematical battery, if you will.[expressing] how much energy that was sacrificed in order to acquire a share of a limited supply.” - @knutsvanholm 17/ “Bitcoin offers a way of converting energy into a small part of a specific number. A mathematical battery, if you will.[expressing] how much energy that was sacrificed in order to acquire a share of a limited supply.” - @knutsvanholm](https://pbs.twimg.com/media/El2PMhYUcAAF1nz.png)